Usually, when one trading session ends and another one starts, the price opens at the same level as the previous session's close. But sometimes, either due to some significant fundamental event or for some other reason, the opening level of the next session is significantly different compared to the previous session's closing level. Such a phenomenon is called a price gap.

While gaps can occur at any time on any timeframe, especially during major events, most commonly, gaps appear between Friday's close and Monday's open as markets are unable to immediately react to the news that comes out during the weekend. And sometimes, the reaction at Monday's opening can be exaggerated.

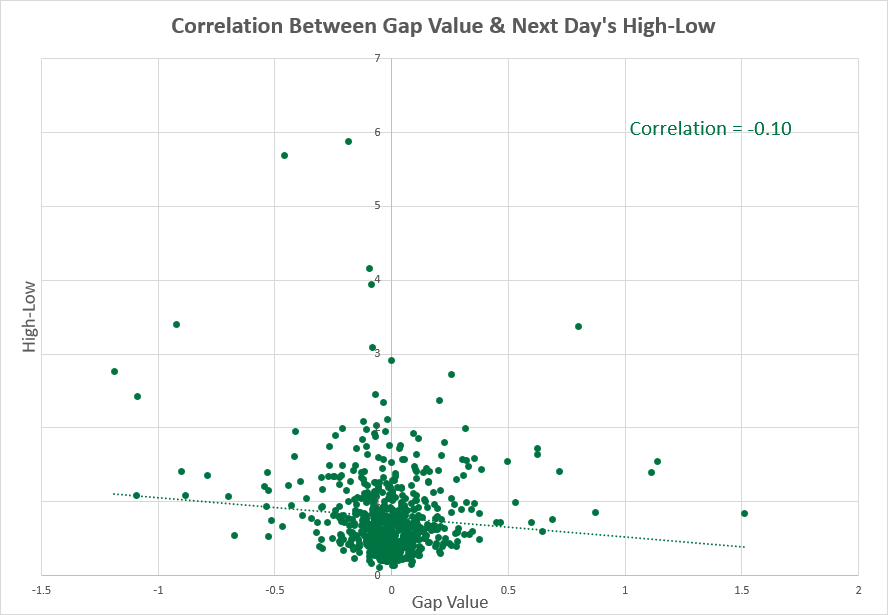

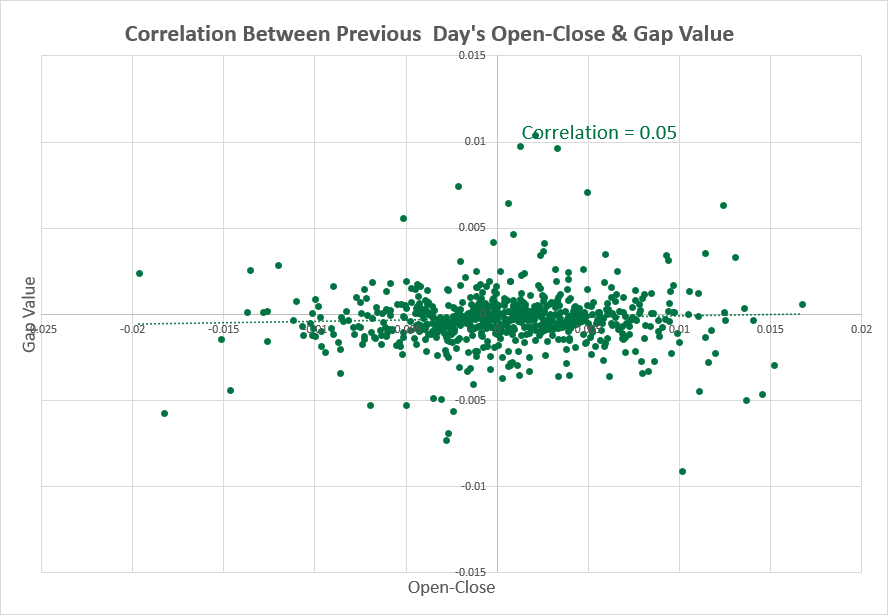

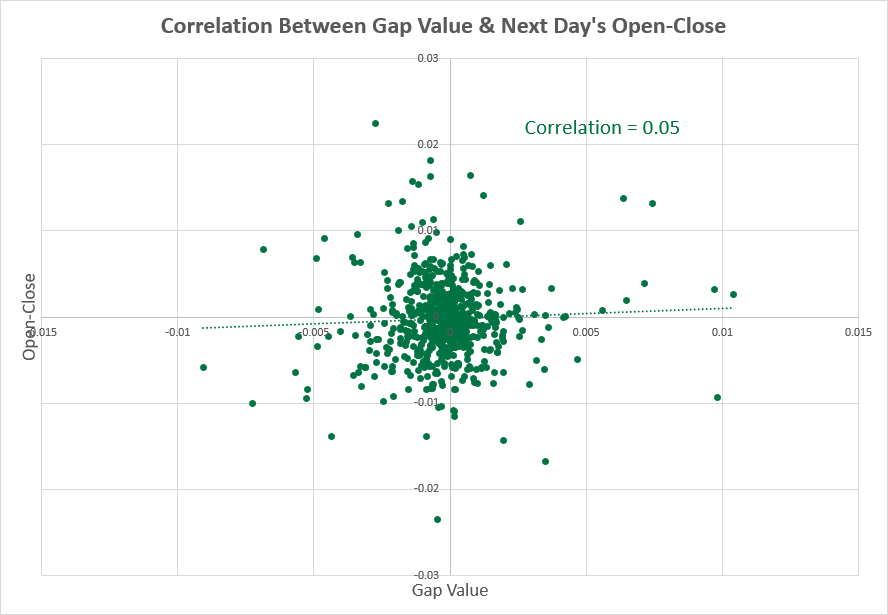

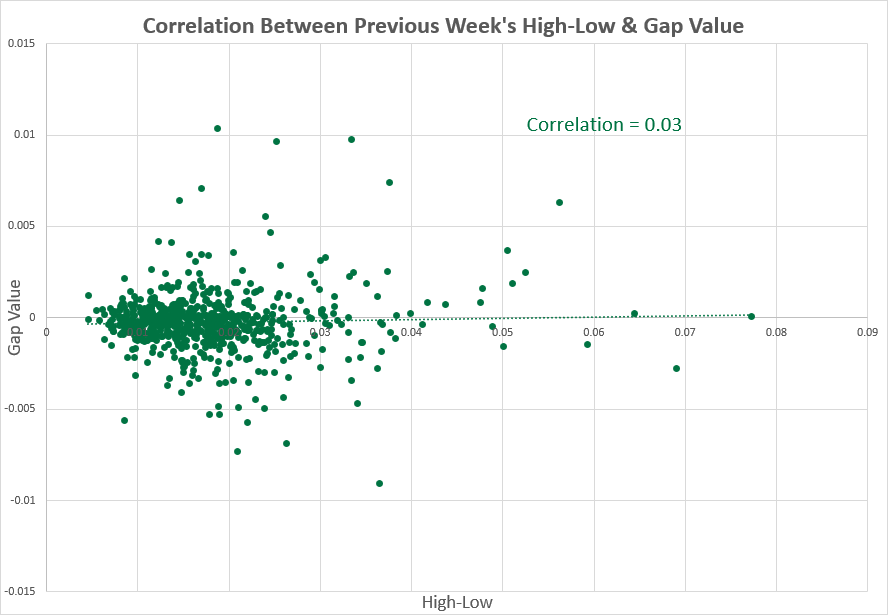

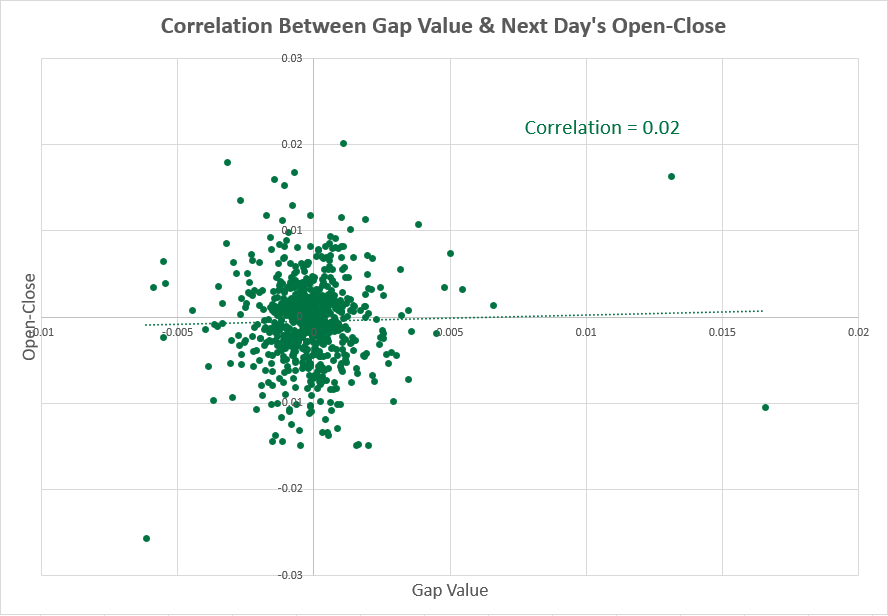

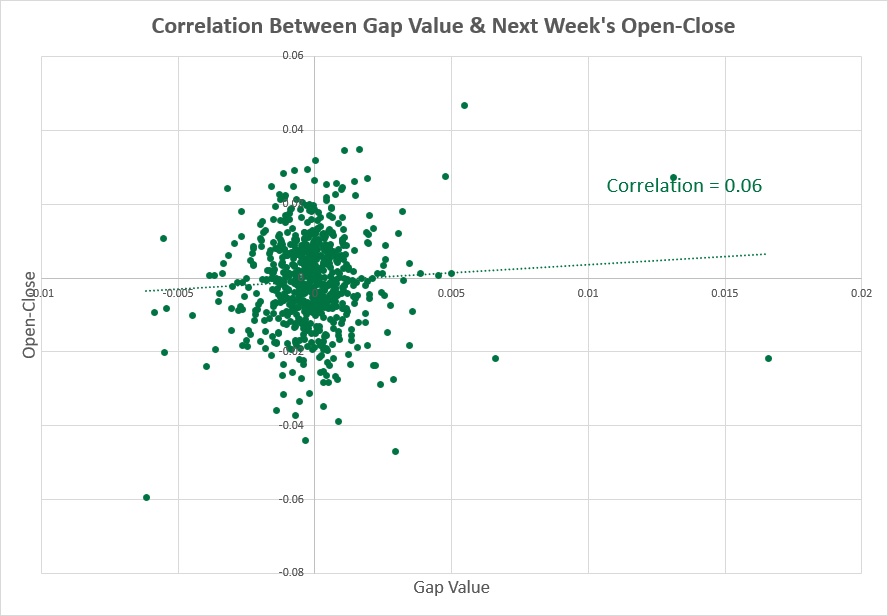

Considering how relatively frequent and important the weekly gaps are, it would be interesting to analyze them. In particular, to check if there is any correlation between the size of the gap and the trading range of the week and the day before and after the gap. The correlation between the size of the gap and the next day's and week's trading range would help traders predict market volatility in the near future and adjust their trading strategies accordingly. For example, it may suggest where to place stop-loss and take-profit levels.

Calculation data

Seven currency pairs were analyzed: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD, USD/CHF, and NZD/USD. For the purposes of the analysis, an MQL5 script was used to create a .csv file for each currency pair. Each file contains the following values:

- Open of the week before the gap

- High of the week before the gap

- Low of the week before the gap

- Close of the week before the gap

- Open of the Friday before the gap

- High of the Friday before the gap

- Low of the Friday before the gap

- Close of the Friday before the gap

- The value of the gap

- Open of the Monday that followed immediately after the gap

- High of the Monday that followed immediately after the gap

- Low of the Monday that followed immediately after the gap

- Close of the Monday that followed immediately after the gap

- Open of the week after the gap

- High of the week after the gap

- Low of the week after the gap

- Close of the week after the gap

- A 14-day average true range (ATR) on Friday before the gap

The script analyzed 684 weeks starting January 1, 2010, and ending with June 3, 2024. In cases when trading started on Sunday evening, Sunday's data was combined with Monday's session.

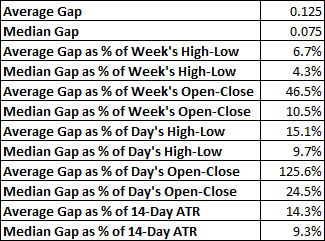

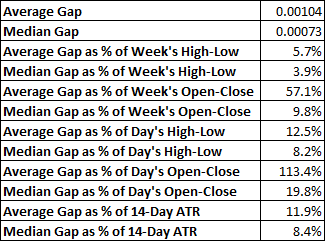

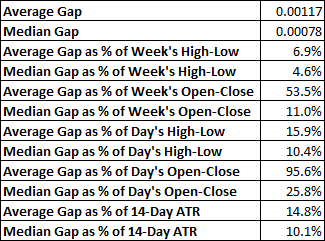

Using the script's output, the following average and median values were calculated:

- The absolute size of the gap

- The size of the gap as a percentage ratio of the range between the High and Low of the week before the gap

- The size of the gap as a percentage ratio of the range between the Open and Close of the week before the gap

- The size of the gap as a percentage ratio of the range between the High and Low of Friday before the gap

- The size of the gap as a percentage ratio of the range between the Open and Close of Friday before the gap

- The size of the gap as a percentage of the 14-day ATR

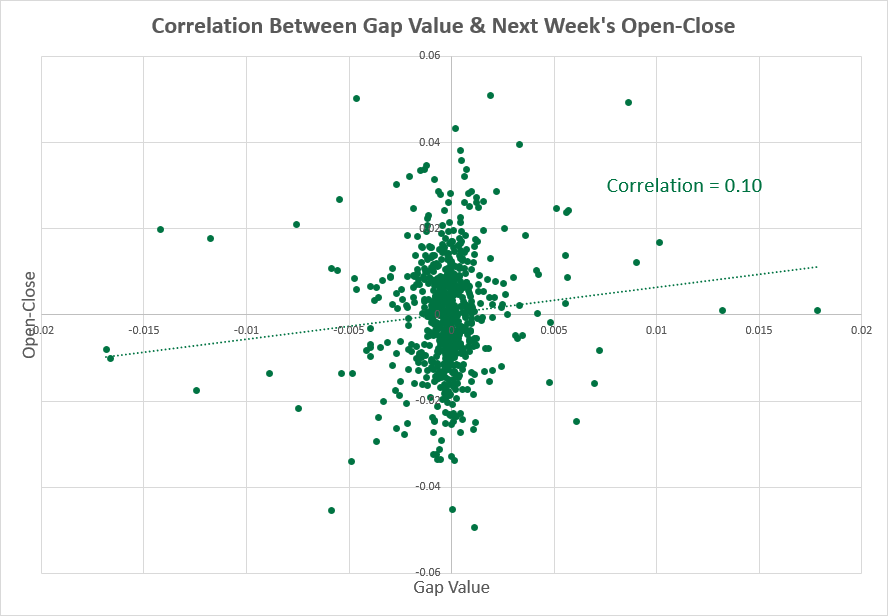

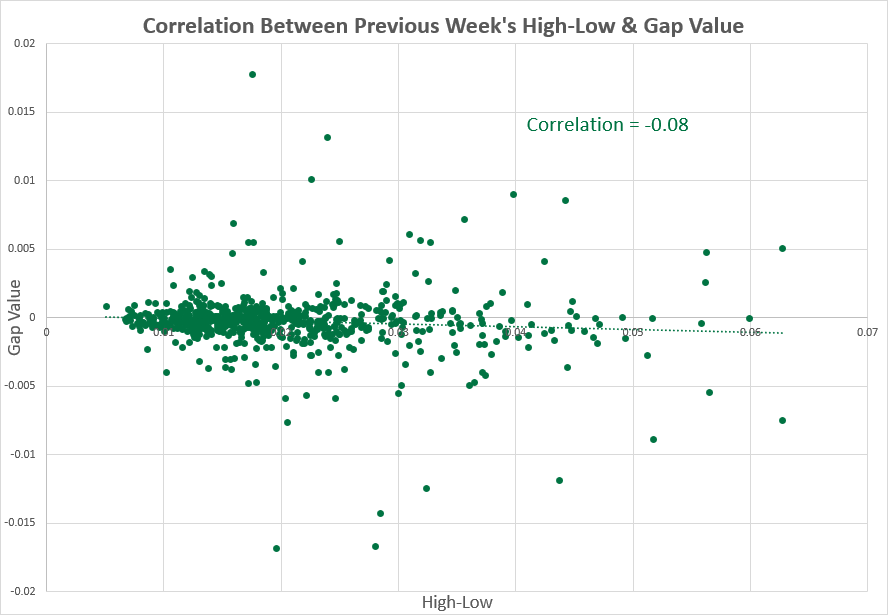

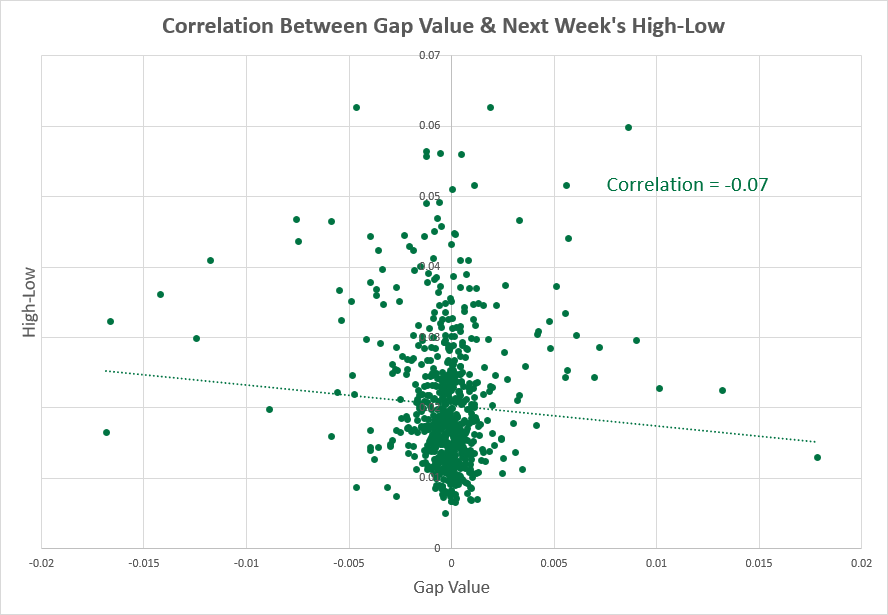

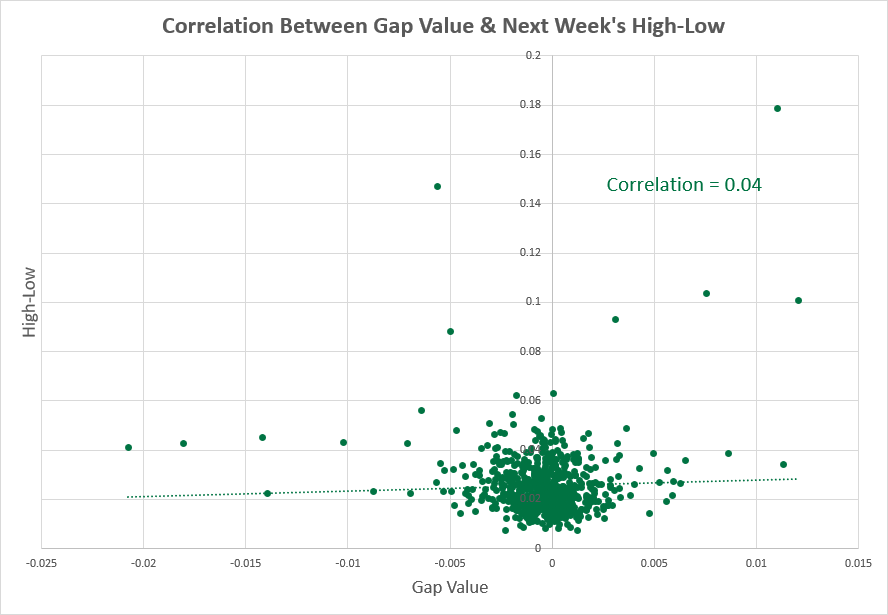

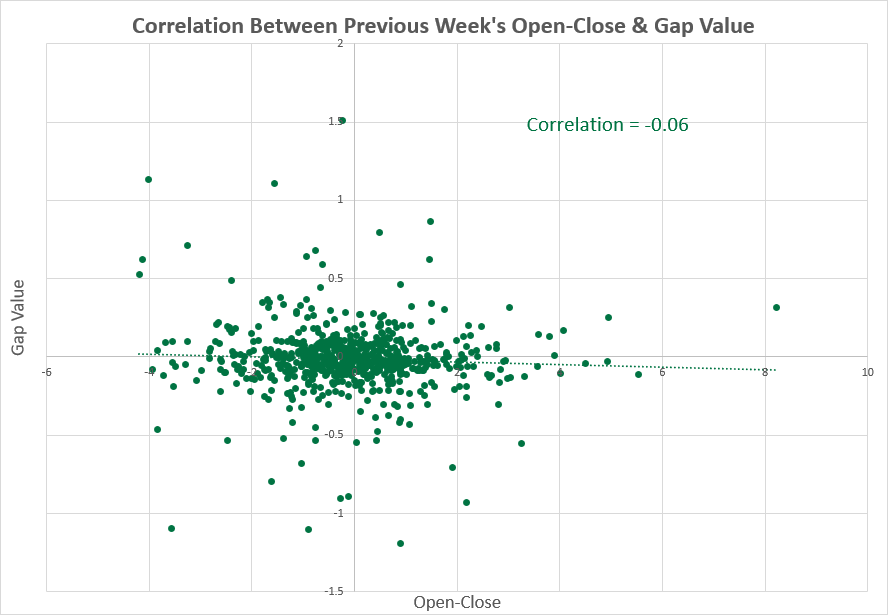

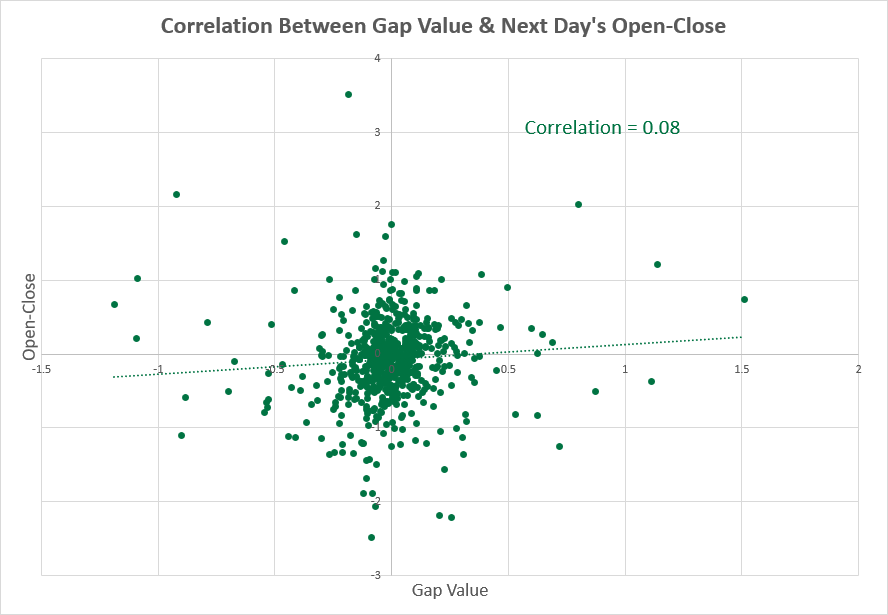

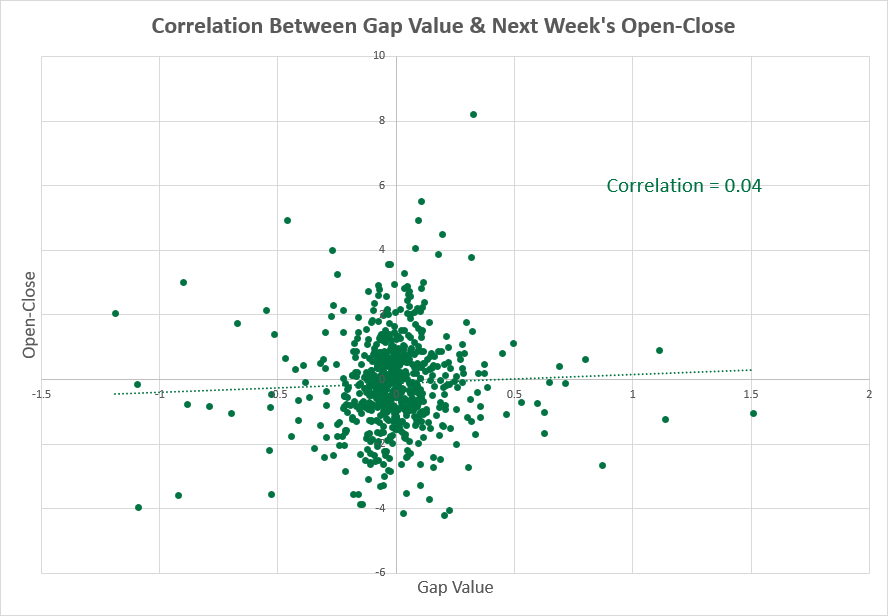

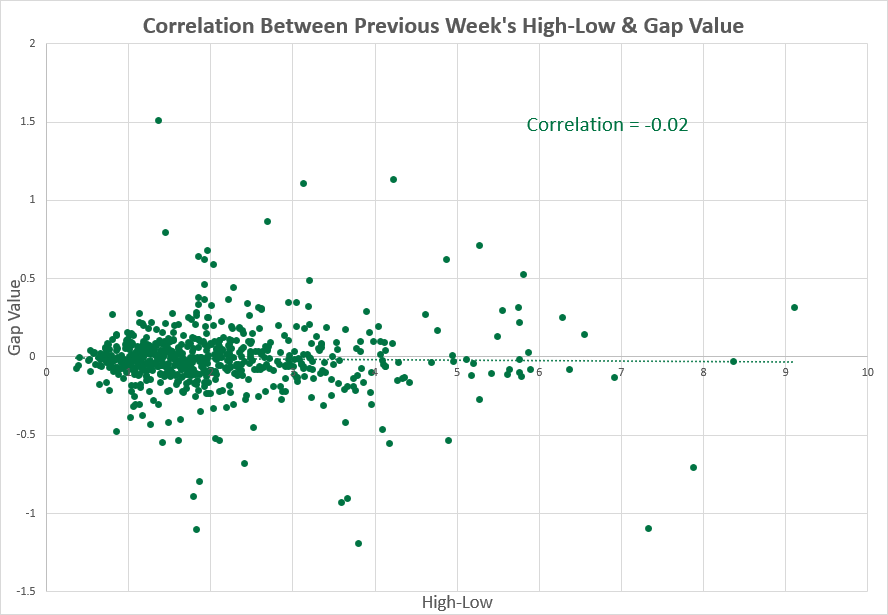

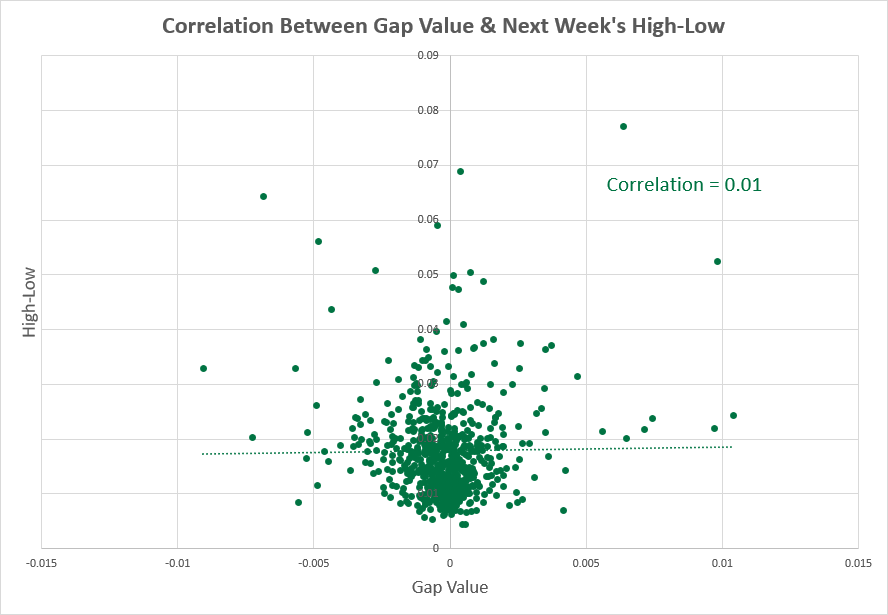

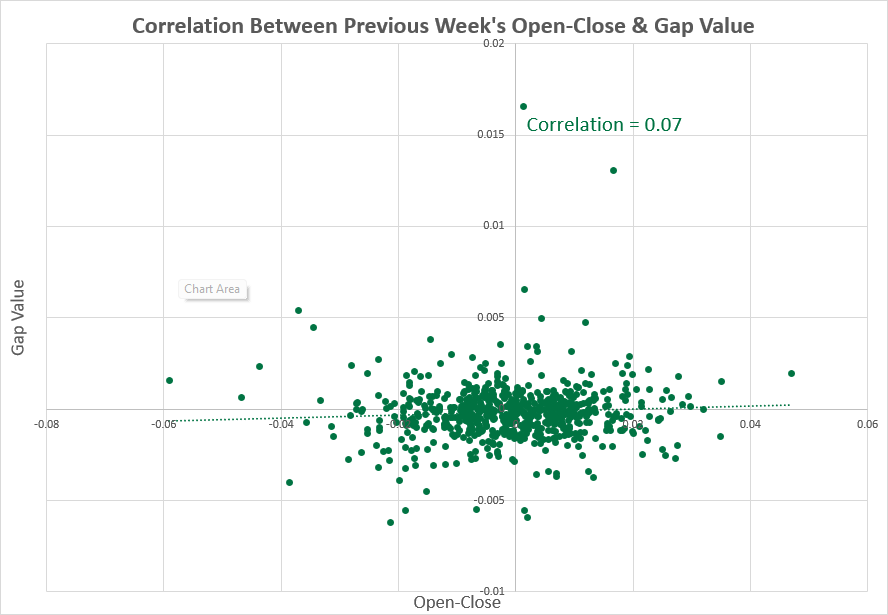

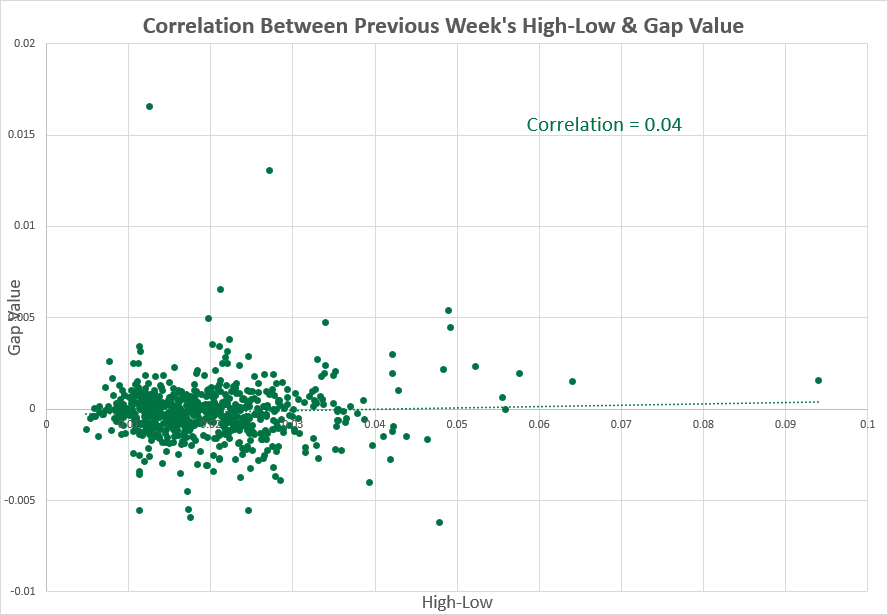

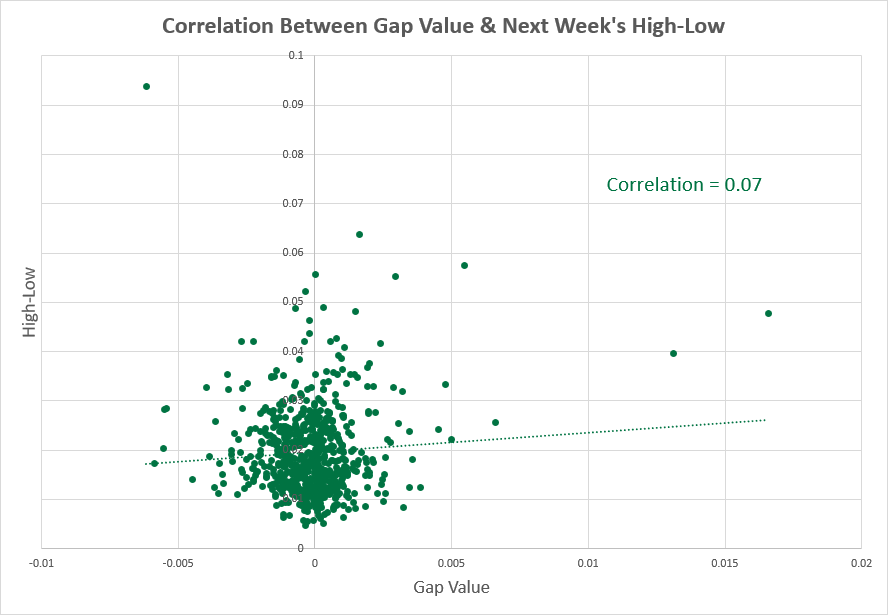

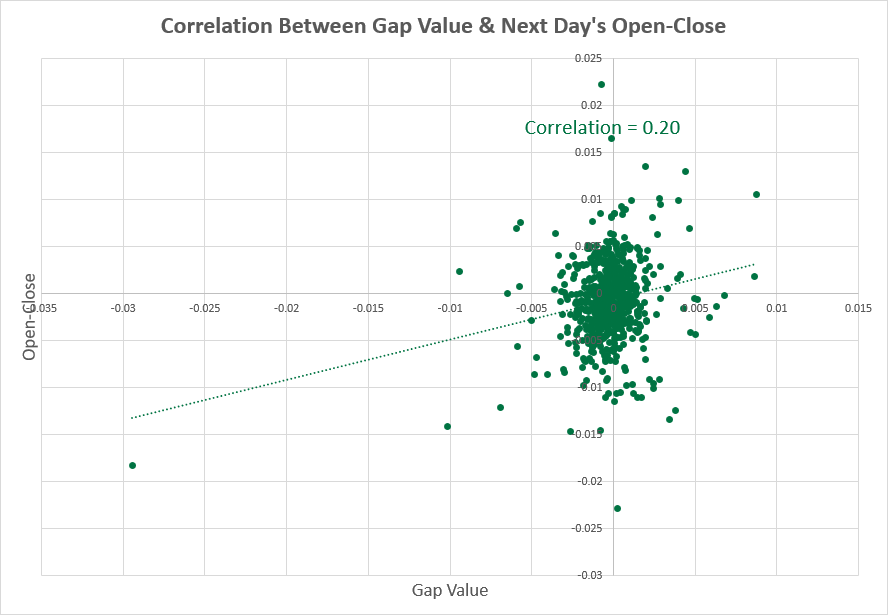

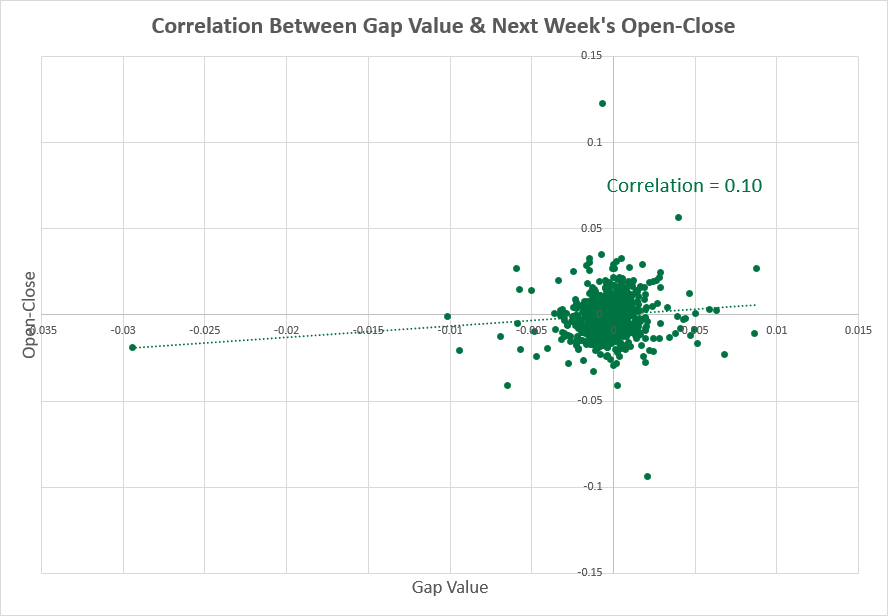

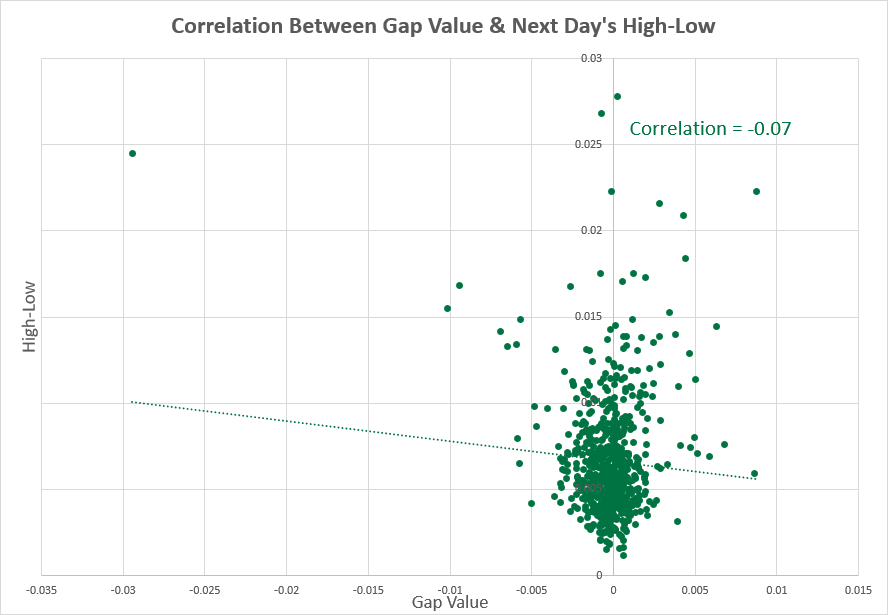

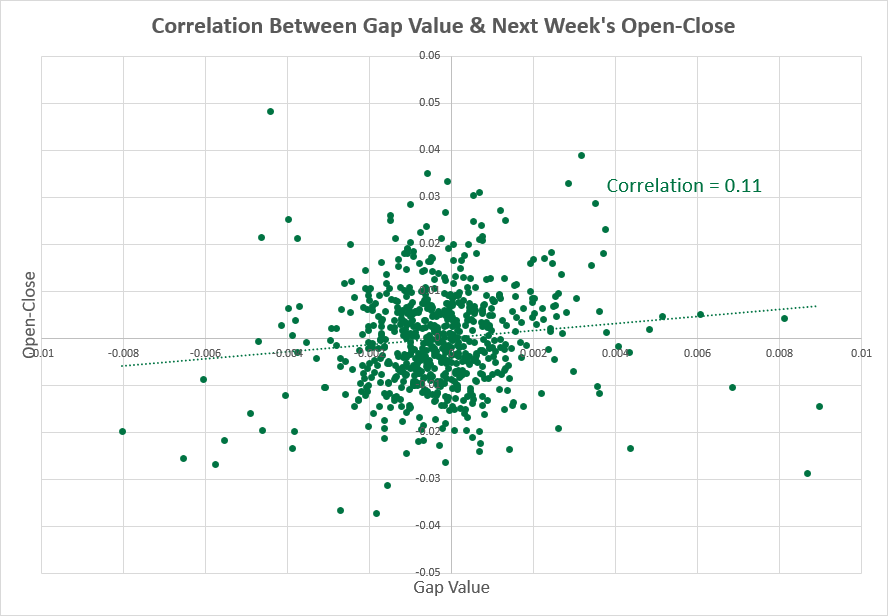

But even more interesting information is provided by the graphs that show a correlation (or lack thereof) between the size of the gap and the price range of the day and the week before the gap as well as immediately after. Both ranges between the Open and the Close, as well as between the High and the Low of the session, were compared separately.

Gap statistics for major currency pairs

EUR/USD

The average size of the weekly gap is a little bit above 70% of both Friday's Open-Close range and the weekly Open-Close range of the EUR/USD currency pair. There is no noticeable correlation between the gap and the trading range of days and weeks before and after the gap.

You can download a CSV-file with raw data or an XLSX-file with calculated statistics for EUR/USD weekly gaps.

GBP/USD

The average size of the gap for the GBP/USD currency pair is about 57% of the weekly Open-Close range and almost 105% of the daily range. No significant correlation between the gap and the trading range of the days and weeks before and after the gap is present, except for the small correlation between Friday's High-Low and the size of the gap.

You can download a CSV-file with raw data or an XLSX-file with calculated statistics for GBP/USD weekly gaps.

USD/JPY

The average size of the gap is about 45% of the USD/JPY weekly Open-Close range. The average size of the gap compared with the daily Open-Close range is more than 125%. No significant correlation between the gap and the trading range of the days and weeks before and after the gap is noticeable.

You can download a CSV-file with raw data or an XLSX-file with calculated statistics for USD/JPY weekly gaps.

AUD/USD

The average size of the gap is slightly above 60% of the weekly Open-Close range and more than 100% of the daily Open-Close range for the AUD/USD currency pair. There is no significant correlation between the gap and the trading range of the days and weeks before and after the gap.

You can download a CSV-file with raw data or an XLSX-file with calculated statistics for AUD/USD weekly gaps.

USD/CAD

The average size of the gap is about 57% of the weekly Open-Close range and more than 100% of the daily Open-Close range for the USD/CAD currency pair. No correlation between the gap value and any of the Open-Close or High-Low ranges studied was discovered as well.

You can download a CSV-file with raw data or an XLSX-file with calculated statistics for USD/CAD weekly gaps.

USD/CHF

The average gap represents more than 50% of the weekly Open-Close range and about 95% of the daily range for the USD/CHF currency pair. Here, the situation is a bit more interesting as there is a small correlation between the size of the gap and Friday's Open-Close and High-Low ranges. Alas, even this correlation is not particularly strong.

You can download a CSV-file with raw data or an XLSX-file with calculated statistics for USD/CHF weekly gaps.

NZD/USD

For NZD/USD, the average size of the weekly gap is near 63% of the weekly Open-Close and about 145% of the weekly range. No significant correlation was found here.

You can download a CSV-file with raw data or an XLSX-file with calculated statistics for NZD/USD weekly gaps.

Conclusions

According to the tables presented above, the average size of the weekly gap is close to the average range between the Open and the Close of Friday immediately before the gap. In fact, for most currencies, the average gap exceeds the average range of Friday's trading. The average gap is also more than half of the average range between the Open and the Close of the week before the gap for most currencies, with the exception of USD/JPY. This happens because just a few large gaps can skew the result measured by the average value. If we look at the median gap, its size is significantly smaller.

As for the correlation between the size of the gap and the volatility immediately before and after the gap, it does not seem to exist, unfortunately. The only correlation worthy of at least some attention is the correlation between the gap value and the Open-Close as well as the High-Low ranges of the Friday immediately before the gap on the USD/CHF currency pair. Even then, the correlation is not strong. It is interesting to see a stronger correlation on a relatively less popular currency pair. One would assume that if a correlation exists, it could be easier to spot on more actively traded pairs. But it does not seem to be the case.

If some important news is released on the weekend that could affect USD/CHF, you can try to predict the size of the resulting gap that might appear after Monday's open based on the volatility demonstrated during Friday before the gap. As the correlation is weak, though, the reliability of such predictions can be low. Therefore, traders should use other technical indicators as well as fundamentals in conjunction with the gap strategy to make their trading decisions.

As for other currency pairs, unfortunately, they do not seem to have a strong connection between the gap and volatility either before or after it occurs. That makes strategies involving the gap extremely difficult to employ as it is hard to predict how far prices will go before reversing to cover the gap, if they do that at all.

If you want to share your opinion, observations, conclusions, or simply to ask a question regarding weekly gaps in Forex trading, feel free to join a discussion on our forum.