Forex Regulation Authorities

Just a few years ago, Forex trading lured thousands of retail traders with its exorbitant leverage, lavish bonuses, and promises of easy profits. This all changed when regulators across the developed world enacted multiple restrictions, rules, and requirements that put a lid on all this excess. Now, the regulatory conditions differ significantly across countries and traders are encouraged to research the standards their brokers are expected to work on.

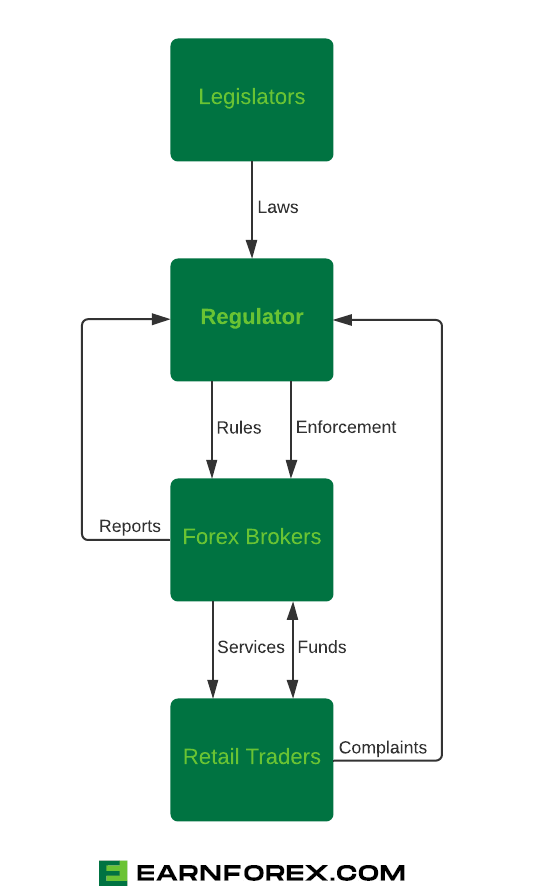

While all transactions in a stock or futures markets are carried out under the supervision of an exchange, Forex is an over-the-counter market where the transacting parties can be from different corners of the globe. Thus, in the interest of investors, it becomes all the more important for the regulatory authorities to closely monitor the brokers facilitating the trades. But who regulates the Forex market and who regulates Forex brokers? Here is an attempt to describe the most popular regulatory authorities around the world that uphold legal and ethical standards in the industry.

Forex regulation is a hot topic for many traders. Unfortunately, there is little concrete information available on the subject outside the official websites of the government institutions. This guide aims to provide such information to help traders understand the implication of this or that regulatory environment on their rights and trading conditions.

For each organization, a list of responsibilities, requirements, and powers is provided. Whenever possible, we provide examples of the regulatory actions committed by a given agency. The regulatory institutions below are listed in alphabetical order:

- ASIC (Australian Securities & Investments Commission)

- CFTC (Commodities Futures Trading Commission)

- CySEC (Cyprus Securities and Exchange Commission)

- FCA (Financial Conduct Authority)

- The Financial Commission (non-regulatory; a dispute resolution scheme)

- FINMA (Swiss Financial Market Supervisory Authority)

- FMA (Financial Markets Authority)

- FSA (Financial Services Authority of Seychelles)

- FSCA (Financial Sector Conduct Authority of South Africa)

- IFSC (International Financial Services Commission)

- CIRO (Canadian Investment Regulatory Organization)

- ISA (Israel Securities Authority)

- JFSA (Japan Financial Services Agency)

- MFSA (Malta Financial Services Authority)

- NFA (National Futures Association)

- VFSC (Vanuatu Financial Services Commission)

The list covers both established regulators and organizations that have started to play an important role in the retail FX ecosystem only recently.

Despite the variety in Forex regulatory environments around the world, traders should understand that there are licensed brokers with bad reputation and unregulated (or poorly regulated) brokers with good reputation. Therefore, the final decision should be made after thoroughly assessing the history of a particular Forex broker.

If you have any additional information about regulation services provided by the authorities in various countries or if you have any questions regarding specific regulatory jurisdictions, please visit our Forex forum.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.