Scaling In and Out of Positions

“Scaling in” means increasing the number of lots in a position as the price is going in the favorable direction and your confidence is rising that the trade will be profitable. “Scaling out” is to reduce the number of lots in a position as price momentum fades. Scaling in and out is a sensible tactic, although it requires good bookkeeping unless you are trading on such a tiny timeframe that you would be spending all your time placing orders and being distracted from watching the market action.

If you are going to trade 5 lots and the trade goes your way, you will make a bigger profit placing all 5 at once at the beginning. Scale in means placing one trade, then a few more at higher prices (if you are a buyer), and the final one or two as your profit target is getting near. But the virtue of scaling in is that you are not putting all your eggs in one basket. We have all seen moves suddenly fizzle and end abruptly. If you are employing the scaling in tactic, you have only one or two positions to exit, and therefore, losses are limited. If you are “all in” from the beginning with all five lots, your losses are bigger.

Some traders say they would never use any tactic that reduces total profitability. But this smacks of desperation and is a failure to see the forest for the trees. Any method that reduces the risk of losses and actual losses over time is keeping you at the table. You cannot play if all your chips are gone. Scaling in is a particularly useful discipline for those who are impetuous in pulling the trigger.

Scaling out is, similarly, a risk-reduction technique. By taking some profit on one or two contracts early in the move, you are improving your gain/loss ratio. The remaining contracts are almost “free,” especially if you are using a trailing stop so that by the time you are taking profit on the first few contracts, the stop is now relatively small.

Scaling in and scaling out work well with trailing stops to get an enhanced risk reduction and with another risk reduction tactic — using additional indicators as the trade matures to affirm your initial analysis and position. By the time the price move is ending — in any and all timeframes — you should have indicators warning you that your exit should be close by. You may enter or exit a contract or two on Indicator #1, add or subtract a contract or two on Indicator #2, and complete the entry/exit as each additional indicator falls into line.

Exiting on scaling out methodology is always harder. For one thing, nobody likes to give up a good thing. For another, indicators are notoriously unreliable. You may see the Stochastic oscillator, RSI, and momentum all starting to droop downward after a strong up-move. These are logical indicators to use for scaling out. But no sooner do you exit one or two contracts than the price perks up again and keeps going upward after only the slightest of pullbacks. Now you have an opportunity loss, and those are irksome. The stochastic oscillator, in particular, will often signal the end of a move — the currency is wildly overbought — but in a really strong trend, it can stay wildly overbought for a very long time. This is why stochastic is not the best indicator to use when scaling out if you are a trend follower. Run it against the long-lasting moves in USD/JPY and you will see why.

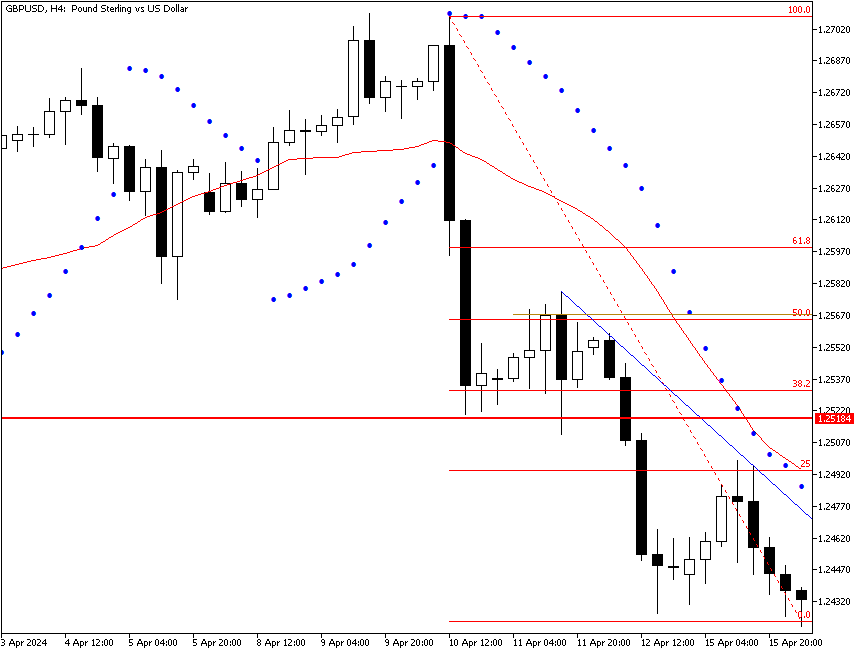

Example

Let’s say you have reason to think GBP/USD has bottomed after a retracement and will return to a primary uptrend that will exceed the previous high. You know your target — the previous high (1.2498) plus 20 points, or 1.2518. You also know your stop — the previous lowest low, 1.2420 minus 10 points = 1.2410. The price is now 1.2443.

You buy one lot at the current price of 1.2443 with a stop at 1.2410. Your profit target is 75 points, and your stop loss is 33 points.

The price moves up to 1.2473. You add a lot and place the stop on the second lot 30 points above the first stop, or 1.2440.

The price moves up to 1.2503. This is very close to the previous high, but the exact level is surpassed, and you can breathe a sigh of relief. Your scenario is coming true. Traders remember when a previous high is surpassed, and they return to the long side in a bandwagon effect. You add a third lot at 1.2505 and raise the stop all three stops up another 30 points at 1.2470.

Now, your target is hit at 1.2518. Your P&L shows a gain of 133 points:

| Bought 1 @ 1.2443 | Sold 1 @ 1.2518 | Gain: 75 |

| Bought 1 @ 1.2473 | Sold 1 @ 1.2518 | Gain: 45 |

| Bought 1 @ 1.2505 | Sold 1 @ 1.2518 | Gain: 13 |

Why not just buy all three lots at the starting point, 1.2443, and have a profit of 225 points? There are two answers. As noted above:

- We are guessing at a likely scenario that we have seen before, but we have also seen expected recovery moves fizzle. By not putting all our eggs in one basket, we are protected from our own wishful thinking.

- We were using confirmation signals from the market itself to warrant additional lots.

It is vital to remember that plain scaling in and scaling out — without proper additional signals that are valid in your trading systems — reduces expected profitability.