//-----The process,

hey tc,,,,,, the process is in the counts...... not much more.....

1) in the trade pictured above, did you just set a PT at the bottom of the ZZ leg? Or was there a trigger? I know this isn’t the most pressing consideration, but I’m curious.

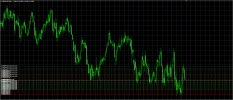

really have no clue as to why the trades were closed there..... but take a close look at that picture..... had i deleted the remaining 3 limit orders , it would appear that i sold the top dead on...... which was not the case..... i simply placed selllimits covering the prior leg.....

i do have expert advisors that will close all orders once a new zigzag leg prints with certain other conditions, but it was not used..... also have expert advisors that will close all orders once a particular price , line, object or total $ profit is hit..... but they were not used either.....

other than atr, i don't give much thought to exits .....

//-----

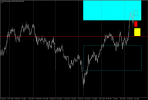

2) do you have a preference between set PT’s for each trade vs a common PT for a series of trades? For example, “Next Weeks Trades” I believe you mentioned setting 50 pips PT per trade. However, the trade above show a common target that closed all trades. Do you choose one over the other, and do you see one as more superior? Also, I do understand the US FIFO rules. I understand that may be a factor, but I still would love to know.

for next weeks trades, the 50 pips was used because over the course of a week that's a very realistic target......

living under nfa's rules, my preference has to be a set profit target per trade...... another factor for that choice is we are very rural...... any sort of high speed internet will never be..... we had dialup, but that service was discontinued about 18 months ago..... there is no way to maintain the platform connection needed for ea's.....

//-----

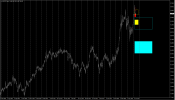

4) how do you analyze and asses the different zz lengths between 75,12, and 5? I’ve seen you use and mention all, but I’d love to know what’s going through your kind when you’re looking at them. When you are going to risk capital with a grid of limits, are hedging your bets on any of the three, or, for example, is it the 12 that you prefer?

the 75 is nothing more than a deal breaker..... once it prints, rarely will i pursue that direction further..... and if i do, those trades have a high chance of failure..... i never hedge bets...... the 12 for some reason is my choice...... using the 5 requires slicing the cake to thin......

i'll check your indicator in a few hours....

//-----

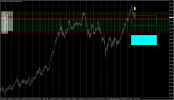

just keep in mind, the sum of the parts can be greater than the whole......h