Week of 14th - 18th AUGUST 2023

Week of 14th - 18th AUGUST 2023

15 August 2023

Tuesday

On August 15th, ten high-impact announcements are scheduled:

- AUD: Monetary Policy Meeting Minutes

- AUD: Wage Price Index q/q

- CNY: Industrial Production y/y

- GBP: Claimant Count Change

- CAD: CPI m/m

- CAD:Median CPI y/y,

- CAD:Trimmed CPI y/y

- USD: Core Retail Sales m/m

- USD:Retail Sales m/m

- USD:Empire State Manufacturing Index

AUD: Monetary Policy Meeting Minutes

The Australian Monetary Policy Statement will cover The International Environment, Bond-Overnight Index Swap Spread, Asset Scarcity in Government Bond Markets, Domestic Economic Conditions, Insights from Liaison, Domestic Financial Conditions, Inflation, and Economic Outlook.

The scheduled time for the Monetary Policy Meeting Minutes is 02:30 GMT+1 on August 15th, 2023.

AUD: Wage Price Index q/q

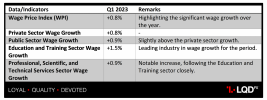

The Wage Price Index (WPI) demonstrated a notable increase of 0.8% in the first quarter of 2023, contributing to a substantial 3.7% growth over the entire year. Both the private and public sectors experienced positive growth in wages, with the private sector seeing a commendable 0.8% increase and the public sector slightly outpacing it with a growth rate of 0.9%. Key industries driving this upward trend in wages were the Education and Training sector, which exhibited an impressive surge of 1.5%, and the Professional, Scientific, and Technical Services sector, following closely with a significant 0.9% rise. These developments underscore the dynamic shifts in wage patterns, emphasizing the impact of the 0.8% WPI increase during the initial quarter of 2023.

The upcoming announcement for the Wage Price Index q/q is set for August 15th, 2023, at 02:30 AM GMT+1.

The forecast reads an increased 3.8%.

TL;DR

CNY: Industrial Production y/y

In June 2023, China's industrial production surged by 4.4% YoY, surpassing May's 3.5% growth and exceeding the anticipated 2.7%. This upswing was driven by accelerated manufacturing activity at 4.8% (compared to 4.1%) and a rebound in mining output at 1.5% (having rebounded from -1.2%). Specific sectors exhibited robust growth, including petroleum and natural gas extraction (4.1% vs 3.7%), ferrous metals' smelting (7.8% vs 3.1%), non-ferrous metals' smelting (9.1% vs 7.1%), chemicals (9.9% vs 3.9%), rubber/plastics articles (3% vs 2.5%), and computers/communication equipment (1.2% vs 0.0%). Electrical machinery output remained strong, achieving 15.4% growth, consistent with May. Notably, certain sectors rebounded: coal mining (2% vs -1.6%), food processing (2.2% vs -1.3%), and metals (2.4% vs -0.1%). Overall, industrial output for the first half of the year achieved a solid growth rate of 3.8%.

The forecast for Chinese Industrial Production y/y is reading an increased 4.5%.

The upcoming Industrial Production y/y announcement is set for August 15th, 2023, at 03:00 AM GMT+1 .

TL;DR

GBP: Claimant Count Change

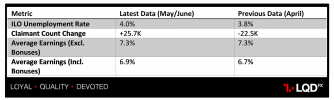

The latest employment data from the Office for National Statistics (ONS) revealed that the United Kingdom's ILO Unemployment Rate increased to 4.0% in the quarter ending in May, up from the 3.8% recorded in the previous three months (April). This exceeded market expectations of 3.8% for the reported period. The data also indicated a significant rise in the Claimant Count Change, with jobless benefit claims surging by 25.7K in June, in contrast to the prior month's decrease of -22.5K. Furthermore, the UK's Average Earnings, excluding bonuses, showed a 7.3% increase on a 3-month-on-3-month basis in May, matching previous figures and expectations. Including bonuses, the measure registered a 6.9% rise, surpassing both the previous rate of 6.7% and the anticipated 6.8% for the fifth month of the year.

The upcoming Claimant Count Change is scheduled for August 15, 2023, at 07:00 AM GMT+1.

Forecast reads a decrease of -30,000.

TL;DR

CAD: CPI m/m

In June, Canadian CPI had risen by 2.8% year-on-year (down from May's 3.4%). Excluding gasoline, inflation had measured 4.0%. The major contributors were grocery prices (+9.1%) and mortgage interest (+30.1%). The monthly CPI had increased by 0.1% (compared to May's 0.4%). However, downward pressure came from travel tours. In a seasonally adjusted context, CPI had risen by 0.1%.

The forecast for Canadian CPI m/m reads an increase of 0.1%.

CAD: Median CPI y/y

In June 2023, Canada's CPI Median retreated to 3.90% from May's 4%.

The forecast for Canadian Median CPI y/y reads a decrease to 3.8%.

CAD: Trimmed CPI y/y

In June 2023, Canada's CPI trimmed-mean increased by 3.7% year-on-year, marking its lowest level since November 2021. This followed a previous rise of 3.8% in May and exceeded market forecasts of a 3.4% gain.

The forecast of Canadian Trimmed CPI y/y reads an increase of 3.5%.

The next scheduled release of Canadian CPI m/m, Median CPI y/y, and Trimmed CPI y/y data is set for August 15, 2023, at 1:30 PM GMT+1.

USD: Core Retail Sales m/m

US retail spending rose 0.2% in June, marking the third consecutive monthly increase. Despite higher interest rates and inflation, American consumers show resilience, but future momentum is uncertain.

The next scheduled release of US Core Retails Sales m/m data is set for August 15, 2023, at 1:30 PM GMT+1.

The forecast reads an increase of 0.4%.

Empire State Manufacturing Index

In July 2023, business activity in New York State remained stable, as per reports from firms in the Empire State Manufacturing Survey. The general business conditions index had fallen to 1.1, while new orders and shipments had experienced slight increases. Inventories had declined, and employment had edged higher, though the average workweek had seen minimal changes. Price increases had been moderated, and optimism had remained subdued. Looking ahead, firms had anticipated improvements, yet capital spending plans had remained weak. Manufacturing activity had shown minor changes, with orders and shipments having risen modestly. Employment and the workweek had recorded slight increases. Price increases had continued to moderate, and optimism had stayed muted with soft capital spending plans.

The upcoming release of the Empire State Manufacturing Index is scheduled for August 15th, 2023, at 1:30 PM GMT+1.

The forecast reads an increased 4 points.

Retail Sales m/m

In June 2023, retail sales in the US recorded a 0.2% month-over-month increase, following a revised 0.5% rise in May. However, this fell short of the expected 0.5% growth. Positive trends were observed in sales at diverse retailers: miscellaneous stores (2%), nonstore retailers (1.9%), furniture (1.4%), electronic and appliances (1.1%), clothing (0.6%), motor vehicle and part dealers (0.3%), and food services and drinking places (0.1%). Conversely, declines were seen in sales at gasoline stations (-1.4%), building materials and garden equipment (-1.2%), sporting goods, hobby, musical, and books (-1%), food and beverages stores (-0.7%), health and personal care stores (-0.1%), and general merchandise stores (-0.1%). Excluding automobiles, gasoline, building materials, and food services, the core retail sales surged by 0.6%. This retail sales data continues to indicate resilient consumer spending, accompanied by a decrease in inflation to a two-year low in June. It's essential to note that retail sales are not adjusted for inflation.

The next Retail Sales m/m announcement will take place on August 15, 2023 at 1:30 GMT+1.

The forecast reads an increase of 0.4%.

TL;DR

16 August 2023

Wednesday

A high-impact news event is scheduled on August 16th, which is likely to have an influence on the NZD, GBP, and USD currencies. The events that follow will be announced:

- NZD Official Cash Rate

- RBNZ Press Conference

- GBP CPI y/y

- USD FOMC Meeting Minutes

NZD Official Cash Rate

In the prior announcement, the Monetary Policy Committee had chosen to maintain the Official Cash Rate (OCR) at 5.50%, aligning with earlier predictions and following previous rate hikes. This decision was guided by the objective of managing expenditure, curbing inflation, and fostering sustainable employment in the long run. Globally, economic growth had experienced a deceleration, and inflationary pressures were subsiding due to the measures undertaken by central banks. Within New Zealand, there was an anticipation of declining inflation, and even though employment had exceeded sustainable levels, indications pointed towards a reduction in labor market strains. Both consumer spending and construction activity had recorded declines, yet tourism had rebounded, and the ongoing rehabilitation initiatives in North Island regions had offered immediate economic support. The Committee's unwavering belief persisted – maintaining a stringent OCR over an extended timeframe would steer consumer price inflation towards the designated 1 to 3% bracket while simultaneously nurturing lasting employment.

The next Official Cash Rate will be set on August 16, 2023, at 03:00 AM GMT+1.

The forecast reads an increased rate of 5.75%.

TL;DR

The Monetary Policy Committee retained the OCR at 5.50% to control inflation and support employment. Despite global economic slowdowns and local employment and spending declines, New Zealand's tourism rose. The Committee aims to keep inflation between 1 to 3% with a steady OCR.

RBNZ Press Conference

The news conference will begin at 3:00 a.m. GMT+1 and will be broadcast live on the RBNZ website. Governor Adrian Orr and other top RBNZ officials will be on hand to answer media inquiries. The RBNZ news conference is a significant economic event in New Zealand. It gives the public an opportunity to hear directly from the central bank on its monetary policy choices and economic forecast. The news conference may also have an influence on financial markets, as investors respond to the RBNZ's latest interest rate and inflation projections.

The news conference is set to take place on August 16, 2023, at 4:00 a.m. GMT+1.

GBP CPI y/y

In June 2023, consumer price inflation in the United Kingdom decreased to 7.9%, marking the lowest level since March 2022 and slightly coming in below the market consensus of 8.2%. This decline was primarily attributed to a slump in fuel prices. Additionally, the core rate, which excludes volatile items such as energy and food, eased to 6.9% from May's 31-year high of 7.1%. Despite this recent slowdown, both rates remained significantly above the Bank of England's target of 2.0%, allowing room for the continuation of the central bank's ongoing policy tightening campaign. The prices for transportation declined by 1.8% (compared to 1.2% in May), primarily driven by a substantial 22.7% drop in the cost of fuels and lubricants. Other notable contributors to the decrease in inflation were food and non-alcoholic beverages (17.3% compared to 18.3%), furniture and household goods (6.5% compared to 7.5%), as well as restaurants and hotels (9.5% compared to 10.3%). On a monthly basis, consumer prices saw a slight increase of 0.1% in June.

The next GBP CPI y/y will be released on August 16, 2023, at 07:00 AM GMT+1.

The forecast reads a decreased 6.7%.

TL;DR

USD FOMC Meeting Minutes

The significance of the FOMC (Federal Open Market Committee) Meeting Minutes lies in the valuable insights they offer into the decision-making process of the United States' central bank, the Federal Reserve. This committee is responsible for crucial monetary policy determinations, including interest rate adjustments and other key measures. Here's why the FOMC Meeting Minutes hold importance:

- Enhanced Transparency and Communication: By offering a comprehensive account of the committee's discussions and considerations, the FOMC Meeting Minutes promote transparency. They shed light on the reasoning behind monetary policy choices, fostering understanding among policymakers, financial markets, and the general public.

- Illuminating Monetary Policy Trajectory: These minutes provide economists, analysts, and investors with deeper comprehension of the FOMC's outlook on economic indicators like inflation, employment, and overall economic health. This perspective aids in forecasting potential shifts in interest rates, which have significant implications for diverse financial assets.

- Guiding Market Expectations: Market participants closely analyze the FOMC Meeting Minutes to assess the probability of forthcoming policy alterations. Alterations in the minutes' tone or focus can influence expectations for rate changes, impacting investment strategies, borrowing expenses, and overall economic activity.

- Economic Indicator Insights: The minutes often reference key economic metrics that the committee members take into account when shaping policy. These indicators, such as GDP growth, unemployment rates, and inflation trends, are pivotal in comprehending the central bank's assessment of the present economic climate.

- Risk Appraisal: The minutes provide a glimpse into the FOMC's evaluation of risks affecting the economy and financial stability. This risk assessment assists market participants in adjusting their approaches and portfolios to match prevailing conditions.

- Potential for Disagreement and Diversity of Opinions: The minutes uncover instances of dissenting viewpoints within the committee. These differences can underscore potential challenges or disagreements within the central bank, offering insights into the preferred policy direction.

- Impact on Financial Markets: The release of FOMC Meeting Minutes often triggers market responses, leading to fluctuations in various assets. Traders and investors scrutinize the minutes for nuances that could influence their investment choices.

In conclusion, the FOMC Meeting Minutes play a crucial role by increasing transparency, providing valuable insights, and guiding expectations concerning the Federal Reserve's monetary policy determinations. They aid market participants in making informed decisions and shaping projections for future economic and financial circumstances.

The FOMC Meeting Minutes will be released on August 16th at 19:00 PM GMT+1.

TL;DR

The FOMC Meeting Minutes from the U.S. Federal Reserve offer insights into the central bank's decision-making regarding monetary policy. Their importance stems from:

- Promoting transparency in monetary policy decisions.

- Indicating the FOMC's economic outlook, aiding in interest rate predictions.

- Guiding market expectations for policy changes.

- Highlighting key economic indicators influencing policy.

- Providing risk assessments affecting economic stability.

- Revealing internal disagreements within the committee.

- Influencing financial market reactions upon release.

The FOMC Meeting Minutes are set to be released on August 16th at 19:00 PM GMT+1.

17 August 2023

Thursday

Australia will reveal the employment change and unemployment rate on Thursday, August 17, 2023. The United States will release unemployment claims on the same day. Both developments will have a significant impact on trading pairs.

- AUD Employment Change & AUD Unemployment Rate

- USD Unemployment Claims

AUD Employment Change & Unemployment Rate

Australia's unemployment rate stayed unchanged at a revised 3.5% in June, while employment data continued to surpass expectations for the second month in a row. The job market displayed strength, with net employment rising by 32,600, following a remarkable surge of 76,600 in May. These figures, released by the Australian Bureau of Statistics, exceeded market forecasts, which had projected a more moderate increase of 15,000. This data underscores a resilient labor market performance, indicating positive trends in employment.

The next announcement for Australia's Employment Change and Unemployment Rate will be made on Thursday, August 17th, at 02:30 AM GMT+1.

The forecast for Australian Employment Change reads an increase of 21,500 in employment.

The forecast for Australian Unemployment Rate reads a steady 3.5%.

USD Unemployment Claims

In the week ending August 5, there was a 21,000 rise in Initial Jobless Claims, as reported by the US Department of Labor (DOL). Meanwhile, Continuing Jobless Claims decreased by 8,000 in the week ending July 29. The US Dollar Index underwent a decline after the release of the US July Consumer Price Index. Initial Jobless claims had reached 248,000 for the week ending August 5, marking the highest level in five weeks. This reading exceeded market expectations of 230,000 and had followed the unrevised figure of 227,000 from the previous week. Further data had revealed a 4-week moving average of 231,000, reflecting an increase of 2,750 from the previous unrevised average of 228,250. Additionally, Continuing Claims had demonstrated an 8,000 decline for the week ending July 29, totaling 1.68 million – a result surpassing market estimates of 1.71 million. The four-week moving average had settled at 1,701,000, indicating a decrease of 9,250 from the prior week's revised average.

The upcoming Unemployment Claims announcement is set for August 17th, 2023, at 1:30 PM GMT+1.

The forecast reads a decreased number of Jobless Claims at 241,000.

TL;DR

Disclaimer: The market news provided herein is for informational purposes only and should not be considered as trading advice.