XAU/USD surges amid political changes in Saudi Arabia

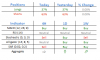

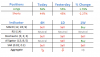

A sudden cleansing in the Saudi establishment enhanced uncertainly about the situation in the Middle East and, as a result, magnified demand for gold. On hourly chart this search for safe haven assets signified creation of a second reaction low a two-week long junior ascending channel. Moreover, the rapid surge allowed the pair to rapidly reach the weekly R1 at 1,281.00. As markets have calmed down already, bears are expected to start pushing the pair back to the bottom. However, there is little chance the rate will succeed to return back to support zone near 1,268.00, as the road to the south is obstructed by a combination of the 55-, 100- and 200-hour SMAs together with the weekly PP at 1,273.35. Unless the rate receives a proper impulse, it is expected to halt the fall there.

A sudden cleansing in the Saudi establishment enhanced uncertainly about the situation in the Middle East and, as a result, magnified demand for gold. On hourly chart this search for safe haven assets signified creation of a second reaction low a two-week long junior ascending channel. Moreover, the rapid surge allowed the pair to rapidly reach the weekly R1 at 1,281.00. As markets have calmed down already, bears are expected to start pushing the pair back to the bottom. However, there is little chance the rate will succeed to return back to support zone near 1,268.00, as the road to the south is obstructed by a combination of the 55-, 100- and 200-hour SMAs together with the weekly PP at 1,273.35. Unless the rate receives a proper impulse, it is expected to halt the fall there.