Trend Trading vs. Counter-Trend Trading

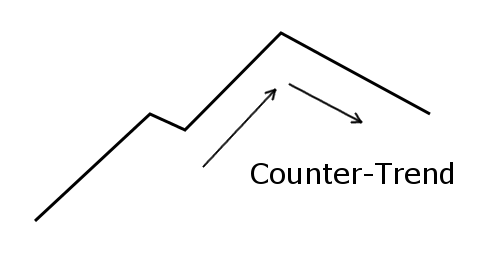

If you analyze the trades of an average chart pattern trader, you will find a large part of them to be against the direction of the trend prevailing at that time. Indeed, it seems that several of the popular chart patterns (channels, double/triple tops and bottoms, and head-and-shoulders) are based on a trend reversal, which is

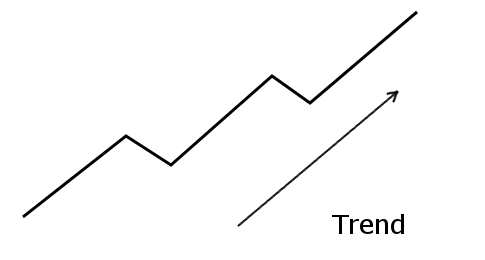

Trend trading offers its own advantages. Without looking deeper, trading with the trend seems like the only sane approach. After all, who would be buying a currency pair knowing that it is going down, or selling when it is going up? Seeing an asset rising in value gives a clear buy signal for a trend trader. The probability of failure is low as the currency pair is riding the momentum. At the same time, going with the trend usually lacks any clear

Obviously, there is little reason (except psychological ones) to attach oneself to only one of these approaches. Even if you favor

If you have any additional details or insights on how you react to trends in Forex trading, please feel free to join a discussion on our forum.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.