Global Financial Markets: Navigating Uncertainty Amid Mixed Economic Signals and Central Bank Caution

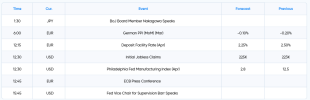

On Friday, the dollar index demonstrated resilience, stabilizing near the 104 mark. This stabilization reflects market reactions to comments from Federal Reserve Governor Christopher Waller, who indicated that the central bank might delay interest rate cuts beyond market expectations. Waller's remarks underscored the importance of a cautious approach, suggesting a hold on rate adjustments to evaluate whether the spike in January's inflation was an anomaly.

In the United States, recent economic data highlighted a deceleration in private sector activity in February. The S&P Global PMI revealed a notable slowdown, particularly in the services sector, which grew less than anticipated, while manufacturing output showed signs of recovery. This mixed economic picture adds complexity to the Federal Reserve's policy decisions, balancing growth concerns with inflationary pressures.

The economic landscape in Europe continued to evolve, with the latest PMI data from the Eurozone and Germany presenting a mixed view. Despite a general disinflationary trend, there were signs of cautious optimism among European Central Bank (ECB) policymakers. The ECB's Monetary Policy Meeting Accounts revealed a consensus to maintain a cautious stance on easing monetary policy, highlighting the ongoing deliberations about the timing of potential rate cuts amidst fluctuating inflation dynamics.

In the United Kingdom, recent Purchasing Managers' Index (PMI) data for February painted a mixed economic picture. The manufacturing sector slightly underperformed against expectations, while the services sector remained robust, exceeding consensus forecasts. This divergence has fueled speculation regarding the Bank of England's (BoE) next moves, especially in light of Governor Andrew Bailey's comments on the UK's declining inflation and the potential for earlier rate cuts.

Japan's economic outlook is spoiled by uncertainties that could delay the Bank of Japan's (BoJ) planned departure from negative interest rates. These uncertainties, along with global shifts in monetary policy expectations, have implications for the Japanese Yen, which faces pressures from both domestic economic challenges and international market dynamics.

Amidst these global financial shifts, gold prices have remained strong, triggered by a combination of a softer dollar and consistent demand for safe-haven assets. This strength is indicative of the market's ongoing uncertainty regarding the Federal Reserve's interest rate trajectory, influenced by mixed signals from US economic data.

The crude oil market has seen its own share of volatility, with prices initially falling due to concerns over sustained high interest rates and demand uncertainties. However, prices later recovered, driven by renewed supply concerns amid escalating geopolitical tensions in the Middle East and reports of a lower increase in US crude inventories.

This detailed overview captures the nuanced dynamics within global financial markets, underscoring the delicate balance central banks must strike between fostering economic growth and controlling inflation, amidst evolving economic indicators and geopolitical uncertainties.

On Friday, the dollar index demonstrated resilience, stabilizing near the 104 mark. This stabilization reflects market reactions to comments from Federal Reserve Governor Christopher Waller, who indicated that the central bank might delay interest rate cuts beyond market expectations. Waller's remarks underscored the importance of a cautious approach, suggesting a hold on rate adjustments to evaluate whether the spike in January's inflation was an anomaly.

In the United States, recent economic data highlighted a deceleration in private sector activity in February. The S&P Global PMI revealed a notable slowdown, particularly in the services sector, which grew less than anticipated, while manufacturing output showed signs of recovery. This mixed economic picture adds complexity to the Federal Reserve's policy decisions, balancing growth concerns with inflationary pressures.

The economic landscape in Europe continued to evolve, with the latest PMI data from the Eurozone and Germany presenting a mixed view. Despite a general disinflationary trend, there were signs of cautious optimism among European Central Bank (ECB) policymakers. The ECB's Monetary Policy Meeting Accounts revealed a consensus to maintain a cautious stance on easing monetary policy, highlighting the ongoing deliberations about the timing of potential rate cuts amidst fluctuating inflation dynamics.

In the United Kingdom, recent Purchasing Managers' Index (PMI) data for February painted a mixed economic picture. The manufacturing sector slightly underperformed against expectations, while the services sector remained robust, exceeding consensus forecasts. This divergence has fueled speculation regarding the Bank of England's (BoE) next moves, especially in light of Governor Andrew Bailey's comments on the UK's declining inflation and the potential for earlier rate cuts.

Japan's economic outlook is spoiled by uncertainties that could delay the Bank of Japan's (BoJ) planned departure from negative interest rates. These uncertainties, along with global shifts in monetary policy expectations, have implications for the Japanese Yen, which faces pressures from both domestic economic challenges and international market dynamics.

Amidst these global financial shifts, gold prices have remained strong, triggered by a combination of a softer dollar and consistent demand for safe-haven assets. This strength is indicative of the market's ongoing uncertainty regarding the Federal Reserve's interest rate trajectory, influenced by mixed signals from US economic data.

The crude oil market has seen its own share of volatility, with prices initially falling due to concerns over sustained high interest rates and demand uncertainties. However, prices later recovered, driven by renewed supply concerns amid escalating geopolitical tensions in the Middle East and reports of a lower increase in US crude inventories.

This detailed overview captures the nuanced dynamics within global financial markets, underscoring the delicate balance central banks must strike between fostering economic growth and controlling inflation, amidst evolving economic indicators and geopolitical uncertainties.