Gold remains above 1,250 mark

"Gold could face more pain if tonight's FOMC (Federal Open Market Committee) minutes shows that the Fed is on course for two to three more rate hikes this year."

– Jeffrey Halley, OANDA (based on Reuters)

Pair's Outlook

The yellow metal's price remains above the 1,250 mark, as the strong support cluster just below that level holds its ground. However, fundamental shifts in the market are possible, as US monetary policy makers will affect the strength of the bullion from the US Dollar's side. The FOMC meeting minutes will reveal, how many and what kind of Federal Funds Rate decisions might take place in the future. Although, from a technical perspective the surge of the bullion should continue, as the SMAs should push it higher soon.

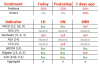

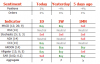

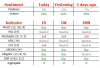

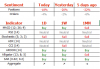

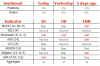

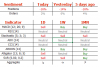

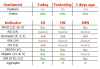

Traders' Sentiment

SWFX market sentiment remains almost neutral, as 52% of open positions are short. However, 67% of trader set up orders are to buy the bullion.

"Gold could face more pain if tonight's FOMC (Federal Open Market Committee) minutes shows that the Fed is on course for two to three more rate hikes this year."

– Jeffrey Halley, OANDA (based on Reuters)

Pair's Outlook

The yellow metal's price remains above the 1,250 mark, as the strong support cluster just below that level holds its ground. However, fundamental shifts in the market are possible, as US monetary policy makers will affect the strength of the bullion from the US Dollar's side. The FOMC meeting minutes will reveal, how many and what kind of Federal Funds Rate decisions might take place in the future. Although, from a technical perspective the surge of the bullion should continue, as the SMAs should push it higher soon.

Traders' Sentiment

SWFX market sentiment remains almost neutral, as 52% of open positions are short. However, 67% of trader set up orders are to buy the bullion.