Daily Analysis by zForex Research Team - 04.30.2025

Markets Steady as Tariff Hopes Offset Dovish Signals

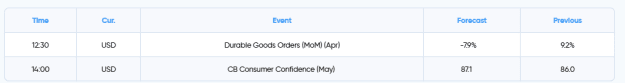

The euro rebounded toward 1.1375 but remained range-bound as dovish ECB rhetoric capped the upside. The yen fell to 142.4 after weak Japanese data, while the pound slipped to 1.338, still near a two-year high, supported by limited UK tariff exposure.Gold dipped below $3,310 as tariff fears eased, though the metal stayed on course for its fourth monthly gain. Silver slid with a stronger dollar, while key U.S. data looms.

EUR/USD Analysis by zForex Research Team - 04.30.2025

EUR/USD Rebounds but Stays Range-BoundEUR/USD bounced from nearly 1.1300 to 1.1375 but stayed range-bound as a modest dollar rebound caps gains. The euro is weighed by dovish ECB comments and growing June rate cut bets, while the dollar is supported ahead of key US data. ECB officials flagged easing inflation and trade risks. Still,

Trump’s trade stance and Fed cut hopes limit USD strength. Markets now await Eurozone inflation and GDP, plus US ADP jobs, Q1 GDP, and PCE data.

Key resistance is at 1.1460, followed by 1.1580 and 1.1680. Support lies at 1.1260, then 1.1200 and 1.1150.

Yen Analysis by zForex Research Team - 04.30.2025

Yen Falls to 142.4 on Weak Data

The Japanese yen fell to around 142.4 per dollar on Wednesday, its second day of losses, after weak March data showed industrial output and retail sales missed forecasts. Investors await the Bank of Japan's decision, with rates expected to stay at 0.5% and a cautious tone likely amid U.S. tariff risks. Meanwhile, U.S. Treasury Secretary Bessent said “substantial talks” with Japan are ongoing, increasing hopes for a trade deal.Key resistance is at 144.00, with further levels at 145.90 and 146.75. Support stands at 139.70, followed by 137.00 and 135.00.

Post automatically merged:

Daily Analysis by zForex Research Team - 05.01.2025

USD Strength on Trade Sentiment Impacts CurrenciesEUR/USD dropped to a two-week low near 1.1300 despite soft U.S. data, as hopes of potential trade deals lifted the dollar.

Gold extended its slide below $3,230 while silver steadied around $32.10 with weak U.S. growth and disappointing jobs data. GBP/USD also retreated slightly, weighed by a firmer dollar ahead of the U.S. non-farm payrolls report expected to influence Fed policy outlook.

EUR/USD Analysis by zForex Research Team - 05.01.2025

EUR/USD Slides Below 1.1300EUR/USD dropped 0.2% on Thursday to around 1.1300, hitting a two-week low. Despite weak U.S. data, investor sentiment shifted toward optimism on trade, lifting the dollar. Comments from President Trump about potential deals with China, Japan, South Korea, and India supported the greenback, adding pressure on the euro. The pair remains under short-term bearish pressure as markets await Friday’s U.S. non-farm payrolls, which may signal a potential slowdown in job growth.

Resistance levels are seen at 1.1460, then 1.1580 and 1.1680, while support rests at 1.1260, followed by 1.1200 and 1.1150.

Yen Analysis by zForex Research Team - 05.01.2025

Yen Rises for Third Day as BoJ Holds RatesUSD/JPY rose to 143.4 on Thursday, marking its third straight daily gain as the yen weakened following the Bank of Japan's decision to keep rates at 0.5%. This was the second consecutive meeting with no changes, as policymakers assess the impact of U.S. tariffs on Japan’s exports.

The dollar also gained after Trump’s comments hinted at progress in trade talks with Japan, India, and South Korea, along with optimism about a deal with China.

Resistance is located at 145.90, followed by 146.75 and 149.80. On the downside, support levels are at 139.70, then 137.00 and 135.00.