Introduction.

Most of the indicators currently used by traders in the Forex market were created for another market - the stock market and for another time, when there were quite monotonous trends and quotes were not so volatile as at present, when there are no trends as steady trends of unidirectional price movement. Therefore, the entire existing arsenal of indicators is not very suitable for trading in the Forex market and does not reflect the key moments of the state of this market. To assess the condition of the Forex market and its instruments, it is necessary first of all to analyze statistical histories of their quotations, which allows identifying patterns that are important for trade, which are latent for the standard indicators (supplied with the MT4 trading platform). One of these, providing a deep statistical analysis of instruments is the indicator PDA (probability distribution of price and asymmetry), which, based on the analysis of the smaller time frames, calculates in real time the probability distribution of the price for the larger time frames, and also calculates the asymmetry of this distribution. The visual control of probability distributions and asymmetry, which provides the indicator PDA, allows us to achieve a deeper understanding of the modern market, namely:

1. Principles of the indicator.

1.1. Calculation of the probability distribution .

To calculate the probability distributions on time frames М5-Н4, the data of the minute chart - М1, is used. For the daily is used time frame M5; for the weekly time frame and for the monthly time frame - M30. The use of smaller time frames for estimating the probability distribution in these large time frames is not advisable, and it is impossible not only because of the braking of the program loaded with large arrays, but also because there is not enough big of M1 history in (for calculating probability densities) the scales of such graphs. Therefore, before the indicator PDA is installed on the chart of a tool, you first need to load the history ( Tools / History Center) quotes for this tool, and also to increase to the limit the options "Max bars in history " and " Max bars in the chart" (Tools /Options / Charts) .Note that if on some large-scale timeframe of data for calculating the probability distribution is not enough, on the " Experts" tab of the window of the term MT4 there will be a message "Download the quotation history of … ".Indicator itself is resource-intensive and requires at least a 4-core processor 2.8 GHz and 4.00 GB of RAM .If the indicator will brake the MT4 terminal, then in the indicator settings it is necessary to reduce the «Number of countable bars of the current chart (<=200)» , which is the default 200.

The calculated probability distribution and asymmetry has a sliding character, and the interval used for calculating the data is determined by the input parameter « The averaging period in the bars of the current graph» ,which we denote IS ;if, for example, IS = 15, and time frame H4, then the columns of probability values corresponding to the time moments at H4 are calculated by 15 * 4 * 60 = 3600 points of the graph M1, i.e. the last column (zero bar n = 0 to H4) - over the last 3600 points of the time frame M1, the penultimate in the range of values [241, 3840], .., nth in the interval [240 * n + 1, 3600 + 240 * n ] minute chart. And, if, say, IS = 1, then the last column is calculated according to the last 240 values of the minute chart, the penultimate column is calculated according to the values of the interval [241,480], etc., with the mapping, of course, in all cases, to H4.

The program splits the total price fluctuation for a given averaging period into seven equal intervals and calculates the frequency of the price hits of historical data of already small timeframes in that intervals. From these 7 intervals for each moment of the analyzed large time frame, rectangles of the probability mapping are formed (7 rectangles for each, marked by a bar of a large time frame, time point). Calculated on the basis of the statistical frequencies of the price (small timeframes) hit in the intervals specified by the program, the probability columns can be displayed in the main terminal window in two ways:

1.2. Calculation of non-lagging moving average .

The PDA indicator calculates the non-lagging moving average, which is calculated at the points (Inf, n + 1) in the usual way, and at the points of the [n, 0] segment, where 0 is the last bar number, is algorithmically and there is a curvilinear sector (cover out the confidence interval) in which the line of the non-lagging moving average fits with the confidence level specified in the indicator settings.It is clear that the more the confidence probability value is taken (which by default is equal to 0.5), the wider the curvilinear sector of the confidence interval is obtained. If we take the confidence probability equal to zero, then the sector of the indicator readings at points [n, 0] will shrink to a curve, which will pass through the most probable values of the non-lagging average. Statistical studies show that the price around the non-remaining average is distributed according to the Laplace law. Knowledge of the distribution law and the algorithm for calculating the most likely non-lagging average on the [n, 0] segment allow us to calculate the confidence interval sector.

1.3. Calculation of non-lagging asymmetry .

The PDA indicator allows you to predict the beginning of a change in the direction of trends, long before their visual manifestation on the price chart, by calculating the asymmetry that is displayed in the lower window of the indicator.

The author statistically revealed that before changing the direction of the trend, the probability distribution function of the price is made as asymmetric as possible. More precisely, the price movement in any direction always pulls sideways the function of its distribution, but when the third-degree root of asymmetry divided by the standard deviation exceeds the unit in absolute value, the price will change its direction. This function the indicator operation is based on this regularity. The indicator calculates the value of the third degree root asymmetry normalized to the standard deviation, i.e. magnitude

ASUMM= (< (x - <x>)^3 >)^(1/3)/ (< (x - <x>)^2 >)^(1/2) ,

where <...> - is the averaging sign, which, when it is module exceeded the unit , serves as a powerful signal to change the direction of a previously established trend.

It has also been established that the asymmetry plot changes sign when the price probability density function makes a sharp jump, which is characteristic of price dynamics.

The sliding asymmetry counted in a particular window, as well as the variance and the moving average, lags behind by about the floor of the averaging period used. Therefore: (1) For past price values, the asymmetry plot shifts back through history by the amount of delay; (2) To receive a signal in a timely manner, a special compression algorithm for the asymmetry calculation period is applied when approaching the beginning of the current history. At the same time, to ensure the possibility of calculating such asymmetry (creating a sufficient array of calculated points) on the M5-H4 time frames, be used the data of the minute chart is M1, the daily time frame is - M5, the weekly - M30, and the monthly - H1. On M1, this indicator, respectively, is not used.

2. Modes of operation of the indicator PDA.

For the convenience of reading the color-coded probability values from the indicator prob_distrib, it is desirable to make a black background on the color scheme of the main window of the MT4 terminal and display prices also with a dark line or red and green bars.

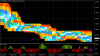

The moving average, taken with the averaging period 2*n+1, is known to lag behind the n bars; the sliding probability distribution that calculates the first mode of the PDA indicator also lags behind, which in this case represents the data in such form (Fig. 1).

Fig. 1 .Mode for calculating the sliding probability distribution of prices and asymmetry IS =15.

However, since the information on the frequencies of the price hit in given intervals is obtained on the basis of a large amount of data extracted from the lower time frames, it is possible to obtain algorithmically the without delay probability distribution, the calculation of which constitutes the second mode of operation of the indicator .In this case, the previous type of distribution is shifted to bars n to the past, and information about the distribution on the n-1 bar is found on the bars 2*(n-1)+1 of a large time frame, i.e. on the points (2*(n-1)+1)*TL/TS, where TL - the duration of a large time frame, TS - - the duration of a small time frame, that detailing a large, the n-k bar on the 2*(n-k)+1 bars of a large time frame, i.e. on (2*(n-k)+1)*TL/TS points, and about a zero bar on on it himself, more precisely, on an array of the prices equal quantity TL/TS ;at the same time, the probability distribution is calculated not on a bar that may be incomplete, but on the last such number of points of a small time frame that forms a full bar, which allows obtaining distributions for individual bars (Figure 2.1).

Fig. 2. The mode of calculating the without delay probability distribution IS =15.

Fig. 2.1. Probability distribution over bars IS =1.

In the third mode , the algorithm for calculating the non-lagging probability distribution is still more complicated. The current price channels corresponding to the averaging period are calculated at the end of the history. (Fig. 3).

Fig. 3. Calculation mode of non-lagging distribution and non-lagging price channels IS =15.

In all operating modes, the confidence interval of the non-lagging average can be, as well as painted over. Shading allows you to better see this interval itself, but impairs the vision of the details of the probability density distribution. Therefore, by default, the confidence interval is not painted over, but is marked only with blue (top of the interval) and red (bottom of the interval) crosses.

Fig. 3.1. Calculation mode of non-lagging distribution and non-lagging price channels. Shading the confidence interval of the non-lagging average. IS =15.

Fig. 3.2. The third mode with filling the confidence interval of the non-lagging average close-up.

In each of the above modes (1-3), the probability density mapping can be changed from its color coding (colors can be customized by the user) to the numerical presentation (Fig.4).

Fig. 4. The third mode with numerical probability mapping IS =15.

In the third mode, based on the calculated channel limits (which then need to place stops), the deposit and the specified risk level, you can also calculate the lot size for the trade within this channel, the lot information is displayed in the main window where its location is configured and can be selected, both at the bottom of the channel and at the top (Fig. 5).

Fig. 5. The third mode with the calculation of the lot.

The indicator is resource-intensive and calculates a small number of bars, but to search for possible new channels, the calculation area can be moved deep into history, for which the «Shifting the calculation area of the indicator» parameter is set in the settings.

The current mode of operation and all its characteristics are printed on the " Experts" tab of the window of the terminal MT4.

Fig. 6. Information about the indicator mode.

3. The indicator settings.

The indicator settings are shown in Fig. 7, where they are described in the terminal window “ inputs”.

Fig. 7. Indicator settings.

The indicator settings are divided into :

Algorithm settings :

Color and display settings :

Colors in probability density descending order .

Parameters of non-lagging moving average .

Trading mode settings .

4. Identified by the PDA indicator of the laws of the market and how to use them for successful trading.

Looking at the color maps of the probability distribution, it is easy to notice that the places where the price "trampled on" the most, form on all time frames rather extensive horizontal bands (Figure 8-9), which are similar to discrete energy levels, when the price from one level to another passes jump, almost avoiding intermediate points, in which the probability density of its hit are sometimes minimal .And, if the averages move smoothly, falling into such zones of maximum probability by passing through all intermediate points (and otherwise can not be) and do not distinguish similar probability concentration bands, these zones are easily identifiable by the indicator PDA, since they really form are constant levels that are essentially discrete or torn apart from each other.

Fig. 8. The bands of the maximum probability concentration on H4.

The existence of such zones can be explained from a psychological standpoint, as a consequence of the habit of key market participants, which determines pricing, when they are confident in the adequacy of certain price values determined at a given moment. This key market participants try set this price for some time, which continues until important events occur. Such levels, imprinted in the memory of these participants, acquire a strong tendency to repeat, which can also be seen on the color distribution of the probability and should be used in the game .Namely, if a trend has been signify, say, to an increase in the price, then necessary (by examining the probability distribution on history, for which it may be necessary to shift the indicator calculation area in the past by the «Shifting the calculation area of the indicator »option )to identify maximum probability zone above current price, where to place the take-profit, since it is possible that the direction of price motion will change after this zone, but price will reach its with a high probability. From the analytical point of view, the existence of such price zones and their isolation from each other is also understandable, since highly nonlinear equations, in principle, describe such complex systems as the market, have huge sets of sharply differing solutions that jump and unpredictably replace each other in points of bifurcation, after which the price only fluctuates around such solutions until the next bifurcation.

The very tendency to change the level of maximum probability is expressed (Fig. 9) in the intersection of the moving average and the band with a fairly low probability (from gold to red-orange), which should be identified by probability distribution without delay and moving average without delay to avoid signal lag.

Moreover, the unbiased normalized asymmetry calculated by the PDA indicator, when the module exceeds one with |ASUMM| > 1 serves as a leading signal to a possible rapid change in direction of a previously established trend.

Fig. 9. The bands of maximum probability concentration and the order of their change to D1.

5. Successful trading strategies using only PDA indicator.

Preliminary actions.

First, on the timeframe chosen by you for trading (M30-D1), roughly estimate the average length of the white bands <l> = (l1+l2+...+lN)/N, where N - the number of bands visible on the chart, li - their extent.

The indicator for both strategies is used in the third mode , where are calculated channels, probability distributions and mean without lag.The indicator channel and, accordingly, is intended mainly for trading through channels.

1. In-channel strategies.

The indicator PDA allows you to reliably trade in channel strategies. Such trade should be carried out on the already well-drawn (but not too long compared to their average lengths) white bands <l>/4 < l < <l>/2 and, of course, beforehand (at least 2 hours for trading on H1 and H4) before important news that may shift the price level to the new channel. Moreover, the asymmetry modulus should not exceed unity and even approach it. In this case, the opening of positions should be done when the current price is either in the yellow or green sectors, and take the take-profit in the middle of the white line. The stops are placed slightly further than the full distribution channel (Figure 10). The value of the lot is calculated by the indicator itself, if in the indicator settings "Is channel strategy used?" set true.

Fig. 10. Channel strategy.

2. Strategies for channel breakdown .

The bands of maximum probability jump discontinuously at the intersection of the without lagging mean of the red strip, which is the band with the minimum probability. In this case, the asymmetry sign is also replaced. Therefore, with the PDA indicator, the channel breakdown strategy can also be implemented in the form of a breakdown of the lowest possible level in an absolutely established channel l ~ <l>, namely: if the normalized asymmetry exceeded the unit in magnitude or approached it, a pending order is placed in the middle of the current red band (Buy_stop - if the red band is above the white and Sell_stop - if the red band is below white). A profitable order is closed manually when the price reaches a new established white band l ~ <l>/4. Stoploss is also placed a little further than the full probability distribution channel (Fig. 11). To calculate the lot, the option " Is channel strategy used?" must be set to false.

Fig. 11. Channel breakdown strategy.

With this indicator, you can also use the classic form of the channel breakdown strategy by placing a pair of pending orders ( Buy_stop and Sell_stop) and their stops just below both boundaries of the established channel.

3. Trend strategy .

For currency pairs, the trend strategy in pure form is realized only on very large-scale charts (MN - H4). If the trend and, most importantly, the high probability of its continuation in the same direction are established (fundamental analysis together with other indicators), then the PDA indicator can be used for the trend strategy for order placement and Stop Loss , more precisely, (3.1) the Buy Stop order for the uptrend (and Sell stop for the downtrend) and Stop Loss are set as in the channel breakdown strategy. It is possible (3.2) also to open an order as in the case of an in-channel strategy, i.e. when rolling back, when the price falls in the green or yellow sectors, separated from the white in the direction opposite to the trend ( Fig. 12). In this case, the lot is calculated according to the appropriate types of channel strategies. Then, when the price steadily <l>/4 < l < <l>/2 takes a new price level, Stop Loss is transferred in accordance with the boundaries of the new channel, etc., with a profitable closing of the Stop Loss order, when the price starts to unfold. In this case, if the trend is identified, for example, by MN, then the channel is determined by W1, if the trend is identified by W1, then the channel by D1, the trend is identified by D1, the channel by H4, the trend is identified by H4, the channel by H1.

Fig. 12. Trend strategy with opening order on the change of the trend and iteration of modifications Stop Loss.

4. The strategy of moving along the bands of maximum probability .

There are no trends, as such, on the modern highly volatile foreign exchange market, but there is a strongly fluctuating movement along the bands of maximum probability and the change of these bands. An upward trend is identified when transitions to the upper bands are more likely than transitions to the lower bands, i.e. Pup >Pdown . The downward trend is the opposite - transitions to the lower bands are more likely than transitions to the upper ones. The stronger the prevalence of one probability over another, the more pronounced the trend is. If these probabilities are equal or their proximity, Pup ~ Pdown , we get a flat. Any random jump against a pronounced trend is treated by traders as a pullback. These bands are pronounced, and their changes are accompanied by certain, statistically recorded changes. Therefore, trade on the change of these bands is the most reliable.

If the position is not open, then the excess | ASUMM |> 1 gives the trader a sign that a transition from one band of maximum probability to another band will occur soon. Then the trader should then be ready to open a position. If after that the unbiased average has moved from the white sector to the red or orange sector, then you need to open a position in the direction of movement of the unbiased average (Fig. 13) . The position is closed as soon as the price is again in the white sector or when excess occurs again | ASUMM |> 1.

Fig. 13. The strategy of moving through zones of maximum probability.

Download or buy the indicator you can by reference PDA

Most of the indicators currently used by traders in the Forex market were created for another market - the stock market and for another time, when there were quite monotonous trends and quotes were not so volatile as at present, when there are no trends as steady trends of unidirectional price movement. Therefore, the entire existing arsenal of indicators is not very suitable for trading in the Forex market and does not reflect the key moments of the state of this market. To assess the condition of the Forex market and its instruments, it is necessary first of all to analyze statistical histories of their quotations, which allows identifying patterns that are important for trade, which are latent for the standard indicators (supplied with the MT4 trading platform). One of these, providing a deep statistical analysis of instruments is the indicator PDA (probability distribution of price and asymmetry), which, based on the analysis of the smaller time frames, calculates in real time the probability distribution of the price for the larger time frames, and also calculates the asymmetry of this distribution. The visual control of probability distributions and asymmetry, which provides the indicator PDA, allows us to achieve a deeper understanding of the modern market, namely:

- statistically strictly identify the current price levels and assess the probabilities of the current (for the current moment) price in other segments of its fluctuations;

- to reveal the microstructure of the true trend movement, as a sequence of such transitions from one price level to another, that have a certain shift in the balance of probabilities towards the growth of the price or its fall;

- establish the beginning of a new trend movement based on the critical output of an non-lagging average beyond the current price level and exceeding the certain level of asymmetry.

1. Principles of the indicator.

1.1. Calculation of the probability distribution .

To calculate the probability distributions on time frames М5-Н4, the data of the minute chart - М1, is used. For the daily is used time frame M5; for the weekly time frame and for the monthly time frame - M30. The use of smaller time frames for estimating the probability distribution in these large time frames is not advisable, and it is impossible not only because of the braking of the program loaded with large arrays, but also because there is not enough big of M1 history in (for calculating probability densities) the scales of such graphs. Therefore, before the indicator PDA is installed on the chart of a tool, you first need to load the history ( Tools / History Center) quotes for this tool, and also to increase to the limit the options "Max bars in history " and " Max bars in the chart" (Tools /Options / Charts) .Note that if on some large-scale timeframe of data for calculating the probability distribution is not enough, on the " Experts" tab of the window of the term MT4 there will be a message "Download the quotation history of … ".Indicator itself is resource-intensive and requires at least a 4-core processor 2.8 GHz and 4.00 GB of RAM .If the indicator will brake the MT4 terminal, then in the indicator settings it is necessary to reduce the «Number of countable bars of the current chart (<=200)» , which is the default 200.

The calculated probability distribution and asymmetry has a sliding character, and the interval used for calculating the data is determined by the input parameter « The averaging period in the bars of the current graph» ,which we denote IS ;if, for example, IS = 15, and time frame H4, then the columns of probability values corresponding to the time moments at H4 are calculated by 15 * 4 * 60 = 3600 points of the graph M1, i.e. the last column (zero bar n = 0 to H4) - over the last 3600 points of the time frame M1, the penultimate in the range of values [241, 3840], .., nth in the interval [240 * n + 1, 3600 + 240 * n ] minute chart. And, if, say, IS = 1, then the last column is calculated according to the last 240 values of the minute chart, the penultimate column is calculated according to the values of the interval [241,480], etc., with the mapping, of course, in all cases, to H4.

The program splits the total price fluctuation for a given averaging period into seven equal intervals and calculates the frequency of the price hits of historical data of already small timeframes in that intervals. From these 7 intervals for each moment of the analyzed large time frame, rectangles of the probability mapping are formed (7 rectangles for each, marked by a bar of a large time frame, time point). Calculated on the basis of the statistical frequencies of the price (small timeframes) hit in the intervals specified by the program, the probability columns can be displayed in the main terminal window in two ways:

- in the form of a color code, the type of the spectrum of visible light, when the most probable values are closer to the violet area, and the least probable values are close to the red, with the coloring of the intervals by the corresponding colors (the order of encoding the decreasing probability by means of the color scale is specified in the settings and can there be changed at the request of the user);

1.2. Calculation of non-lagging moving average .

The PDA indicator calculates the non-lagging moving average, which is calculated at the points (Inf, n + 1) in the usual way, and at the points of the [n, 0] segment, where 0 is the last bar number, is algorithmically and there is a curvilinear sector (cover out the confidence interval) in which the line of the non-lagging moving average fits with the confidence level specified in the indicator settings.It is clear that the more the confidence probability value is taken (which by default is equal to 0.5), the wider the curvilinear sector of the confidence interval is obtained. If we take the confidence probability equal to zero, then the sector of the indicator readings at points [n, 0] will shrink to a curve, which will pass through the most probable values of the non-lagging average. Statistical studies show that the price around the non-remaining average is distributed according to the Laplace law. Knowledge of the distribution law and the algorithm for calculating the most likely non-lagging average on the [n, 0] segment allow us to calculate the confidence interval sector.

1.3. Calculation of non-lagging asymmetry .

The PDA indicator allows you to predict the beginning of a change in the direction of trends, long before their visual manifestation on the price chart, by calculating the asymmetry that is displayed in the lower window of the indicator.

The author statistically revealed that before changing the direction of the trend, the probability distribution function of the price is made as asymmetric as possible. More precisely, the price movement in any direction always pulls sideways the function of its distribution, but when the third-degree root of asymmetry divided by the standard deviation exceeds the unit in absolute value, the price will change its direction. This function the indicator operation is based on this regularity. The indicator calculates the value of the third degree root asymmetry normalized to the standard deviation, i.e. magnitude

ASUMM= (< (x - <x>)^3 >)^(1/3)/ (< (x - <x>)^2 >)^(1/2) ,

where <...> - is the averaging sign, which, when it is module exceeded the unit , serves as a powerful signal to change the direction of a previously established trend.

It has also been established that the asymmetry plot changes sign when the price probability density function makes a sharp jump, which is characteristic of price dynamics.

The sliding asymmetry counted in a particular window, as well as the variance and the moving average, lags behind by about the floor of the averaging period used. Therefore: (1) For past price values, the asymmetry plot shifts back through history by the amount of delay; (2) To receive a signal in a timely manner, a special compression algorithm for the asymmetry calculation period is applied when approaching the beginning of the current history. At the same time, to ensure the possibility of calculating such asymmetry (creating a sufficient array of calculated points) on the M5-H4 time frames, be used the data of the minute chart is M1, the daily time frame is - M5, the weekly - M30, and the monthly - H1. On M1, this indicator, respectively, is not used.

2. Modes of operation of the indicator PDA.

For the convenience of reading the color-coded probability values from the indicator prob_distrib, it is desirable to make a black background on the color scheme of the main window of the MT4 terminal and display prices also with a dark line or red and green bars.

The moving average, taken with the averaging period 2*n+1, is known to lag behind the n bars; the sliding probability distribution that calculates the first mode of the PDA indicator also lags behind, which in this case represents the data in such form (Fig. 1).

Fig. 1 .Mode for calculating the sliding probability distribution of prices and asymmetry IS =15.

However, since the information on the frequencies of the price hit in given intervals is obtained on the basis of a large amount of data extracted from the lower time frames, it is possible to obtain algorithmically the without delay probability distribution, the calculation of which constitutes the second mode of operation of the indicator .In this case, the previous type of distribution is shifted to bars n to the past, and information about the distribution on the n-1 bar is found on the bars 2*(n-1)+1 of a large time frame, i.e. on the points (2*(n-1)+1)*TL/TS, where TL - the duration of a large time frame, TS - - the duration of a small time frame, that detailing a large, the n-k bar on the 2*(n-k)+1 bars of a large time frame, i.e. on (2*(n-k)+1)*TL/TS points, and about a zero bar on on it himself, more precisely, on an array of the prices equal quantity TL/TS ;at the same time, the probability distribution is calculated not on a bar that may be incomplete, but on the last such number of points of a small time frame that forms a full bar, which allows obtaining distributions for individual bars (Figure 2.1).

Fig. 2. The mode of calculating the without delay probability distribution IS =15.

Fig. 2.1. Probability distribution over bars IS =1.

In the third mode , the algorithm for calculating the non-lagging probability distribution is still more complicated. The current price channels corresponding to the averaging period are calculated at the end of the history. (Fig. 3).

Fig. 3. Calculation mode of non-lagging distribution and non-lagging price channels IS =15.

In all operating modes, the confidence interval of the non-lagging average can be, as well as painted over. Shading allows you to better see this interval itself, but impairs the vision of the details of the probability density distribution. Therefore, by default, the confidence interval is not painted over, but is marked only with blue (top of the interval) and red (bottom of the interval) crosses.

Fig. 3.1. Calculation mode of non-lagging distribution and non-lagging price channels. Shading the confidence interval of the non-lagging average. IS =15.

Fig. 3.2. The third mode with filling the confidence interval of the non-lagging average close-up.

In each of the above modes (1-3), the probability density mapping can be changed from its color coding (colors can be customized by the user) to the numerical presentation (Fig.4).

Fig. 4. The third mode with numerical probability mapping IS =15.

In the third mode, based on the calculated channel limits (which then need to place stops), the deposit and the specified risk level, you can also calculate the lot size for the trade within this channel, the lot information is displayed in the main window where its location is configured and can be selected, both at the bottom of the channel and at the top (Fig. 5).

Fig. 5. The third mode with the calculation of the lot.

The indicator is resource-intensive and calculates a small number of bars, but to search for possible new channels, the calculation area can be moved deep into history, for which the «Shifting the calculation area of the indicator» parameter is set in the settings.

The current mode of operation and all its characteristics are printed on the " Experts" tab of the window of the terminal MT4.

Fig. 6. Information about the indicator mode.

3. The indicator settings.

The indicator settings are shown in Fig. 7, where they are described in the terminal window “ inputs”.

Fig. 7. Indicator settings.

The indicator settings are divided into :

Algorithm settings :

- The averaging period in the bars of the current graph (2n+1) - averaging period (1-99).

- Number of countable bars of the current chart (<=200) - number of calculated indicator graph bars (1-200).

- Shifting the calculation area of the indicator - global indicator shift (0-100).

- The non-lagging distribution is calculated - calculate a non-lagging distribution.

- The non-late channel is calculated - calculate the current non-lagging channel.

- Show the values of the probabilities of zones - display area probability values.

Color and display settings :

Colors in probability density descending order .

- Color of the maximum probability zone (0) =clrLightCyan;

- Color of zone (1) =clrAqua;

- Color of zone (2) =clrDodgerBlue;

- Color of the zone of average probability (3) =clrMediumSeaGreen;

- Color of zone (4) =clrGold;

- Color of zone (5=clrOrange);

- Color of the minimum probability zone (6) =clrOrangeRed;

Parameters of non-lagging moving average .

- Moving average price type - applied price. Values : Close price, Open price, High price, Low price, Median price ( (high + low)/2 - default ), Typical price ( (high + low + close)/3 ), Weighted price ( (high + low + 2*close)/4).

- The averaging method - averaging method. Values: Simple (default), Exponential, Smoothed, Linear weighted.

- Confidence probability - Values: from 0 to 0.999 (0.5 by default).

- Color of the moving average line=clrDarkOliveGreen; - The color of the indicator line and its figure sector.

- Paint over the confidence interval? Values: true, false (by default)

Trading mode settings .

- Calculate the lot size from the risk, deposit and channel

- Deposit in $

- Allowable losses in %

- The channel strategy is used - true - intra-channel strategy (false - channel breakthrough strategy)

- Color of message about the size of the lot

- Information about the lot at the bottom of the channel (false - information at the top of the channel)

4. Identified by the PDA indicator of the laws of the market and how to use them for successful trading.

Looking at the color maps of the probability distribution, it is easy to notice that the places where the price "trampled on" the most, form on all time frames rather extensive horizontal bands (Figure 8-9), which are similar to discrete energy levels, when the price from one level to another passes jump, almost avoiding intermediate points, in which the probability density of its hit are sometimes minimal .And, if the averages move smoothly, falling into such zones of maximum probability by passing through all intermediate points (and otherwise can not be) and do not distinguish similar probability concentration bands, these zones are easily identifiable by the indicator PDA, since they really form are constant levels that are essentially discrete or torn apart from each other.

Fig. 8. The bands of the maximum probability concentration on H4.

The existence of such zones can be explained from a psychological standpoint, as a consequence of the habit of key market participants, which determines pricing, when they are confident in the adequacy of certain price values determined at a given moment. This key market participants try set this price for some time, which continues until important events occur. Such levels, imprinted in the memory of these participants, acquire a strong tendency to repeat, which can also be seen on the color distribution of the probability and should be used in the game .Namely, if a trend has been signify, say, to an increase in the price, then necessary (by examining the probability distribution on history, for which it may be necessary to shift the indicator calculation area in the past by the «Shifting the calculation area of the indicator »option )to identify maximum probability zone above current price, where to place the take-profit, since it is possible that the direction of price motion will change after this zone, but price will reach its with a high probability. From the analytical point of view, the existence of such price zones and their isolation from each other is also understandable, since highly nonlinear equations, in principle, describe such complex systems as the market, have huge sets of sharply differing solutions that jump and unpredictably replace each other in points of bifurcation, after which the price only fluctuates around such solutions until the next bifurcation.

The very tendency to change the level of maximum probability is expressed (Fig. 9) in the intersection of the moving average and the band with a fairly low probability (from gold to red-orange), which should be identified by probability distribution without delay and moving average without delay to avoid signal lag.

Moreover, the unbiased normalized asymmetry calculated by the PDA indicator, when the module exceeds one with |ASUMM| > 1 serves as a leading signal to a possible rapid change in direction of a previously established trend.

Fig. 9. The bands of maximum probability concentration and the order of their change to D1.

5. Successful trading strategies using only PDA indicator.

Preliminary actions.

First, on the timeframe chosen by you for trading (M30-D1), roughly estimate the average length of the white bands <l> = (l1+l2+...+lN)/N, where N - the number of bands visible on the chart, li - their extent.

The indicator for both strategies is used in the third mode , where are calculated channels, probability distributions and mean without lag.The indicator channel and, accordingly, is intended mainly for trading through channels.

1. In-channel strategies.

The indicator PDA allows you to reliably trade in channel strategies. Such trade should be carried out on the already well-drawn (but not too long compared to their average lengths) white bands <l>/4 < l < <l>/2 and, of course, beforehand (at least 2 hours for trading on H1 and H4) before important news that may shift the price level to the new channel. Moreover, the asymmetry modulus should not exceed unity and even approach it. In this case, the opening of positions should be done when the current price is either in the yellow or green sectors, and take the take-profit in the middle of the white line. The stops are placed slightly further than the full distribution channel (Figure 10). The value of the lot is calculated by the indicator itself, if in the indicator settings "Is channel strategy used?" set true.

Fig. 10. Channel strategy.

2. Strategies for channel breakdown .

The bands of maximum probability jump discontinuously at the intersection of the without lagging mean of the red strip, which is the band with the minimum probability. In this case, the asymmetry sign is also replaced. Therefore, with the PDA indicator, the channel breakdown strategy can also be implemented in the form of a breakdown of the lowest possible level in an absolutely established channel l ~ <l>, namely: if the normalized asymmetry exceeded the unit in magnitude or approached it, a pending order is placed in the middle of the current red band (Buy_stop - if the red band is above the white and Sell_stop - if the red band is below white). A profitable order is closed manually when the price reaches a new established white band l ~ <l>/4. Stoploss is also placed a little further than the full probability distribution channel (Fig. 11). To calculate the lot, the option " Is channel strategy used?" must be set to false.

Fig. 11. Channel breakdown strategy.

With this indicator, you can also use the classic form of the channel breakdown strategy by placing a pair of pending orders ( Buy_stop and Sell_stop) and their stops just below both boundaries of the established channel.

3. Trend strategy .

For currency pairs, the trend strategy in pure form is realized only on very large-scale charts (MN - H4). If the trend and, most importantly, the high probability of its continuation in the same direction are established (fundamental analysis together with other indicators), then the PDA indicator can be used for the trend strategy for order placement and Stop Loss , more precisely, (3.1) the Buy Stop order for the uptrend (and Sell stop for the downtrend) and Stop Loss are set as in the channel breakdown strategy. It is possible (3.2) also to open an order as in the case of an in-channel strategy, i.e. when rolling back, when the price falls in the green or yellow sectors, separated from the white in the direction opposite to the trend ( Fig. 12). In this case, the lot is calculated according to the appropriate types of channel strategies. Then, when the price steadily <l>/4 < l < <l>/2 takes a new price level, Stop Loss is transferred in accordance with the boundaries of the new channel, etc., with a profitable closing of the Stop Loss order, when the price starts to unfold. In this case, if the trend is identified, for example, by MN, then the channel is determined by W1, if the trend is identified by W1, then the channel by D1, the trend is identified by D1, the channel by H4, the trend is identified by H4, the channel by H1.

Fig. 12. Trend strategy with opening order on the change of the trend and iteration of modifications Stop Loss.

4. The strategy of moving along the bands of maximum probability .

There are no trends, as such, on the modern highly volatile foreign exchange market, but there is a strongly fluctuating movement along the bands of maximum probability and the change of these bands. An upward trend is identified when transitions to the upper bands are more likely than transitions to the lower bands, i.e. Pup >Pdown . The downward trend is the opposite - transitions to the lower bands are more likely than transitions to the upper ones. The stronger the prevalence of one probability over another, the more pronounced the trend is. If these probabilities are equal or their proximity, Pup ~ Pdown , we get a flat. Any random jump against a pronounced trend is treated by traders as a pullback. These bands are pronounced, and their changes are accompanied by certain, statistically recorded changes. Therefore, trade on the change of these bands is the most reliable.

If the position is not open, then the excess | ASUMM |> 1 gives the trader a sign that a transition from one band of maximum probability to another band will occur soon. Then the trader should then be ready to open a position. If after that the unbiased average has moved from the white sector to the red or orange sector, then you need to open a position in the direction of movement of the unbiased average (Fig. 13) . The position is closed as soon as the price is again in the white sector or when excess occurs again | ASUMM |> 1.

Fig. 13. The strategy of moving through zones of maximum probability.

Download or buy the indicator you can by reference PDA