Chart patterns are one of the most versatile tools in your Forex trading toolbox. One of the most popular chart patterns is a channel pattern. Channels can be used to trade with the trend or to help you get in on breakouts against the trend. This guide will explain exactly what channel formations are. We will go over how you can draw them on your charts as well as several different ways you can use them as part of your Forex strategies.

What are channels in Forex trading?

A channel is simply a set of two parallel trend lines:

- One line goes across the tops of the price bars

- One line goes across the bottoms of the price bars

The top line shows you resistance, while the bottom line shows you support. Price bounces up and down between the two lines (for the most part), so long as the trend continues. Eventually, price will break out of the channel and go in a new direction. When that happens, you can draw a new set of support and resistance lines to create a new channel. Note that the lines must be parallel to establish a channel.

Key point:

A channel is a set of parallel trend lines. Price bounces between them.

Three types of Forex channels

There are three types of Forex channels:

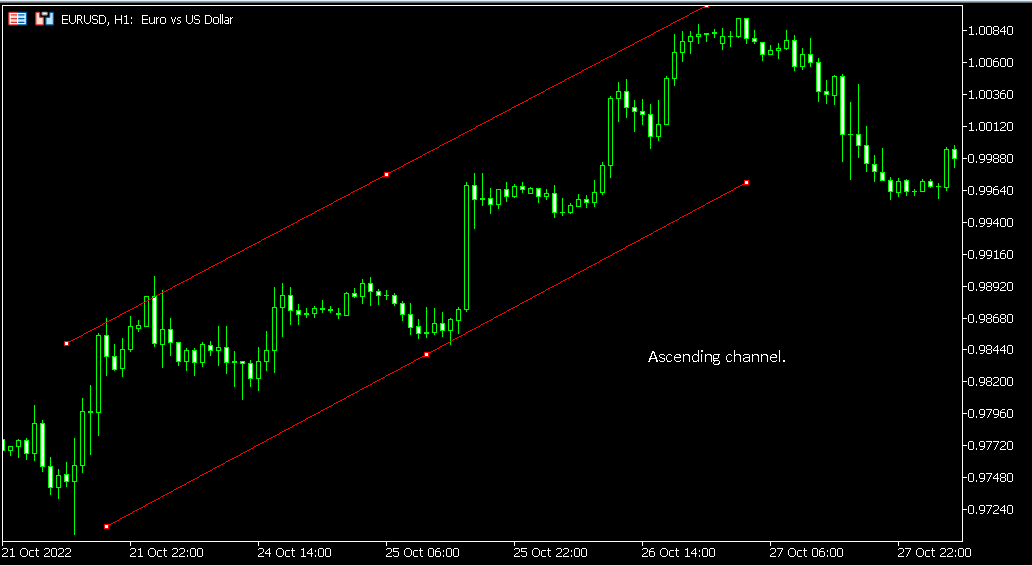

- Ascending: This is a channel that is showing an upward trend.

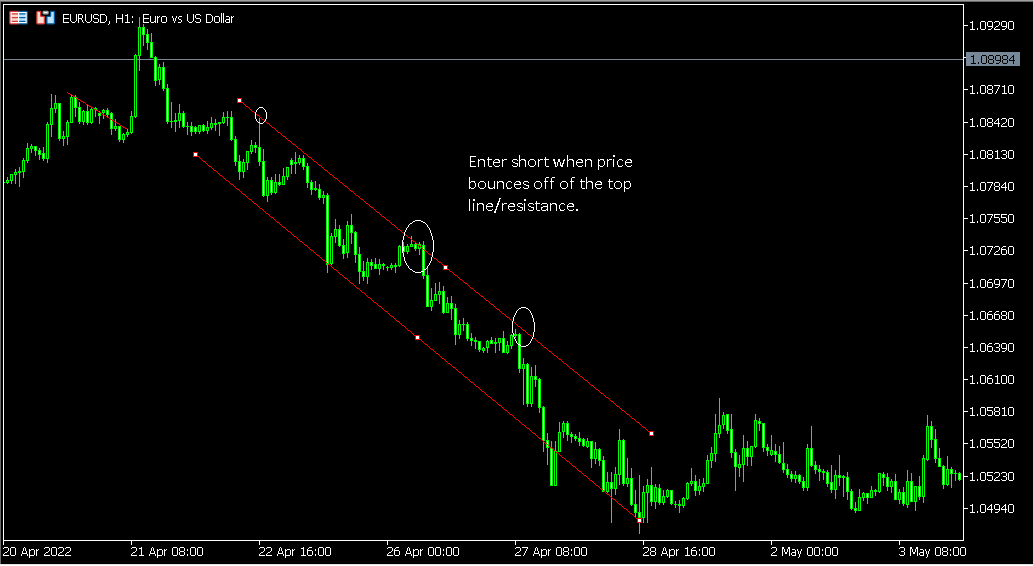

- Descending: This is a channel that is showing a downward trend.

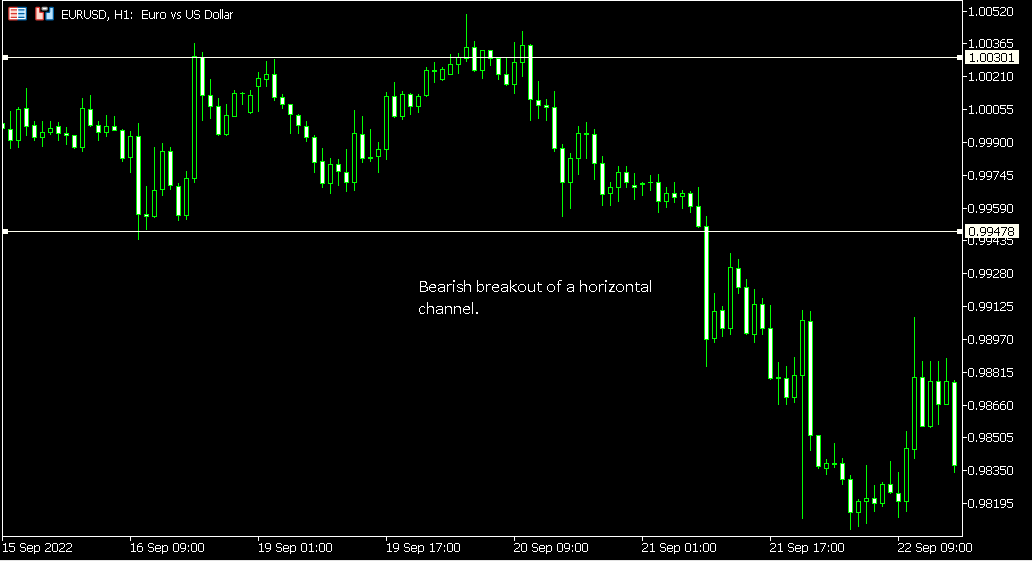

- Horizontal: This is a channel where price is ranging sideways.

Key point:

The three types of channels in FX are ascending, descending, and horizontal.

How to draw channels on your Forex charts

If you are in MetaTrader 4, here is how you can draw channels: Channels and trendlines are in the menu for drawing tools, not indicators. If you look at the top of MT4 toward the right-hand side, you will see the drawing tools.

- Use the 'draw equidistant channel' tool (recommended).

- For a horizontal channel, you can also use the 'draw horizontal line' tool.

- For any other type of channel, you can also use the 'draw trendline' tool.

Here is how to draw the channel using the 'draw equidistant channel' tool:

- Click on the 'draw equidistant channel' tool to select it.

- Look at a trend on your chart, and note the approximate angle of the trend. If it helps, you can draw a trendline through the middle of it (which you will get rid of later) to help you visualize that angle.

- Click on your chart where you want to start drawing one of the lines and begin dragging the mouse in the direction you want the channel to go. As you do, you will see two parallel lines forming. One should be above the trend, and the other below the trend. The lines should both be at the same angle as the trend.

- You may need to move the lines around to get them to the best positions after you draw them. This should be easy as they will remain attached to one another.

Note that your channel may not look exactly perfect. Any of the following are perfectly okay:

- Lines not 100% parallel (if you drew them individually rather than using the recommended tool).

- Lines not touching swing high/swing low points.

- Price sometimes moves outside of the channel (though never for long).

You can see in this example that this channel is not perfect. Price breaks briefly above and below it at points, and the ends do not touch price at all, but that is fine. The angle and approximate spacing are what matter. The lines are angled with the trend, and do a good job at containing it and showing support and resistance.

Key point:

You can use the drawing tools in MT4 and other trading platforms to manually draw channels on your charts. It is more of an art than a science and may take some practice to do well.

How to use channels for trading Forex

Here are some common ways that currency traders put channels to use:

- Breakouts. One way you can use a channel when trading Forex is to look for a breakout. Price can push beyond a channel and then turn around sometimes (channels are not perfect), but if you do not see a quick return to the channel after a break, a strong move may follow. You can see an example of a breakout from a horizontal channel below.

- Trade with the trend. Another option is to trade within the channel in the same direction as the trend. So, for example, say you have an ascending channel. You can enter when price bounces off the support line at the bottom of the channel. If you want, you can stay in the trade as price continues to rise, fall, and rise within the channel, or you can get out when price nears the top line/support for a quick profit. Below is an example of where you could enter when trading in the direction of a trend with a channel.

- Trade off retracements. Some people trade against the trend as price retraces. So, continuing with the example of the ascending channel, they might enter when price bounces off the top/resistance line, and then either exit when it nears the bottom/support line, or stay in the trade to see if price breaks out (you would need to have a good reason to expect this).

Key point:

There are multiple ways you can trade with or against the trend using channels.

General tips for using channels

Earlier, we already talked about how you do not need your channels to be 'perfect' when you draw them. They rarely will be. What else should you know about using channels? It can be easy for them to fake you out if you are trying to trade breakouts since they can sometimes break above or below the channel only to retrace instead of continuing. There are a couple of ways you can deal with this:

- One option is to use indicators or price action in conjunction with channels for confirmation. This is something you should be doing anyway, as 'channels' by themselves are tools, not a trading method.

- You can wait a little bit before entering to make sure price is not just going to return to the channel. Often these breakouts are such large moves that even if you do not catch the start of the move, you will still get plenty of pips.

One other thing to note about using channels is that you can easily start to believe you are seeing amazing setups all the time. This is especially true if price is moving in a relatively narrow channel, and is frequently bouncing off support and resistance. So, if you are someone who tends to overtrade, just be aware of this. Do not get in over your head.

Key point:

You will have the best experience trading with channels if you avoid overtrading, pair channels with indicators or price patterns for context, and take care to avoid getting faked out.

Conclusion

Channels are not ideal but they make it easy to visualize support and resistance. While channels are conceptually easy to understand, you will need to practice with them many times to draw and trade with them effectively. Once you do get good at drawing channels, you will love how effortless they make it to visualize support and resistance. You will also appreciate their versatility for trend and breakout trading.