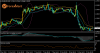

NZD/USD Technical Analysis: January 10, 2018

During the trading course on Tuesday, the New Zealand dollar appears to be choppy and mainly negative. The marketplace is characterized as wrist sensitive because the NZ dollar is generally influenced by “risk appetite” and commodity markets. Aside from that, there exist a dollar bias that further leads the market.

The 0.7150 mark looks like offering some kind of support for the NZD/USD currency pair, which appeared to be really strong lately. But the markets are consolidating which means that pullbacks are expected to attempt establishing momentum in order to resume the move to the upside. The longer-term charts imply consolidation between the 0.68 region on the bottom and 0.75 level above, which caused the market to resume further consolidation but the situation is regarded to be larger and longer term.

There is a tendency for the market to continue buying on the dips due to inability to reach the top of the consolidation zone after the rebound from the bottom. The Kiwi dollar would likely be slightly oversold, therefore, it is acceptable for some recovery and normality. Upon the breakdown, a significant support at the 0.71 handle should be expected which is previously a significant resistances and accompanied by a large gap since the past few weeks. Most likely, the American currency will continue to lose it strength.

During the trading course on Tuesday, the New Zealand dollar appears to be choppy and mainly negative. The marketplace is characterized as wrist sensitive because the NZ dollar is generally influenced by “risk appetite” and commodity markets. Aside from that, there exist a dollar bias that further leads the market.

The 0.7150 mark looks like offering some kind of support for the NZD/USD currency pair, which appeared to be really strong lately. But the markets are consolidating which means that pullbacks are expected to attempt establishing momentum in order to resume the move to the upside. The longer-term charts imply consolidation between the 0.68 region on the bottom and 0.75 level above, which caused the market to resume further consolidation but the situation is regarded to be larger and longer term.

There is a tendency for the market to continue buying on the dips due to inability to reach the top of the consolidation zone after the rebound from the bottom. The Kiwi dollar would likely be slightly oversold, therefore, it is acceptable for some recovery and normality. Upon the breakdown, a significant support at the 0.71 handle should be expected which is previously a significant resistances and accompanied by a large gap since the past few weeks. Most likely, the American currency will continue to lose it strength.