Introduction

The COVID-19 pandemic triggered an unprecedented global economic crisis in early 2020, prompting central banks worldwide to implement extraordinary monetary stimulus measures. These policies — ranging from near-zero interest rates to massive quantitative easing programs — profoundly affected foreign exchange markets, creating volatility patterns and currency movements that differed markedly from previous financial crises.

The Scale of central bank intervention

United States Federal Reserve

The Federal Reserve's response was both swift and massive. In March 2020, the Fed reduced short-term interest rates to a range of 0% to 0.25%. In April 2020 alone, the Fed's securities holdings increased by approximately $1.2 trillion, with the balance sheet surpassing $7 trillion by May 2020 — far exceeding its previous all-time high of $4.5 trillion.

The Fed's asset purchases were structured to provide sustained support, with $80 billion per month in Treasury securities and $40 billion per month in agency mortgage-backed securities to provide additional policy accommodation beyond just addressing market dysfunction. This represented the most aggressive deployment of quantitative easing in the Fed's history, as the Fed initially indicated it would purchase $500 billion in Treasury securities and $200 billion in government-guaranteed mortgage-backed securities before expanding the program.

European Central Bank

The European Central Bank responded with comparable force through its Pandemic Emergency Purchase Programme (PEPP). The ECB initially announced a €750 billion PEPP envelope, which was later expanded to €1,850 billion, designed to lower borrowing costs and increase lending throughout the euro area. The program's flexibility marked a departure from previous ECB policies, with purchases of eligible private and public securities throughout 2020 and longer if needed, supported by enhanced targeted longer-term refinancing operations.

The ECB also made up to €3 trillion in liquidity available through refinancing operations, including at the lowest interest rate ever offered at -0.75%. This negative rate lending was designed to amplify the stimulus from negative rates and channel it directly to those who could benefit most from the support.

Divergent currency responses

The dollar's atypical behavior

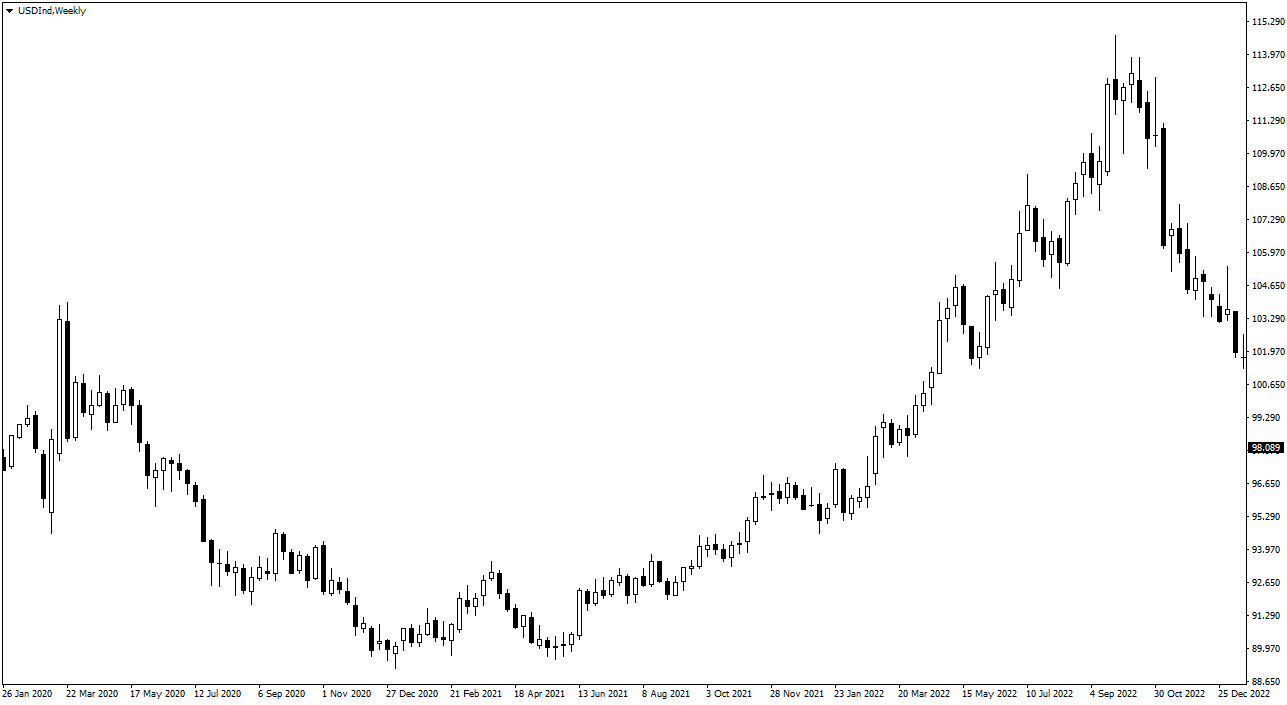

Contrary to its traditional safe-haven role during financial crises, the US dollar exhibited unusual characteristics during the COVID-19 pandemic. Research found that the USD did not show any safe haven characteristics during the pandemic, and the estimated volatility indicated that COVID-19 was not as risky as previous stressful events such as the Global Financial Crisis.

Market participants appeared to bet on further fiscal and monetary stimuli to mitigate the impact of COVID-19 on the real economy, which contributed to this departure from historical patterns. The synchronized global monetary response may have reduced the relative attractiveness of the dollar as a safe haven.

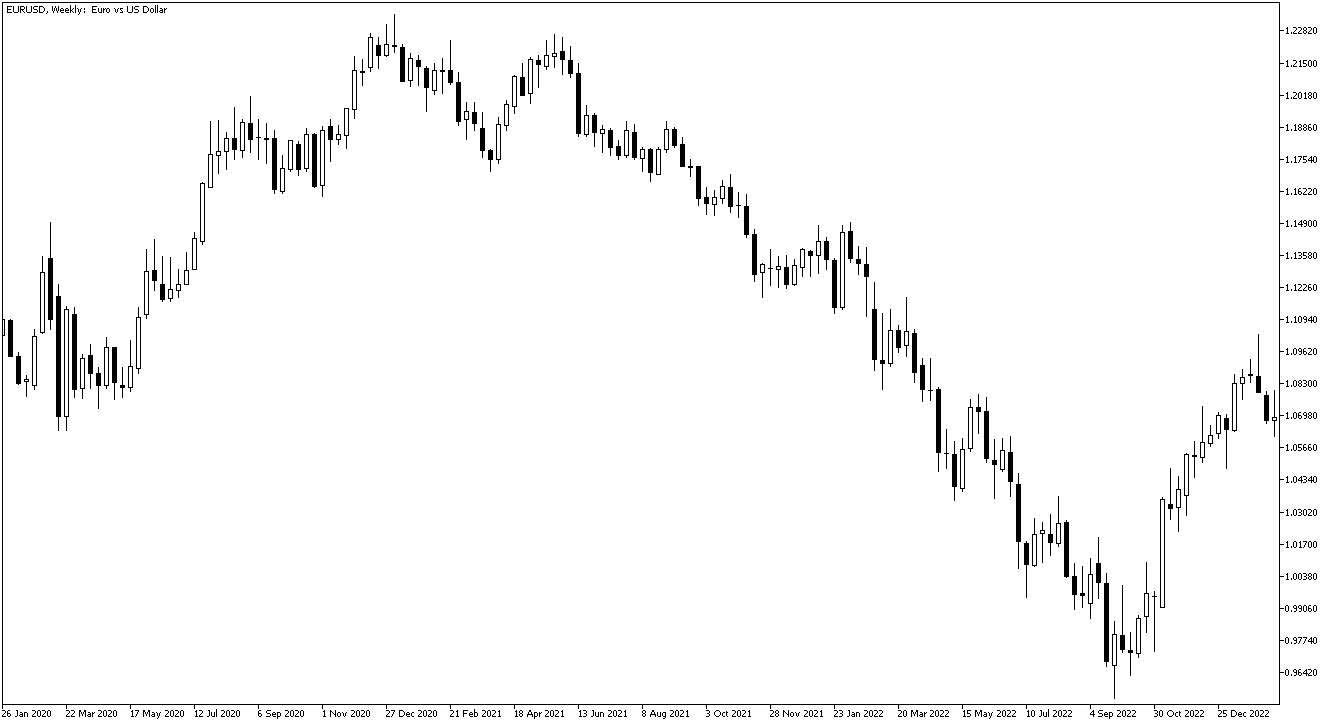

Euro's appreciation despite crisis

The euro exhibited a remarkable recovery pattern during the pandemic. From a low point on March 20, 2020, the euro rose over 10% through the end of August versus the US dollar. However, this rally was not driven purely by economic fundamentals — it was halted by growing evidence of a second wave of the virus taking hold in Spain and France, which was expected to negatively impact the economic rebound.

The euro's movements illustrated how currency markets incorporated real-time pandemic developments, with infection trajectories and containment success becoming key drivers of exchange rate expectations alongside traditional monetary policy factors.

Chinese yuan's dynamics

The Chinese yuan's trajectory reflected China's earlier experience with and recovery from the pandemic. The yuan initially weakened during the early stages of the pandemic through the end of May, but from June onward it became apparent that China had made progress in controlling the spread of the virus and the economy came back strong. This pattern demonstrated how relative pandemic management success translated into currency strength.

Transmission mechanisms

Spillover effects and the disease outbreak channel

Research on US monetary policy spillovers revealed a critical finding: the effectiveness of international monetary transmission changed during the pandemic. US monetary policy had spillover effects for almost all countries during the pre-COVID-19 period, whereas they were effective for only certain countries during the COVID-19 period.

The key differentiator was pandemic management. Only the exchange rates of countries that were successful in fighting against COVID-19 were subject to the spillover effects of US monetary policy during the COVID-19 period, introducing what researchers termed the "disease outbreak channel" as a new factor in international monetary transmission.

Market efficiency deterioration

The pandemic severely disrupted foreign exchange market efficiency. The FX market volatility reached unprecedented levels, making it more difficult for policymakers to formulate an appropriate policy response. Central banks scrambled to adjust their monetary frameworks to address feedback loops between exchange rate movements and capital outflows.

Studies examining market efficiency found a decline in the efficiency of foreign exchange markets during the ongoing COVID-19 pandemic, with the Australian dollar showing the highest efficiency before the crisis but the lowest during it. This deterioration in market efficiency complicated the transmission of monetary policy and increased uncertainty for market participants.

The role of COVID-19 deaths as a market signal

Pandemic severity directly influenced exchange rates through its impact on economic expectations. Panel analysis showed a unidirectional long-run causality running from COVID-19 deaths to exchange rates, with the coefficient of COVID-19 deaths positive and significant in explaining exchange rates in the long run. This meant that rising death tolls in major economies led to currency depreciation as markets incorporated expectations of deeper economic damage.

Research on daily exchange rate movements confirmed that an increase in new cases associated with a depreciation of that country's currency, with responses particularly pronounced for countries with more flexible exchange rate regimes. At a time when policy rates were at their lower bound in most advanced economies, currency depreciation could potentially provide additional stimulus to the domestic economy.

Policy coordination and market stabilization

International swap lines

Central banks coordinated their responses through enhanced liquidity arrangements. The Fed, in coordination with the Bank of Canada, Bank of England, Bank of Japan, European Central Bank, and Swiss National Bank, increased the frequency of 7-day US dollar swap operations from weekly to daily to improve dollar liquidity in global markets.

This coordination was crucial because dollar funding costs in the forex market demonstrated a sharp rise during this turmoil, with both corporate and institutional investors worried about the eventual fall of their portfolio investments. The swap lines helped prevent a dollar shortage from compounding the economic crisis.

Asset purchase programs' market impact

The ECB's PEPP announcement had an immediate stabilizing effect on European financial markets. The announcement of the PEPP halted the tightening in financial conditions which had prevailed, with the decline in fragmentation and the associated fall in the GDP-weighted sovereign yield being significant. This demonstrated how decisive central bank action could arrest deteriorating market conditions.

The Fed's quantitative easing worked through multiple channels. Research indicated that QE operates through the expansion of bank reserves lowering a liquidity premium, the purchase of assets lowering a volatility risk premium, and the economic stimulus lowering a credit risk premium. However, because bank reserves were already larger during COVID-19 than in past crises, the liquidity premium channel was weaker, making QE somewhat less effective than during the 2008 financial crisis.

Recovery patterns and currency realignment

Faster depreciation, quicker recovery

One notable feature of the COVID-19 currency crisis was its compressed timeline. Currencies depreciated faster than during the Global Financial Crisis, but such depreciations did not persist as much, with all currencies on average appreciating against the US dollar from March to August 2020, ranging from 2% for the Canadian dollar to 18% for the euro.

This rapid reversal reflected both the effectiveness of the monetary policy response and market confidence that the crisis, while severe, would be temporary once vaccines became available and containment measures proved effective.

Heterogeneous currency paths

Despite coordinated monetary policies, exchange rates followed heterogeneous paths after the outbreak of the COVID-19 pandemic. This heterogeneity stemmed from differences in pandemic severity, fiscal policy responses, economic structures, and the timing of infection waves across countries.

Research found that investors could minimize COVID-19 risk by investing in the Canadian dollar and Japanese yen while reducing exposure to European currencies, suggesting that certain currencies provided better defensive characteristics during the crisis based on their countries' pandemic management and economic resilience.

Implications for monetary policy transmission

Fiscal-monetary policy interaction

The effectiveness of monetary stimulus was heavily dependent on complementary fiscal action. Without countercyclical fiscal policy measures such as loan guarantees, moratoria, and job retention schemes, the adverse economic impact of the pandemic would have been much more substantial. This fiscal-monetary coordination helped stabilize exchange rates by addressing both liquidity and solvency concerns.

The European Union's Next Generation EU recovery fund, a €750 billion shared budgetary instrument at European level, provided an important complement to ECB monetary policy and helped support the euro's recovery against other major currencies.

Estimated economic impact

Policy decisions on asset purchases and TLTROs were projected to cumulatively contribute around 0.8 percentage points to annual headline inflation and 1.3 percentage points to real GDP growth between 2020 and 2022. These estimates were considered conservative as they did not account for preventing adverse non-linear dynamics that could have led to inflation expectations becoming de-anchored.

Impact on cryptocurrency markets

Direct stimulus effects on Bitcoin trading

The COVID-19 fiscal stimulus had a measurable, if modest, impact on cryptocurrency markets. Research found a significant increase in Bitcoin buy trades of size $1,200, which is the modal economic impact payment amount distributed by the US government in April 2020. The stimulus checks represented a wealth shock for households that translated into increased retail cryptocurrency trading activity.

The economic impact payments increased Bitcoin buy volume by 3.8% and the price by 0.6%, though this represented only 0.02% of all distributed stimulus dollars. Similar patterns emerged in Japan, Singapore, and South Korea, which all ran similar direct stimulus payment programs during the same period. The rise in Bitcoin trading was highest among individuals without families and at exchanges catering to nonprofessional investors, suggesting specific demographic patterns in cryptocurrency adoption during the crisis.

Monetary stimulus and the cryptocurrency bull run

Large-scale economic stimulus measures during the pandemic caused fiscal deficits, currency devaluation, and political instability, prompting more investors to incorporate cryptocurrencies like Bitcoin into their portfolios to guard against uncertainties of traditional systems and protect their purchasing power. The narrative that massive monetary expansion would lead to currency debasement became a powerful driver of cryptocurrency interest.

The unprecedented $20 trillion in global stimulus spending created what many analysts viewed as an ideal macroeconomic environment for Bitcoin. The rationale was two-fold: in an inflationary scenario, Bitcoin's fixed supply would make it attractive as a store of value, while in a deflationary scenario with institutional collapse, Bitcoin could serve as a hedge against systemic risk. Research examining the relationship between Bitcoin and stock markets during COVID-19 found statistically significant correlations during the pandemic period, suggesting that cryptocurrency markets were increasingly integrated with traditional financial markets during the crisis response.

Implications for carry trade

Disruption of traditional carry trade strategies

The COVID-19 pandemic and the unconventional US monetary policy adopted in March 2020 jointly presented unprecedented shocks to the global economy, resulting in unusual currency spillover patterns in the FX market. The near-universal adoption of zero or negative interest rates across major economies compressed interest rate differentials, which are the foundation of currency carry trade strategies.

Currency carry trades traditionally involve borrowing in low-yielding currencies to invest in high-yielding currencies, profiting from the interest rate differential. However, when central banks globally slashed rates to near zero simultaneously, these differentials largely evaporated. Research showed that the different spillover responses of high-yield and low-yield currencies to the Fed's conventional and unconventional monetary policies were closely related to currency carry trade activities and portfolio rebalancing adjustments.

Portfolio rebalancing and risk reassessment

The coordinated monetary stimulus forced a fundamental reassessment of carry trade risk-return profiles. During the first months of the pandemic, with interest rates near the zero lower bound across developed markets, carry traders had to look to emerging markets for yield opportunities, but these came with substantially higher volatility and pandemic-related risks. Starting spring 2020, investors could continue betting on higher-yielding currencies such as the Great Britain pound or the Canadian dollar against such currencies as Japanese yen despite the lack of a significant interest rate difference.

The massive liquidity injections also changed the volatility dynamics that carry trades depend on. Historically, carry trades perform well in low-volatility environments but suffer during volatility spikes. The Fed's and other central banks' aggressive interventions aimed to suppress volatility and inadvertently supported carry trades.

Conclusion

The COVID-19 pandemic necessitated monetary stimulus on an unprecedented scale, fundamentally altering foreign exchange market dynamics. Unlike previous crises, the synchronized global response, combined with the unique "disease outbreak channel," created novel patterns in currency movements. The US dollar lost its traditional safe-haven status, while currencies of countries successfully managing the pandemic strengthened regardless of traditional monetary fundamentals.

Central bank actions — particularly massive quantitative easing programs and coordinated liquidity provisions — successfully stabilized markets and prevented a complete collapse of the international monetary system. However, the crisis also revealed new complexities in monetary policy transmission, with pandemic management effectiveness becoming as important as traditional monetary policy in determining exchange rate movements.

The experience demonstrated that in a globally synchronized crisis, monetary policy alone cannot stabilize currencies without concurrent fiscal support and effective public health responses. The relationship between pandemic severity and exchange rates established a new framework for understanding currency dynamics during health crises, with implications for future monetary policy design and international coordination mechanisms.