Daily Analysis by zForex Research Team - 06.23.2025

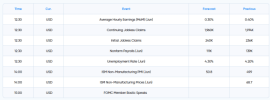

Trump’s Iran Strike Fuels Dollar Rally, Pressures Euro and GoldMarkets opened the week gripped by fresh geopolitical risks after U.S. forces struck Iranian nuclear sites, prompting a wave of safe-haven demand.

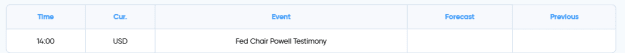

The dollar surged as tensions escalated, pulling EUR/USD lower and weighing on risk assets. Gold held near recent highs, while silver rebounded on renewed uncertainty. Central bank outlooks and PMI data remain in focus for the week ahead.

View attachment 33206

EUR/USD Analysis by zForex Research Team - 06.23.2025

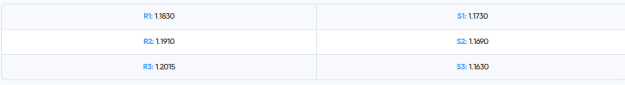

Trump’s Strike on Iran Lifts Dollar, Weighs on EuroEUR/USD dipped to around 1.1480 in early Asian trading Monday as the dollar strengthens following President Trump’s decision to join Israel’s war on Iran, escalating the conflict. Over the weekend, US forces struck three Iranian nuclear sites; Fordo, Natanz, and Isfahan. Trump claimed the facilities were “totally obliterated” and warned of harsher attacks unless Iran seeks peace. The escalation supports safe-haven demand for the dollar, pressuring EUR/USD.

Meanwhile, the ECB cut rates for the eighth time this year but signaled a pause in July. President Lagarde said cuts are nearing an end, which may help limit euro losses.

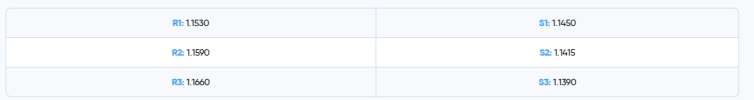

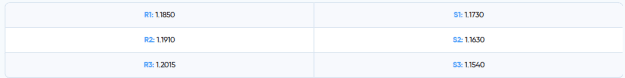

Resistance is located at 1.1530, while support is seen at 1.1450

View attachment 33202View attachment 33203

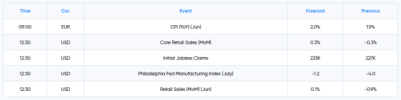

Gold Analysis by zForex Research Team - 06.23.2025

Middle East Conflict Keeps Gold ElevatedGold traded near $3,360 per ounce in choppy conditions on Monday, as investors closely watched developments in the intensifying Middle East conflict following U.S. involvement in Israeli airstrikes on Iran. Over the weekend, U.S. forces targeted Iran’s three main nuclear facilities, with President Donald Trump warning of further action unless Tehran agrees to peace. The eruption of war between Israel and Iran has added new fuel to a rally that has pushed gold prices up nearly 30% this year.

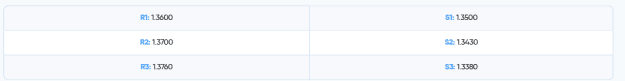

Resistance is seen at $3,395, while support holds at $3,316.

View attachment 33204View attachment 33205