Traders constantly seek new, more profitable ways to trade and tools to help them with this. Fair Value Gap is one of the Smart Money Concepts that has gained popularity recently as an easy and effective instrument that can help a trader increase the success of their trades. So, what is all the rage about? This article will explain to you what a Fair Value Gap (FVG) is, how to spot it on a chart, what factors can lead to its appearance, why traders care about FVGs, and how FVGs can help you in your trading, as well as pros and cons of using them.

What is a Fair Value Gap?

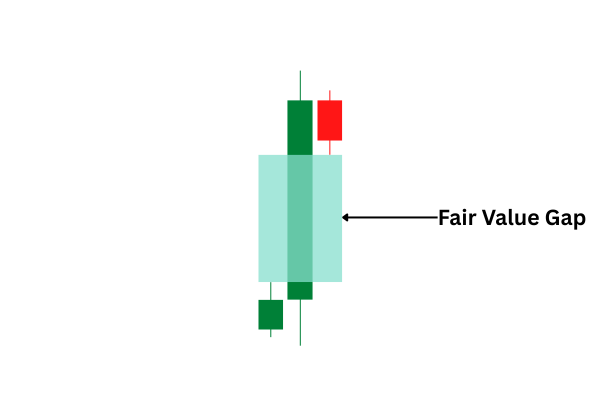

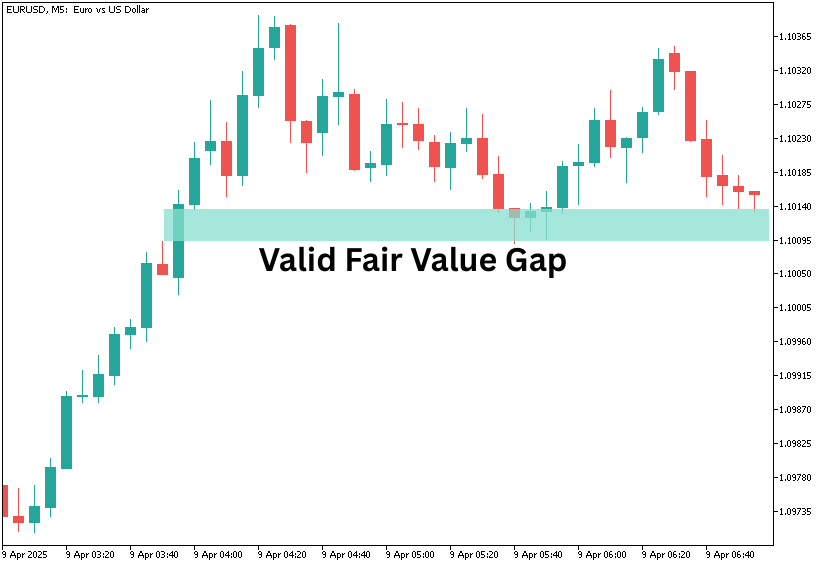

Fair Value Gap (FVG) is a chart pattern (some call it an indicator, which is not strictly correct) consisting of three candles. In an FVG, the second (middle) candle has a large body, whereas the wicks of the first and third candle do not overlap, creating a gap.

According to the theory of Fair Value Gaps, FVGs appear when there is an imbalance between buyers and sellers on the market. Usually, there is a seller for each buyer. However, during significant shifts in market sentiment a situation may arise when either there are more buyers than sellers or vice versa. The resulting big price move creates a gap in which some orders remain unfulfilled. Fans of FVGs believe that this creates a liquidity pool that attracts price. In other words, they expect the price to retrace and fill the gap.

How do Fair Value Gaps look, and how do you spot them on a chart?

There are two types of Fair Value Gaps – bullish and bearish. They both work in similar ways, and both are relatively easy to spot on a chart.

Bullish Fair Value Gaps

Bullish Fair Value Gaps are also sometimes called BISI – Buy Side Imbalance, Sell Side Inefficiency. They appear during times when there are many more buyers than sellers on the market, leaving some of the buy orders unfulfilled. As a result, a bullish gap occurs after prices rally to the upside.

On a chart, a bullish FVG looks like a big bullish candle surrounded by two smaller candles (it does not matter whether bullish or bearish), with the highest point of the first candle and the lowest point of the third candle not overlapping.

Bearish Fair Value Gaps

Bearish Fair Value Gaps are also known as SIBI – Sell Side Imbalance, Buy Side Inefficiency. As the latter name suggests, they are created when there is an imbalance in favor of sellers, with the buying side of the market being inefficient. As a result, some of the sell orders remain unfulfilled, creating a bearish gap after the prices crash.

On a chart, a bearish FVG looks like a big bearish candle surrounded by two smaller candles (again, it does not matter whether the smaller candles are bearish or bullish), with the lowest point of the first candle and the highest point of the third candle not overlapping.

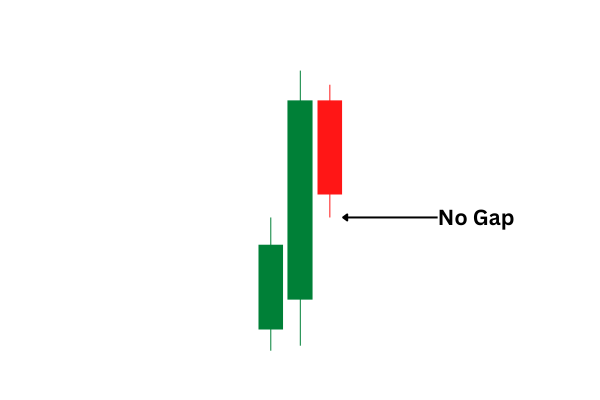

Remember that if there is no gap between the wicks of the first and the third candle, there is no Fair Value Gap, regardless of how big the second candle is.

What factors lead to the appearance of Fair Value Gaps?

As mentioned previously, Fair Value Gaps appear when a significant price move leaves some orders unfulfilled, preventing traders from buying or selling an asset at a price they wanted (or considered 'fair' – thus the name Fair Value Gap). Such moves usually occur when a market sentiment experiences a sudden significant shift or somebody places a large order. The most common factors leading to such a sudden and extreme change in a trading environment are:

- Macroeconomic reports and news. Important macroeconomic releases, such as inflation reports, employment data, and central bank interest rate decisions, can have a significant impact on markets, especially if they surprise market participants. That is why experts often warn against participating in markets during such an announcement. The problem is that not everyone can enter the market in time after the announcement's impact becomes clear. And even pending orders might not be executed at the 'fair ' price as brokers can have a hard time executing a large number of orders in the same direction.

- Geopolitical and other major news. Important news, such as the Russian invasion of Ukraine or the announcement of massive tariffs by US President Donald Trump, can rattle markets in a big way. Unlike macroeconomic reports, which have set dates for release, such news is often completely unpredictable, making it extremely hard for traders to prepare for their impact on the market. It is unsurprising, then, that such news often leads to the appearance of FVGs.

- Involvement of large institutions, such as big hedge funds or central banks. Sudden big price moves without any apparent reason are usually attributed to the participation of some big institutional trader. It may be a large hedge fund buying an asset or a central bank intervening in the market to push an exchange rate in a favorable direction. Whatever the case, it is impossible to predict such moves without being an insider, and regular retail traders can only react to them.

Why do traders care about Fare Value Gaps?

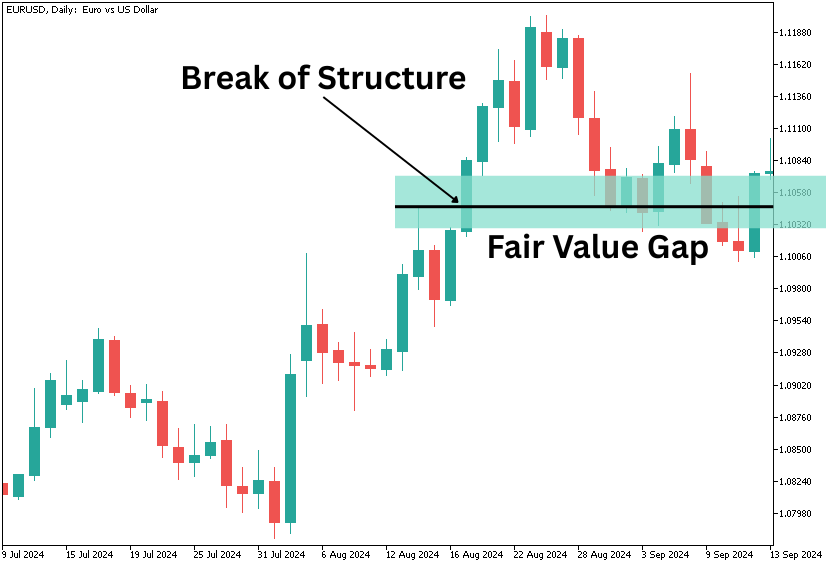

One of the reasons traders look for Fair Value Gaps is that they confirm strong trends. And that is a crucial point to remember: Fair Value Gaps work only in trending markets. In range-bound markets, FVGs are usually not particularly useful. Furthermore, if an FVG is opposed to the general trend, it is also usually ignored (though it may signal a trend reversal). FVGs that move in the direction of the trend suggest that the market sentiment is strong in favor of the trend and the price is likely to continue moving in the same direction.

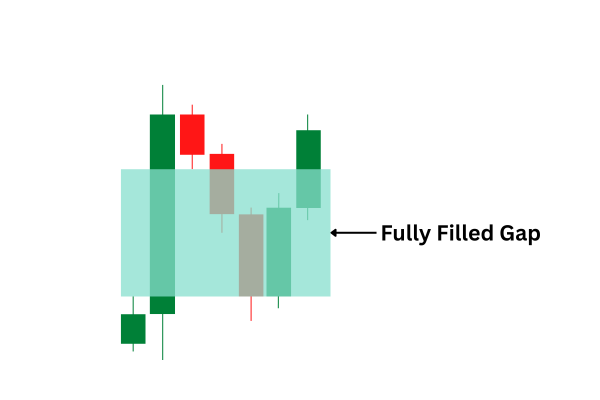

Yet perhaps even more important is the belief that the price will return to fill in the gap sooner or later. That is because, according to fans of Fair Value Gaps and similar concepts, the sharp price move created a liquidity void that acts like a magnet to the price, making it retrace towards the gap. There is some logic to it: as the FVG signals about a bunch of unfulfilled orders, it is reasonable to assume that someone will step in to fill them sooner or later.

The idea of the price retracing towards FVG is the foundation of strategies based on Fair Value Gaps. It can be used in different ways. As the price is expected to resume its movement in the direction of the overall trend after the retracement, the FVG can be used as the entry point for a position in the direction of the trend. Additionally, the expectation of the price returning towards its previous movement after the retracement means that FVGs can be used as support/resistance levels, helping set stop-losses and profit-taking objectives.

Mind you, while the price retraces to fill the gap, it often does not fill the whole gap, leaving it only partially filled.

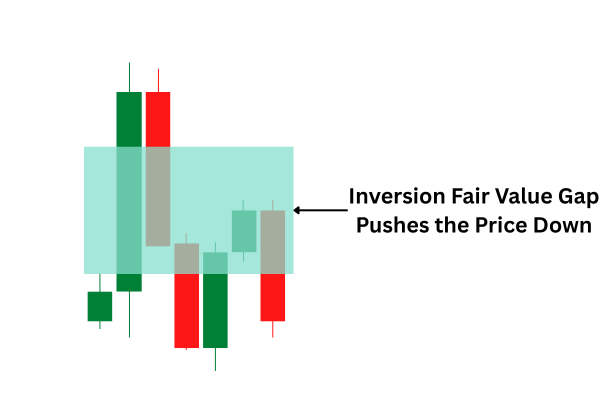

Inversion Fair Value Gap

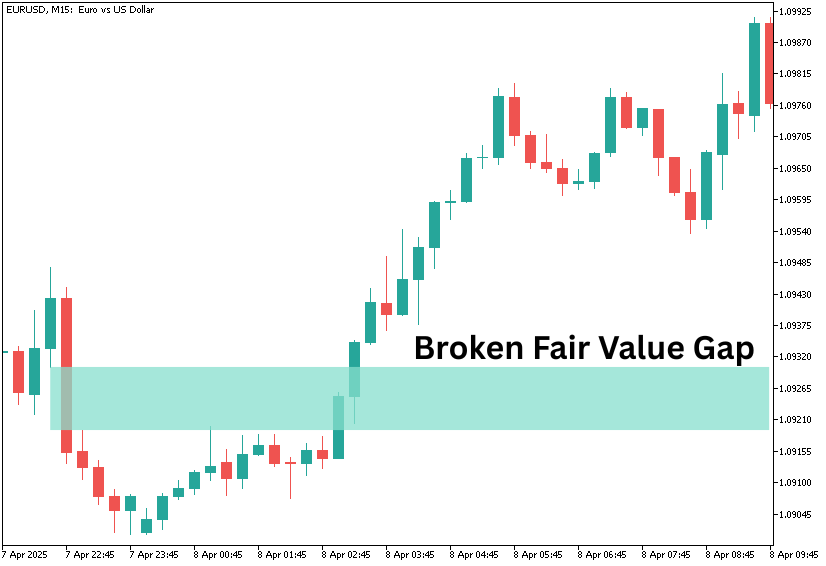

But what about the times when the price not only returns to a Fair Value Gap but also breaches it, reversing its trend? Does it make the FVG useless? Not necessarily. This just means that the FVG has switched its characteristics from a regular Fair Value Gap to an Inversion Fair Value gap (IFVG). It still continues to act as an area of probable support or resistance.

For example, a sharp rise in the price led to the formation of a bullish Fair Value Gap. Then, the price retreats below the gap, creating an Inversion FVG in the process.

Now, if the price attempts to rally again, those traders who rely on FVGs in their trading expect the IFVG to stop the price, pushing it back down.

How to trade using Fair Value Gaps?

There are no universal trading strategies appropriate to every single trader, and each trader should decide for themselves how to use Fair Value Gaps and whether to use them at all. This article does not aim to provide you with trading advice. That said, we can discuss the most common methods traders who use FVGs employ in their trading strategies.

Looking at any chart, we most likely will be able to see plenty of FVGs, many of which probably were not respected by the price. Furthermore, among those that were respected, some were fully filled, while in other cases, the price just barely touched them during retracing before resuming its movement in the direction of the trend. And there will probably be plenty of instances where the price does not retrace at all. So, the two main questions traders have while trading FVGs are which Fair Value Gap to use and where to place their entry point (assuming traders are using the FVG to decide where to open a position).

Which Fair Value Gaps should I use?

As was said previously, traders usually use only those Fair Value Gaps that move in the direction of the prevalent trend. For example, if the trend is bullish, then traders should ignore bearish FVGs.

As with other patterns and indicators, FVGs should not be used alone but rather employed using indicator confluences. Moving averages, MACD, and Fibonacci levels are among the indicators that traders who use FVGs prefer to utilize. And, of course, a trader should never forget about using stop-losses.

One of the main rules of trading FVGs is that once the particular FVG has been tested, it becomes invalid for further trading. As with many other rules mentioned here, not every trader adheres to this rule, but many FVG traders believe that retesting an FVG suggests a weakening of the sentiment and a potential reversal of the trend. A broken FVG makes the likelihood of a trend reversal even bigger.

FVG traders prefer to combine Fair Value Gaps with other Smart Money Concepts, such as Break of Structure (BoS) and Change of Character (ChoCh). The former happens when the price breaks above the higher high (in a bullish trend) or below the lower low (in a bearish trend). The latter means that the price drops below the previous higher low (in a bullish trend) or rises above the lower high (in a bearish trend). It is recommended that traders only trade those FVGs that appeared after BoS or ChoCh. It is even better if the FVG coincides with the BoS or the ChoCh.

As for which of the potentially useful FVGs to choose, the bigger an FVG, the better it is. Some traders prefer to use FVGs only if their second candle is at least twice as big as both the first and third candles, but that is not strictly necessary. Some also state that it is better if the second candle is surrounded by small consolidation candles, but again, it is not required to consider a particular FVG valid.

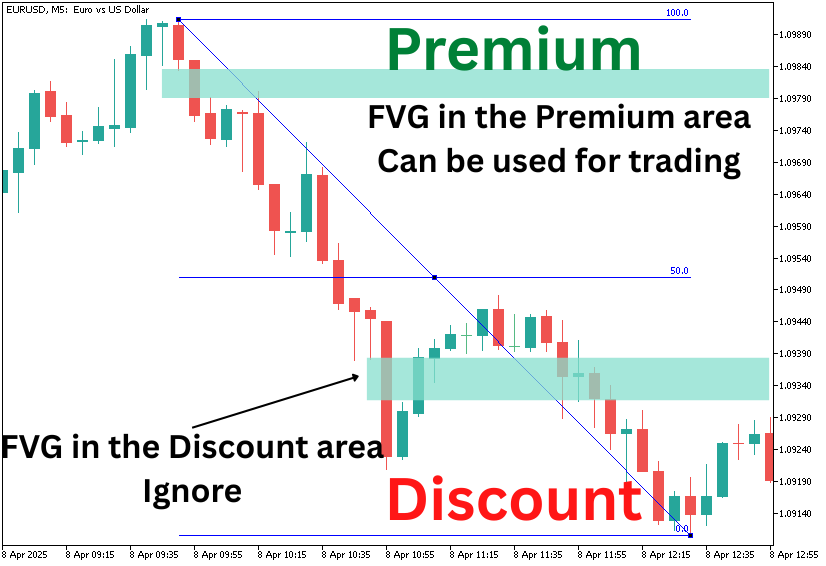

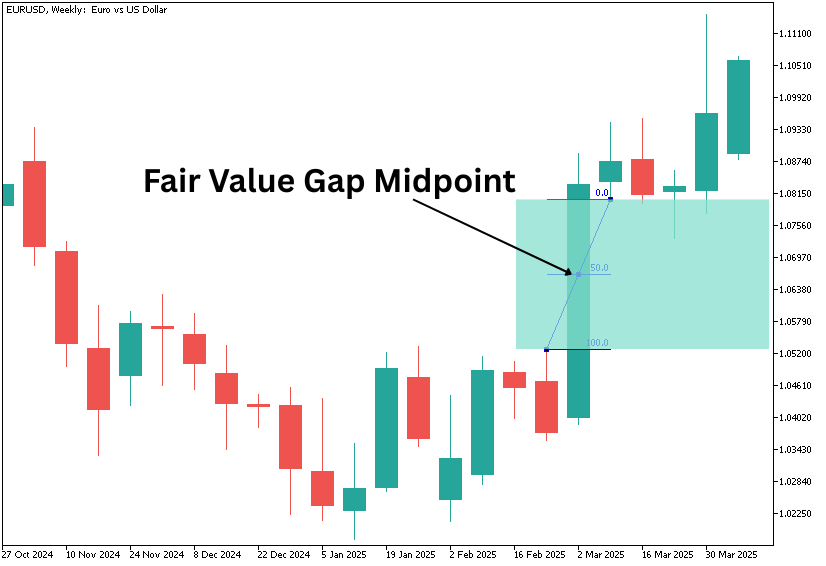

Another major rule is that the closer the FVG is to the start of the trend, the more valid it is. In fact, one of the common methods is to divide the trend into two halves. Some traders use Gann Box for this, or, in case of platforms that do not support this tool by default (like MetaTrader), you can use Fibonacci retracement. Adjust it so it would show only the 0%, 50%, and 100% levels. The top half of the move is called Premium, while the bottom half of the move is called Discount. In a bullish trend, consider only Fair Value Gaps that reside in the Discount area. Conversely, in a bearish trend, look only at FVGs that appear in the Premium area.

Where do you enter a position using Fair Value Gaps?

The most common method of using a Fair Value Gap is to open a position once the price touches the midpoint of a Fair Value Gap (50% consequent encroachment). You can also use Gann Box or Fibonacci retracement to see this level on a chart.

Remember, the price does not always reach the midpoint of an FVG, and it can also break the FVG, making it hard to follow the midpoint entry rule at times.

Some experts state that the trend will likely continue if the price respects the 50% FVG level. If the prices violate that level, you can expect a trend reversal.

FVG experts often advise using different timeframes while using FVGs. The usual approach is to spot an FVG on a higher timeframe and then to look for FVGs on a lower timeframe to refine your entry point.

There are numerous approaches to determining where to place stop-losses. One common tactic is to place a stop-loss at the lower (in a bullish trend) or the higher (in a bearish trend) end of the Fair Value Gap, though, depending on the size of the FVG, such stop-loss can be too tight. Another strategy is to place the stop-loss at the nearest Break of Structure or Change of Character level. Usually, traders prefer to use a stop-loss with at least a 1:2 risk/reward ratio.

Advantages and Disadvantages of Fair Value Gaps

As any trading strategy, indicator, etc. Fair Value Gaps have both advantages and disadvantages. Here are some of them:

Pros

- Fair Value Gaps can provide a good risk/reward ratio and good profit potential. Proponents of Fair Value Gaps insist that using FVGs can help increase your profits and reduce losses.

- Fair Value Gaps can be easily identified on a chart. FVG is very easy to spot on a chart, especially if you are an experienced trader. Many strategies involving FVGs are not that hard to follow either.

- Fair Value Gaps can work with any asset and can be used in any timeframe. FVGs are universal and can work on any chart. It is important to note, though, that FVGs work better on actively traded markets as high trading activity leads to higher rates of FVG occurrence, which in turn makes it easier to find a valid FVG.

Cons

While fans of Fair Value Gaps make the concept of FVGs sound really attractive, critics of the Fair Value Gap concept list numerous arguments against it. Some of them are:

- Flimsy theoretical foundation. A big candle on a higher timeframe does not always result in similarly big candles on lower timeframes. While the Fair Value Gap theory implies that every FVG is a result of a sharp move, which creates a liquidity pool waiting to be tapped by traders, that is not always the case. Sometimes, a big candle on a higher timeframe consists of overlapping candles on a lower timeframe. And sometimes, even if candles on the lower timeframe do not overlap, they can still avoid creating gaps, signaling a steady move in one direction, which absorbs all the liquidity along the way.

- High potential for false signals. FVGs are prone to sending false signals, especially if you adhere to the rule that states once an FVG is tested, it becomes invalid.

- It can take a while before the gap is filled. The theory of Fair Value Gaps states that any FVG will be filled sooner or later. But it does not say how late the 'later' can be. You may pass a lot of trading opportunities waiting for a gap to be filled.

- Gaps might not be filled at all. Not all Fair Value Gaps are filled. Sometimes, strong movement in one direction can leave a bunch of FVGs unfilled. And it is impossible to determine ahead of time whether the particular FVG will be filled or not.

- Fair Value Gaps work only in trending markets and are unsuitable for range-bound markets. FVG trading relies on following the existing trend (or predicting a trend reversal, in the case of Inversion Fair Value Gaps). FVGs are simply unusable without a clear trend.

- Entry and exit points can be considered subjective. There is no single universal rule for how to use Fair Value Gaps to determine where to enter or exit a position. While there are plenty of different suggestions and ideas of how to use FVGs to determine your entry or exit points, there are no strong arguments in favor of one method or the other, making the placement of such points seem arbitrary.

- Wrongly placed stop-loss and take-profit may result in a bad risk/reward ratio. While fans of Fair Value Gaps insist that FVGs can provide an excellent risk/reward ratio, detractors of FVGs believe that it is too easy for losses to outpace profit while using FVGs.

Conclusion

Whether you are going to use Fair Value Gaps or not largely depends on whether you believe in the Smart Money Concepts. They promise an easy-to-understand and easy-to-use strategy with considerable profit potential. At the same time, there is a certain degree of subjectivity when it comes to using FVGs, and some decisions you might make may seem downright arbitrary. As with any strategy or tool, it is better to backtest the FVG strategies to determine whether they are suitable for you and which approach provides a better return. Also, do not forget to use other indicators in conjunction with FVGs to improve the results and limit your losses.