In Forex trading, currencies are traded in pairs. The value of a currency is indicated relative to the value of another currency. Now, in the case of the US dollar index, the value of the US dollar is indicated relative to the value of a basket of currencies. The article discusses the brief history of the US dollar index (DXY), the manner in which the dollar index calculated, its variants, implications, and, finally, how it is useful to a Forex trader.

History

Until the first-half of 1971, the international monetary system was regulated by the Bretton Woods System, which is more or less a modified gold standard system that existed in the early 1940s. Under the system, the major currencies were tied to the US dollar, which was in turn pegged to the gold reserves at Fort Knox. The inherent loop holes in the system and the transition of the Europe towards the free movement of capital ultimately resulted in the collapse of the system.

In August 1971, the US President Richard Nixon unilaterally announced the discontinuation of the Bretton Woods system, as the country’s gold reserves dipped to one-third of the dollar held by other countries. The main reason for discontinuation was that it looked like France would ask for the delivery of the yellow metal in return for the US dollars. Finally, when the US dollar started floating, it paved way for other currencies to pursue a similar path.

The discontinuation of the Bretton Woods system created a need for the determination of the value of the US dollar relative to other major currencies. In 1973, the US Federal Reserve created the dollar index to track the greenback against a basket of geometrically weighted average of six currencies, namely: the euro, the Japanese yen, the British pound, the Canadian dollar, the Swedish krona, and the Swiss franc. At the time of creation of the US dollar index, the currencies of the countries that dominated the trade with the USA were used. Officially, the weightage of each of the currencies that make up the US dollar index is as follows:

- Euro (EUR) - 57.6%

- Japanese yen (JPY) - 13.6%

- Pound sterling (GBP) - 11.9%

- Canadian dollar (CAD) - 9.1%

- Swedish krona (SEK) - 4.2%

- Swiss franc (CHF)- 3.6%

Before the euro came into existence on January 1st, 1999, the US dollar index was made up of 10 currencies including the Deutsche mark of Germany. The arrival of the eurozone resulted in the modification or rebalancing of the currencies that makes up the DXY. Since then no changes have been made, even though the currencies are no longer the most traded with the US dollar.

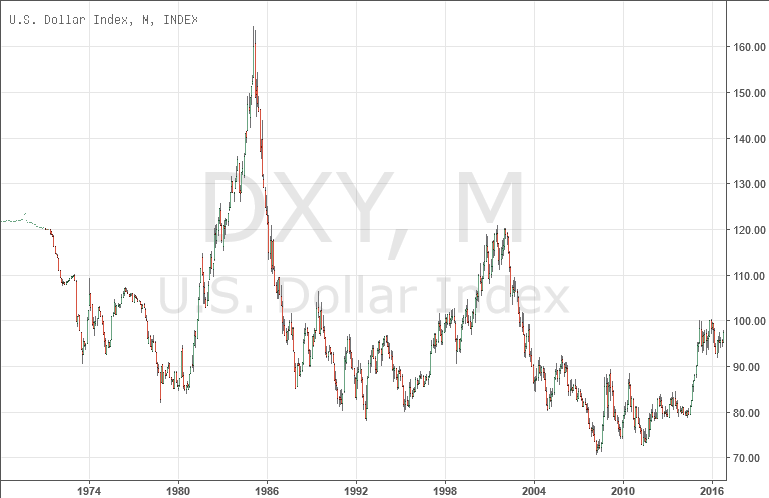

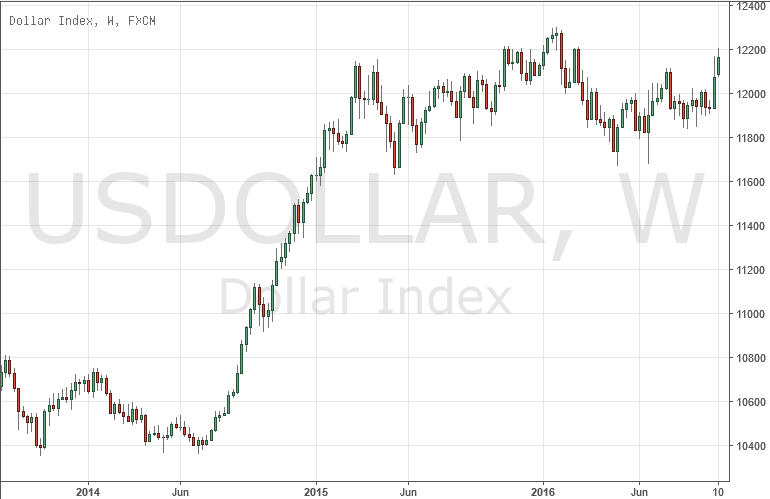

At the beginning, the value of the US dollar index was 100. Since then, it has traded at a high of 164.72 (February 1985) and at a low of 70.698 (March 2008).

Math behind the US dollar index

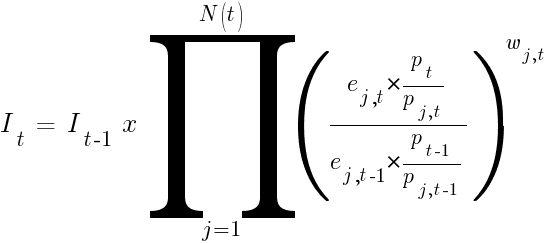

The formula for the calculation of the US dollar Index is as follows:

DXY = 50.14348112 × EURUSD -0.576 × USDJPY 0.136 × GBPUSD -0.119 × USDCAD 0.091 × USDSEK 0.042 × USDCHF 0.036

If the US dollar is the base currency in a pair, then the weighing coefficient is positive. On the other hand, if the US dollar is the quote currency, then the coefficient of that pair would be negative.

Interpretation

The value of the US dollar index enables a trader to understand whether the US dollar has strengthened or weakened against the basket of currencies and by how much. If the US dollar index trades at 125, then it means that the greenback has appreciated by 25% against the basket of currencies compared to the initial value. Likewise, if the US dollar index trades at 75, then it means that the greenback has depreciated by 25% against the basket of currencies. So, when the US dollar index is in a clear uptrend, a Forex trader should avoid taking a short position in the US dollar based currency pairs and vice-versa.

Trading the US dollar index

The US dollar index futures contracts are traded on the Intercontinental Exchange (ICE). The US dollar index is the most widely recognized and traded currency index. The futures contracts were first offered for trading on November 20, 1985. From September 3, 1986, the US dollar index options were made available for trading. Both futures and options are available exclusively for trading electronically on the ICE platform. The exchange symbol for the futures contract is DX (SDX for mini futures contracts) followed by the month and year code.

The quotes are updated once every 15 seconds using multiple Forex data feeds. The midpoint of the top bid/ask price is used for the calculation of the US dollar index and is passed on to different data vendors. Some of the data vendors use their own symbol. For example, Bloomberg uses the symbol DXY (commonly referred to as Dixie). Trading in the contract starts at 18:00 EST on Sunday and ends on 17:00 EST Monday. The market re-opens again at 8:00 EST and closes at 17:00 EST on Tuesday through Friday. Similar to other exchanges, the traders can place orders during the pre-open period (30 minutes before the trading/execution of orders begin). The derivative contracts enable an investor to hedge his portfolio against the volatility risk of the US dollar. The US dollar index ICE contract is the only USD futures contract which is publicly traded in a regulated exchange and offers a transparent price discovery mechanism. Based on the personal capability, variations of the US dollar index are privately traded by the hedge funds and high net worth investors with the investment banks.

The size of the US dollar index futures contract is $1,000 times the index value. For example, if the US dollar index is trading at 96.550, then the size of the contract is $96,550. The tick size is 0.005 ($5 worth). The contracts have quarterly expiration cycle - March, June, September, and December. Daily settlement is based on the volume-weighted average price of all the transactions executed during the closing period (14:59–15:00 EST). Even though the tick size is 0.005, the settlement price is expressed in 0.001 increments.

In general, the futures contract of the US dollar index is stated to be offered by the New York Board of Trade (NYBOT), which is a subsidiary of the ICE. The DXY is also traded as ETFs and mutual fund units through various exchanges.

Trade-weighted US dollar index

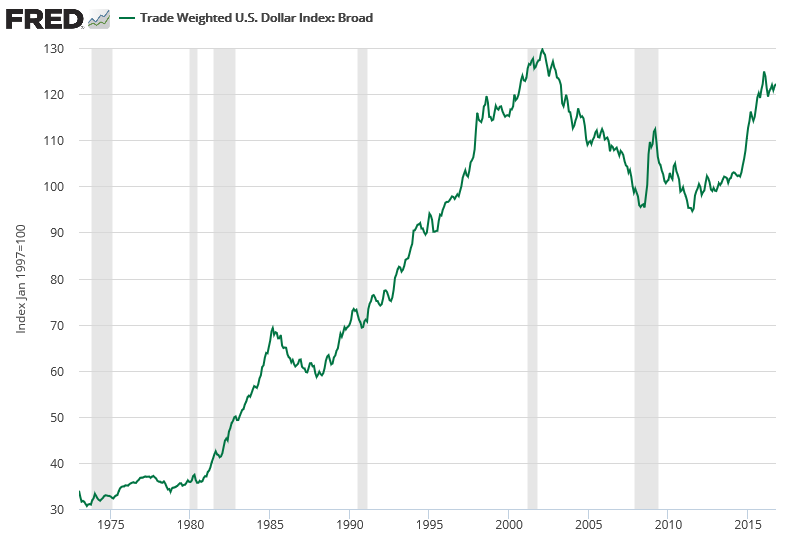

In order to make the index relevant to the current economic situation, in 1998, the Federal Reserve created an alternative to the US dollar index. Firstly, there was a need to include the currencies of countries such as Brazil, China, and Mexico, which were gaining prominence in the international trade with the USA. Secondly, the arrival of the euro made it a necessity for the creation of an alternative to the existing US dollar index. The newly created index was referred by the name trade-weighted US dollar index or Broad Index.

As mentioned earlier, the index was primarily created to assess the strength of the US dollar in an accurate manner. The weightage of the currencies used in the calculation is based on the volume of imports and exports between the United States and the respective countries. The trade data is used to update the weightage of the currencies once a year. The trade-weighted US dollar index is updated once a week. It is not available for trading. The currencies that were used for the creation of a trade-weighted US dollar index and the corresponding weightage as of October 26, 2015 were as follows:

| Eurozone | 16.638 |

| Canada | 12.664 |

| Japan | 6.462 |

| Mexico | 12.119 |

| China | 21.562 |

| United Kingdom | 3.322 |

| Taiwan | 2.387 |

| Korea | 3.929 |

| Singapore | 1.665 |

| Hong Kong | 1.328 |

| Malaysia | 1.536 |

| Brazil | 2.052 |

| Switzerland | 1.804 |

| Thailand | 1.381 |

| Philippines | 0.572 |

| Australia | 1.23 |

| Indonesia | 1.007 |

| India | 1.991 |

| Israel | 1.01 |

| Saudi Arabia | 0.957 |

| Russia | 1.37 |

| Sweden | 0.654 |

| Argentina | 0.55 |

| Venezuela | 0.33 |

| Chile | 0.793 |

| Columbia | 0.687 |

Math behind the trade-weighted US dollar index

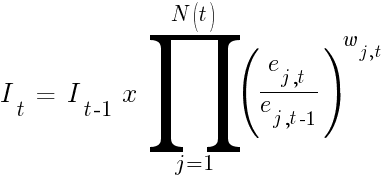

The trade-weighted US dollar index can be calculated using the nominal exchange rates (the rates provided by a Forex broker) and the real exchange rates. The formula for calculating the US dollar index using the nominal exchange rates is as follows:

— value of index at time

— value of index at time  .

.

— value of index at time

— value of index at time  .

.

— number of currencies in index at time

— number of currencies in index at time  .

.

— exchange rate of currency

— exchange rate of currency  at time

at time  .

.

— exchange rate of currency

— exchange rate of currency  at time

at time  .

.

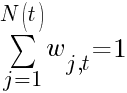

— weight of currency

— weight of currency  at time

at time  and:

and:

Before looking at the other formula, it is better to understand what a real exchange rate is. A real exchange rate takes into account the difference in the inflation rate that exists between the United States and the other country. The real exchange rate calculation is done using the prevailing Consumer Price Index (CPI) values. So, the formula for calculating the US dollar index using the real exchange rates is as follows:

— US consumer price index at time

— US consumer price index at time  .

.

— US consumer price index at time

— US consumer price index at time  .

.

— value of the country

— value of the country  consumer price index at time

consumer price index at time  .

.

— value of the country

— value of the country  consumer price index at time

consumer price index at time  .

.

Other variants

From the currency composition and the corresponding weightage, it can be easily understood that the US dollar index no longer reflects the current situation. The ICE also charges a considerable amount for the real-time and delayed quote feed.

Furthermore, the weighted geometric mean used for the calculation of the US dollar index makes it costlier for the market makers. Moreover, the US dollar index chart looks more or less like an inverted euro dollar chart. Finally, the difference in weightage means that the euro’s impact on the US dollar index is larger than other currencies, even though it may not be the case always (for example, another round of monetary easing by the ECB and BoJ will not create a similar impact on the value of the US dollar index).

Considering the above mentioned disadvantages, the Dow Jones and FXCM created the DJ FXCM Dollar Index. The DJ FXCM Dollar Index is made up of four major currencies – the euro, the yen, the aussie, and the pound. Each of the four currencies is given a 25% weightage. The system enables a trader to perfectly track a position in one of the four currencies with relative ease by simply watching the DJ FXCM Dollar Index. The index can be traded on the trading platform offered by the Forex broker FXCM.

Conclusion

The US dollar index can be used as a quick reference guide to assess the strength of the US dollar against the rival currencies. However, considering the huge investment required, it is arguably suited only for large traders. Still, it is worth to check out the index chart before entering into a trade as it will assist in avoiding wrong entries.