USD/JPY: no significant changes expected

"The near-term balance of risk appears to favor JPY strength."

– Scotiabank (based on FXStreet)

Pair's Outlook

The USD/JPY pair's behavior fell in line with expectations yesterday, as the exchange rate remained relatively unchanged and no level of significance was pierced. Technically, the Greenback should rebound today, with the weekly S1 providing the required bullish momentum, but with the immediate resistance, namely thee 55-day SMA and the weekly PP, still remaining intact. On the other hand, technical indicators suggest the given pair is to decline today, which would make it the fifth consecutive drop. Poor ADP figures today could be the catalyst for a possible loss, however, it should not exceed 50 pips.

Traders' Sentiment

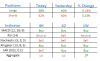

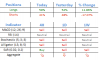

There are 53% of traders holding short positions today, compared to 57% on Wednesday. At the same time, the share of sell orders edged significantly higher, namely from 45 to 70%.

"The near-term balance of risk appears to favor JPY strength."

– Scotiabank (based on FXStreet)

Pair's Outlook

The USD/JPY pair's behavior fell in line with expectations yesterday, as the exchange rate remained relatively unchanged and no level of significance was pierced. Technically, the Greenback should rebound today, with the weekly S1 providing the required bullish momentum, but with the immediate resistance, namely thee 55-day SMA and the weekly PP, still remaining intact. On the other hand, technical indicators suggest the given pair is to decline today, which would make it the fifth consecutive drop. Poor ADP figures today could be the catalyst for a possible loss, however, it should not exceed 50 pips.

Traders' Sentiment

There are 53% of traders holding short positions today, compared to 57% on Wednesday. At the same time, the share of sell orders edged significantly higher, namely from 45 to 70%.