️ High-Impact Economic Events – Tuesday, June 24

Time Zone: GMTCurrencies most likely to be impacted: EUR, CAD, and USD — based on sentiment data from Germany, inflation releases from Canada, and key U.S. events including Powell’s testimony.

08:00 – Germany

IFO Business Climate Index

- Forecast: 88.4 | Previous: 87.5

- What it Measures: Business sentiment across key sectors: manufacturing, services, trade, and construction.

- Why it Matters: A critical leading indicator for the German economy. A stronger reading may support EUR strength, signaling improved business expectations and economic activity.

12:30 – Canada

Core Inflation Rate (MoM)

- Forecast: 0.6% | Previous: 0.5%

- Focus: Excludes volatile components such as fuel and food.

- Significance: Watched closely by the Bank of Canada. An uptick may fuel interest rate hike expectations, supporting CAD.

Headline Inflation Rate (YoY)

- Forecast: 1.5% | Previous: 1.7%

- Focus: Measures the change in the entire consumer basket annually.

- Insight: A decrease could ease inflationary pressure, lowering rate hike urgency.

Inflation Rate (MoM)

- Forecast: 0.4% | Previous: -0.1%

- Focus: Month-to-month price fluctuations.

- Market Watch: A positive turnaround from last month’s decline may revive inflation concerns.

Core Inflation Rate (YoY)

- Forecast: 2.6% | Previous: 2.5%

- Insight: A steady rise reinforces longer-term inflation persistence and may influence central bank policy tightening.

14:00 – United States

Fed Chair Powell Testimony

- Details: Powell appears before Congress to provide updates on monetary policy and economic outlook.

- Market Relevance: Investors will scrutinize his tone for signals on potential rate cuts amid inflation concerns and geopolitical risks.

CB Consumer Confidence

- Forecast: 99 | Previous: 98

- Measures: Sentiment from a broad household survey on current and future financial conditions.

- Importance: Confidence drives spending, which supports over two-thirds of U.S. GDP.

Richmond Fed Manufacturing Index

- Forecast: -7 | Previous: -9

- Measures: Regional factory activity in the Mid-Atlantic.

- Interpretation: A reading above zero signals growth; below zero indicates contraction. May offer a micro-level look at broader industrial health.

Market Insight

Global geopolitical tensions, particularly in the Middle East, are contributing to a cautious tone across financial markets. While traditionally a driver of short-term volatility, such developments influence investor sentiment, energy prices, and inflation expectations — all of which shape equity valuations. With key data and central bank updates from the U.S., Canada, and Europe on the horizon, markets remain sensitive to how global uncertainty may guide risk appetite, sector rotation, and broader equity trends.

How Key Economic Releases Move Markets — Chart Examples

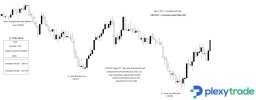

EUR/USD Intraday Analysis: Ifo-Driven Spike Meets Resistance

German business sentiment improved in May as trade tensions eased and expectations for increased public spending lifted economic outlooks. The Ifo Institute’s expectations index rose to 88.9 from 87.4, surpassing analyst forecasts, while the current conditions measure saw a slight decline. Ifo President Clemens Fuest noted that uncertainty had subsided and confidence was gradually returning. Despite this, Germany’s economy remained stagnant, with GDP expected to show no growth for a third consecutive year. Earlier data also revealed a contraction in private-sector activity, as a sharp decline in services offset gains in manufacturing.

**Following the German Ifo Business Climate release, EUR/USD rallied from the session open at 1.13212 to a high of 1.1347, which now stands as immediate resistance. Initial support was established at 1.12903, the low before subsequent US data releases.

USD/CAD Price Action Following Canadian CPI Data

In April, Canada’s Consumer Price Index (CPI) rose 1.7% year over year, easing from 2.3% in March, as energy prices dropped 12.7% following the removal of the federal carbon tax and weaker crude oil prices amid slowing global trade and rising OPEC+ supply. Excluding energy, inflation rose 2.9%, suggesting persistent underlying price pressures. Grocery prices accelerated to 3.8%, driven by significant increases in beef (+16.2%), coffee (+13.4%), and sugar (+8.6%). Travel tour costs also surged 6.7% annually. On a monthly basis, CPI fell 0.1% (0.2% seasonally adjusted). Regionally, price growth slowed in nine provinces, except Quebec, where gasoline prices fell less due to the province’s cap-and-trade system.

**Following the Canadian inflation data release, USD/CAD opened at 1.39596 — the session high — before gradually declining to establish intraday support at 1.39089, the lowest point of the day.Reminder:

Earnings season is a major catalyst for price action across global indices. While headline names like the US30, S&P 500, NASDAQ 100, FTSE 100, and DAX40 often take the spotlight, broader equity benchmarks worldwide can also react sharply. Market sentiment is shaped not only by results, but also by forward guidance and executive commentary — making this a key period for both opportunity and risk.Disclaimer: The content provided is for educational and informational purposes only and is not intended as trading or financial advice. This analysis seeks to enhance your understanding of market behavior and highlight potential opportunities that may have existed, offering insights into how the market operates and the possibilities it may present.