GBP/USD ready for another attempt to jump to 1.3230

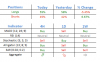

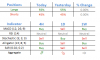

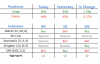

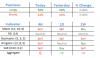

As release of British employment data, generally, was perceived positively, the Pound expectedly climbed to the 1.3200 level. Nevertheless, a subsequent release of the American retail sales and inflation data neutralized this achievement by returning the pair back to combined support area formed by the 55-, 100- and 200-hour SMAs near the 1.3135 mark. After making a rebound the cable resumed the surge. Second day in a row bulls are hoping to use macroeconomic data release to push the rate to the pre-fall 1.3230 level. Whether they succeed or not will mainly depend on the UK retail sales growth rate. There just a need to take into account that the pair is unlikely to climb above a combination of the monthly PP and upper edge of dominant channel from the north and the above MAs from the south.

As release of British employment data, generally, was perceived positively, the Pound expectedly climbed to the 1.3200 level. Nevertheless, a subsequent release of the American retail sales and inflation data neutralized this achievement by returning the pair back to combined support area formed by the 55-, 100- and 200-hour SMAs near the 1.3135 mark. After making a rebound the cable resumed the surge. Second day in a row bulls are hoping to use macroeconomic data release to push the rate to the pre-fall 1.3230 level. Whether they succeed or not will mainly depend on the UK retail sales growth rate. There just a need to take into account that the pair is unlikely to climb above a combination of the monthly PP and upper edge of dominant channel from the north and the above MAs from the south.