EUR/USD trades below 1.09 on Wednesday

"The dollar slid on Wednesday and the perceived safe-haven yen gained after U.S. President Donald Trump abruptly fired FBI Director James Comey in a move that shocked Washington and piqued investors' aversion to risk."

– Mansoor Mohiuddin, NatWest Markets (based on Bloomberg)

Pair's outlook

On Wednesday morning the common European currency was regaining some of its losses against the US Dollar, as the currency exchange rate traded just below the 1.09 mark. The currency pair was still set to decline down to the strong support cluster below it. The cluster consists of the weekly S2 at 1.0833, 20 and 200-day SMAs at 1.0830 and the 38.20% Fibonacci retracement level, which is located at the 1.0826 mark. However, before that cluster is reached the rate might surge to the resistance put up by the weekly S1 at 1.0916.

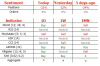

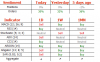

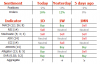

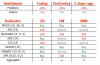

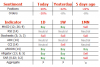

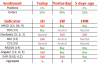

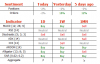

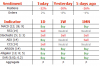

Traders' sentiment

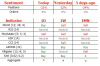

SWFX traders have not changed their opinion since Tuesday, as 39% of open positions are long and 54% of trader set up orders are to sell.

"The dollar slid on Wednesday and the perceived safe-haven yen gained after U.S. President Donald Trump abruptly fired FBI Director James Comey in a move that shocked Washington and piqued investors' aversion to risk."

– Mansoor Mohiuddin, NatWest Markets (based on Bloomberg)

Pair's outlook

On Wednesday morning the common European currency was regaining some of its losses against the US Dollar, as the currency exchange rate traded just below the 1.09 mark. The currency pair was still set to decline down to the strong support cluster below it. The cluster consists of the weekly S2 at 1.0833, 20 and 200-day SMAs at 1.0830 and the 38.20% Fibonacci retracement level, which is located at the 1.0826 mark. However, before that cluster is reached the rate might surge to the resistance put up by the weekly S1 at 1.0916.

Traders' sentiment

SWFX traders have not changed their opinion since Tuesday, as 39% of open positions are long and 54% of trader set up orders are to sell.