Getting Paid by Prop Firms Isn’t Easy

Prop firms look like an attractive option for those traders with experience and skill but also with a limited budget. Yet it is a well-known fact that very few traders pass the evaluation in prop firms, with the vast majority failing to meet the objectives and even fewer reaching the first payout. But how bad is the situation exactly?

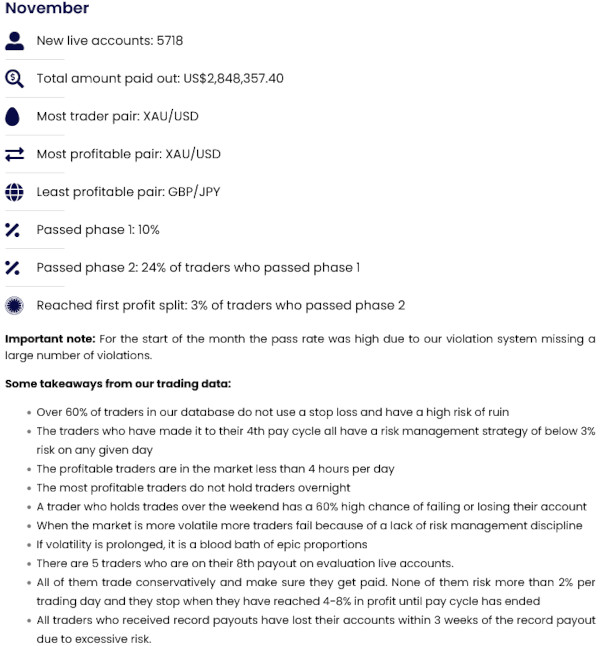

Just look at this data released by MyForexFund in December 2021:

It provides quite a few interesting insights, like the fact that day traders seem to be much more successful than swing or other longer-term traders. But for the topic of this guide, the important part is the rate of traders who have reached the first payout. While the 3% rate seems to be already very low, it is important to understand that it is the percentage among the people who have already passed both stages of the evaluation. Using simple math, we can discover that the rate of people who have reached the first payout compared to the total number of people attempting to pass the evaluation is just a meager 0.072%! That result should look catastrophic for anyone who hopes to join a prop firm.

The article from Lux Trading Firm provides slightly different results. According to it, 4% of traders, on average, pass prop firm challenges. But only 1% of traders kept their funded accounts for a reasonable amount of time. While this result is not nearly as bad as the one discussed earlier, it still looks bleak for prospective prop traders.

But why is the percentage of failure so high? It is true that, according to some studies, the rate of loss among Forex traders can be higher than 90%. But it is still nowhere as terrible as a 99.9% failure rate reported by prop firms. So, what can the reasons for this be? While it can be hard to say for sure, market experts and traders have several theories for such a phenomenon.

Conflict of interests between traders and prop companies

Usually, one of the first reasons for an extremely high failure rate of prop traders cited by detractors of prop trading is often strict and unfair rules imposed by prop firms. Or, to put it simpler, those people claim that prop trading is a scam, equating it to a Ponzi scheme. And they point to the results shown above as evidence that prop trading is bad.

This point of view does not seem to be without merit. After all, when a prop trader fails, the prop firm can pocket the application fee without paying the trader anything back. And if 99.9% of the applicants fail, it should not be hard to pay out the monthly profit split for the few successful traders from the money acquired from the fees. And the prop firm can still earn hundreds of thousands or even millions of dollars each month. That is especially likely in the case of prop firms who boast a 100% profit payout, as they simply do not have many other sources of income besides the application fees. And, of course, this leads to a conflict of interests as it is beneficial for prop firms to make the applicants fail the evaluation, so they would have to pay the fees again.

Defenders of prop trading claim that it is far more beneficial for prop firms to earn profit with the help of successful traders than to make them fail. After all, the vast majority of traders will very likely fail anyway, so there are few benefits for a prop firm to make a profitable trader fail as well. Some even claim that many prop firms, banking on profit from application fees and not on employing profitable traders, have failed as the fees do not cover the expenses. Without solid data and evidence, it is hard to say whether it is true or not.

What is easier to confirm is the fact that prop firms can offer another chance to retry the evaluation. For example, probably the most popular prop firm, FTMO, offers a free extension of the evaluation period and a retry free of charge if your account is in profit. Some other prop firms have similar offers, providing either limited retries or unlimited retries if you manage to be profitable. This makes it look more likely that such firms genuinely want to find profitable traders and not just collect application fees from them, making them fail again and again. Other firms do not offer free retries but offer discounts for those traders who have failed the evaluation process.

While it is highly likely that there are indeed a number of scam prop firms out there, that does not necessarily mean all prop firms are scammers. There can be other reasons for how difficult it is to join a prop firm. Such as...

Anyone can try to apply to a prop firm

It is true that prop firms aim to find experienced and skilled traders. But that does not mean that only such traders can try to join a prop firm. Anyone can apply and start the evaluation process providing they have paid the application fees. And the prospect of significant trading capital attracts many newbie and inexperienced traders who are drawn towards prop firms by the promise of seemingly easy money. Such traders will almost certainly fail, but they are still included in the statistics. Traders who had applied for evaluation but were not trading for whatever reasons, traders who burned their account in the first few days and left, and other people who were not serious about trading — all of them are also included in the stats, and they make the success rate looks worse than if only serious traders were included in the data. There are many mistakes that an inexperienced trader can make. Among them...

Greed

Prop trading may look like a fast road to easy money. And traders, who were lucky to pass the evaluation, may feel themselves overflown with confidence and lose caution because of this. And this can lead to greed among novice investors who, after getting funded, may want to try earning as much money as they can as fast as they can. Such an approach can lead to overtrading, the use of extremely big leverage, and other mistakes that lead such traders to lose their funded accounts. And among the most frequent mistakes is...

Lack of proper risk discipline

Risk discipline is crucial regardless of your style of trading. But it is especially important in prop trading as prop firms' strict rules make it too easy to blow your funded account. While some prop firms demand their traders to use mandatory stop-losses, not all do. The data from MFF shows that more than 60% of traders do not use stop-losses. Some specialists voiced doubts about that statistic, theorizing that plenty of traders may be using hidden stop-losses, which the prop firm does not see. Whether this is true or not, there is no doubt that many traders, especially beginners, fail to assess risks properly and fail because of that. Of course, it is essential to understand that evaluating risks in prop trading can be more complicated than in regular trading due to...

Not understanding what drawdown entails

Almost universally, prop firms have a drawdown limit. If a trader breaches it, they lose their funded account. Some traders argue that this means that the size of trading accounts offered by prop firms should be considered far smaller than prop firms claim. For example, a prop firm provides a $100,000 account with a 10% drawdown limit, which is pretty typical. Let us say a trader wants to risk no more than 1% of their account size on each trade and opens five trades, risking 5% of the overall account size or $5,000. That seems pretty reasonable. Except, some traders argue that due to the drawdown limit, the effective capital a prop trader can actually risk without exceeding the drawdown limit is just $10,000. Meaning that in the aforementioned example, the prop trader's risk is not 5% (like it would be if they were trading with their own money) but 50%. But that is not the only problem traders may have with a drawdown.

Relative drawdown

A relative drawdown is one of the more insidious limits a prop firm may have. Unlike an absolute drawdown, which is easy to calculate and account for, a relative drawdown changes together with changes in your trading performance. And it increases not only with losses but also with profit. With an absolute drawdown, you can shield yourself from exceeding the drawdown limit by not taking the payout and growing your account. This way, the losses you incur will eat up your profits but will not bring you closer to the drawdown limit. But you will not be able to do so with a relative drawdown. That is because the increase in your account size increases the amount of funds you have to keep in your account without going into a drawdown. And that makes it impossible to protect yourself from the volatility and unpredictability of markets.

Conclusion

It is incredibly challenging to become a funded trader, and the data discussed in this guide proves this. Prop firms want to do business only with the best of the best, and the vast majority of traders do not cut it. That does not mean you cannot try to join the select few traders funded by prop firms. But if you want to try your hand at prop trading, you need to be wary of the reasons that make the majority of traders fail to join a prop firm or get a payout from it.

If you want to share your opinion, observations, and conclusions or simply ask questions regarding why getting paid by a prop firm is not easy, feel free to join a discussion on our forum.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.