Daily News Update

23 November 2023

Thursday

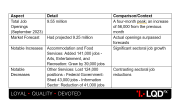

On Thursday, November 23, 2023, a significant market-moving event is anticipated as France, Germany, and the UK are scheduled to release their Flash Manufacturing and Flash Services Purchasing Managers' Index (PMI), a key indicator of economic health in the manufacturing and service sectors.

EUR - French Flash Manufacturing PMI

Traders consider this data crucial as it serves as a forward-looking indicator of economic health. Businesses quickly adapt to market conditions, and their purchasing managers hold insights that are among the most timely and relevant regarding the company's view of the economy.

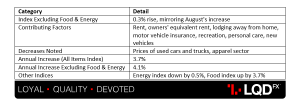

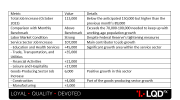

In October 2023, the S&P Global France Manufacturing PMI saw a minor upward revision to 42.8 from the initial estimate of 42.6, yet it still represented a decline from September's 44.2. This marked the ninth successive month of shrinking French factory activity, with the most severe contraction since May 2020, primarily due to widespread demand weakness. The decline in new orders, both domestic and international, was the sharpest since March 2009, excluding the pandemic-affected months. As a result, October witnessed the seventeenth consecutive month of output reduction, the most intense in 41 months, leading to significant reductions in staffing numbers, accelerated cuts in purchasing activity, and lower stocks of inputs. On the pricing front, operating costs for firms decreased for the sixth straight month, thanks to supplier discounts and reduced raw material prices. Concurrently, selling prices saw a slight decrease. Additionally, business confidence fell to its lowest in three and a half years.

TL;DR

- S&P Global France Manufacturing PMI (October 2023): Revised to 42.8, a decline from September's 44.2.

- New Orders: Sharpest drop since March 2009 (excluding pandemic months), indicating widespread demand weakness.

- Output: 17th consecutive month of reduction, the most severe in 41 months, leading to staffing and purchasing cuts.

- Operating Costs: Decreased for the sixth month, due to supplier discounts and lower raw material prices.

- Selling Prices: Experienced a slight decrease.

- Business Confidence: Fell to its lowest in three and a half years.

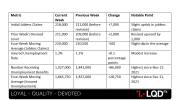

The anticipated forecast for the

French Flash Manufacturing PMI suggests a minor decrease, moving from the previous figure of

42.8 down to

42.6, indicating a slight contraction in the manufacturing sector.

The last time,

French Flash Manufacturing PMI was announced on the 24th of October, 2023. You may find the

market reaction graph (EURGBP M5) below:

EUR – French Flash Services PMI

Traders give significant weight to this data as it acts as a key indicator of economic vitality. Businesses swiftly adapt to changing market conditions, and the insights from their purchasing managers provide highly current and relevant information on the company's economic prospects.

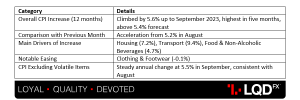

In October 2023, the HCOB France Services PMI registered at 45.2, experiencing its second-steepest decline in three years, following September's 44.4 and falling below initial estimates of 46.1. Reports indicate that decreased client activity, coupled with inflation and rising interest rates, led to a downturn in service sector output. New business volumes contracted for the sixth consecutive month, slightly easing from September's 34-month low. Additionally, there was a sharp decrease in export orders, one of the steepest recorded. Despite challenging business conditions, service firms expanded their workforce for the 34th month in a row. Regarding costs, input prices reached a five-month peak, primarily influenced by wage pressures and escalating fuel prices. However, output charges increased at the slowest pace since May 2021, as weak demand limited companies' ability to pass on rising costs to consumers. Lastly, the business outlook for the next 12 months remained subdued, falling below the long-term average.

TL;DR

- France Services PMI (Oct 2023): Fell to 45.2, a significant decline from September.

- Client Activity: Decreased due to inflation and rising interest rates.

- New Business & Export Orders: Continued contraction; export orders sharply down.

- Workforce Expansion: Persisted for 34 months, despite tough conditions.

- Costs and Charges: Input costs rose, but output charge increases slowed due to weak demand.

- Business Outlook: Remained subdued for the next 12 months.

The latest forecast for the

French Flash Services PMI suggests an uptick to

45.6, slightly higher than the previous figure of 45.2.

The upcoming release of the

French Flash Manufacturing, Flash Services, and

Purchasing Managers' Index (PMI) is scheduled for

Thursday, November 23, 2023, at 08:15 AM GMT. This data is a critical indicator of the country's economic health in both manufacturing and service sectors.

The last time,

French Flash Services PMI was announced on the 24th of October, 2023. You may find the

market reaction graph (EURGBP M5) below:

EUR - German Flash Manufacturing PMI

The importance of this data lies in its function as a key predictor of economic health. Companies quickly react to market dynamics, and the insights from their purchasing managers provide timely and significant perspectives on how businesses view the economy.

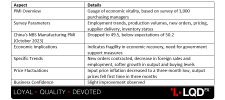

In October 2023, the HCOB Germany Manufacturing PMI saw a minor revision upward to 40.8 from its initial estimate of 40.7, a slight increase from September's 39.6. Despite this rise, the PMI still indicated a significant contraction in the manufacturing sector. This downturn was primarily due to a continuous drop in new orders, with production often sustained by clearing backlogs. However, the rates of decline did slow, and firms' outlook on future production, though still negative, showed some signs of improvement. On the contrary, there was a notable and accelerated decrease in factory employment numbers. Supply chain pressures continued to ease, attributed to diminished demand, which also led to further reductions in both input costs and output charges, as companies faced intense competition for new business.

TL;DR

- Germany Manufacturing PMI (Oct 2023): Slightly revised up to 40.8 from 40.7, a minor increase from September's 39.6.

- Sector Status: Despite the rise, the PMI still indicates a significant contraction in manufacturing.

- New Orders: Continued decline, with production sustained by clearing backlogs.

- Rate of Decline: Slowed, with a somewhat improved future production outlook.

- Factory Employment: Experienced a notable and accelerated decrease.

- Supply Chain Pressures: Eased, mainly due to reduced demand.

- Costs and Prices: Input costs and output charges decreased due to intense competition and lower demand.

The projected

German Flash Manufacturing PMI indicates a modest increase to

41.2, up from the previous result of

40.8.

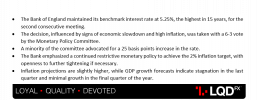

The last time,

German Flash Manufacturing PMI was announced on 24th of October, 2023. You may find the

market reaction graph (EURUSD M5) below:

EUR - German Flash Services PMI

This data is highly valued by traders for its role as a leading indicator of economic health. Businesses rapidly adjust to market changes, and the views of their purchasing managers provide exceptionally current and relevant information about the company's economic prospects.

In October 2023, the HCOB Germany Services PMI saw a slight upward revision to 48.2 from its initial reading of 48. Despite this revision, the data indicated that the German services sector entered a phase of contraction at the beginning of the fourth quarter, primarily due to ongoing demand weakness. New business declined for the fourth month in a row, marking the fastest decrease since May 2020, influenced by customer caution and rising interest rates. Both domestic and international sales experienced downturns. Employment in the sector saw only a marginal decrease, reflecting limited impact on the labor market. Inflationary pressures also showed signs of abating, with the slowest rise in prices charged in over two years, attributed to milder cost increases and intensifying competition for new contracts. Lastly, while firms' outlook on future activity remained low, there was a slight improvement in confidence.

TL;DR

- Germany Services PMI (Oct 2023): Revised slightly up to 48.2 from the initial 48, indicating sector contraction.

- Demand Weakness: Ongoing issue leading to the contraction at the start of Q4.

- New Business: Declined for the fourth consecutive month, marking the fastest decrease since May 2020.

- Influencing Factors: Customer caution and rising interest rates.

- Sales: Both domestic and international sales saw downturns.

- Employment: Only a marginal decrease, showing limited impact on the labor market.

- Inflationary Pressures: Showing signs of easing, with the slowest rise in prices charged in over two years.

- Future Outlook: Remains low, but there's a slight improvement in firms' confidence.

The forecast for the

Flash German Services PMI points to a slight rise to

48.4, marginally up from the previous figure of

48.2.

The upcoming release of the

German Flash Services is scheduled for

Thursday, November 23, 2023, at 08:30 AM GMT. This announcement is a crucial indicator of the country's manufacturing and service sector health.

The last time,

German Flash Services PMI was announced on the 24th of October, 2023. You may find the

market reaction graph (EURUSD M5) below:

GBP - Flash Manufacturing PMI

This data is a key measure of economic strength, reflecting how quickly businesses adapt to market changes. The insights from purchasing managers are particularly valuable, providing the most up-to-date and relevant views on the company's economic outlook.

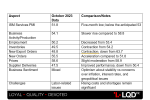

In October 2023, the S&P Global/CIPS UK Manufacturing PMI was adjusted to 44.8, a slight drop from the initial estimate of 45.2 and lower than September's 44.3. The sector experienced its eighth consecutive month of decline, the longest uninterrupted period of contraction since the 2008/09 recession. New orders also fell for the seventh month in a row, albeit at a marginally slower pace than in September. Employment continued its downward trend, declining for the 13th consecutive month. Regarding costs, purchase prices decreased for the sixth straight month, influenced by lower expenses for materials like board, energy, fuels, packaging, paper, pulp, steel, and transportation. Conversely, selling prices fell for the fourth time in five months. Business optimism reached a ten-month low, impacted by growing concerns about consumer uncertainty, the cost of living crisis, and challenging market conditions.

TL;DR

- UK Manufacturing PMI (Oct 2023): Adjusted to 44.8, down from the initial 45.2 and September's 44.3.

- Sector Trend: Eighth consecutive month of decline, the longest since the 2008/09 recession.

- New Orders: Fell for the seventh consecutive month, though at a slightly slower pace than in September.

- Employment: Continued its downward trend, declining for the 13th month in a row.

- Costs: Purchase prices decreased for the sixth consecutive month, due to lower costs for various materials and transportation.

- Selling Prices: Fell for the fourth time in five months.

- Business Optimism: Reached a ten-month low, impacted by consumer uncertainty, cost of living crisis, and challenging market conditions.

The forecast for

British Flash Manufacturing PMI suggests a slight increase to

45, up from the previous mark of

44.8.

Last time, the

British Flash Manufacturing PMI was announced on 24th of October, 2023. You may find the

market reaction graph (GBPUSD M5) below:

GBP - Flash Services PMI

This indicator is crucial for assessing economic health, as it reflects how businesses quickly react to market changes. Purchasing managers are recognized for having the most current and relevant insights into a company's viewpoint on economic conditions.

In October 2023, the S&P Global/CIPS UK Services PMI experienced a modest upward revision to 49.5 from the preliminary figure of 49.2, slightly higher than September's 49.3, but still remaining under the critical 50.0 threshold for the third consecutive month. Survey respondents attributed the subdued customer demand to cost of living pressures, elevated interest rates, and weakened consumer confidence, leading to continued job cuts due to decreased new orders and uncertainty about future business prospects. Furthermore, the level of optimism for future growth among service companies was at its lowest for the year.

TL;DR

- UK Services PMI (Oct 2023): Revised up modestly to 49.5 from initial 49.2.

- Comparison to Previous Month: Slightly higher than September's 49.3 but still below 50.0 threshold.

- Customer Demand: Subdued, impacted by cost of living pressures, high interest rates, and weak consumer confidence.

- Employment: Continued job cuts due to lower new orders and business uncertainty.

- Business Outlook: Optimism for future growth at its lowest for the year.

The upcoming release of

British Flash Manufacturing and

Flash Services PMI is scheduled for

Thursday, November 23, 2023, at 09:30 AM GMT, providing a key insight into the health of the UK's manufacturing and service sectors.

The upcoming forecast for

Great Britain's Flash Services PMI shows a modest rise, anticipated to reach

49.7, slightly higher than the previous figure of

49.5.

The last time, the

British Flash Services PMI was announced on the 24th of October 2023. You may find the

market reaction graph (GBPUSD M5) below:

Disclaimer: The market news provided herein is for informational purposes only and should not be considered as trading advice.