(Week of 16th - 20th) October 2023

16 October 2023

Monday

On Monday, October 16, 2023, the United States is set to publish the Empire State Manufacturing Index, and concurrently, New Zealand will release its CPI q/q data.

USD - Empire State Manufacturing Index

Traders value this indicator because it acts as a leading gauge of economic health. Businesses are quick to adapt to market dynamics, and changes in their sentiment can offer early indications of future economic activities, including spending, employment, and investment trends.

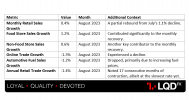

In September 2023, the NY Empire State Manufacturing Index made a remarkable jump from -19 in August to 1.9, surpassing expectations of -10. This upswing indicated a stabilization in business activity, driven by increased new orders (5.1), robust shipments (12.4), and improved selling prices (19.6). While the labor market saw a slight decline, the overall outlook remained optimistic, with a reading of 26.3.

TL;DR

The forecast for the Empire State Manufacturing Index is reading a decrease to -1.4 points, potentially meaning a slight contraction in the manufacturing activity in the US, during the month of October.

The upcoming release of the Empire State Manufacturing Index is scheduled for Monday, October 16, 2023, at 1:30 PM GMT+1.

Last time, the Empire State Manufacturing Index was announced on the 15th of September, 2023. You may find the market reaction graph (GBPUSD M1) below:

NZD - CPI q/q

Consumer prices make up a substantial portion of overall inflation, and this inflationary aspect holds significance for currency valuation. The rationale behind this connection is that when prices rise, it prompts the central bank to consider raising interest rates as part of its commitment to managing inflation.

During the second quarter (Q2), the inflation rate saw a decline to 6% due to the impact of high-interest rates on household budgets. Specifically, the consumer price index experienced a modest increase of only 1.1% from March to June, which marked the lowest uptick since the first quarter (Q1) of 2021. Over the same period, the annual inflation rate exhibited a significant drop, moving from 6.7% in March and 7.2% in December 2022, with a peak of 7.3% noted in June 2022.

The forecast for the New Zealand CPI q/q is reading an increase of 2%, potentially indicating inflation control will be harder than anticipated.

The forthcoming release of the CPI q/q is set for Monday, October 16, 2023, at 10:45 PM GMT+1.

Last time, the CPI q/q was announced on the 19th of July, 2023. You may find the market reaction graph (NZDJPY M1) below:

17 October 2023

Tuesday

On Tuesday, October 17, 2023, several significant announcements are on the agenda. Australia is poised to reveal its Monetary Policy Meeting Minutes, the UK will publish its Claimant Count Change, Canada is scheduled to release their CPI, and the US will announce both Core Retail Sales m/m and Retail Sales m/m figures. These updates are anticipated to have an impact on financial markets.

AUD - Monetary Policy Meeting Minutes

The Monetary Policy Meeting Minutes serve as a documented record of the central bank's monetary policy committee discussions and decisions. Usually released a few weeks after the meeting, these minutes offer valuable insights into the committee's perspectives on the economy and their outlook regarding monetary policy. The minutes typically encompass several key areas:

The Reserve Bank of Australia is entrusted with the responsibility of formulating monetary policy, primarily through the adjustment of the cash rate, aimed at reducing funding costs and facilitating credit availability in the economy since 2020. These monetary policy measures exert influence on lending and borrowing activities, overall economic performance, and ultimately, the inflation rate. In fulfilling its mandate, the Reserve Bank is committed to contributing to the stability of the Australian currency, achieving full employment, and promoting the economic well-being of the populace. To attain these statutory objectives, the Bank adheres to an inflation target, striving to maintain consumer price inflation within the range of 2–3 percent over the medium term, as this practice safeguards the purchasing power of the currency and fosters robust and sustainable economic growth in the long run.

TL;DR

- The Reserve Bank of Australia (RBA) is responsible for formulating monetary policy, notably by adjusting the cash rate.

- Since 2020, the focus has been on reducing funding costs and facilitating credit availability.

- The RBA's monetary policy affects lending/borrowing activities, economic performance, and inflation rates.

- It aims to stabilize the Australian currency, support full employment, and promote economic well-being.

- The Bank targets an inflation range of 2–3 percent over the medium term to preserve purchasing power and encourage sustainable economic growth.

The forthcoming release of the Monetary Policy Meeting Minutes is scheduled for Tuesday, October 17, 2023, at 1:30 AM GMT+1.

GBP - Claimant Count Change

Traders closely monitor unemployment data as it serves as a significant predictor of broader economic well-being, despite being a lagging indicator. Labor market conditions have a substantial impact on consumer spending, and unemployment plays a pivotal role in shaping a nation's monetary policy.

In the prior announcement, the Change in Claimant Count indicated a minor increase, with July seeing a rise of 9,000 individuals filing for unemployment benefits, which stands in contrast to the significant 29,000 increase observed in the previous month.

The forecast for the UK Claimant Count Change is reading an increase of 22,000 individuals. This is signaling that the UK is still struggling with individual employment.

The forthcoming release of the Claimant Count Change data is scheduled for October 17, 2023, at 07:00 AM GMT+1.

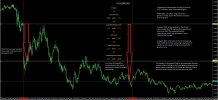

Last time, the Claimant Count Change was announced on the 12th of September, 2023. You may find the market reaction graph (GBPUSD M1) below:

CAD – CPI m/m

Traders closely watch the Consumer Price Index (CPI) announcement because consumer prices play a significant role in determining overall inflation. This is crucial for currency valuation because when prices are on the rise, central banks often respond by increasing interest rates to fulfill their mandate of containing inflation. These interest rate changes can have a profound impact on currency values, making the CPI a key event of interest to traders.

In August, the Consumer Price Index (CPI) recorded a 0.4% increase on a monthly basis, which marked a slight deceleration from the 0.6% gain observed in July. This moderation can be attributed primarily to notable price declines in travel tours (-6.4%) and air transportation (-6.9%), with prices decreasing as the peak of summer travel demand in July tapered off. When seasonally adjusted, the CPI demonstrated a 0.6% monthly upturn.

The forecast for the Canadian CPI m/m is reading an increase of 0.5%, following the pattern seen throughout the year, which shows a slight but consistent increase in consumer prices.

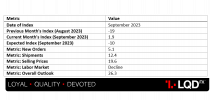

CAD - Median CPI y/y

In the economic landscape of August 2023, the Consumer Price Index (CPI) Median in Canada exhibited a noteworthy year-on-year uptick of 4.1%. This represented a clear acceleration from the revised 3.9% growth observed in the preceding month of July. These figures provide valuable insights into the evolving inflationary trends in Canada, indicating the potential impact on the cost of living and the broader economic landscape for Canadian residents. Economists and analysts closely monitored these developments as part of their ongoing assessment of the country's economic health.

The forecast for the Canadian CPI y/y is reading an unchanged 4.1%.

CAD - Trimmed CPI y/y

In August 2023, the CPI trimmed-mean in Canada had surged by 3.9% compared to the previous year, marking an acceleration from the 3.6% increase observed in July. These statistics provided insights into the evolving inflationary trends and their potential impact on the economic landscape, making them a focal point of analysis for economists and financial experts.

The forecast for the Canadian Trimmed CPI y/y is reading an unchanged 3.9%.

On Tuesday, October 17, 2023, at 1:30 PM GMT+1, Canada will unveil the latest figures for the Consumer Price Index (CPI) m/m, Median CPI y/y, and Trimmed CPI y/y.

Last time, the Consumer Price Index (CPI) m/m, Median CPI y/y, and Trimmed CPI y/y were announced on the 19th of September, 2023. You may find the market reaction graph (GBPCAD M1) below:

USD - Core Retail Sales m/m

Traders find this information crucial because it serves as the primary indicator of consumer spending, a key driver of the majority of economic activity.

In August 2023, retail sales in the United States, excluding automobile sales, experienced a 0.6% month-on-month upturn. This followed a revised 0.7% increase in the preceding month, surpassing market expectations of a 0.4% advance. Remarkably, this marked the fifth consecutive month of rising retail sales.

The forecast for the US Core Retail Sales m/m is reading a slight increase of 0.1%.

USD – Retail Sales m/m

In August 2023, retail sales in the United States saw a month-on-month increase of 0.6%, surpassing expectations of a 0.2% rise, despite the previous month's figure being revised downward to 0.5%. This data underscores the resilience of consumer spending, even in the face of elevated prices and borrowing costs.

The forecast for the US Retail Sales m/m is reading an increase of 0.2%.

The next Core Retail Sales m/m and Retail Sales m/m data is scheduled for release on Tuesday, October 17, 2023, at 1:30 PM GMT+1. This announcement is eagerly anticipated for its insights into market trends.

Last time, the Core Retail Sales m/m and Retail Sales m/m were announced on the 14th of September, 2023. You may find the market reaction graph (GBPUSD M1) below:

18 October 2023

Wednesday

On Wednesday, October 18, 2023, China is slated to release its Industrial Production year-on-year figures, while the United Kingdom is scheduled to announce its Consumer Price Index year-on-year data. These economic releases hold significant importance for investors and analysts monitoring global economic trends.

CNY - Industrial Production y/y

Industrial Production year-on-year (y/y) figures are closely observed by traders due to their role as a leading indicator of economic well-being. Given that production plays a pivotal role in driving the economy and is highly responsive to shifts in the business cycle, it provides traders with invaluable insights.

In August, China’s industrial production experienced a notable year-on-year surge of 4.5%, surpassing the earlier forecast of 3.9% and accelerating from July’s 3.7% growth. This growth marked the strongest performance since April and was notably boosted by Beijing’s supportive measures. Within the industrial landscape, manufacturing activity showed a robust increase of 5.4% (compared to 3.9% in July), while mining output climbed to 2.3% (up from 1.3%). Numerous sectors exhibited accelerated growth, including petroleum extraction (7.2% vs. 4.2%), chemicals (14.8% vs. 9.8%), vehicles (9.9% vs. 6.2%), electronics (5.8% vs. 0.7%), transport equipment (3.1% vs. 1.0%), rubber/plastics (5.4% vs. 3.6%), and coal mining (1.6% vs. 0.4%). Textiles rebounded with a growth of 1.4% (compared to a previous -0.3%), and food production also saw a rise of 2.5% (compared to 0.0%). In the broader context, industrial output for the first eight months of 2023 demonstrated a solid growth rate of 3.9%.

TL;DR

The forecast for the Chinese Industrial Production y/y is reading an unchanged 3.9%.

The next release of Industrial Production year-on-year (y/y) data is scheduled for Wednesday, October 18, 2023, at 3:00 AM GMT+1. Analysts and investors eagerly await this release for its valuable insights into economic trends.

Last time, the Industrial Production y/y was announced on the 15th of September, 2023. You may find the market reaction graph (USDCNH M1) below:

GBP – CPI y/y

Traders diligently monitor the Consumer Price Index (CPI) given its significant emphasis on consumer prices, a pivotal component of the broader inflationary picture. The profound relevance of inflation lies in its profound impact on currency valuation, as heightened prices frequently prompt central banks to raise interest rates, aligning with their primary goal of managing inflation effectively. This intricate relationship between the CPI and monetary policy plays a pivotal role in shaping the financial landscape.

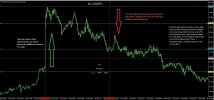

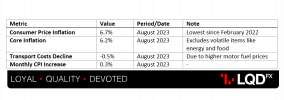

In August 2023, UK consumer price inflation saw a decrease to 6.7%, surprising markets that had anticipated 7.0%, and marking the lowest level since February 2022. This decline was chiefly influenced by reduced food prices and a drop in accommodation service expenses. Core inflation, which excludes volatile elements like energy and food, also dipped to 6.2%, notably below the expected 6.8%. Several categories, including food and beverages, furniture, recreation, restaurants, and miscellaneous goods, experienced more moderate price increases. However, transport costs showed a smaller decline of 0.5%, attributed to higher motor fuel prices driven by global oil trends. On a monthly basis, the Consumer Price Index (CPI) exhibited a 0.3% increase in August.

TL;DR

The forecast for the UK CPI y/y is reading a decreased 6.4%.

The next release of the Consumer Price Index year-on-year (CPI y/y) data is scheduled for Wednesday, October 18, 2023, at 7:00 AM GMT+1. This highly anticipated announcement will provide valuable insights into price trends and economic indicators.

Last time, the Consumer CPI y/y was announced on the 20th of September, 2023. You may find the market reaction graph (GBPCAD M1) below:

Last edited: