GOLD H4 Technical and Fundamental Analysis for 10.10.2025

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GOLD/USD (XAUUSD) market is trading cautiously as traders await key speeches from multiple Federal Reserve (FOMC) members, including Mary Daly, Austan Goolsbee, and Alberto Musalem. Their remarks are expected to provide further clues about the Fed’s stance on inflation, monetary tightening, and future interest rate decisions. Additionally, the University of Michigan Consumer Sentiment and Inflation Expectations reports later today could significantly influence the USD’s direction and, in turn, impact gold prices. Any hawkish tone or stronger-than-expected consumer sentiment data could strengthen the USD, putting temporary pressure on XAU/USD, while dovish commentary might support a rebound in gold. Overall, the market remains sensitive to Fed rhetoric amid lingering inflationary concerns and geopolitical risk factors that continue to underpin safe-haven demand for gold.

Price Action:

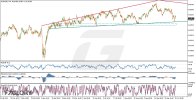

On the XAUUSD H4 timeframe, the gold price has recently recorded a new All-Time High (ATH) at 4059.01 USD on October 8th, before entering a mild correction phase. The price has now moved below the psychological 4000.00 level, currently trading around 3974.68 USD. Despite this retracement, the pair remains within a clearly defined ascending bullish channel, maintaining an overall bullish structure that has persisted throughout 2025, with only one bearish month (July). The recent pullback has tested the 3940.00 support zone, which has held firm so far, indicating ongoing buyer interest. A break below this zone could expose the 3900.00 level as the next major support, while recovery above 4000.00 may resume the bullish leg toward retesting the ATH.

Key Technical Indicators:

Moving Averages (MA 9 & 17): The short-term MA (9) has slightly turned downward, reflecting the ongoing price correction, yet it remains above the MA (17), showing that the overall bullish structure is still intact. However, the narrowing gap between the two averages suggests potential short-term consolidation or a minor bearish crossover if downward momentum extends.

RSI (Relative Strength Index 14): The RSI(14) stands at 49.41, indicating a neutral market sentiment after the recent overbought conditions near the ATH. This mid-range value suggests equilibrium between buyers and sellers, leaving room for either a bounce from support or further correction if selling pressure strengthens.

MACD (12,26,9): The MACD currently shows the main line at 23.749 and the signal line at 38.510, displaying a decreasing histogram. This signals waning bullish momentum and a possible short-term correction phase within the broader uptrend. Traders should monitor for any bearish crossover that might confirm further downside movement toward support.

Support and Resistance:

Support: The first key support is at 3940.00, which has already shown price reaction, followed by 3900.00 as the secondary and more crucial support zone.

Resistance: The nearest resistance remains at the psychological 4000.00 level, while the ATH of 4059.01 serves as the major resistance to beat for continuation of the bullish trend.

Conclusion and Consideration:

The XAUUSD H4 chart analysis suggests that despite the recent pullback below 4000, Gold remains in a strong long-term bullish trend, supported by an ascending channel structure and firm demand from global investors. However, short-term technicals hint at potential consolidation as the market digests recent gains and anticipates fresh guidance from upcoming FOMC speeches. Traders should closely monitor support at 3940.00 and the reaction to USD-related news today, as these factors could define the next directional move. A rebound above 4000.00 would likely reignite bullish momentum, while a sustained drop below 3900.00 could trigger a deeper correction.

Disclaimer: The analysis provided for GOLD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GOLDUSD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

10.10.2025

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GOLD/USD (XAUUSD) market is trading cautiously as traders await key speeches from multiple Federal Reserve (FOMC) members, including Mary Daly, Austan Goolsbee, and Alberto Musalem. Their remarks are expected to provide further clues about the Fed’s stance on inflation, monetary tightening, and future interest rate decisions. Additionally, the University of Michigan Consumer Sentiment and Inflation Expectations reports later today could significantly influence the USD’s direction and, in turn, impact gold prices. Any hawkish tone or stronger-than-expected consumer sentiment data could strengthen the USD, putting temporary pressure on XAU/USD, while dovish commentary might support a rebound in gold. Overall, the market remains sensitive to Fed rhetoric amid lingering inflationary concerns and geopolitical risk factors that continue to underpin safe-haven demand for gold.

Price Action:

On the XAUUSD H4 timeframe, the gold price has recently recorded a new All-Time High (ATH) at 4059.01 USD on October 8th, before entering a mild correction phase. The price has now moved below the psychological 4000.00 level, currently trading around 3974.68 USD. Despite this retracement, the pair remains within a clearly defined ascending bullish channel, maintaining an overall bullish structure that has persisted throughout 2025, with only one bearish month (July). The recent pullback has tested the 3940.00 support zone, which has held firm so far, indicating ongoing buyer interest. A break below this zone could expose the 3900.00 level as the next major support, while recovery above 4000.00 may resume the bullish leg toward retesting the ATH.

Key Technical Indicators:

Moving Averages (MA 9 & 17): The short-term MA (9) has slightly turned downward, reflecting the ongoing price correction, yet it remains above the MA (17), showing that the overall bullish structure is still intact. However, the narrowing gap between the two averages suggests potential short-term consolidation or a minor bearish crossover if downward momentum extends.

RSI (Relative Strength Index 14): The RSI(14) stands at 49.41, indicating a neutral market sentiment after the recent overbought conditions near the ATH. This mid-range value suggests equilibrium between buyers and sellers, leaving room for either a bounce from support or further correction if selling pressure strengthens.

MACD (12,26,9): The MACD currently shows the main line at 23.749 and the signal line at 38.510, displaying a decreasing histogram. This signals waning bullish momentum and a possible short-term correction phase within the broader uptrend. Traders should monitor for any bearish crossover that might confirm further downside movement toward support.

Support and Resistance:

Support: The first key support is at 3940.00, which has already shown price reaction, followed by 3900.00 as the secondary and more crucial support zone.

Resistance: The nearest resistance remains at the psychological 4000.00 level, while the ATH of 4059.01 serves as the major resistance to beat for continuation of the bullish trend.

Conclusion and Consideration:

The XAUUSD H4 chart analysis suggests that despite the recent pullback below 4000, Gold remains in a strong long-term bullish trend, supported by an ascending channel structure and firm demand from global investors. However, short-term technicals hint at potential consolidation as the market digests recent gains and anticipates fresh guidance from upcoming FOMC speeches. Traders should closely monitor support at 3940.00 and the reaction to USD-related news today, as these factors could define the next directional move. A rebound above 4000.00 would likely reignite bullish momentum, while a sustained drop below 3900.00 could trigger a deeper correction.

Disclaimer: The analysis provided for GOLD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GOLDUSD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

10.10.2025