Ever feel like the market is out to get you? "Inducement" in trading refers to a theory that institutional investors engage in deliberate manipulation to try and trick retail traders. While inducement may seem intuitive, there are some flaws with the theory.

This guide will explain exactly what inducement trading is, the beliefs operating behind it, and whether inducement trading strategies make sense to employ.

What is inducement trading?

Picture this: you place a trade entry and a stop-loss. Your trade triggers. Then, price turns against you. You get stopped out. And then the really infuriating thing happens. Price turns around and goes right back in the direction you were originally trading in. If only you hadn't been stopped out, you could be in a winning trade.

Whipsaws like these can baffle and enrage traders. If you find yourself getting stopped out in this way frequently, you might even start to wonder if there's something deliberate to it. The market seems like it's against you, almost like it's hunting you.

Traders who follow inducement trading strategy believe that the institutional investors are hunting them.

Here is what they claim is unfolding:

- Retail traders initially take positions that are in the correct direction.

- "Smart money" institutional investors engage in market manipulation, taking positions to make it appear that price is moving in the opposite direction.

- Retail traders fall for the trap. They are induced by the manipulation into exiting their trades.

- Price then moves in the direction that the retail traders initially believed that it would.

In other words, retail traders who believe in the inducement theory think that the whipsaws that cause them to get stopped out are deliberately manufactured by institutional traders for the express purpose of stopping them out.

This is referred to as "hunting" retail stop-losses.

You may see this theory in other markets, but it is especially popular among retail Forex traders. This is because Forex is pretty volatile, and whipsaws are common.

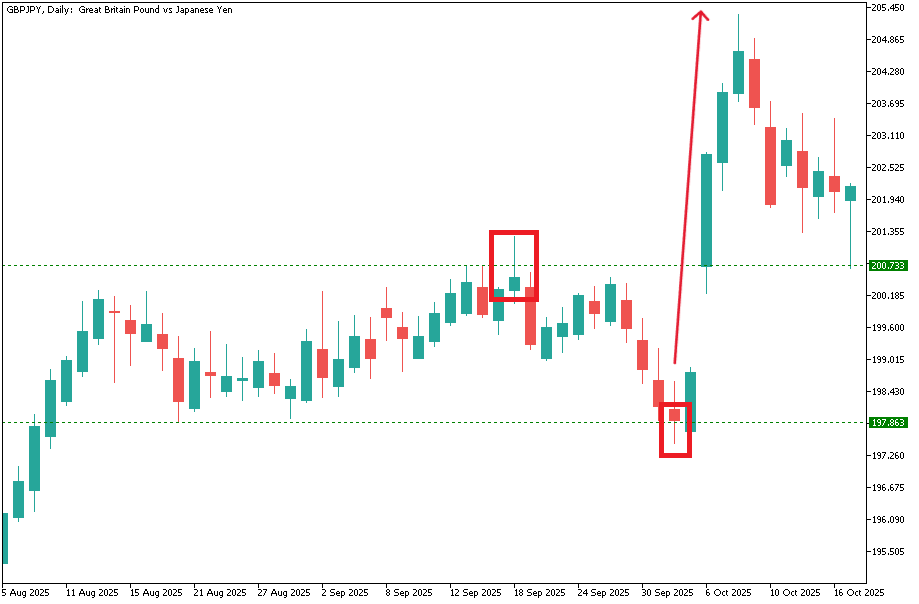

You can see a clear example of such an inducement situation on this GBP/JPY chart from September 2025. Were these false breakouts caused by price manipulation or genuine market conditions?

Inducement strategies

Inducement traders believe that there are multiple types of inducement, including:

- Supply and demand zone inducement

- Support and resistance inducement

- Consolidation inducement

To avoid getting caught in inducement traps, retail traders need to learn how to identify these types of inducement on their charts.

This can be achieved by strategies such as checking the order flow on a larger timeframe, identifying areas of liquidity or high volatility, and spotting premature reversals. Traders are also advised to wait for the first pullback to be completed before entering a trade when a new trend appears to form.

Are smart money manipulators laying traps for retail traders?

Think for a moment about what you represent to an institutional trader: nothing.

The vast majority of retail traders control very little money in comparison to institutional traders. And even the wealthier retail traders still control a much smaller amount.

Even if you add together a bunch of retail traders, they still are pretty insignificant to the "smart money" traders.

So, what is happening here? A couple of things.

Liquidity zones

There are some obvious levels where orders tend to cluster together. These include retail stops, stops from smaller funds, option hedging, and so forth.

If an institution needs to fill a large order, it can benefit from the liquidity at that obvious level. So, institutions may sometimes target these zones, even though they are not targeting individual retail traders. You, as the trader, however, may sometimes pay for it.

Poor individual trading decisions

The other shortcoming of this theory is that it can tempt some traders to blame their failures on institutions instead of looking to their own strategic mistakes.

If you are frequently getting stopped out of trades that would have won, the pattern may not point toward a conspiracy. It might instead just point toward you making the same mistake over and over again.

Maybe you are failing to recognize liquidity zones and navigate them appropriately. Or perhaps you are placing your stop-losses too close. Maybe you are doing that because you are risking too much on each trade, which is making you nervous. Or perhaps you just have a hard time managing your anxiety while you trade. Those are a few of the possibilities.

Regardless, the smart thing to do is to figure out why you keep getting stopped out, and what you can do to make it stop happening.

Focus less on what the institutional traders are up to, and more on your own strategies, money management, and trading psychology.

Do inducement trading strategies work?

We have criticized some of the thinking behind inducement trading strategies. But some of the strategies themselves can actually be helpful.

- Context awareness: When trading on any particular timeframe, try zooming out to a higher timeframe to check the order flow. What is the overall trend right now, and what does it tell you about what is happening on the lower timeframe? This can help you to "screen out the noise."

- Market conditions: Are you looking at extremely choppy market conditions? If so, consider waiting them out. Trade when conditions are smoother.

- Be cautious when you are looking at an obvious liquidity area. Try not to put your stop in the liquidity zone.

- Wait for the first retracement before jumping into a trade.

- If you don't want to wait for the retracement, at least make sure you set your stops far enough out that they won't usually get triggered. You can figure out where to put your stops based on your backtests and demo tests.

Whether it is really possible to spot "inducement zones" depends on who you ask. But all the recommendations above are broadly applicable to traders who are using a wide variety of trading methods.

Say, for example, I am using a simple trading method where I am using pinbars to trigger entries. Checking a higher timeframe for context and waiting for the retracement are just smart precautions to take before entering a trade.

Verdict: There are issues with inducement theories, but some of the strategies are useful

It is incredibly unlikely that institutional traders are actually lying in wait for retail traders, setting traps to lure them into losses. The amount they would contribute to liquidity does not justify that kind of effort, and the liquidity zone, if it exists, is already there.

That is good news, because it means you can quit worrying about institutional traders coming after your stops, and just focus on what you yourself are doing.

Getting stopped out on a retracement is very common, and points toward issues with strategy, money management, or psychology.

Troubleshoot what is going on in demo mode. See if there is a pattern to your trading decisions that is resulting in you getting stopped out. If there is, try changing the pattern to see if that results in improvements.

Try and improve your awareness of market context and conditions, and consider waiting for the retracement before you jump in on a trade, even if that means sacrificing a few pips of potential profit.