Could you please record a short video of how you are turning on autotrading in one place and it gets turned off in another? Also, do you have any other indicators/EAs active in this terminal?Thanks for your quick reply 🙂.Yes, i try it several times to re-installing my MT5 but it still does not work :/. I really don't know what I can do :/

Position Sizer

- Thread starter Enivid

- Start date

- Watchers 408

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hello, I am facing a problem with the Position Size Calculator. I am entering a position with no problem but once I am in a trade I don´t get the lines that I would need to eg. drag my sl to be or move my tp further/closer. The original lines are still there which show me my entry and sl before entering but the lines that I should be able to drag to manage my position while in a trade are somehow not showing up

The lines you are talking about (trade levels) have nothing to do with the Position Sizer. You can enable trade levels via Tools->Options->Charts->Show trade levels. If you are on MT5, you can also enable them individually on each chart via chart properties (F8).Hello, I am facing a problem with the Position Size Calculator. I am entering a position with no problem but once I am in a trade I don´t get the lines that I would need to eg. drag my sl to be or move my tp further/closer. The original lines are still there which show me my entry and sl before entering but the lines that I should be able to drag to manage my position while in a trade are somehow not showing up

Thank you very much!The lines you are talking about (trade levels) have nothing to do with the Position Sizer. You can enable trade levels via Tools->Options->Charts->Show trade levels. If you are on MT5, you can also enable them individually on each chart via chart properties (F8).

I don't think this is connected to the Position Sizer. It looks like a general MT4 "feature" irrespective of whether the PS is attached to the chart or not.On MT4, With the EA loaded chart, if I change the chart from 5 digit symbols(like EU,GU) to 2 digit symbols (US30,US500) the right side price isn't having enough space., Kindly refer the screenshot.

View attachment 34433

View attachment 34434

Hello, im using this position sizer for many execution. I buy a new prop and i trade always on MT5 but i cant open trade, to the other broker i can but in this one no and i also can open manually the trade so the account is active...do you know wht i can open trade on this prop in mt5 using the position sizer?

What's the output in the Experts tab log when you try to trade? Most likely, algo trading is disabled by your prop firm's server.Hello, im using this position sizer for many execution. I buy a new prop and i trade always on MT5 but i cant open trade, to the other broker i can but in this one no and i also can open manually the trade so the account is active...do you know wht i can open trade on this prop in mt5 using the position sizer?

I enabled Broker Surpass with multiple trades, and now whenever I take a loss, it’s around 1.3%. Since I take many trades, including on prop firms, it would be ideal if my risk per trade were exactly 1%. How can I adjust it to achieve that? ( im on mt4 v3.11) and i already changed it to the right commission price

Could you please show some examples of the trades you set up and of what is being opened? Screenshots would be the best.I enabled Broker Surpass with multiple trades, and now whenever I take a loss, it’s around 1.3%. Since I take many trades, including on prop firms, it would be ideal if my risk per trade were exactly 1%. How can I adjust it to achieve that? ( im on mt4 v3.11) and i already changed it to the right commission price

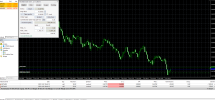

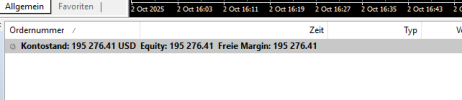

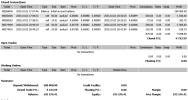

I hope this is helpful. As you can see in the attached screenshots, the actual loss was 1.21% instead of 1%, which is clearly visible in the images. If you need anything else, please don’t hesitate to ask—I’ll do my best to respond as quickly as possible. Thank you very much for your support and assistance!Could you please show some examples of the trades you set up and of what is being opened? Screenshots would be the best.

Attachments

I see that your stop-losses are very tight - just 22 and 24 points any slippage on entry or exit will cause significant deviations on the resulting risk. I see that there was at least some slippage on one of the trade (I don't know what the calculated Entry was, but it should be the same for both positions), but I don't see your Trade History to check if there was some exit slippage.I hope this is helpful. As you can see in the attached screenshots, the actual loss was 1.21% instead of 1%, which is clearly visible in the images. If you need anything else, please don’t hesitate to ask—I’ll do my best to respond as quickly as possible. Thank you very much for your support and assistance!

I see that your stop-losses are very tight - just 22 and 24 points any slippage on entry or exit will cause significant deviations on the resulting risk. I see that there was at least some slippage on one of the trade (I don't know what the calculated Entry was, but it should be the same for both positions), but I don't see your Trade History to check if there was some exit slippage.

here this is the histroy. so the only way to fix that would be a bigger size of my stop loss right? what size would you recommend sinze i trade very small and fast scalps

That's not the only solution (you could also try to find a broker without slippage), but it's one of the feasible solutions. I don't scalp, so I cannot really recommend anything here. What you can do is to calculate the average slippage you get per position and then decide what SL-to-slippage ratio is OK for you. Basically, if your SL-to-TP ratio is 4-to-1, you will get extra 0.25 Risk per trade lost to slippage, so risking 1% per trade, you'll be losing extra 0.25% of your account to slippage. If you increase your SL 10x, you'll be losing just 1.025% instead of 1% per trade on average.View attachment 34612

here this is the histroy. so the only way to fix that would be a bigger size of my stop loss right? what size would you recommend sinze i trade very small and fast scalps

Alternatively, you can decrease your planned risk from 1% per trade to 0.8% per trade and lose something closer to 1% per trade with slippage included. Though, your rewards will also be lower obviously.

It's up to you to decide based on your actual strategy.

Hello fellow trader. Just do a simple math with those kind of lot size.. for example, with your lot size 70, a 10 points = 700 USD = 0.35% of the 200K account ... in the financial markets the slippage around 10 pips = 100 points even possible while higher impact news or in very low liquidity time.here this is the histroy. so the only way to fix that would be a bigger size of my stop loss right? what size would you recommend sinze i trade very small and fast scalps

PS: Even you got passed the challenge with this kind of risks the firm may avoid to provide you the funded account.

Hi Enivid, Kindly add option in the Margin tab for the "Pending orders margin". Also add the "Positions margin in %" and "Pending orders margin in %" with the radio button option All, Only current symbol, Only other symbol. It will be easy to understand the maximum orders/positions margin and it's percentages. (Some firms ask to have positions/order only with in some margin range).

BR.

BR.

Last edited:

And, on Main tab, having option for margin utilization "Risk margin ", "Risk margin in %" options (like already we have Risk,%, Risk,USD) will be more advantages.

BR.

BR.

Not sure what you mean here. Do you want to move the margin info from the Margin tab to the Main tab?And, on Main tab, having option for margin utilization "Risk margin ", "Risk margin in %" options (like already we have Risk,%, Risk,USD) will be more advantages.

BR.

No, I didn't mean that. Let me give you the details Enivid, So you can understand well. If I have 10K account and I should use only 25% of the margin all over or max 2500 USD magin and maximum per instrument I should use 10 % of the margin. (leverage is differ from instrument type to instrument, FX = 1:100, metals = 1:25, index =1:10). So having option to inputs for "Risk margin", "Risk margin in %" on Main tab and on Margin tab to view "Positions margin in %", "Pending orders margin", "Pending orders margin in %" with the radio button option "All Symbols", "Current symbol only", Other symbols only" will be more good to manage positiosn/orders..Not sure what you mean here. Do you want to move the margin info from the Margin tab to the Main tab?

I hope the following painthsop will make you understand the feature.

If making on the main tab feature is hard/more time consumed, having the margin tab feature will be the good solution.

Kind regards

I more or less understand what the stuff on the margin tab. But what do those input fields on the Main tab do? For example, the trader enters 5 in the Risk Margin % field. What effect would it have?No, I didn't mean that. Let me give you the details Enivid, So you can understand well. If I have 10K account and I should use only 25% of the margin all over or max 2500 USD magin and maximum per instrument I should use 10 % of the margin. (leverage is differ from instrument type to instrument, FX = 1:100, metals = 1:25, index =1:10). So having option to inputs for "Risk margin", "Risk margin in %" on Main tab and on Margin tab to view "Positions margin in %", "Pending orders margin", "Pending orders margin in %" with the radio button option "All Symbols", "Current symbol only", Other symbols only" will be more good to manage positiosn/orders..

I hope the following painthsop will make you understand the feature.

View attachment 34653

View attachment 34654

If making on the main tab feature is hard/more time consumed, having the margin tab feature will be the good solution.

Kind regards

Similar threads

- Replies

- 138

- Views

- 35K

- Replies

- 2K

- Views

- 684K

- Replies

- 0

- Views

- 562

- Replies

- 1K

- Views

- 365K