(Week of 23th - 27th) October 2023

(Week of 23th - 27th) October 2023

24 October 2023

Tuesday

On October 24, 2023, the financial markets are poised for significant developments as a series of high-impact news announcements are on the horizon. The United Kingdom is gearing up to unveil its Claimant Count Change data, while France, Germany, the United Kingdom, and the United States are all scheduled to release their eagerly anticipated Flash Manufacturing and Flash Services Purchasing Managers' Index (PMI) reports. These releases are expected to have a notable impact on the global economic landscape, making it a crucial date for investors and analysts alike.

GBP - Claimant Count Change

Traders closely monitor unemployment data as it serves as a vital predictor of the broader economic well-being, despite being a lagging indicator. Labor market conditions hold a significant correlation with consumer spending, and unemployment plays a pivotal role in shaping a nation's monetary policy.

As of September 12, 2023, the United Kingdom experienced a slight uptick of 0.9 thousand individuals in search of unemployment-related benefits. Notably, this number stood considerably below the earlier forecast of 17.1 thousand and the preceding recorded figure of 7.4 thousand.

In an eagerly anticipated economic development, the forecast for the Claimant Count Change is pointing towards an increase of 2.3 thousand individuals. This projection suggests a rise in the figures, signaling potential shifts in the labor market landscape.

The upcoming announcement is scheduled for Tuesday, October 24th, at 07:00 AM GMT+1.

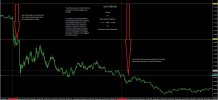

Last time, the Claimant Count Change was announced on the 12th of September, 2023. You may find the market reaction graph (GBPUSD M1) below:

EUR – French Flash Manufacturing PMI

For traders, this holds great importance since it serves as a leading indicator of economic health. Businesses react swiftly to market conditions, and their purchasing managers hold some of the most up-to-date and relevant insights into a company's outlook on the economy.

In September 2023, the S&P Global France Manufacturing Purchasing Managers' Index (PMI) was revised slightly upward to 44.2 from the initial estimate of 43.6, although it remained below August's reading of 46. This marked the eighth consecutive month of contraction, the most severe since May 2020, with notable declines in production and new orders. Across different industrial sectors, capital goods and intermediate goods experienced sharp contractions, while the consumer goods segment saw its first decline in four months. Simultaneously, purchasing activity, inventories, and employment decreased, indicating businesses' efforts to enhance cash flow amidst weakened demand. Both input and output prices fell, and business expectations for the next year remained pessimistic, anticipating further output decline.

The projection for the French Flash Manufacturing Purchasing Managers' Index stands at 45.1, indicating a marginal uptick compared to the previous reading.

The upcoming announcement is scheduled for Tuesday, October 24th, at 8:15 AM GMT+1.

EUR – French Flash Services PMI

This data holds a high degree of importance due to its role as a leading indicator for assessing economic health. Businesses react promptly to market dynamics, and the insights provided by their purchasing managers are exceptionally current and relevant in gauging the company's economic outlook.

In September 2023, the HCOB France Services PMI declined to 44.4, marking the fourth consecutive contraction period and the most significant decrease since November 2020. This drop was attributed to a combination of slowing market conditions and diminishing demand. New business experienced its most substantial decline in nearly three years, while activity levels decreased for the fourth consecutive month. Export orders also declined significantly, reaching their second-steepest rate on record, excluding the months most affected by the pandemic. Notably, despite the absence of overall business growth, employment rates rose faster than in August, surpassing the historical survey average. Rising input costs, driven by increased wages and fuel pressures, led to a corresponding increase in output charges. Additionally, business sentiments for the 12-month outlook became less optimistic and reached their lowest point since October 2020.

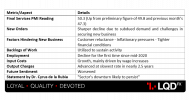

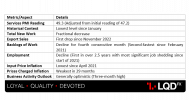

TL;DR

The forecast for the French Flash Services Purchasing Managers' Index is currently at 44.9, signaling a modest improvement compared to the prior reading.

The upcoming announcement is scheduled for Tuesday, October 24th, at 8:15 AM GMT+1.

EUR - German Flash Manufacturing PMI

Market observers closely monitor this data as it functions as a prominent indicator of economic health. Businesses demonstrate rapid responsiveness to prevailing market conditions, and the insights provided by their purchasing managers offer the most up-to-date and relevant information regarding the company's economic outlook.

In September 2023, the HCOB Germany Manufacturing PMI was revised slightly lower to 39.6 from the preliminary figure of 39.8, indicating the fifteenth consecutive month of contraction in the manufacturing sector. This contraction was driven by a significant decline in output, the sharpest in almost three-and-a-half years, coupled with a continued drop in new orders. Multiple factors, including customer uncertainty, stock reduction efforts, and weakness in construction activity, contributed to weaker demand. Additionally, backlogs of work decreased steeply, leading manufacturers to reduce staffing, resulting in the third consecutive month of falling factory employment. Input costs and output charges also saw declines, and there was a notable decline in goods producers' expectations for future output, reaching their lowest point since November of the previous year.

TL;DR

The forecast for the German Flash Manufacturing Purchasing Managers' Index is set at 41.5, suggesting a slight increase when compared to the previous reading.

The upcoming announcement is scheduled for Tuesday, October 24th, at 8:30 AM GMT+1.

EUR - German Flash Services PMI

This metric holds importance due to its role as a leading economic indicator. As businesses are acutely attuned to market conditions, the insights provided by their purchasing managers offer up-to-date and pertinent assessments of the overall economic outlook.

The final reading for the HCOB Germany Services PMI in September 2023 revealed an increase to 50.3, surpassing preliminary estimates of 49.8 and marking a marginal expansion from the previous month's 47.3. Despite this improvement, subdued demand and challenges in securing new business led to a sharper decline in new orders. Companies relied on backlogs of work to sustain activity, while factors like customer reluctance, inflationary pressures, and tighter financial conditions posed obstacles to securing new work. Consequently, employment saw a decline for the first time since mid-2020. Input costs continued to grow, primarily driven by wage increases, while output charges advanced at their slowest rate in nearly two-and-a-half years. Looking forward, sentiment among German service providers worsened, with Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, suggesting that the sector's downturn was likely to persist.

TL;DR

The projection for the German Flash Services Purchasing Managers' Index is at 50.2, indicating a slight decline in comparison to the prior reading.

The forthcoming announcement is scheduled for Tuesday, October 24th, commencing at 8:30 AM GMT+1.

GBP - Flash Manufacturing PMI

This data is closely monitored because it functions as a leading indicator of economic well-being. Businesses respond rapidly to market conditions, and their purchasing managers possess the most up-to-date and pertinent insights into the company's perspective on the economy.

In September 2023, the S&P Global/CIPS UK Manufacturing PMI registered at 44.3, displaying marginal change from the preliminary estimate of 44.2 and a slight improvement from August's 39-month low of 43.0. However, it still marked one of the lowest readings in the past 14 years. The sector witnessed a seventh consecutive month of output decline, driven by persisting market uncertainties, a cost-of-living crisis, and subdued overseas conditions. Employment experienced its twelfth successive monthly decrease, with the rate of decline ranking as the second-steepest in this period, while backlogs of work contracted at their fastest pace since April 2020. Input costs continued to decline at a rate close to the over-seven-year record set in August, while average selling prices saw their first increase in four months. Business confidence also saw a decline.

TL;DR

The forecast for the UK Flash Manufacturing is yet to be determined. Once available, the post will be updated accordingly.

The forthcoming announcement is set for Tuesday, October 24th, at 09:30 AM GMT+1.

GBP - Flash Services PMI

This data garners significant attention as it serves as a leading indicator of economic health. Businesses demonstrate swift responses to market dynamics, with their purchasing managers offering the most current and relevant insights into the company's economic outlook.

In September 2023, the S&P Global/CIPS UK Services PMI was adjusted upward to 49.3 from an initial reading of 47.2, although it still signified the lowest level since January. The report highlighted a fractional decrease in total new work and the first drop in export sales since November 2022. Backlogs of work declined for the fourth consecutive month at the second-fastest pace since February 2021. The sector also witnessed a decline in staffing, marking the first instance in over two and a half years, with the most substantial job shedding since the start of 2021. Inflation pressures showed some easing, with input price inflation reaching its lowest point since April 2021 and a similar trend in prices charged inflation, which was the weakest in 29 months. On a positive note, expectations for future business activity were generally optimistic, reaching a three-month high.

This indicates a challenging environment for the UK services sector, marked by declining workloads, exports, and employment, while inflation pressures are showing signs of moderation. However, businesses retain an overall optimistic outlook for future activity.

TL;DR

In the forthcoming release, the UK Flash Services Purchasing Managers' Index is projected at 49.8, showing a slight uptick from the previous reading.

The upcoming announcement is scheduled for Tuesday, October 24th, at 09:30 AM GMT+1.

Last time, the Flash Manufacturing PMI and Flash Services PMI for EUR, and GBP were announced on the 22th of September, 2023. You may find the market reaction graph (EURUSD M1) below:

USD - Flash Manufacturing PMI

This data garners substantial interest due to its role as a leading indicator of economic health. Businesses react promptly to market conditions, and their purchasing managers provide the most up-to-date and relevant insights into the company's economic outlook.

In September 2023, the S&P Global US Manufacturing PMI was revised upward to 49.8, surpassing the preliminary estimate of 48.9 and exceeding August's reading of 47.9. Although the sector recorded a fifth consecutive month of contraction, it was only slight. Output showed marginal growth, the quickest since May, while job creation remained moderate. New orders declined for the fifth consecutive month due to high interest rates and inflation affecting consumer demand. Input costs and output charges accelerated, though inflation rates remained historically low. Business confidence reached its highest level since April 2022, driven by optimism about improving demand conditions.

TL;DR

The US Flash Manufacturing Purchasing Managers' Index is expected to reach 49.5 in the upcoming release, indicating a slight uptick from the previous reading.

The upcoming announcement is scheduled for Tuesday, October 24th, at 2:45 PM GMT+1.

USD - Flash Services PMI

This data draws significant attention as it functions as a leading indicator of economic health. Businesses respond promptly to market dynamics, with their purchasing managers offering the most current and relevant insights into the company's economic outlook.

In September 2023, the S&P Global Services PMI for the US was revised slightly lower to 50.1 from a preliminary estimate of 50.2. This revision underscores the ongoing sluggish performance in the services sector, resembling the weakest since January. Business activity remained stagnant amid lackluster demand, with new orders declining for a second consecutive month due to reduced domestic and foreign client demand. Companies worked through their backlogs of work at the fastest rate since November 2022 to sustain current activity levels. Despite these challenges, firms continued to expand their workforce, driven by strong output expectations for the coming year. Input costs increased at a notable pace, similar to August, and efforts to pass on these higher costs to customers resulted in a quicker uptick in output charges. Business confidence, while matching August levels, remained below the series trend. Optimism centered on investments in new service offerings, increased marketing efforts, and hopes of stronger customer demand.

TL;DR

The forecast for the US Flash Services Purchasing Managers' Index, is expected to reach 49.8 in the upcoming release, indicating a slight decrease from the previous reading

The forthcoming announcement is set for Tuesday, October 24th, at 2:45 PM GMT+1.

Last time, the Flash Manufacturing PMI and Flash Services PMI for USD were announced on the 22nd of September, 2023. You may find the market reaction graph (USDJPY M1) below: