The Commitment of Traders Report

Each Friday, unless there is a holiday, the Commodity Futures Trading Commission, a US government agency (CFTC), releases what is called a Commitments of Traders Report (COT) on a wide array of currencies, commodities, and interest rate futures. This reveals the size of outstanding positions for various players as of the preceding Tuesday.

Currencies traded include all of the major currencies (the euro, sterling, yen, etc.) as well as several minor currencies (Brazilian real, Mexican Peso, Russian ruble, etc.)

The COT report is the only publicly available information on positioning that we have in the Forex market since the dominant sector, interbank spot, is made up of private transactions that are not reported to any government agency. (Some central banks collect data periodically from the big banks, but it is never made public.)

While the volumes seen in futures are just a drop in the bucket in the $7.5 trillion per day traded in spot foreign exchange, the COT report offers rare insight into positioning. If X percent of traders hold a long in a currency on the Chicago Mercantile Exchange (CME), then logic follows that those in the spot market may have a similar position. If positions become extended (overbought or oversold) on the CME, then it is likely that positions are extended in the trading community as a whole. Some analysts look at the dollar equivalent holdings of the seven major currencies (EUR, JPY, GBP, CAD, AUD, CHF, NZD) to gauge overall sentiment towards the dollar.

Selecting the Right Report

The CFTC publishes two versions of the COT report, one the “legacy” version that is the main focus of Forex analysts and a newer report that was issued starting in September 2009. The old version divides the CME Forex futures trading population into commercial and non-commercial populations, with commercials interpreted as hedgers and non-commercials taken to be speculators.

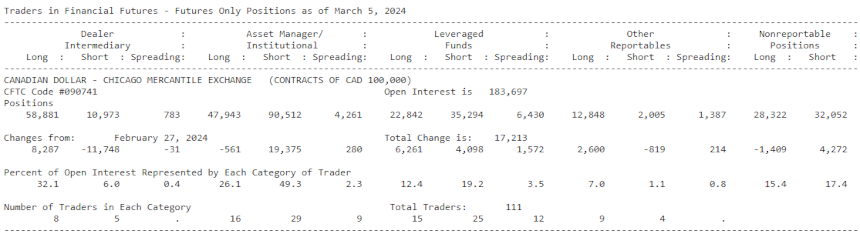

The new version adds many other markets in addition to the Chicago Mercantile Exchange, plus non-futures derivatives contracts, and categorizes the trading populations specifically as Dealer/Intermediary, Asset Manager/Institutional, Leveraged Funds, and Other Reportable, as well as the Non-Reportable category. It also offers just the futures positions in each currency, as in the old report. An example of the new report is presented below:

When the new form report first came out, analysts thought it would be an improvement. Generally, the first two categories use FX positions as a hedge, and so their holdings are not going to offer as much insight into current holdings of speculative positions as "money manager" and "other reportable" holdings, which are like the old non-commercial category. However, many analysts still have not abandoned the old legacy version. They believe that the breakdown did not improve the analysis. They figure it is better to look at what the non-commercials are doing as a whole rather than bother to look at the breakdown and have to add up two numbers that are available elsewhere as a single one.

The Legacy CFTC Report

It can be a real nuisance to try to incorporate the COT report into your trading plan because the report itself is badly designed and not user-friendly. The CFTC offers a long form and a short form for each commodity on each of a dozen exchanges, plus breakouts for futures and options and futures alone, as well as other complexities. You can get lost in the contracts for milk and cheese before you find the currencies.

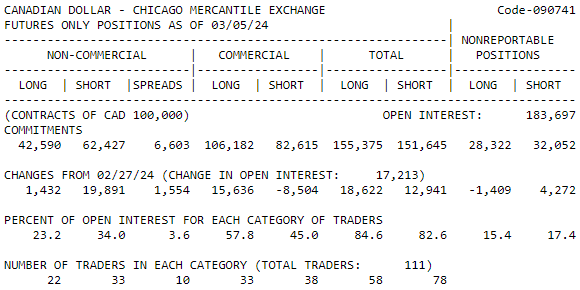

For an example of a Forex COT report, you can refer to the following image. It is for the same currency as the report pictured above.

A number of software packages and websites offer a reorganization of the COT data, including in chart form, to make the data more easily digestible, including famous trader Larry Williams, who wrote the first book on how to use the COT report to get an edge. You could also download the data into a spreadsheet and make up your own chart. The charts of most software will show commercials vs. speculators as they raise and lower their positions over time. You can often see a turning point when one or the other changes direction.

Be careful if you are using the chart form to remember that it is weekly data and, therefore, to set your data timeframe to the weekly setting.

In addition to user-unfriendliness, the other big drawback to the COT report is that it is nearly a week late by the time you get the data. The report contains data collected each Tuesday, and if there was a giant move on Wednesday and Thursday, by the time you get the report on Friday, the information could well be stale and not a good guide.

Understanding CFTC Terms

In its explanatory notes, the CFTC breaks the currency positioning data into open interest, reportable positions, commercial and non-commercial traders, and non-reportable positions. These terms are probably unfamiliar, so here is a quick guide:

Open interest: “It is the total of all futures and/or option contracts entered into and not yet offset by a transaction, by delivery, by exercise, etc.” In futures, for every contract bought, there is a seller. Therefore, “The aggregate of all long open interest is equal to the aggregate of all short open interest.” Technically, we have the same thing in the spot market — for every $1 million sold, there is a $1 million buyer and a $1 million seller, but we do not know who they are — bank position-taker, corporate hedger — or how long they will hold the position. The seller may now have a zero position while the buyer is accumulating a bigger position.

Reportable positions: “Clearing members, futures commission merchants, and foreign brokers (collectively called reporting firms) file daily reports with the Commission. Those reports show the futures and option positions of traders that hold positions above specific reporting levels set by CFTC regulations. If, at the daily market close, a reporting firm has a trader with a position at or above the Commission’s reporting level in any single futures month or option expiration, it reports that trader’s entire position in all futures and options expiration months in that commodity, regardless of size. The aggregate of all traders’ positions reported to the Commission usually represents 70 to 90 percent of the total open interest in any given market.”

Commercial and non-commercial traders: “When an individual reportable trader is identified to the Commission, the trader is classified either as ‘commercial’ or ‘non-commercial.’" All of a trader's reported futures positions in a commodity are classified as commercial if the trader uses futures contracts in that particular commodity for hedging as defined in CFTC Regulation 1.3(z): “…To ensure that traders are classified with accuracy and consistency, Commission staff may exercise judgment in re-classifying a trader if it has additional information about the trader’s use of the markets.”

In other words, it is the trader who is classified as commercial or speculative, not the trade. This is why big players like Goldman Sachs applied for (and got) a commercial designation, even though it is obvious many of its trades are actually speculative. Those designated “commercial” can usually get higher leverage from their brokers.

Non-reportable positions: “The long and short open interest shown as Nonreportable Position" is derived by subtracting total long and short Reportable Positions from the total open interest. Accordingly, for Nonreportable Positions, the number of traders involved and the commercial/non-commercial classification of each trader are unknown. The bottom line is that non-reportable positions are the small fry in the market with small positions and a distinct inability to move the market. And yet, you might want to notice that non-reportable positions can be nearly as big as the “Leveraged Funds” category in the legacy version of the report.

Commercials vs. Speculators: In the non-commercial field in a given currency, traders look at the net contract holdings between the long positions and the short positions. If non-commercials have a euro long of 113,000 contracts and a euro short of 60,000, then their net position is a euro long of +53,000 contracts. In this case, one contract is €125,000, so the speculative community at the CFTC has a net euro long of €6,625,000,000.

Traders tend to look at the seven major currencies (yen, euro, Swiss franc, sterling, Aussie, New Zealand, and Canadian dollars) both individually and as a whole.

If a major currency has a net long or short of 100,000 contracts, that would generally be viewed as being extended. Similarly, if the six major currencies all showed that non-commercial accounts had sizable net currency longs (implying they were short US dollars), that might also raise a red flag.

Example: In late 2013, the CFTC data for positions as of December 24 showed that speculative accounts (non-commercials) had a net yen short of 143,822 contracts, which was the largest yen short since July 2007. USD/JPY closed at 104.25 on December 24. A week later, the pair topped out at 105.41, and there was some profit-taking, with the net yet shorts shrinking modestly to 135,288 contracts but still suggesting that the yen was oversold. By February 4, USD/JPY had fallen to 100.76, and the net yet short position had been reduced to 76,829 contracts. A trader seeing the extended yen short positions in late December might have decided to go the other way and either sold USD/JPY or EUR/JPY.

Should You Follow the Commercials?

Traditional trading lore has it that the way to use COT data is to “follow the commercials.” In FX, this is not always the best advice.

Who are commercials, anyway? Technically, they are enterprises that have a currency position that is incidental to their core business. To them, a long Forex position is a nuisance. Say you are a Chicago manufacturer of widgets that you sell in Mexico. The importer pays you in pesos. You want to sell the pesos in the futures market as soon as you know the size of the order in order to protect your revenue stream. In fact, you probably consulted the futures price for the payment date before you priced the product in pesos to the importer. By the time you have placed your peso sell order, you no longer care where the peso goes. If it goes down, you are protected by your fixed price already secured with your futures sale. If it goes up, you have an opportunity loss but not a cash loss. Commercials are not trying to make money from trading currencies — they are making money buying and selling widgets. To be fair, some commercials in Forex might exit the peso short contract by covering (buying it back) if they see an important rising trend, but trying to improve profit margins via currencies is not their core business.

In Forex, the large speculators are the trend-followers. Many small speculators will be trend followers, too. Who are they? Commodity fund managers, for the most part, plus a few of the big banks and brokers. You might think you want to follow the money managers but remember: trend followers generally miss the turning points. The important thing you are looking for is when the position of either commercials or speculators gets proportionately large compared to recent data, at which point the professionals think it is “extended” or overdone. This is often, if not always, a reliable guide to a pending turning point.

Why Care About Speculative Positions?

Even if a trader works at a large bank and sees sizable client flows going through, these flows may not impart enough knowledge to assess the size of current positions in a given currency. Just because a big euro sell order is executed in the market, it does not necessarily mean that market players as a whole are short euros. Perhaps players were heavily long euros instead and now are squaring up. Because flow data can be deceptive and because many players do not have access to these flows, traders look for any gauge that offers insight into which way the market is leaning. Because of this, they like to look at the positioning data by CFTC as well as reports released by the Tokyo Financial Exchange.

Before entering into an FX position, a trader should have an idea of market positioning because this tells him not just what other market players think is going to happen to a given currency but also how fervently players believe this. This knowledge helps a trader better decide when to put on a long or short currency position.

Pro tip: Forex traders tend to focus on the Reportable Positions and then home in on the Non-Commercial Positions, as these are deemed speculative in nature, in contrast to Commercial positions, which are looked at as a hedge against underlying commodity positions.

If you are interested in trading based on COT reports, you might find our COT strategy useful.