"Cut your losses short and let your profits run."

— Proverb

Introduction

When a Forex traders decides to open a position, usually he has some profit target in mind. Often such target is set as a

Here's a simple example of a trade with partial profit taking. A trader buys 1 lot of EUR/USD at 1.3330 and sets

So is the partial profit taking a viable Forex trading technique? Does it improve the overall trading record? Does it provide any other advantages to the trader? You'll find different opinions on this matter in trading related sources. Some successful traders promote this method, while others call it dangerous (Van K. Tharp does so in his Trade Your Way to Financial Freedom on p. 265, Chapter 10 — How to Take Profits — What to Avoid). In this article I will try to demonstrate the actual difference in the impact on the account's end balance when using partial profit taking compared to conventional profit taking.

Random Walk Market

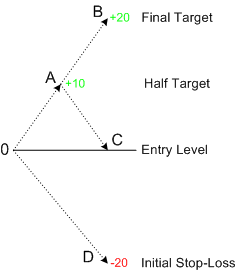

For our first model let's look at the random walk market, i.e. the one where the price changes are completely random and there's an equal probability for going up and down at any given moment. That means that our trading strategy doesn't have an edge — it can't have an edge in a completely random market. The trading scenario for conventional profit taking and for half profit targets with an

Position is open at entry level and, obviously, has 0 profit at that level. If our trading system has no edge, there's the same chance for going up as for going down. That means that if we use simple profit taking (with one target), we have 0.5 probability of reaching point B (20 pips profit) and 0.5 probability of reaching point D (20 pips loss), resulting in the trade expectancy of $0.00 (

- The chance to reach level A is twice as high as to the one to reach level D — 0.66 vs. 0.33, because it's located twice closer. That results in the intermediate trade expectancy of -$3.33 (

5 × 0.66 + (-20) × 0.33 = -3.33 ). Remember that we close only half of our position at level A, so we book only 5 pips of profit instead of 10. - If we reach level A, we now have to calculate the probabilities of reaching level B or going back down to zero level (we also move our

stop-loss up tobreak-even level). Probability to reach level B from level A is the same as of reaching zero level — 0.5. The trade expectancy then is $3.33 ((10 × 0.5 + 0 × 0.5) × 0.66 = 3.33 ) - The resulting trade expectancy of the partial profit taking method is

-$3.33 + $3.33 = $0.00 — the same as with theone-target method.

So does it has any advantages or disadvantages with the

Trading Strategy with Edge

Now, let's get back to the real world, where traders assume that their Forex trading systems have some sort of an edge compared to entering the market blindly. For our second model to be more demonstrative, let's assume that our system has a really nice edge over the market — the price at our entry point has a double chance of going in our direction compared to that of going in the opposite direction. So how does our trade expectancies fare with two different profit taking methods? Considering the same chart as above, we have the following trade expectancy for a single profit target method: $6.66 (

- The chance to reach level A is now four times higher than to reach level D — 0.8 vs. 0.2, because we have an edge and also because it's located twice closer. Our intermediate trade expectancy then is $0.00 (

5 × 0.8 + (-20) × 0.2 = 0 ). - Now, at level A, we have probability of 0.66 to reach level B and probability of 0.33 to reach zero level. The resulting trade expectancy then is approximately $5.33 (

(10 × 0.66 + 0 × 0.33) × 0.8 = 5.33 ). - Calculating the resulting trade expectancy of the partial profit taking method gives us

$0.00 + $5.33 = $5.33 — result, which is $1.33 worse than the one attained with a singletake-profit level.

It turns out that when we use this method of profit taking with a

Conclusion

According to the above calculations, the bigger is the edge of your Forex trading system, the bigger is the advantage of the conventional single profit target method over the partial profit taking method. That means that the former should be used only if you don't believe that your market entry system can fare better than if you'd be trading completely randomly. Even then, the partial profit taking system offers no significant advantage compared with the common single

If you have your own opinion on this topic or would like to ask a question about partial profit taking in Forex, feel free to visit our Forex forum.