Investors increase positions in gold

Gold quotes continue to be traded at increased volumes and are kept in the area of annual highs, at the second most important psychological level of $1900.

The positive dynamics is facilitated by the acceleration of inflation rates in the world and increased geopolitical risks, since the news background regarding the crisis on the borders of Ukraine again occupies a significant place on the current agenda. In the context of global price pressure and the imminent increase in rates by central banks, investors are buying the precious metal as a defensive asset, withdrawing their capital from risky instruments such as stocks and currencies.

The current dynamics also have a local reason.

The Federal Office for Customs and Border Security of Switzerland published a report on the import and export of gold in January 2022, according to which the total export volume of the precious metal from the country amounted to 115.74 tons, which is 20% higher than in December last year, and 43% higher than in January 2021.

Asian buyers account for more than 100 tons:

China ranked first in terms of exports, importing 70 tons of gold; another 11.6 tons were bought by India, and 8 tons were bought by Singapore. The total amount of exports of the precious metal for the month exceeded 6.22B Swiss francs. In turn, the volume of imports to Switzerland also increased to 6.51B Swiss francs, which is significantly higher than in December.

Support and resistance

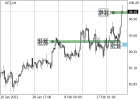

On the daily chart, the price reached the level of the global high of June 2021 and is now trying to consolidate at this level.

Technical indicators maintain a steady buy signal:

the fast EMAs of the Alligator indicator are above the signal line, and the histogram of the AO oscillator is trading in the buy zone, forming new ascending bars.

Support levels: 1878, 1810.

Resistance levels: 1914, 1950.

Gold quotes continue to be traded at increased volumes and are kept in the area of annual highs, at the second most important psychological level of $1900.

The positive dynamics is facilitated by the acceleration of inflation rates in the world and increased geopolitical risks, since the news background regarding the crisis on the borders of Ukraine again occupies a significant place on the current agenda. In the context of global price pressure and the imminent increase in rates by central banks, investors are buying the precious metal as a defensive asset, withdrawing their capital from risky instruments such as stocks and currencies.

The current dynamics also have a local reason.

The Federal Office for Customs and Border Security of Switzerland published a report on the import and export of gold in January 2022, according to which the total export volume of the precious metal from the country amounted to 115.74 tons, which is 20% higher than in December last year, and 43% higher than in January 2021.

Asian buyers account for more than 100 tons:

China ranked first in terms of exports, importing 70 tons of gold; another 11.6 tons were bought by India, and 8 tons were bought by Singapore. The total amount of exports of the precious metal for the month exceeded 6.22B Swiss francs. In turn, the volume of imports to Switzerland also increased to 6.51B Swiss francs, which is significantly higher than in December.

Support and resistance

On the daily chart, the price reached the level of the global high of June 2021 and is now trying to consolidate at this level.

Technical indicators maintain a steady buy signal:

the fast EMAs of the Alligator indicator are above the signal line, and the histogram of the AO oscillator is trading in the buy zone, forming new ascending bars.

Support levels: 1878, 1810.

Resistance levels: 1914, 1950.