Many Forex traders still prefer to use binary options and in their currency trading. Quite a few also use other types of financial options to trade Forex. Although it is not much compared with the popularity of the spot market, options can be very useful in the portfolio of every trader. However, there are two problems when dealing with online options trading industry:

- The majority of online Forex traders lack basic understanding of the financial options concept.

- Binary options have a very poor reputation thanks to many brokers acting like they are online casinos with a

get-rich-quick attitude.

The first problem will be addressed here by explaining the basics of binary and vanilla options and their main difference. The second problem cannot be addressed by a single website, but we can start by introducing vanilla options and manageable binary options as a viable alternative to gambling opportunities that most popular BO brokers actually offer.

What are options and why traders need them?

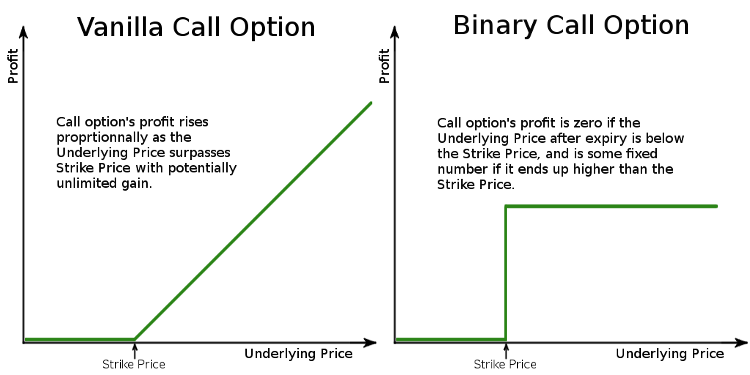

Vanilla options are financial contracts that entitle a right to buy or sell a specific asset at a particular price (called strike) on or before an agreed time/date. An example of a call option (bullish) is a contract for a right to buy 1 lot of EUR/USD at 1.2000 (assuming the current rate of 1.1837) on December 31, 2021. If you buy such an option, you are betting on significant EUR/USD uptrend during this year. Your gain on the strike date is calculated as X — 1.2000, where X is the EUR/USD rate on December 31, 2021. For the sake of example, let's consider that it reaches 1.2221. Your end gain is 1.2221 — 1.2000 or 221 pips or $2,210. Depending on the price you paid for this call option, you can calculate your total profit or loss. E.g., if you paid $1,000 for it, your total profit would be $2,210 — $1,000 = $1,210.

You might be asking — what is the point of buying such an option when you could make 384 pips (1.2221 — 1.1837) buying 1 lot of EUR/USD on spot Forex? Because your risk is limited with a call option. If you buy 1 lot of EUR/USD, your risk is virtually limitless. Of course, you would apply a

Let us look at an example of a losing vanilla option trade but now with a put option (bearish). You anticipate a

American and European style options

Vanilla options come in many styles, but the most popular are two of them: American and European. American options can be exited or, simply telling, sold before the expiration time. You might decide to exit a call option to cut your loss if you see that the currency pair is poised to move down. Or you might want to sell a contract when the underlying rate moves in your favor but you need some cash. In this case, you earn the profit, which is a difference between the price you sold your option for and the price that you have paid for it. In the examples above, you could have sold your call or put contract before December 31, 2021, if you had been buying

European options cannot be sold before the contract's expiry date. In the examples above, you would not be able to sell your European options before December 31, 2021. Obviously, European options for the same underlying asset, same entry and strike price, and same expiry date should always be valued cheaper or equally to American options. If you are focusing on Forex trading, you will probably never deal with European options as currency options are rarely traded in the European style.

Binary options

Binary options are not vanilla options. They are exotic style options as they are neither American nor European. The main difference between the binary and the vanilla options is the fixed outcome of the former: you get a fixed ROI (return on investment) on the contract's price if option ends

How to use options to your advantage?

Getting the right platform

Despite their disadvantages and apparent difference from the traditional spot Forex trading, both vanilla and binary variants can be used as an auxiliary tool by common retail traders. You have probably read our case study for using a spot FX trade to hedge a binary option trade. There are other ways to combine spot and options, but to do so, you have to choose your broker carefully.

First thing to do is to avoid binary trading brokers with inflexible strike prices and times. It is also a bad idea to trade with binary option providers that forbid exiting a trade before the expiry of the option. A flexible contract size is also a very important property for successful combination of binary and spot trading. If your broker lacks all of the

Second, the best binary brokers offer not only the standard calls and puts but also such important option types as "touch"/"

Third, going with a vanilla options broker (like Interactive Brokers or easyMarkets) should be your preferred choice. Unfortunately, with companies offering vanilla options trading, it is still true that the better their conditions and the platform, the more difficult it is to set up an account with them. You would need at least $10,000 to open an options trading account with Interactive Brokers and also pay for the price feed subscription, but you would get an exceptionally powerful options trading platform. With easyMarkets, starting is much easier (who would have thought!), but their product is less sophisticated and would not satisfy a professional participant of the options market.

Combining spot and options FX trading

There is a number of ways to enhance your overall trading performance using different kinds of options. Here is a short list of some such methods:

- An earlier mentioned method for hedging a

no-touch option on the spot FX market. - Binary options can be used to trade your ideas of the future market volatility. For example, even a simple uncovered sale of the normal call and put options can be used to bet on a decrease in volatility.

Long-term trades are probably safer in options than in spot. When you bet on along-term behavior, you normally want to avoid using astop-loss because it may prevent your trade from maturing. On the other hand, trading spot market without astop-loss can be very risky. This is where buying a call or a put would do the trick for you.- You can use data from your options platform to analyze the current market sentiment. Higher values for certain strike prices usually mean higher probability of moving towards those levels.

If you would like emphasize some other advantages or disadvantages of the different types of FX options, please feel free to join our Forex forum for a discussion.