Back in 2013, inspired by a poll on the future of the EUR/USD currency pair, we decided to conduct a small case study on combining a traditional FX trade with a binary no-touch trade to hedge some of the risks. That experiment is described below.

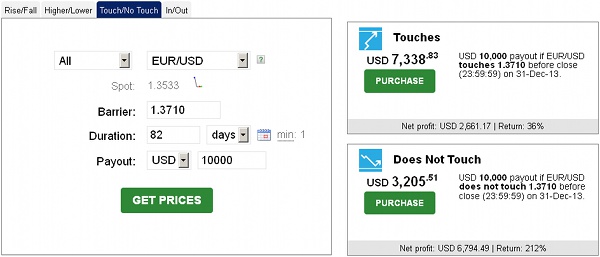

No-touch trade opportunity

Usually, we do not trade binary options as the pricing is too high in my opinion. What I mean is that if you add prices of two opposite direction options (e.g., touch and

This case is rather different. First, there is no 100% certainty that EUR/USD will not reach 1.3710 level by the end of 2013, but that level looks like a significant resistance for the currency pair. So, the current price on

Protecting against risks

No hedge

You may decide to skip the hedging part completely and risk your full stake to get $2 for each $1 risked in case EUR/USD does not reach 1.3710 during the remaining 82 days before December 31, 2013. Here are the possible outcomes and your profit/loss for this case (here and on, we will use $100 contract as an example):

1. EUR/USD does not touch 1.3710 — you win and get a $67 profit.

2. EUR/USD touches 1.3710 — you lose and book a $33 loss.

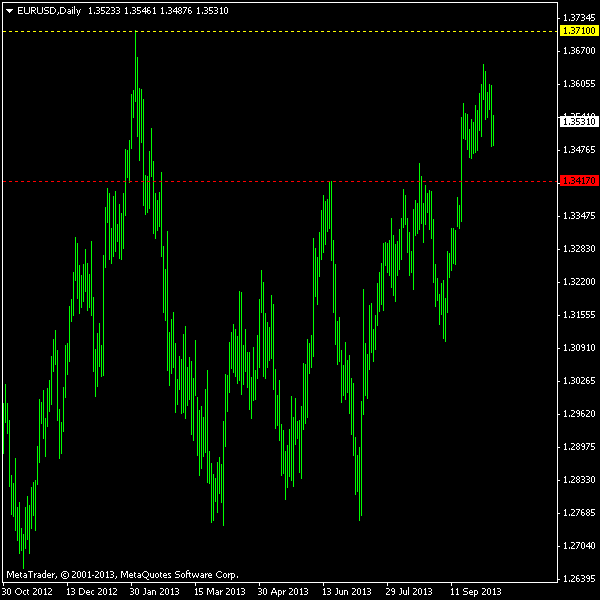

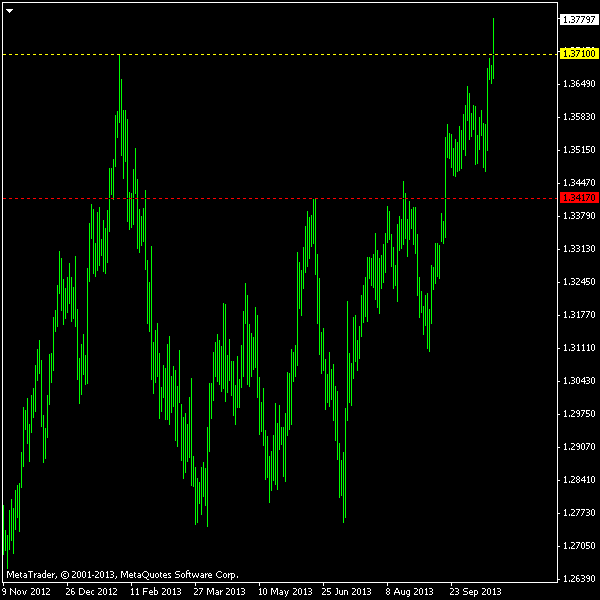

Conclusion: simple, straightforward way to bet on an event. The option strike price (yellow line) and the major support level (red line) are marked, but no hedging is visible on the chart below:

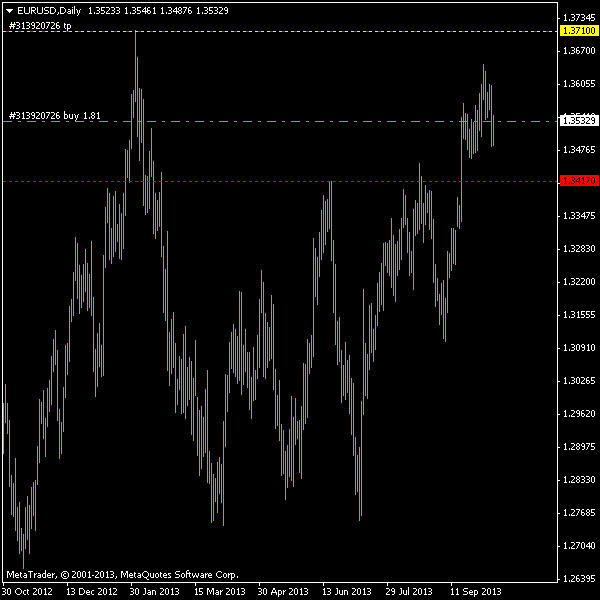

Simple spot hedge without stop-loss

If losing $33 in case of a EUR/USD price hitting 1.3710 sounds too dangerous, you may decide to hedge your binary contract with a specially sized spot Forex transaction. Since we are aiming to compensate for the case when EUR/USD goes up to 1.3710, we can easily say that we need a buy order with 1.3710

1. EUR/USD reaches 1.3710 during the period — binary options contract loses $33, spot position earns $33, net result: $0.

2. EUR/USD ends the period above 1.3532 (hedge position entry level) and below 1.3710 without touching it — binary option contract yields $67 profit, spot position earns $0-$33 (18.54 cents per pip), net result: $67-$100 profit.

3. EUR/USD ends the period below 1.3532 but above 1.3354 without touching 1.3710 level — binary option contract still yields $67 profit, but the spot position loses up to $67 (18.54 cents per pip), net result: $0–67 profit.

4. EUR/USD ends the period below 1.3354 without touching 1.3710 level — binary option contract still yields $67 profit; spot position becomes a major loser with uncapped potential for loss (18.54 cents per pip), net result: $0-$∞ loss.

Conclusion: simple hedging with a single position and a single calculation routine — the position size based on distance between current rate and option's strike price. The perfect outcome here is when the price remains between 1.3710 (the option's strike) and the spot position's open level. The only losing scenario is EUR/USD finishing far below the spot entry level, which still gets partially compensated by the binary option win. It can be recommended when you are confident that the market will be

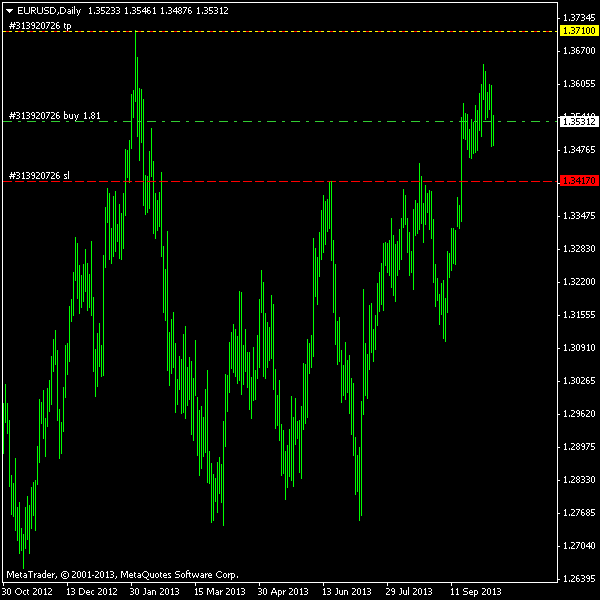

Simple spot hedge with stop-loss

If you get a panic attack from thinking about unlimited loss that is possible in the previous scenario, you might want to lock your potential drawdown with a

1. EUR/USD reaches 1.3710 during the period before hitting SL — the binary options contract loses $33, spot position earns $33, net result: $0.

2. EUR/USD ends the period above 1.3532 (hedge position entry level) and below 1.3710, touching neither it nor SL — the binary option contract yields $67 profit, spot position earns $0-$33 (18.54 cents per pip), net result: $67-$100 profit.

3. EUR/USD ends the period below 1.3532 but above 1.3417 (SL) without touching the 1.3710 level — the binary option contract still yields $67 profit, but the spot position loses up to $21.32 (18.54 cents per pip), net result: $45.68-$67 profit.

4. EUR/USD ends the period without reaching 1.3710, but having triggered SL — the binary option contract still yields $67 profit; spot position ends with $21.32 loss (18.54 cents per pip), net result: $45.68 profit.

5. EUR/USD reaches SL first, then proceeds to 1.3710 — the binary option contract results in $33 loss; spot position ends up with $21.32 loss (18.54 cents per pip), net result: $54.32 loss.

Conclusion: as you can see, there are five distinct outcomes now. All but two lead to significant profit (compared to the initial risk on binary option). One leads to a zero gain. Only one outcome is really bad — when the price goes down to spot position's SL first and then proceeds to a new yearly high. The loss there is more than double of the initial risk. How probable is such an outcome greatly depends on the chosen SL and the EUR/USD volatility during the period. The

Conditional spot hedge with stop-loss

If you really hate losing big amounts, you can consider adding a small twist to the SL hedge model — a conditional exit out of the binary option. The initial settings are the same as with the simple SL hedge model — TP, SL, position sizing, and all. But now, since you can sell your

1–3. The first three outcomes are the same as in the previous model.

4. EUR/USD ends the period without reaching 1.3710, but having triggered SL. The spot position results in $21.32 loss (18.54 cents per pip), but the binary option sale yields some profit. As the current EUR/USD price is now below your option entry price, its value can be anywhere between $33 and $100, which means $0-$67 profit. Net result: between $21.32 loss and $45.68 profit.

Conclusion: the new twist removes the previous worst outcome of $54.32 loss and adds an outcome with a rather undefined loss/profit situation. In fact, the farther is your SL from your spot entry price and the less time left till the binary option's expiry, the higher is the option's selling price. There is one disadvantage with this hedging method — you have to sell the option contract manually unless your binary trading platform offers conditional sale on certain underlying price. It may be a difficult thing to do both physically (e.g., you are asleep when your SL is hit) and emotionally (e.g., you suddenly decide against selling your option).

Which hedge model to choose?

It totally depends on two factors: your forecast for the EUR/USD behavior and your risk tolerance:

- If you just believe that EUR/USD will not rise much before the year's end and you are comfortable taking a

full-risk trade at it, then there is no need to resort to hedging at all. - If you believe that EUR/USD has some potential for rising and you take risk lightly, you can use the simple spot hedge model without

stop-loss . However, if you want to limit your spot exposure risks, then the simplestop-loss model is probably a better choice. - If you are afraid of EUR/USD jumping wildly down then up and want as little risk as possible, then the conditional spot hedge model with

stop-loss is your friend.

The actual trade

We will not be trading this position on a live account, but instead we entered a virtual option trade and a demo spot trade. We have used a $10,000 contract instead of a $100 one, so that hedging position could be entered with an exact sizing using hundredths of a standard lot. Our exact

The MetaTrader screenshots that you see above are of our actual position. We will use the simple hedging model with

A note on swaps

82 days is a rather long period to hold an open foreign exchange position. Normally, your spot EUR/USD hedge position will incur swap payments for every day it is left overnight unless you are trading via

In reality, not all brokers calculate their rollover interest logically or fairly. We have opened our hedge position on a demo account from Alpari, and they charge $0.70 per standard lot to hold a long position overnight (so, that is -$1.27 per day for our case study example). They would be us paying $0.30 per standard lot for holding a short EUR/USD position. The good thing is that our loss on swaps will be rather small compared to the overall balance change caused by this hedged binary option trade. If we scale it down to $100 contract, it would be only $1.04 additional loss for 82 days, and the position could be closed by the

On the other hand, our live account broker (Exness) offers a $1.073 positive swap on long EUR/USD deals and a $2.505 negative swap on short EUR/USD deals. If we decided to conduct this hedging case study with real money, we would be getting extra $1.94/day just for holding our hedge position open.

As you can see, swaps are worth paying close attention to when setting up a hedge position. You could be either earning some small additional income or losing slightly from them. In our opinion, the former is a preferred choice in nearly all cases. By the way, did you notice an arbitrage opportunity that exists between Alpari and Exness swaps? But that is a completely different story.

Case study results

So today, on October 22, 2013, the EUR/USD currency pair has finally surpassed its previous maximum for 2013 and thus has finalized our case study research. The

The resulting EUR/USD chart:

Disclaimer: The links to Binary.com used above are affiliate links. Here is a direct link to their website if you prefer: https://www.binary.com/. You may also try to find better trading conditions with other binary brokers.

PS: You might be interested in this hedging calculator if you are serious about this trading technique.

If you have some questions about the proposed ways of hedging a binary trading position using a spot trade, you can discuss it on our Forex forum.