Daily Analysis by zForex Research Team - 06.02.2025

Markets React to Tariff Escalation and Central Bank SignalsGlobal markets kicked off the week on edge as renewed tariff threats from the U.S. and escalating geopolitical risks spurred demand for safe-haven assets.

The euro found some footing after ECB officials hinted at further policy moves, while the yen and gold strengthened amid rising trade and war concerns. Meanwhile, silver tracked gold higher, and the pound inched up on Fed rate cut hopes. Legal developments in U.S. tariff policy and looming economic data releases continue to shape investor sentiment.

EUR/USD Analysis by zForex Research Team - 06.02.2025

ECB Signals More Action as Eurozone Outlook WaversEUR/USD rebounded to near 1.1370 in Monday’s Asian session as the US Dollar weakened after legal shifts in tariff rulings. On Thursday, the US Court of Appeals backed Trump’s tariff policy, overturning Wednesday’s lower court decision that had declared his April 2 executive orders unlawful.

Trade tensions escalated as Trump announced plans to double tariffs on steel and aluminum imports to 50%. In response, the European Commission warned it would retaliate, despite both sides agreeing to accelerate talks after extending the EU tariff deadline to July 9.

Meanwhile, Eurozone economic concerns persist. ECB’s Klaas Knot cited inflation uncertainty, while François Villeroy de Galhau said policy normalization is likely not finished, suggesting more action ahead.

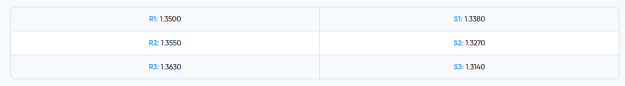

The key resistance is located at 1.1460 and the first support stands at 1.1300.

Yen Analysis by zForex Research Team - 06.02.2025

Yen Rises Amid Trump Tariff Threat and China Dispute

The Japanese yen rose to around 143.5 per dollar on Monday, marking its third straight session of gains as rising global trade tensions lifted demand for safe-haven currencies. The move followed President Trump’s threat on Friday to double tariffs on steel and aluminum imports to 50% starting June 4. Japanese steelmakers like JFE Holdings and Kobe Steel fell, while Nippon Steel was less affected after Trump praised its planned merger with U.S. Steel. Meanwhile, U.S.-China tensions grew as China denied Trump’s claim of breaching a recent Geneva trade agreement. On the domestic front, Japan’s Q1 capital spending beat expectations, with investment rising across both manufacturing and services, reflecting solid internal momentum.

The key resistance is at $143.50 meanwhile the major support is located at $143.00.