️ High-Impact Economic Calendar – October 24, 2025

⚡ Thursday brings a wave of preliminary PMI readings across key economies, offering a timely gauge of business activity in the manufacturing and services sectors. With inflation data also in focus from the U.S., markets are closely watching whether global demand is holding firm amid lingering policy uncertainty.

Preparing ahead of high-impact news releases is essential, as these events often trigger sharp volatility, widen spreads, and shift market direction within seconds. Staying informed allows you to view forecasts in advance and prepare to enter the market accordingly, helping manage risk and avoid unexpected price movements.

Timeline: GMT |

Focused Currencies: JPY, GBP, EUR, USD

00:30 GMT

Japan – S&P Global Manufacturing PMI Flash

Forecast: 48.8 | Previous: 48.5

Currency: JPY

Market lens:

The manufacturing sector remains under pressure, with the index still in contraction territory. A reading below 50 signals weak output and dampens JPY sentiment if downside risks to growth persist.

00:30 GMT

Japan – S&P Global Services PMI Flash

Forecast: 53.0 | Previous: 53.3

Currency: JPY

Market insight:

Resilient services growth suggests domestic demand is steady. This supports the BoJ’s cautiously optimistic stance and could limit JPY downside.

00:30 GMT

Japan – S&P Global Composite PMI Flash

Forecast: 51.2 | Previous: 51.3

Currency: JPY

Quick take:

Overall private sector activity remains in expansion, driven by services. The balance reinforces Japan’s recovery narrative.

06:00 GMT

United Kingdom – Retail Sales Month-on-Month

Forecast: -0.1% | Previous: 0.5%

Currency: GBP

Market lens:

A dip in retail spending may raise concerns about household resilience. Weakness could dampen GBP as rate expectations adjust lower.

06:00 GMT

United Kingdom – Retail Sales Year-on-Year

Forecast: 0.5% | Previous: 0.7%

Currency: GBP

Market mover:

Annual growth remains tepid. Any miss versus expectations may reinforce a dovish BoE outlook, adding pressure to GBP.

07:30 GMT

Germany – HCOB Manufacturing PMI Flash

Forecast: 49.0 | Previous: 49.5

Currency: EUR

Why Traders Care:

Germany’s industrial slowdown remains a key drag on Eurozone recovery. A below-50 reading underscores contraction and weighs on EUR.

08:30 GMT

United Kingdom – S&P Global Services PMI Flash

Forecast: 51.1 | Previous: 50.8

Currency: GBP

Market lens:

Service sector resilience is key to cushioning the U.K. economy. Gains above 50 suggest stable activity and could support GBP.

08:30 GMT

United Kingdom – S&P Global Composite PMI Flash

Forecast: 50.5 | Previous: 50.1

Currency: GBP

Market insight:

Slight improvement signals tentative growth. Traders will watch how this interacts with softening consumer demand data.

08:30 GMT

United Kingdom – S&P Global Manufacturing PMI Flash

Forecast: 46.7 | Previous: 46.2

Currency: GBP

Quick take:

Manufacturing contraction deepens despite mild improvement. BoE may stay cautious as output challenges persist.

12:30 GMT

United States – Inflation Rate Month-on-Month

Forecast: 0.4% | Previous: 0.4%

Currency: USD

Market lens:

Sticky inflation keeps pressure on the Fed. A stronger-than-expected print may revive talk of further tightening.

12:30 GMT

United States – Core Inflation Rate Month-on-Month

Forecast: 0.3% | Previous: 0.3%

Currency: USD

Market insight:

Core remains elevated, reinforcing the idea that services inflation is persistent. A firm reading could lift the USD.

12:30 GMT

United States – Inflation Rate Year-on-Year

Forecast: 3.0% | Previous: 2.9%

Currency: USD

Why Traders Care:

Annual CPI ticking higher may stall Fed pivot hopes. Dollar bulls would welcome an upside surprise.

12:30 GMT

United States – Core Inflation Rate Year-on-Year

Forecast: 3.0% | Previous: 3.1%

Currency: USD

Market mover:

Core CPI holds steady. No sharp drop means the Fed may remain cautious, keeping USD supported.

13:45 GMT

United States – S&P Global Manufacturing PMI Flash

Forecast: 52.1 | Previous: 52.0

Currency: USD

Market lens:

Stable factory activity keeps recession fears at bay. Another expansionary print supports growth resilience narrative.

13:45 GMT

United States – S&P Global Services PMI Flash

Forecast: 54.3 | Previous: 54.2

Currency: USD

Fast track:

Solid services growth highlights continued momentum. This may reinforce Fed patience before any policy pivot.

13:45 GMT

United States – S&P Global Composite PMI Flash

Forecast: 54.0 | Previous: 53.9

Currency: USD

Quick take:

Broad-based expansion across sectors reflects underlying strength in the U.S. economy.

✅ Thursday’s data-heavy calendar centers on PMI signals and inflation metrics, giving traders fresh insight into global growth momentum and central bank policy paths. Attention will focus on whether stable services and sticky inflation keep policymakers cautious heading into year-end.

Important Note: Because of the U.S. government shutdown, certain releases are provisional and could shift, be revised, or not publish at all.

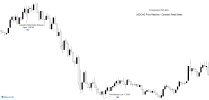

The chart below

is a display of GBP/USD in five-minute intervals following the

U.S. CPI and jobless-claims releases on September 11, 2025, highlighting the news-driven move and subsequent volatility that quickly shifted USD sentiment.

U.S. CPI & Jobless Claims — 11 September 2025

U.S. data painted a mixed backdrop ahead of the Sept. 17 Fed meeting: August CPI rose

0.4% m/m—the largest monthly gain since January—and

2.9% y/y, while core CPI increased

0.3% m/m and

3.1% y/y, in line with forecasts.

Shelter (+0.4%) was the biggest driver, with

food (+0.5%) and

energy (+0.7%; gasoline +1.9%) also contributing; services ex-energy rose

0.3% m/m and

3.6% y/y. Producer prices

fell 0.1% m/m, and tariff-sensitive goods such as new vehicles

(+0.3% m/m) and select home products registered firmer prices, consistent with some pass-through from import duties.

U.S. labor data

softened: initial jobless claims

jumped to 263,000 for the week ended Sept. 6 (up

27,000 from a revised

236,000 and the highest since

Oct. 2021), the

4-week average rose to

240,500, and

continuing claims held near late-2021 highs at

1.939 million (insured jobless rate

1.3%; 4-week average

1.9457 million). Markets read the combination as

cut-friendly, pricing a

certain September rate reduction (to

4.25%–4.50%) and higher odds of additional cuts in

October and

December; equities rallied as the deterioration in claims

outweighed the slightly hotter CPI, with commentary pointing to Chair Powell

signaling a sequence of rate cuts.

Profit Study

The Profit Study below illustrates the required margin and potential profit for this setup, showing how leverage impacted outcomes.

At the time of this release, GBP/USD traded at

1.35214.

- If entered at the low 1.34958, trading 1 standard lot with 1:500 leverage required a margin of $269.92.

- At the same entry price and 1:2000 leverage, the required margin dropped to $67.48.

Pip value (GBP/USD): $10 per pip per standard lot.

- Entering a long at Point A (1.34958) and exiting at Point B (1.35828) would have captured 87.0 pips, ≈ $870 on one standard lot.

Disclaimer: The content provided is for educational and informational purposes only. This analysis seeks to enhance your understanding of market behavior and highlight potential opportunities that may have existed, offering insights into how the market operates and the possibilities it may present.