Currency Strength Indicator

Contents

Have you ever heard about currency strength indicators, sometimes also called currency strength meters? They are indicators that show the strength of individual currencies. Here, you will learn what a currency strength indicator is, how it works and how you can integrate it in your trading.

Before we begin, it should be noted that currency strength indicators are not a holy grail and despite that what you might have heard about them, they won't provide sure-fire trading signals for 100% profitable trades. A currency strength indicator is just another sort of indicator, albeit very useful, and it is great for combining with other technical indicators.

What Is Currency Strength Indicator?

As you may know, in the Forex market, traders always work with currency pairs. But what if we want to measure the absolute strength of a currency, "disconnecting" it from a specific pair? In other words, how can we estimate the strength of a currency in the foreign exchange market?

The purpose of the currency strength indicator (or a currency strength meter) is to show the strength of the individual currencies in the market in order to understand which of them are the strong (or getting stronger) and which of them are the weak (or getting weaker).

How Currency Strength Indicator Works?

There is no unique formula to estimate the strength of a currency in the market, but there are a few ways to approximate it. It is very common in this case to use other existing normalized indicators and to combine them together in order to calculate the strength of a specific currency.

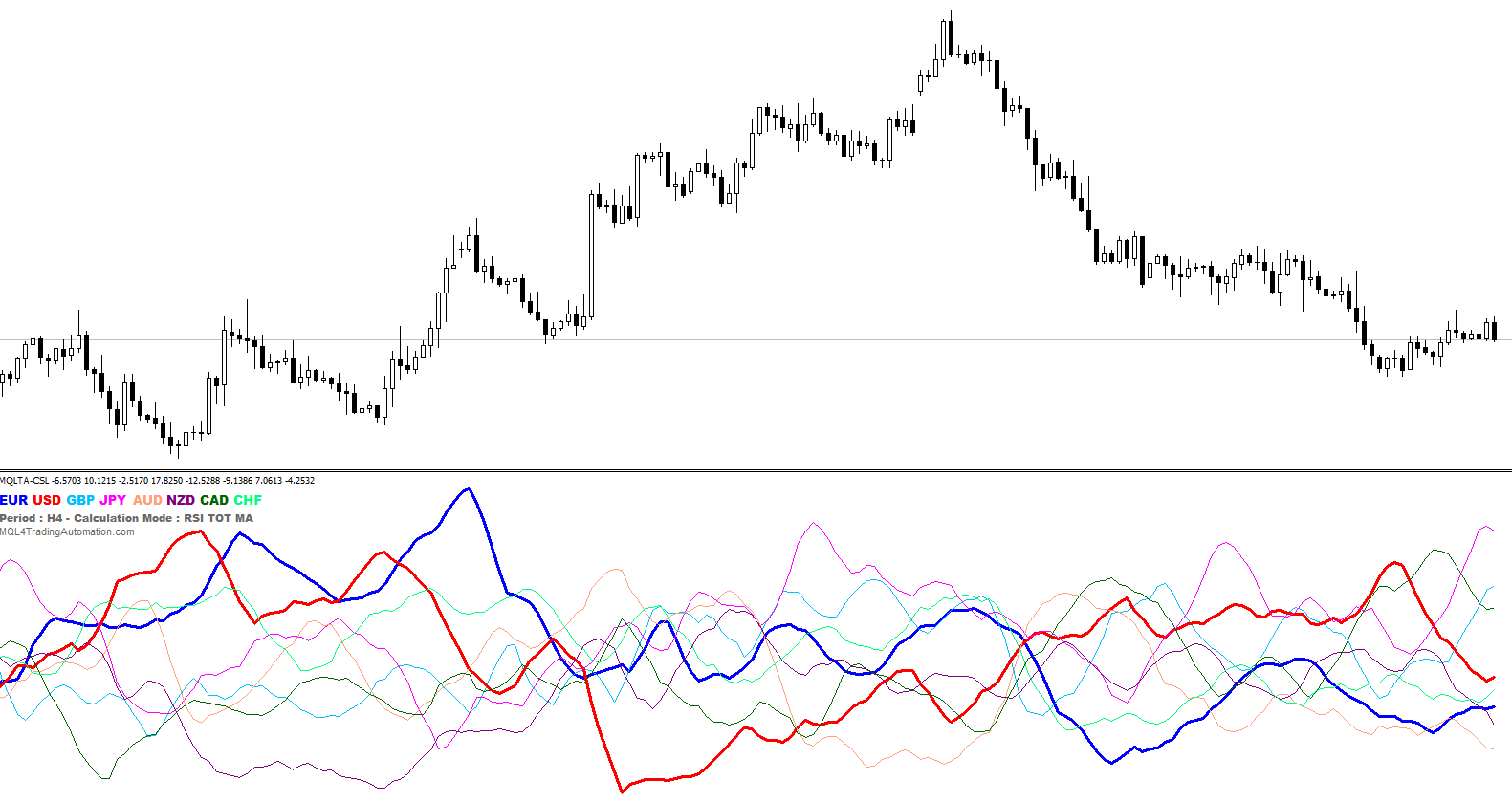

For example, if we want to know the strength of the EUR we can consider all the pairs involving the EUR, like EUR/USD, EUR/GBP, EUR/JPY, EUR/AUD, EUR/NZD, EUR/CAD, EUR/CHF, apply the same technical indicator and see its value in each pair. Then we can combine the values together with some formula to get a total or an average. Doing so for each currency, you will obtain comparable values and you can draw lines of these to make sense of which currency is stronger.

Common sub-indicators for measuring strength in comparable manner are Rate of Change and Relative Strength Index. Additionally, a binary-mode (strong/weak) currency strength indicator can determine whether a given currency is "strong" or "weak" by its current close rate to its previous close rate or by the difference of its fast and slow moving averages.

How Does Currency Strength Indicator Look Like?

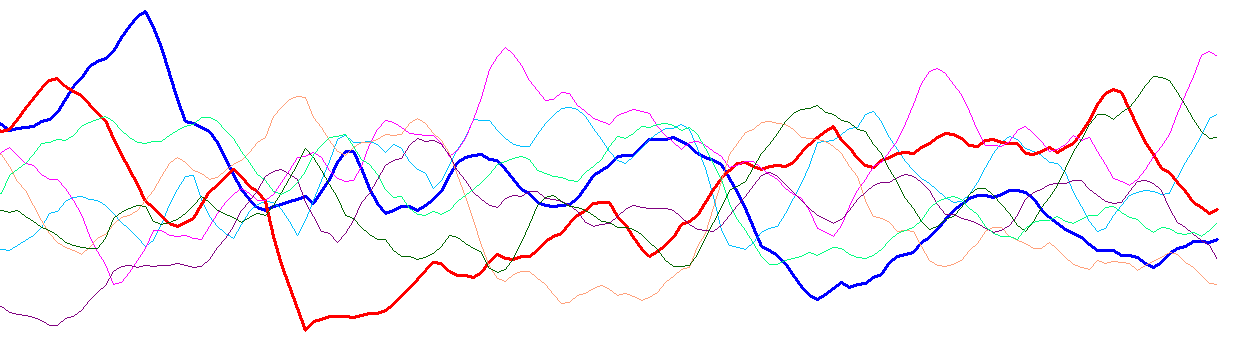

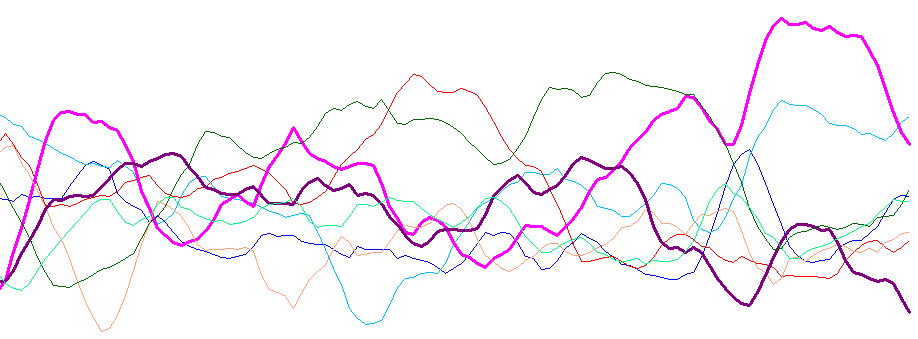

Usually, a currency strength indicator comprises lines that fluctuate around a horizontal line (zero level). These lines can be smooth or rough depending on the algorithms and parameters used.

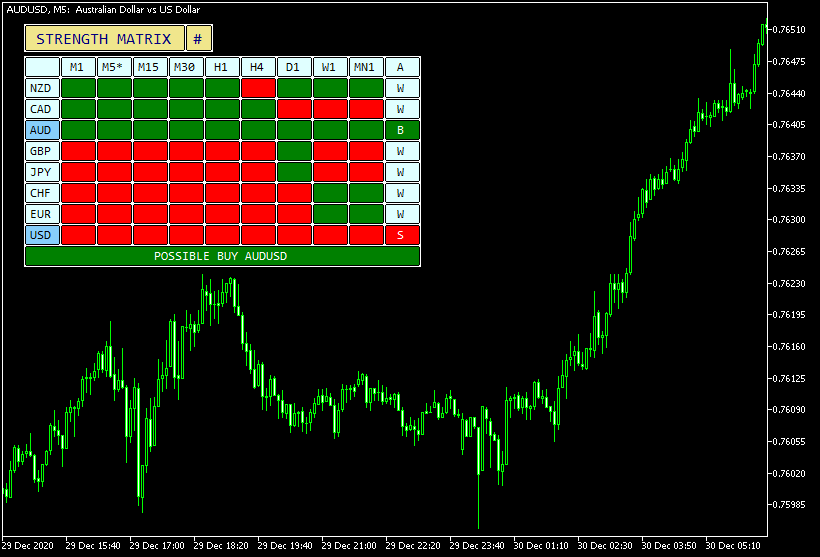

Sometimes, a matrix (or heatmap) is used to highlight the strength of currencies across multiple timeframes in an easy-to-read form.

How to Use Currency Strength Indicator?

A currency strength indicator is a very useful tool, but I recommend using it together with some other indicators or with price action in order to validate entry signals.

Using a currency strength indicator is quite easy:

- A line is above another line usually means that the first currency is stronger than the second one. Especially so if the first line is above zero and the second one is below zero.

- A line pointing upwards means that the currency is gaining strength.

- A line pointing downwards means that the currency is becoming weaker.

As a general rule, you would want to buy a stronger currency and sell a weaker one.

You can integrate a currency strength indicator into your own strategies and trading style.

Where to Get Currency Strength Indicators?

There are many currency strength indicators available around. There are both free and paid versions. Generally, the free ones are slow and lack configuration parameters, while the paid ones are usually quite expensive.

Not being happy with what had been available to Forex traders on MetaTrader before, we developed our custom currency strength indicators that are more reliable and flexible than an average free version, yet are completely free of charge and are available for download from our website.

We let you download both the Currency Strength Lines indicator and Currency Strength Matrix indicator to accommodate different trading styles.

Conclusion

If you are new to currency strength indicators, it would be worthwhile to spend some time understanding how they work and considering their use in your trading system. A currency strength indicator can be a valuable tool to spot trading opportunities. Instead of showing the value of a currency in relation to another currency, a currency strength indicator will show the total strength of the currency vs. the entire market in a normalized way. This is achieved by calculating values in all the pairs involving a specific currency. You can use this indicator with different trading styles.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.