Currency Strength Lines Indicator for MT4 and MT5

Table of contents

- What Is a Currency Strength Lines?

- Why Our Currency Strength Lines Indicator?

- Features

- Requirements and Support

- How to Read Currency Strength Lines Indicator?

- How to Trade Currency Strength Lines?

- Advantages

- Download for MT4

- Installation Instructions for MT4 Version

- Download for MT5

- Installation Instructions for MT5

- FAQ

- Discussion

- Changelog

A currency strength indicator is a tool that helps you understand the absolute strength of a currency when you are trying to forecast the future trend. Below, you will find more information about Currency Strength Lines indicator for MetaTrader.

Currency Strength Lines indicator for MT4 and MT5 is a powerful tool that can evaluate the strength of a currency and generate trading signals in your MetaTrader platform.

What Is a Currency Strength Lines?

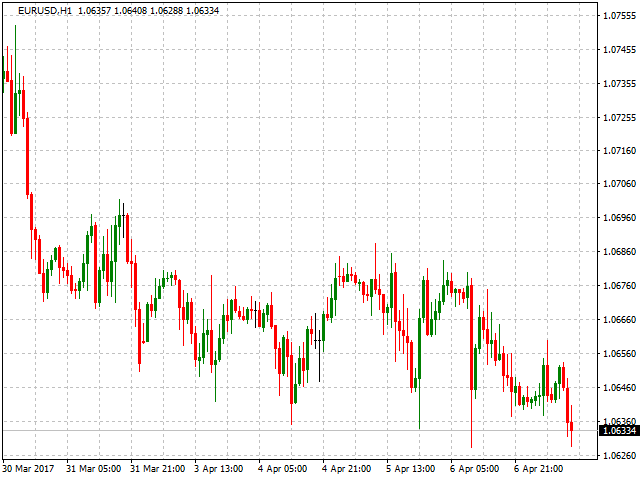

To understand what a currency strength lines indicator for MetaTrader is, you should know that the value of a currency is always expressed in relation to another currency or commodity. We call it an exchange rate.

For example, see the EUR/USD currency pair. We express the value of EUR relatively to USD, 1.0638. This means that with 1 EUR you can buy 1.0638 USD.

But what if you want the absolute strength of a currency? The is what a Currency Strength Lines indicator is for.

A Currency Strength Indicator (or Meter) is a tool that tries to express the absolute strength of a currency, so that you can compare this strength with the strength of other currencies.

There is no exact rule to calculate this strength, but there are several ways that can help in the approximation.

Almost all methods involve some kind of analysis in all the pairs where a currency is present. For example, if we want to measure the strength of the EUR, we will have to analyze how the EUR is faring in all its pairs: EUR/USD, EUR/GBP, EUR/JPY, EUR/AUD, EUR/NZD, EUR/CAD, EUR/CHF.

This will allow us to calculate the strength without depending solely on one other currency. In other words, it will express the strength of a currency across the board.

This concept can be quite confusing at first, but with some examples, it will get easier.

Why Our Currency Strength Lines Indicator?

- Find trading opportunities — get entry and exit signals based on the strength of currencies.

- Complex algorithm — the algorithm will detect the strength by analyzing the price in several pairs.

- Get notified — receive notifications when an entry or exit signal is generated.

- Free — no need to risk by paying money to indicator sellers.

- MT4 + MT5 — two versions available for MetaTrader 4 and MetaTrader 5.

Features

The following are the features of our Currency Strength meter for MetaTrader:

- Automated complex algorithm

- Detection of strength based on multiple pairs

- Sensitivity adjustment

- Generation of entry and exit signals

- Alerts inside platform, by email or via mobile notifications

- Enable or disable currencies as you prefer

- Display of different timeframes

- Free and open-source

- Works in MT4 and in MT5

Requirements and Support

Before you start using the Currency Strength Lines indicator, you need to understand its requirements and capabilities:

- MetaTrader 4 — this indicator works in MetaTrader 4.

- MetaTrader 5 — this indicator works in MetaTrader 5.

- Free download — get .mq4, .mq5, .mqh files to control the indicator as you like.

- Multiple instruments — you can use this indicator with eight major currencies: USD, EUR, GBP, CHF, JPY, CAD, AUD, and NZD.

How to Read Currency Strength Lines Indicator?

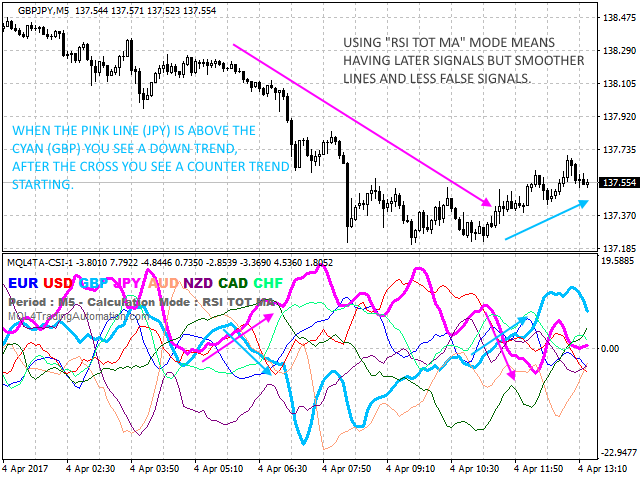

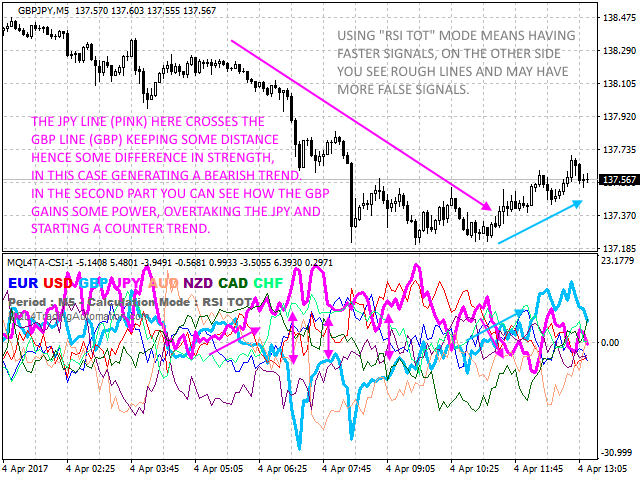

Interpreting a Currency Strength Lines indicator for MetaTrader is not difficult. This Currency Strength meter shows the strength of a currency with a line, and there are some simple rules to read it.

There are several ways to calculate the strength, however, the main rules are:

- A line going upwards means that the currency is gaining strength.

- A line pointing downwards means that the currency is becoming weak.

- Flat lines, or almost flat, represent currencies that are maintaining their current strength.

- A line above another one means that one currency is stronger than the other one.

- A line above zero is likely to have a bullish trend against currencies below zero and vice versa.

How to Trade Currency Strength Lines?

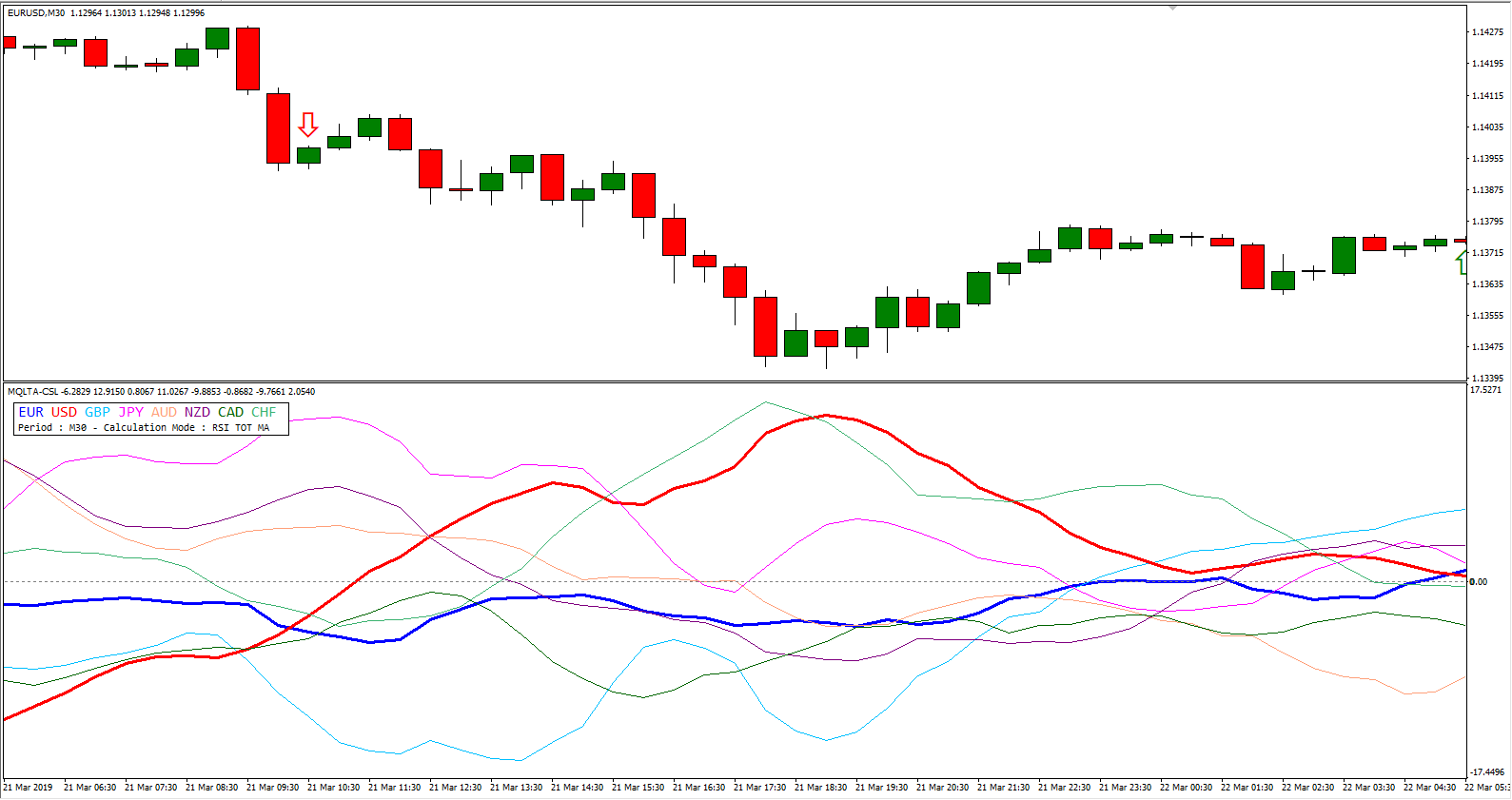

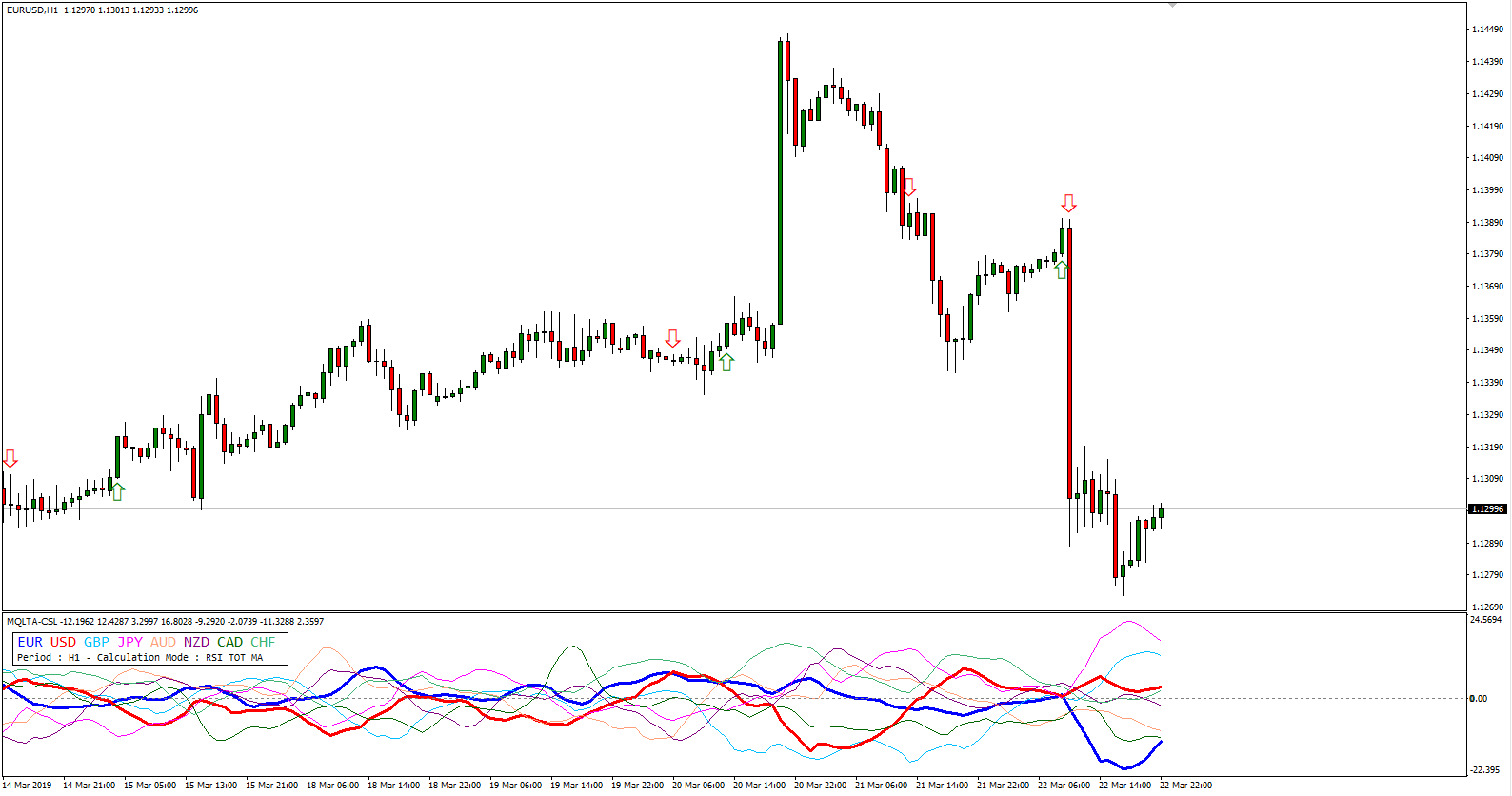

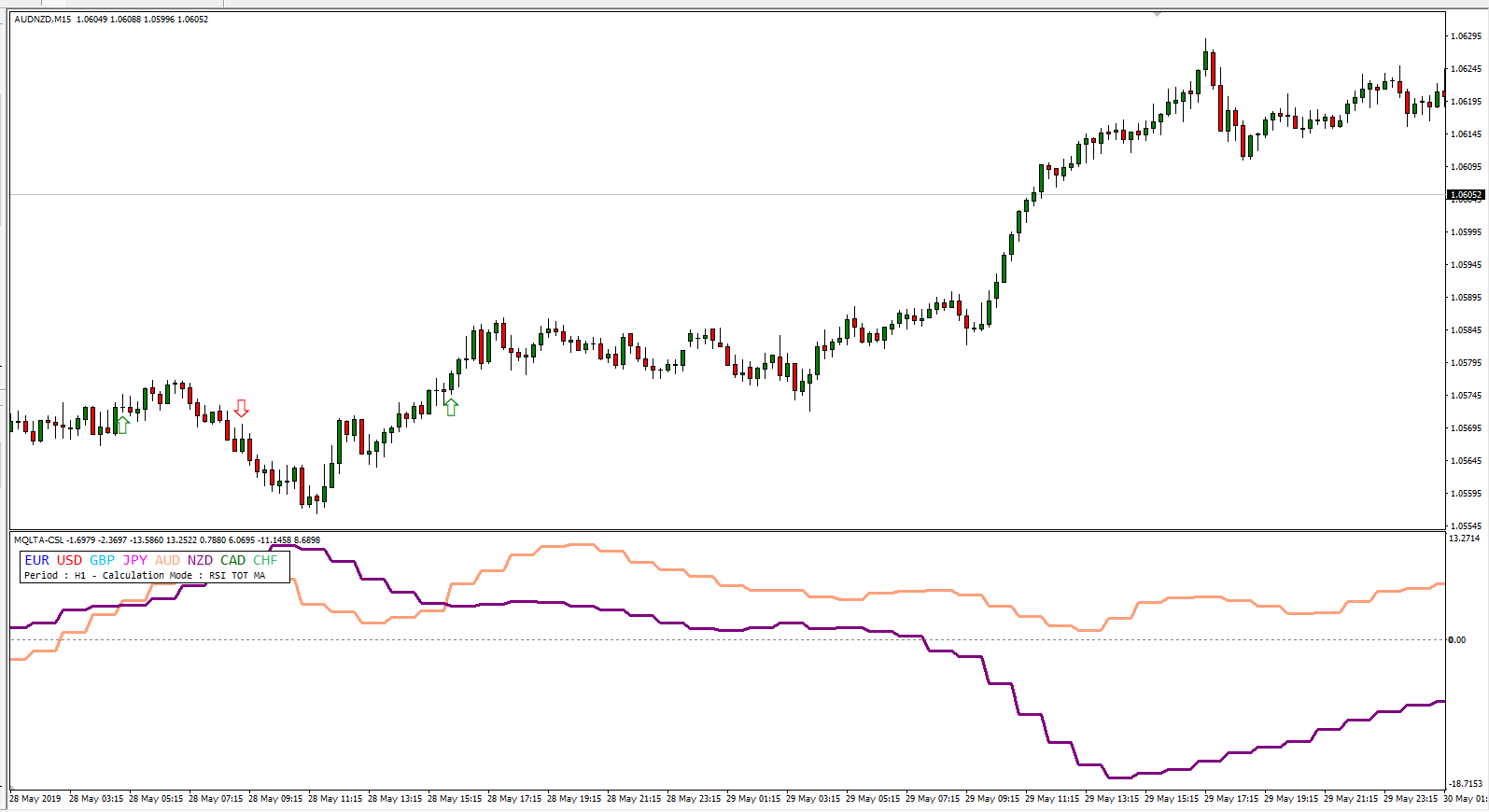

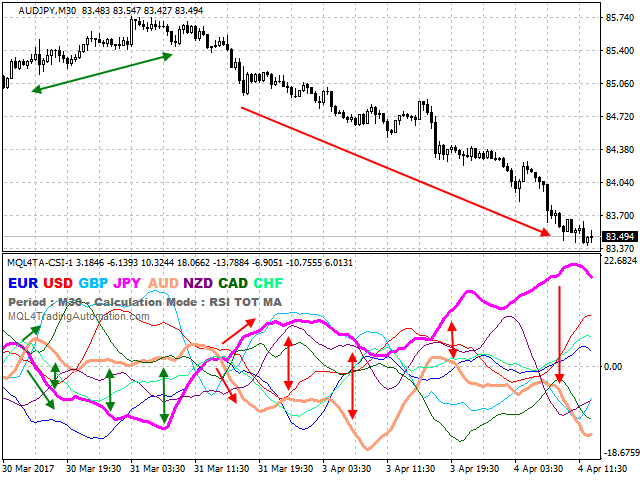

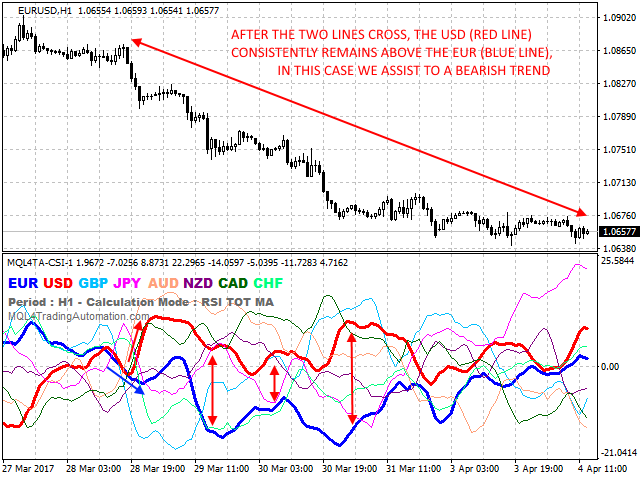

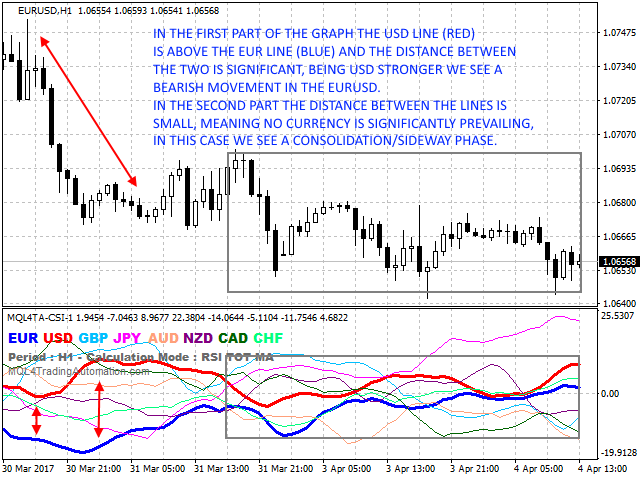

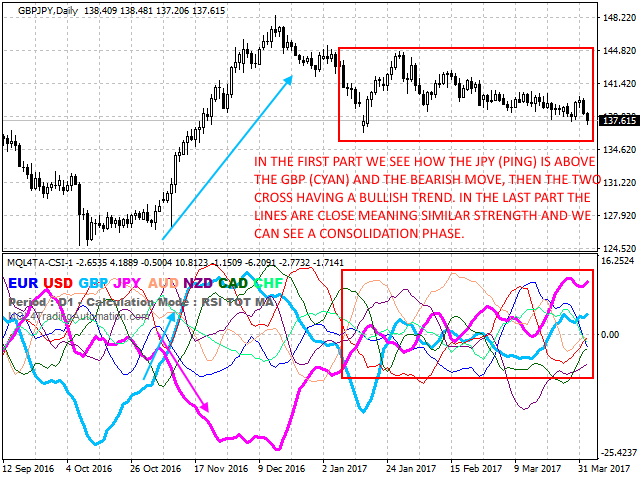

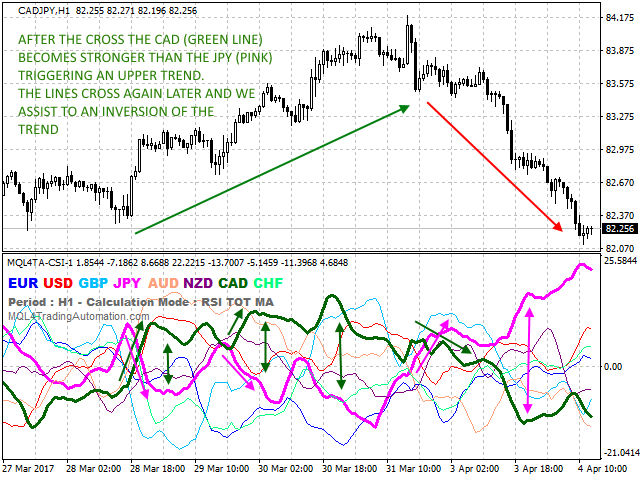

Considering the basic rules explained above, ideally you always want to trade a strong currency (or a strengthening one) against a weak currency (or a weakening one).

The Currency Strength Lines indicator is versatile and, depending on your trading style, you can use it for both long-term trading and scalping.

It is best to use Currency Strength Lines with some confirmation signals when trading.

Generally, you might want to trade:

- Diverging lines, where one currency is gaining strength and the other one is losing strength.

- Currencies on opposite sides — one with its line significantly above zero and one — significantly below.

- BUY the STRONG and SELL the WEAK.

And here are some examples for better understanding of those rules:

Advantages

As you can see in the examples, knowing the strength of individual currencies can be very useful. In particular, the advantages of the Currency Strength Lines indicator for MetaTrader are:

- It shows the strength of a currency across the board, confirming or denying the price trend in a pair.

- Allows you to spot which currencies are strong and which are weak, so you can choose what pair to trade.

- Helps you understand if a trend is still strong or is exhausting.

- Helps you spot possible countertrends.

Long story short, the indicator can be a helpful instrument for your trading, and if you employ technical analysis in your trading, you want it in your tool case.

Downloads

This Currency Strength Lines indicator for MT4 tries to show you the absolute strength of the 8 major currencies. The indicator uses an algorithm based on the standard MetaTrader RSI indicator to calculate the strength of a currency. The Currency Strength is established by scanning the RSI of all the currency pairs, finding then a value that is independent.

The indicator also includes alert features. You can download it for free:

➥ Download MQLTA MT4 Currency Strength LinesInstallation Instructions for MT4 Version

To install the MT4 Currency Strength Lines indicator, please follow the instructions below:

- Download the indicator archive file.

- Open the MetaTrader 4 data folder (via File->Open Data Folder).

- Open the MQL4 Folder.

- Copy all the folders from the archive directly to the MQL4 folder.

- Restart MetaTrader 4 or refresh the indicators list by right-clicking the Navigator subwindow of the platform and choosing Refresh.

Or you can read a more detailed instruction on how to perform the installation.

Downloads

This Currency Strength Meter Lines indicator for MT5 measures the absolute strength of separate currencies.

To know the absolute strength, it uses an algorithm that takes into consideration the value of the standard MT5 RSI indicator of a currency in all the pairs involving it.

For example, to understand the strength of the EUR the indicator scans the RSI for all the EUR pairs inside your MetaTrader 5 platform (EUR/USD, EUR/GBP, EUR/JPY, and so on).

This method allows you to get the strength lines of all the currencies. You can then use their strength trends to make informed trading decisions.

The indicator offers customizable parameters and supports three types of alerts (native, email, and push-notifications). The free download link is available below:

➥ Download MQLTA MT5 Currency Strength LinesInstallation Instructions for MT5

To install the MT5 Currency Strength Lines indicator, please follow the instructions below:

- Download the indicator archive file.

- Open the MetaTrader 5 data folder (via File->Open Data Folder).

- Open the MQL5 Folder.

- Copy all the folders from the archive directly to the MQL5 folder.

- Restart MetaTrader 5 or refresh the indicators list by right-clicking the Navigator subwindow of the platform and choosing Refresh.

Or you can read a more detailed instruction on how to perform the installation.

FAQ

What do I need to run this indicator?

This indicator is a plugin that can be installed in a MetaTrader 4 and MetaTrader 5 platform.

Does this indicator work with multiple assets?

This indicator can be used with eight major currencies: EUR, GBP, USD, CHF, CAD, AUD, NZD, and JPY.

Can I use it on multiple devices?

The indicator is completely free of charge. You can copy its files to any device that supports MT4 and MT5 with custom indicators.

How do I install the indicator?

You can find the instructions to install the indicator above and also read a separate guide on installing MetaTrader products.

Can I backtest the indicator?

Due to the complexity of this indicator, MT4 Strategy Tester cannot backtest it properly. The problem with the backtest is that MT4 Strategy Tester cannot backtest algorithms that use multiple currency pairs. Currency Strength Lines indicator for MT4 uses 28 FX pairs concurrently, so it cannot be run in a backtest. MetaTrader 5 Strategy Tester's engine is capable of backtesting multi-currency indicators and EAs, so yes, you will be able to backtest the MT5 version of this indicator.

You might be interested in our Currency Strength Matrix indicator as well.

You can open a trading account with any of the MT4 Forex brokers to freely use the presented here indicator for MetaTrader 4. If you want to use an MT5 version of the indicator presented here, you would need to open an account with a broker that offers MetaTrader 5.

If you would like to see other multi-timeframe indicators, you can read our guide on MTF indicators.

Discussion

Do you have any suggestions or questions regarding this indicator? You can always discuss Currency Strength Lines with the other FX traders and MQL programmers on the indicators forums.

Changelog

1.19 — 2023-10-16

- Fixed line calculation when new bars haven't yet appeared for some of the currency pairs.

- Fixed the calculation modes based on moving averages.

1.18 — 2023-04-18

- Added panel scaling on hi-DPI screens.

- Added an option to base alerts either on the current (incomplete) bar or on the latest finished bar.

- Improved performance on a large number of bars.

- Changed the indicator's behavior so that it adds missing currency pairs to the Market Watch automatically.

- Clarified alert messages.

- Fixed alerts to trigger once per signal.

- Fixed some calculation inconsistencies.