Nowadays, the diversity of timeframes offered by modern trading platforms is astounding, with some platforms allowing unrestricted customization of the chart periodicity. Still, analyzing timeframes that no one else is analyzing is probably not the best idea in trading. Understanding which timeframes are favored by traders in today's markets is going to be both interesting and useful.

We examine five popular trading platforms to compile the list of timeframes: MetaTrader 4, MetaTrader 5, cTrader, NinjaTrader, and TradingView. Timeframes in MT4 form a subset of those present in MT5. TradingView's default timeframes are entirely covered by those from MT5 too. It is possible to define a completely custom timeframe in both TradingView and NinjaTrader but here we will list only those offered by default.

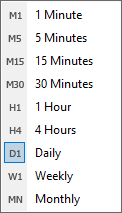

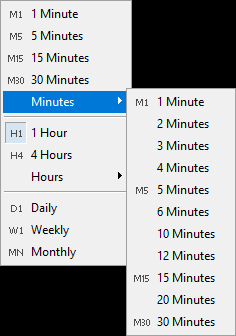

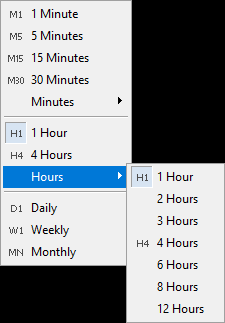

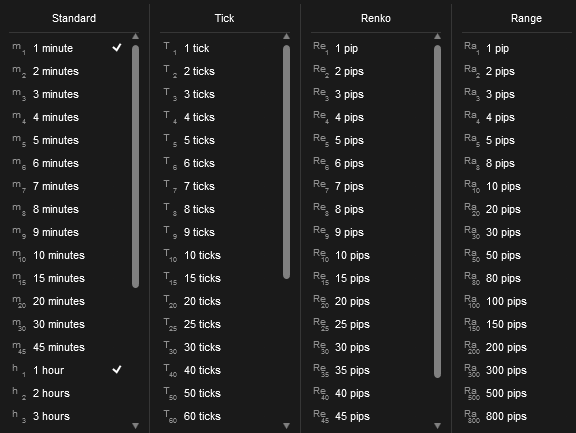

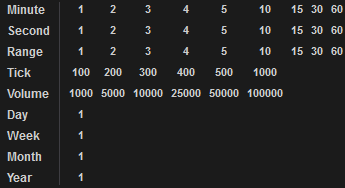

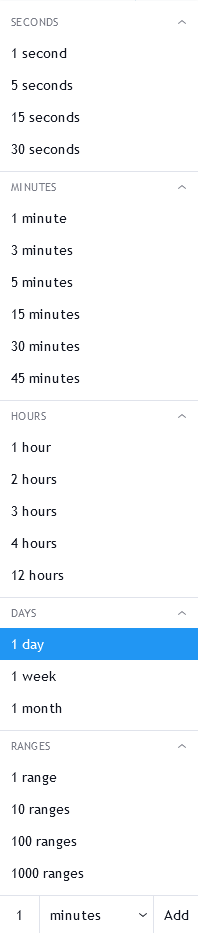

Below are the screenshots with the timeframes provided by each of the five platforms:

MT4

Good old MetaTrader 4 isn't very generous with its choice of timeframes, but for the majority of traders they seem to work just fine. Of course, both in MT4 and MT5, you can easily convert M1 charts to any timeframe higher than M1 using the

MT5

MetaTrader 5 offers a significant improvement in the variety of available timeframes compared to its predecessor.

cTrader

cTrader, unlike MetaTrader, provides quite a lot of nontraditional period choices — for ticks, Renko, and range charts.

NinjaTrader

In NinjaTrader, timeframes are called intervals and can be set up however you like them. For example, you can configure a 37-second or an 89-minute timeframe. Notably, there are no hourly timeframes by default — you either use a 60-minute or define your own

TradingView

TradingView too calls its timeframes intervals and lets you set up a custom timeframe (starting from minutes — you cannot set custom seconds timeframe). There are no ticks or volume timeframes in TradingView, but you can set price range intervals.

If you have any questions about timeframes or if you want to share some details about your preferred timeframes for analysis in Forex trading, please proceed to our community forum.