Popular results

Position Sizer

Calculate risk-based position size directly in your MetaTrader platform and execute a trade in one click or a press of a button.What Is Forex

Learn what Forex is and how it works from this simple explanation.Supertrend

Download the Supertrend indicator for MT4 and MT5 to detect trend changes based on the price action.Position Size Calculator

Calculate your position size based on risk, stop-loss, account size, and the currencies involved. A simple online calculator for quick results.Market Profile

Market Profile MetaTrader indicator — is a classic Market Profile implementation that can show the price density over time, outlining the most important price levels, value area, and control value of a given trading session. This indicator can be attached to any timeframe and supports multiple session lengths, including a free-draw rectangle session to create a custom market profile of arbitrary length. Lower timeframes offer higher precision. Higher timeframes are recommended for better visibility. Six different color schemes are available to draw the profile's blocks. Drawing profiles as a plain color histogram is also possible. Alternatively, you may choose to color the profile based on bullish/bearish bars. This indicator is based on bare price action and does not use any standard indicators. It is available for MetaTrader 4, MetaTrader 5, and cTrader platforms.

A system of alerts is available for price crossing the levels of Value Area high and low, Median, and Single Print zones.

The following sessions are supported:

- Daily: the common 24-hour session popular in Forex trading. By default, it uses your broker's timezone for day start and day end, but you can set your own time shift to change that.

- Weekly: a session length that works well for both Forex and stocks analysis as both asset types have clear weekly start and end.

- Monthly: can be useful to analyze long-term movements in any financial asset.

- Quarterly: this session length is intended mostly for analysis of the stock market with its quarterly company reports.

- Semiannual: another long-term session, which can be useful for assets that show high seasonality.

- Annual: the ultimate long-term session, which can help with analysis of any asset, be it Forex, commodities, equities, or cryptocurrencies.

- Intraday: with this session, you can break down the day into 4 or less sections to analyze specific trading sessions, for example, New York and Asian, together or separately.

- Rectangle: a free-form session, useful when you would prefer to analyze some specific period that has no fixed calendar counterpart.

Sessions can be switched either via input parameters or via the following keyboard shortcuts:

Ctrl +1 for Daily.Ctrl +2 for Weekly.Ctrl +3 for Monthly.Ctrl +4 for Quarterly.Ctrl +5 for Semiannual.Ctrl +6 for Annual.Ctrl +7 for Intraday.Ctrl +8 for Rectangle.

Input parameters

Main

- Session (default = Daily) — a trading session for market profile: Daily, Weekly, Monthly, Quarterly, Semiannual, Annual, Intraday, and Rectangle. For a rectangle session to get calculated, a rectangle chart object with the name starting with MPR should be added to the chart. Pressing 'r' on the keyboard will add a properly named rectangle object automatically.

- StartFromDate (default = __DATE__) — if StartFromCurrentSession is false, then the indicator will start drawing profiles from this date. It draws to the past. For example, if you set it 2018-01-20 and SessionsToCount is 2, then it will draw the profiles for 2018-01-20 and 2018-01-19.

- StartFromCurrentSession (default = true) — if true, then the indicator starts drawing from today, else — from the date given in StartFromDate.

- SessionsToCount (default = 2) — for how many trading sessions to draw the market profiles.

- SeamlessScrollingMode (default = false) — if true, the StartFromDate and StartFromCurrentSession parameters are ignored; the sessions are calculated and displayed starting from the current chart position's rightmost bar. This allows scrolling back in time indefinitely to view past sessions.

- EnableDevelopingPOC (default = false) — if true, multiple horizontal lines will be drawn to depict how the Point of Control developed through the session.

- EnableDevelopingVAHVAL (default = false) — if true, multiple horizontal lines will be drawn to depict how the Value Area High and Value Area Low developed through the session.

- ValueAreaPercentage (default = 70) — a percentage share of the session's TPOs to include in the Value Area.

Looks and colors

- ColorScheme (default = Blue to Red) — color scheme for profile's blocks:

- blue to red

- red to green

- green to blue

- yellow to cyan

- magenta to yellow

- cyan to magenta

- SingleColor (default = clrBlue) — if ColorScheme is set to Single Color, this color will be used to draw market profiles.

- ColorBullBear (default = false) — if true, the color of the profile blocks depends not on the age of the origin bar but on its direction.

- MedianColor (default = clrWhite) — the color of the control value (median).

- ValueAreaSidesColor (default = clrWhite) — the color of the value area side borders.

- ValueAreaHighLowColor (default = clrWhite) — the color of the value area top and bottom borders.

- MedianStyle (default = STYLE_SOLID) — the Point of Control (median) line style.

- MedianRayStyle (default = STYLE_DASH) — the Point of Control (median) ray line style.

- ValueAreaSidesStyle (default = STYLE_SOLID) — the style of the value area side borders.

- ValueAreaHighLowStyle (default = STYLE_SOLID) — the style of the value area top and bottom borders.

- ValueAreaRayHighLowStyle (default = STYLE_DOT) — the style of the value area top and bottom rays.

- MedianWidth (default = 1) — the Point of Control (median) line width.

- MedianRayWidth (default = 1) — the Point of Control (median) ray line width.

- ValueAreaSidesWidth (default = 1) — the width of the value area side borders.

- ValueAreaHighLowWidth (default = 1) — the width of the value area top and bottom borders.

- ValueAreaRayHighLowWidth (default = 1) — the width of the value area top and bottom rays.

- ShowValueAreaRays (default = None) — can be set so that the value area's High and Low price levels are projected to the right side of the chart. Can be set to previous session, current, previous and current, all previous, or all.

- ShowMedianRays (default = None) — can be set so that the median is projected to the right side of the chart. Can be set to previous session, current, previous and current, all previous, or all.

- RaysUntilIntersection (default = Stop_No_Rays) — defines the way median and value area rays will be cut off when they meet the next trading session's price range:

- Stop_No_Rays — no rays are stopped anywhere.

- Stop_All_Rays — all rays are stopped at an intersection with the price of another session.

- Stop_All_Rays_Except_Prev_Session — all rays except the previous session's rays are stopped at an intersection with the price of another session.

- Stop_Only_Previous_Session — only rays of the previous session are stopped at an intersection with the price of another session.

- HideRaysFromInvisibleSessions (default = false) — if true, rays from sessions starting behind the left edge of the screen won't be displayed until you scroll back to them.

- TimeShiftMinutes (default = 0) — time shift for the sessions, in minutes. Positive value will move the session start to the left; negative — to the right.

- ShowKeyValues (default = true) — if true, Value Area High, Value Area Low, and Point of Control are displayed on the left of the market profile.

- KeyValuesColor (default = clrWhite) — the color for Value Area High, Value Area Low, and Point of Control printout.

- KeyValuesSize (default = 8) — the font size for Value Area High, Value Area Low, and Point of Control printout.

- ShowSinglePrint (default = No) — can be set to Leftside or Rightside and will mark the single print profile — a part of the profile, which is only one TPO wide.

- SinglePrintRays (default = false) — if true, single print edges are marked with rays.

- SinglePrintColor (default = clrGold) — the color for single print marking if ShowSinglePrint isn't set to No.

- SinglePrintRayStyle (default = STYLE_SOLID) — the single print ray line style.

- SinglePrintRayWidth (default = 1) — the single print ray line width.

- ProminentMedianColor (default = clrYellow) — the color for the prominent median (PPOC) if ProminentMedianPercentage is set to 100 or less.

- ProminentMedianStyle (default = STYLE_SOLID) — the style for the prominent median (PPOC) if ProminentMedianPercentage is set to 100 or less.

- ProminentMedianWidth (default = 4) — the width for the prominent median (PPOC) if ProminentMedianPercentage is set to 100 or less.

- ShowTPOCounts (default = false) — if true, TPO counts for the number of TPOs above and below the median (POC) are displayed to the right of the market profile.

- TPOCountAboveColor (default = clrHoneydew) — the color for the TPO count above the median (POC) if ShowTPOCounts is set to true.

- TPOCountBelowColor (default = clrMistyRose) — the color for the TPO count below the median (POC) if ShowTPOCounts is set to true.

- RightToLeft (default = false) — if true, the current session's market profile has its histogram drawn from right to left. In case Session is set to Rectangle, market profiles of all sessions are drawn right-to-left.

Performance

- PointMultiplier (default = 0) — the higher it is, the wider are the profile's price boxes and the fewer are the chart objects. You can use it to reduce the indicator's load on CPU. When the value is zero, an adaptive multiplier is used — the indicator attempts to calculate the optimal value automatically.

- ThrottleRedraw (default = 0) — a delay in seconds that will be applied before each redraw of the profiles. You can use it to reduce the indicator's load on CPU.

- DisableHistogram (default = false) — if true, no market profile histogram is drawn, but Value Area and Median are still marked. This makes indicator work extremely fast, but is less useful for thorough market analysis.

Alerts

- AlertNative (default = false) — if true, the indicator will issue the platform's native pop-up alert when some alert conditions are met.

- AlertEmail (default = false) — if true, MetaTrader's email alerts will be sent when some alert conditions are met. Email should be properly configured in MetaTrader via Tools->Options->Email

- AlertPush (default = false) — if true, MetaTrader's push notification alerts will be sent to your mobile device when some alert conditions are met. Notifications should be properly configured in MetaTrader via Tools->Options->Notifications. This alert type is not available in the cTrader version of the indicator.

- AlertArrows (default = false) — if true, MetaTrader will draw arrows on the chart when some alert conditions are met.

- AlertCheckBar (default = Previous) — controls the bar to check the alert conditions on. Current — the indicator will check the current unfinished bar; expect a lot of alerts. Previous — the indicator will check the previous (closed) bar; alerts will be delayed but more concise.

- AlertForValueArea (default = false) — if true, alerts will be issued whenever a Value Area ray (high or low) is crossed by the price.

- AlertForMedian (default = false) — if true, alerts will be issued whenever a Median ray is crossed by the price.

- AlertForSinglePrint (default = false) — if true, alerts will be issued whenever a Single Print ray is crossed by the price.

- AlertOnPriceBreak (default = false) — if true, alerts will be issued when the price breaks any of the trigger levels but then returns back behind it.

- AlertOnBarClose (default = false) — if true, alerts will be issued when the bar opens on one side the trigger level and closes on the other side of it.

- AlertOnGapCross (default = false) — if true, alerts will be issued when the trigger level appears inside a price gap between the last two bars.

- AlertArrowCodePB (default = 108) — arrow code for price break alert arrows.

- AlertArrowCodeCC (default = 110) — arrow code for candle close alert arrows.

- AlertArrowCodeGC (default = 117) — arrow code for gap crossover alert arrows.

- AlertArrowColorPB (default = clrRed) — arrow color for price break alert arrows.

- AlertArrowColorCC (default = clrBlue) — arrow color for candle close alert arrows.

- AlertArrowColorGC (default = clrYellow) — arrow color for gap crossover alert arrows.

- AlertArrowWidthPB (default = 1) — arrow width for price break alert arrows.

- AlertArrowWidthCC (default = 1) — arrow width for candle close alert arrows.

- AlertArrowWidthGC (default = 1) — arrow width for gap crossover alert arrows.

Intraday sessions

- EnableIntradaySessionN (default = true) — if true and Session is set to Intraday, then the indicator will attempt to drawn the intraday market profile #N on the chart.

- IntradaySessionNStartTime (default = "HH:MM") — start time in HH:MM format for the intraday session #N.

- IntradaySessionNEndTime (default = "HH:MM") — end time in HH:MM format for the intraday session #N.

- IntradaySessionNColorScheme (default = Blue_to_Red) — color scheme for the intraday session #N.

Miscellaneous

- SaturdaySunday (default = Normal sessions) — how to treat Saturday and Sunday sessions:

- Normal sessions — Saturday and Sunday will be treated as normal sessions with their own daily and intraday sessions.

- Ignore Saturday and Sunday — Saturday and Sunday candlesticks will be ignored.

- Append Saturday and Sunday — Saturday candlesticks will be appended to the Friday session; Sunday candlesticks will be appended to the Monday session.

- DisableAlertsOnWrongTimeframes (default = false) — if true, no pop-up alerts will appear on using Market Profile with wrong timeframe/session combination.

- ProminentMedianPercentage (default = 101) — percentage of TPOs out of all possible that should occur inside a median for it to be considered prominent (PPOC). For example, if you set it to 50%, a median will be marked as prominent if it contains at least 24 TPOs in a daily session on M30 timeframe. If it is set to 101, no prominent median is possible.

Examples

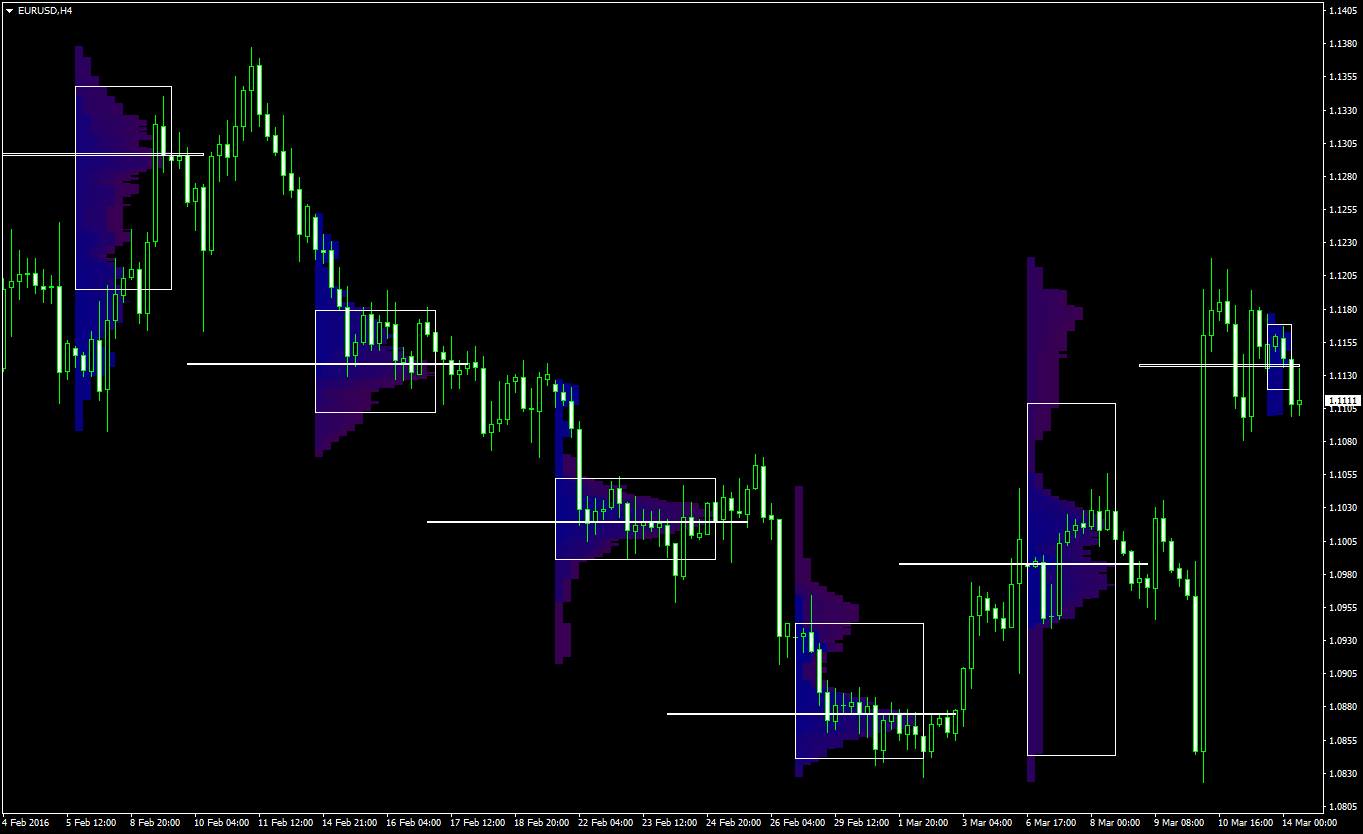

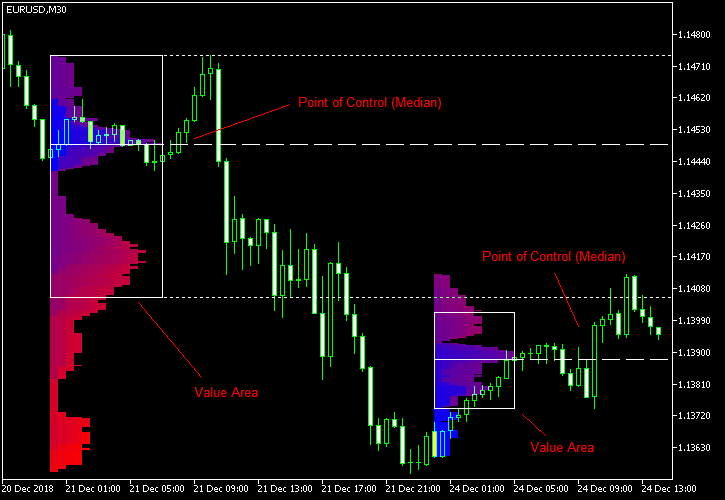

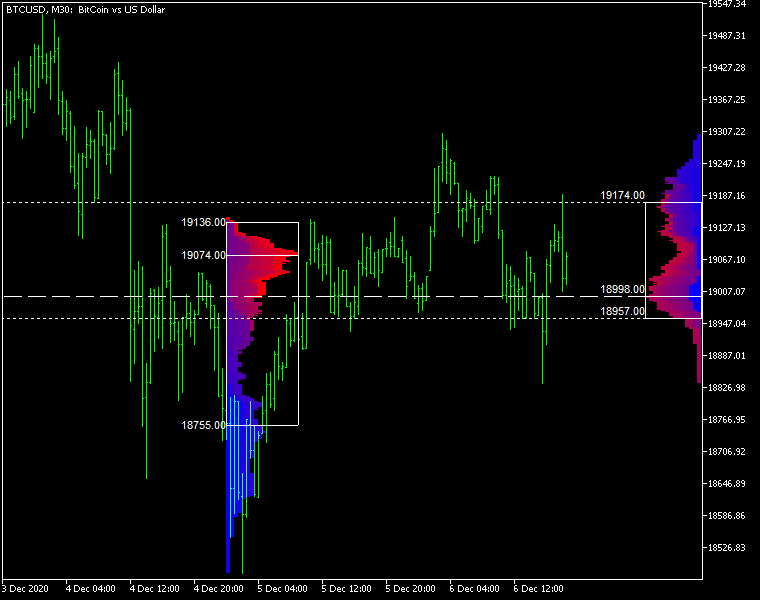

Daily sessions

The chart screenshot shows market profiles calculated and displayed for two daily Forex trading sessions. The timeframe is M30 and the right-hand daily session is still in progress. The earliest prices are blue and the latest prices are red. The medians and the value areas are marked with the white lines and display the most important price areas. Traders tend to return to those areas if the volume of the breakout movement is not too high. High-volume breakout out of these areas signifies a real breakout. You can read more about Market Profile in this short e-book: Book on Market Profile.

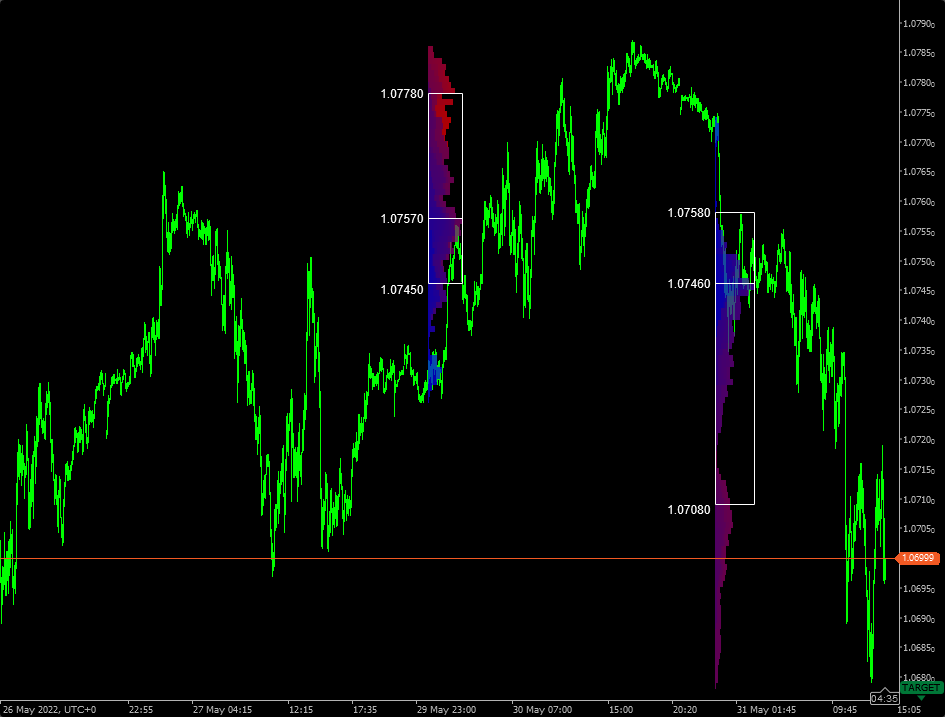

Bullish/bearish coloring

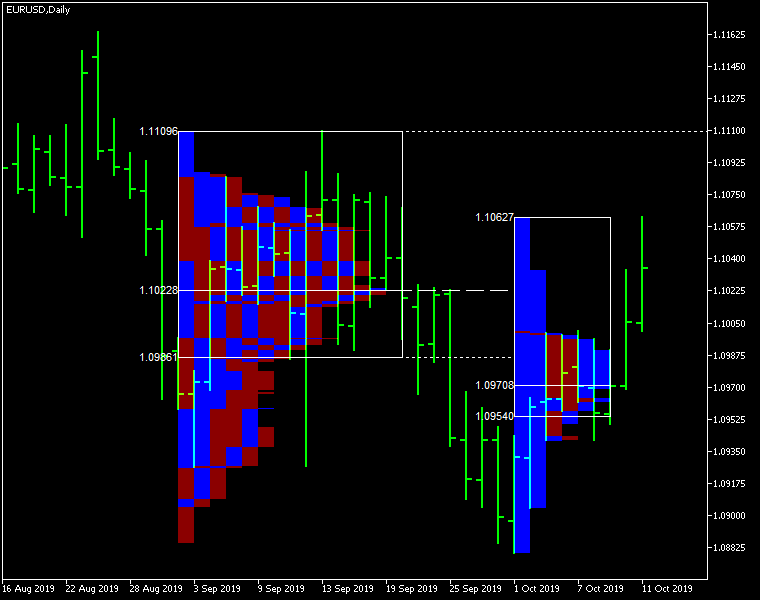

The example below demonstrates how the Market Profile can be colored according to the direction of each bar in the session rather than its age. This is done when ColorBullBear is set to true.

Rectangle sessions

This example demonstrates how the indicator can display a market profile based on the rectangle chart objects freely drawn by a trader. For this to work, a rectangle object's name has to start with MPR and the Session input parameter has to be set to Rectangle. You can press 'r' on your keyboard to add such a rectangle to the chart automatically.

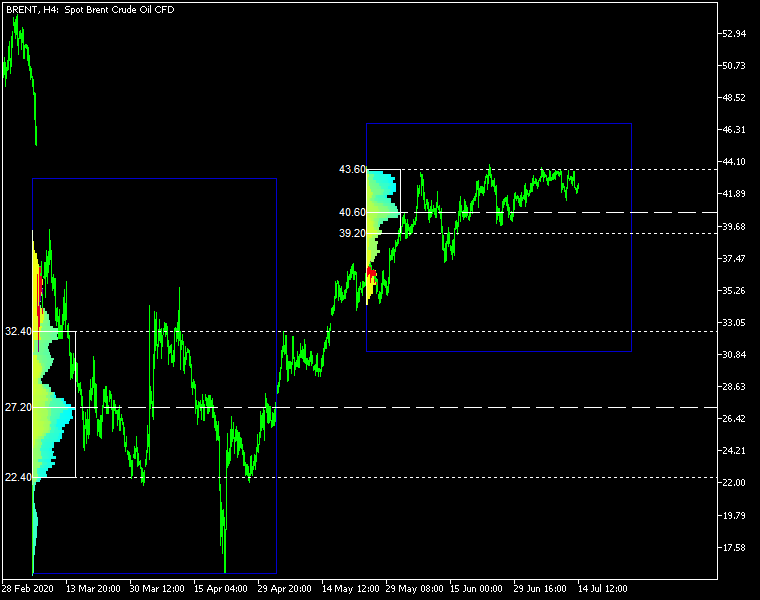

Right-to-left display

Market Profile indicator can also draw histogram from right to left. Unlike the traditional left-to-right display, it can be helpful to focus on the current trading session, without obscuring its chart. You can see how this works in the chart screenshot below.

cTrader

Market Profile indicator is also available as a free cTrader indicator. It is very similar to its MetaTrader siblings, but cannot work with push notification alerts.

Download (ver. 1.24, 2025-06-17)

MarketProfile indicator is being developed via a dedicated GitHub repository. You are encouraged to actively participate in the improvement of this indicator by submitting your own features via pull-requests and reviewing existing suggestions, changes, fixes, and so on.

MT4/MT5

Market Profile for MetaTrader 4 in .zip Market Profile for MetaTrader 4 in .mq4 Market Profile for MetaTrader 5 in .zip Market Profile for MetaTrader 5 in .mq5How to use Market Profile in Forex trading?

Market Profile indicator is a powerful tool developed by a CBOT trader. Its original purpose was to graphically organize price and time information obtained during a trading session in a manner useful to traders. Today's Forex market is quite different from what commodity futures trading was back in 1985 when Peter Steidlmayer introduced his charting instrument to the public. Can Market Profile be a useful tool to Forex traders?

Issues with Forex

The main difference between today's currency market and the futures market of 80's is the lack of daily trading sessions. Fortunately, it does not produce any real problems. The lack of strict daily close and daily open can be compensated by one of the following methods:

- A rolling 24-hour window for Market Profile calculation. Each new bar, the Market Profile calculation window is shifted right by one bar as well. This way, a trader is always looking for the graphical profile of the recent 24 hours of trading. Unfortunately, this would require a complete recalculation of the whole curve with every new bar arriving. Still, this can be accomplished by using the Rectangle session type in our Market Profile indicator.

- Smaller geographically-bound time windows. The Forex market operates through several widely recognized trading sessions. The most prominent of them are: London, New York, and Tokyo. A trader operating mainly inside the New York trading session could use a 10-hour window based on the NY open and close to calculate and display Market Profile. A trader operating within a mix of New York and Asian sessions could use the span of both. The good thing is that with this method, the calculation process is much simpler than with a rolling window. The bad thing is that it ignores all the market data that is left outside of the target trading sessions.

- Weekly trading sessions. Unlike days, the weeks in Forex are clearly defined. The minor difference of Sunday/Monday open and Friday/Saturday close between different brokers and liquidity providers is small enough to ignore (one or two hours of thin-volume trading). Weekly Market Profile is easy to calculate and offers a lot of data to traders. However, it is rarely suitable to short-term intraday traders, less so to scalpers.

Apparently, it is still possible to apply Market Profile to modern foreign exchange market. The most consistent approach seems to be the third one, which is based on weekly sessions.

Another important issue to solve when using this indicator in analysis is whether to apply it to the current session — and suffer from the lack of data during the early hours — or to the previous session, which could be based on stale data. In reality, this is no issue at all. As outlined in the CBOT's A Six-Part Guide to Market Profile, the most important profile is based on the current session, but the profile built during the previous one is also relevant and should be analyzed by a trader.

Moreover, it is possible (and useful) to look at several previous profiles at once, analyzing how the trend developed across more than one value area. The multi-session Market Profile analysis is also a key to detecting long-term areas of balance and states of imbalance. In fact, long-term traders should be looking at Market Profiles of many sessions to determine possible points of entry and exits.

The following example shows Market Profile calculated for six weekly sessions of the EUR/USD currency pair:

Usage

As the indicator's author stated, the Market Profile should not be used as a buy/sell signal generator. It is a tool for analyzing the market and getting information that isn't evident from a bare chart. Here is how the main parts of the Market Profile can be used in Forex trading:

Value area — the area of market acceptance. The price spent a hefty amount of time at those levels — the market likes it. The edges of the value area form strong support and resistance levels.

Median — the middle of the value area offers a strong pivot point. It serves both as the attractor for the price and as the bounce level. The median is also called a fair price. If market is below the level, it is considered undervalued. If it is above the median, it is overvalued.

Areas of low volume — the long tails below and above the value area show the price areas rejected by the market. The bottom tail is telling us of long-term buyers outperforming long-term sellers at those price levels. The top tail is telling us about the long-term sellers doing better than buyers at the respective price levels.

Even if you aren't a regular user of Market Profile indicator and your main trading strategy is based on a different concept or if your strategies are either automated with expert advisors or use fundamental indicators, you can still consult the long-term market profiles in times of doubt when lacking accurate information on where to put an entry order, take-profit, or stop-loss.

Discussion

Warning!

If you do not know how to install this indicator, please read the MetaTrader Indicators Tutorial.

Do you have any suggestions or questions regarding this indicator? You can always discuss Market Profile with the other traders and MQL programmers on the indicators forums.

Changelog

1.24 — 2025-06-17

- Added Quarterly, Semiannual, and Annual sessions.

- Added hotkeys to switch between sessions (

Ctrl +1-8 ) without changing input parameters. - Added an option to display the TPO counts for the number of TPOs above/below the POC (median).

- Added informative tooltips to various chart objects.

- Fixed a bug in the MT5 version that could result in some random values showing up on the chart.

- Fixed a bug in the MT5 version that would set the developing POC color to none.

- Optimized and reworked the cTrader version of Market Profile for better performance and more clarity with input parameters.

- Changed how automatic point multiplier calculation works (when PointMultiplier is set to 0) to make one TPO the size of 1 pixel on the chart.

- Changed allowed timeframes for the Intraday session to include M30.

- Changed developing POC, VAH, and VAL display to enable it for prices that were valid during just a single bar.

1.23 — 2024-05-20

- Added Developing Value Area High and Value Area Low lines.

- Added support for negative prices in MT5.

- Fixed some bugs with Developing POC not appearing or appearing in wrong places.

- Fixed a bug with cTrader version when extra sessions could appear.

- Changed all input parameters for colors in the cTrader version from

stringtoColor.

1.22 — 2023-06-14

- Added input parameter headings in the MT4 version of the indicator.

- Improved performance for right-to-left and seamless scrolling modes.

- Fixed an issue with flickering profiles in the seamless scrolling mode in MT5.

1.21 — 2023-01-09

- Fixed an MT5-only bug that prevented the developing POC from showing up.

1.20 — 2022-12-07

- Added arrow alerts for history — arrows are now displayed immediately for old sessions that should have generated alerts in the past.

- Fixed rays in the seamless scrolling mode.

- Fixed a bug with alert arrows that prevented them from showing up if no other alert types were turned on.

- Fixed a minor bug when single print rays weren't hiding correctly.

- Changed the default value for the AlertCheckBar input parameter from Current to Previous.

- Fixed removal of arrows when a rectangle is removed in the Rectangle session mode.

1.19 — 2022-05-17

- Added the arrow alerts option.

- Added the seamless scrolling mode to display sessions starting from the rightmost bar of the current chart window. This can be helpful to analyze past sessions without going back to the indicator's input parameters constantly.

- Fixed input parameter types for SinglePrint ray style and width.

- Fixed a bug with when value area and POC rays could be shown for a wrong session in some cases.

- Fixed description of the RaysUntilIntersection parameters' values.

- Fixed a glitch when random indicator plot values could be displayed in the MT5 version of the indicator.

- Fixed a glitch when value area rays could be disappearing and appearing again in the MT5 version of the indicator.

- Fixed a bug when single print wasn't properly removed for the current trading session.

1.18 — 2022-01-12

- Added alerts for crossing Median (Point of Control), Value Area, and Single Print zones.

- Added a new ray drawing mode (via the HideRaysFromInvisibleSessions input parameter) where rays are not shown in the chart if their source sessions are behind the left edge of the screen. This helps to reduce chart clutter when working with many sessions at once.

- Improved performance in both MT4 and MT5 version of the indicator.

- Fixed a bug with session colors in latest MT5 builds.

- Fixed Value Area lowest edge — it is now drawn at its real level.

- Fixed a bug when all rays could disappear when a new session started.

1.17 — 2021-07-17

- Added a developing POC option to show how the Point of Control (median) developed during the session.

- Added style and width input parameters for all lines and rays.

- Added a hotkey (r) to place a properly named rectangle chart object in the Rectangle session mode.

- Added an input parameter (ValueAreaPercentage) to control how many TPOs (the profile's building blocks) should be captured by the Value Area.

- Added an option for Single Print rays to mark the edges of single print profile ranges.

- Fixed time zone shift parameter (TimeShiftMinutes) to work properly with Intraday sessions.

1.16 — 2020-12-07

- Added an input parameter (DisableHistogram) to prevent the indicator from drawing profile histograms (TPO's). Value area and point of control are still drawn in this mode.

- Added an input parameter (RightToLeft) for right-to-left histogram display. Works for the current trading session for non-Rectangle session types, and for all trading sessions for Rectangle session type.

- Added adaptive point multiplier option via setting the PointMultiplier input parameter to 0 (which is now default).

1.15 — 2020-07-14

- Added Rectangle session type to display market profile based on rectangle objects added to the chart. It works on any timeframe. A rectangle should have a name starting with MPR to be detected by the indicator.

- Added single print highlighting (ShowSinglePrint and SinglePrintColor input parameters).

- Added prominent median (PPOC) highlighting (ProminentMedianPercentage and ProminentMedianColor input parameters).

1.14 — 2020-01-26

- Replaced ValueAreaColor input parameter with two separate parameters: ValueAreaSidesColor and ValueAreaHighLowColor to provide more control over how the value area is shown on the chart.

- Changed RaysUntilIntersection input parameter to provide more control over which value area or point of control (median) rays are cut off at intersection with other sessions.

- Fixed a rounding error in MT5 version, which resulted in value areas being biased towards higher prices.

- Fixed a bug in MT5 version, which resulted in profile blocks being displayed in white color rather than not displayed at all when Single_Color scheme is used and SingleColor parameter is set to

clrNone. - Bypassed a coloring bug in MT4 version that would cause the chart discoloring and blinking along with visible gaps showing in the profile.

1.13 — 2019-10-18

- Added ColorBullBear input parameter to color the market profile according to bars' directions.

- Added DisableAlertsOnWrongTimeframes input parameter to disable popup alerts when Market Profile is applied to a wrong timeframe.

- Added optional printouts for Value Area High, Value Area Low, and Point of Control rates for each profile.

- Added grouping for input parameter in MT5 version of the indicator.

1.12 — 2019-03-27

- Added RaysUntilIntersection input parameter, which helps to hide the rays of the previous sessions' median and value area that have already been violated by newer trading sessions.

- Fixed a bug with TPO display when the symbol's

TickSizeis higher than_Point× PointMultiplier.

1.11 — 2019-01-20

- Fixed a bug when empty holes could appear in the profile when the current session was built.

- Fixed a bug that prevented current session profile from drawing from the first bar.

- Fixed some potential 'array out of range' errors.

1.10 — 2018-12-25

- Fixed potential array out of range error when old chart with Market Profile indicator is reopened.

1.09 — 2018-12-24

- Added two alternative options for dealing with Saturday and Sunday candlesticks.

- Added more flexibility to displaying Median and Value Area rays.

- Changed Median to draw as a single line inside the value area.

- Reduced the size of the working arrays significantly, which should make MP calculation on some trading instruments faster.

1.08 — 2018-05-28

- Added smart color graduation depending on timeframe and session type.

- Added an option to project the Median (Point of Control) of the previous session to the right side of the chart.

- Added single color scheme.

- Added PointMultiplier input parameter to allow traders to set wider profile box, helping with indicator's performance.

- Added ThrottleRedraw input parameter to delay indicator's display updates, helping to reduce its load on the CPU.

- Fixed a potential bug when incorrect chart object naming routine could cause glitchy display of the market profile.

- Changed hard initialization failure to a soft one — this will prevent input parameters from resetting when incorrect timeframe and session type combination is used.

1.07 — 2018-02-06

- Added support for up to four intraday sessions.

- Added three new color schemes for drawing the market profile.

- Some minor code tweaks and improvements.

1.06 — 2017-11-30

- Added proper object cleanup when Market Profile is used with chart templates.

1.05 — 2017-11-23

- Added optional display for the previous session's Value Area High/Low lines.

- Added time shift input parameter to move the sessions across time zones.

1.04 — 2016-11-07

- Fixed "Array out of range" errors.

1.03 — 2016-01-25

- Added support for three sessions: daily, weekly, and monthly.

- Fixed chart object deletion to only delete indicator's own objects.

- Optimized execution speed.

- Increased the range of supported timeframes.

- Added inline indicator description.

- Improved interface (enumerated input parameters).

- Fixed some potential "Array out of range" errors.

- Code rewritten completely to comply with the current MQL4 and MQL5 standards.

1.01 — 2011-12-11

- Fixed compatibility issues due to new coding conventions in MQL5.

1.00 — 2010-07-23

- Original version of Market Profile released for MT4 and MT5.