forex aint real and i see why some countries are actually banning it, i compared two brokers and both trading gmt + 2; there market watch time is inconsistence so as there charts, candles are not consistent at all, highs and lows are not consistent, i compared both companies and there charts are not consistent at all, they only consistent in the trend movement, try it and see ..

Forex Time Zone?

- Thread starter wanorbit

- Start date

- Watchers 7

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Brokers use different price feeds because they use different liquidity providers and, sometimes, sets of liquidity providers. You will rarely find two brokers with exactly the same candlesticks.

because trading companies MT4 and MT5 highs and lows are different, like today i checked on EUR/GBP with two trading companies, there H4 was contradictive, the highs and lows was not the same, forex is price central, i'm sorry but i just realized price is not the same with the 2 trading companies i researched with, with that indicators are conflicting in results, losses are imminent, profit in inconsistency is very slim.I am confused, why do you think Forex is not real, wanorbit?

so in that case, signals wont be accurate, especially signals from other signal providers because the highs and lows are very much different, there should be a universal price feed to be used by every broker, you dont see a stock price differ from another broker or is it likewise price dont match as well?Brokers use different price feeds because they use different liquidity providers and, sometimes, sets of liquidity providers. You will rarely find two brokers with exactly the same candlesticks.

Stocks are traded on centralized exchanges. Forex is traded over-the-counter, without a centralized exchange.so in that case, signals wont be accurate, especially signals from other signal providers because the highs and lows are very much different, there should be a universal price feed to be used by every broker, you dont see a stock price differ from another broker or is it likewise price dont match as well?

The discrepancies in price feeds are often minor and affect only scalp positions. If your take-profit is several hundred pips large, 1-2 pips don't matter much.

Enivid said it right, it is normal for charts to differ but that is not what makes or breaks your progress if you know what you are doing. I can see you are very frustrated, I'd say take a little break then read some more things about how the forex market works. I promise you it is real.

Signals can be unreliable, I would say learn as much as you can about what drives the prices, how to do technical analysis, and what different trading strategies are out there. If you do that, it is absolutely possible to become consistently profitable.

Signals can be unreliable, I would say learn as much as you can about what drives the prices, how to do technical analysis, and what different trading strategies are out there. If you do that, it is absolutely possible to become consistently profitable.

//----i compared both companies and there charts are not consistent at all, they only consistent in the trend movement, ..

unless your trying to game the difference between 2 or more brokers, there is only 1 price that matters..... your brokers price..... there are those that attempt to profit from those differences between brokers.....

i trade with multiple brokers and the exact same ea will have slightly different orders between the 2..... that is to be expected.....

but does it really matter..... we pretty much just deal with one broker..... if oanda is selling the eurusd at 1.8560 and buying at 1.8559, should i care if some other broker is selling for a few pips less or more..... the other brokers prices have no effect on me....

i just paid 50 cents a pound, 25 cents a kg, for bananas..... enivid might have to pay twice or half that..... how does the price he pays effect me......

if oanda was buying and selling the eurusd at twice the price of fxcm, it would not matter to me..... only oanda's eurusd price movement after my entry does......h

so signals accuracy may be much more to false because one brokers highs/lows is far much more different than another?//----

unless your trying to game the difference between 2 or more brokers, there is only 1 price that matters..... your brokers price..... there are those that attempt to profit from those differences between brokers.....

i trade with multiple brokers and the exact same ea will have slightly different orders between the 2..... that is to be expected.....

but does it really matter..... we pretty much just deal with one broker..... if oanda is selling the eurusd at 1.8560 and buying at 1.8559, should i care if some other broker is selling for a few pips less or more..... the other brokers prices have no effect on me....

i just paid 50 cents a pound, 25 cents a kg, for bananas..... enivid might have to pay twice or half that..... how does the price he pays effect me......

if oanda was buying and selling the eurusd at twice the price of fxcm, it would not matter to me..... only oanda's eurusd price movement after my entry does......h

//-----so signals accuracy may be much more to false because one brokers highs/lows is far much more different than another?

i'm not sure what you mean by 'signals accuracy'.... and you would also have to define 'signal'.....

keep in mind, for many of us the 'close' is more important than the high or low..... most indicators are based on the closing price.....

//-----

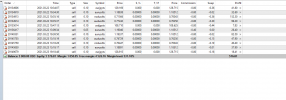

the picture below is this weeks trades..... look at the opening time for each trade and figure out the price at that time for your broker.....

your total profit should be most identical to mine.... no matter the broker......

if we defined a 'signal' as being price breaking the psar(0.01,0.2) , there will be a predictable number of signals missing between brokers..... in other words oanda might have 262 signals and fxcm might have only 260..... that's to be expected as you have noted the differences between high and lows of brokers......

if we defined a signal as the qqe() crossing the 50.0 line, there will be a predictable number of signals missing between brokers..... in other words oanda might have 44 signals and fxcm might have 46..... that's to be expected because it is based on the closing price and they also differ between brokers......

none of that should be cause for alarm.....

the only thing that matters is your signal and your broker.....h

//------

market watch inconsistency is causing alot of latency in the spread, liquidity is not the problem but a universal spread system in respect to wherever country people are trading, it should have the same market watch time for every mt4 and mt5, if showing different and you getting different highs/lows, then its manipulated, why should we be getting diff highs/lows when we all trading a pair, forex should stay with the inter bank trades, now i can fully understand why alot of traders are losing funds and frustrated with forex, its because its not universally streamed under 1 blanket/umberella but from diff sources kinda like black market trading//-----

i'm not sure what you mean by 'signals accuracy'.... and you would also have to define 'signal'.....

keep in mind, for many of us the 'close' is more important than the high or low..... most indicators are based on the closing price.....

//-----

the picture below is this weeks trades..... look at the opening time for each trade and figure out the price at that time for your broker.....

your total profit should be most identical to mine.... no matter the broker......

if we defined a 'signal' as being price breaking the psar(0.01,0.2) , there will be a predictable number of signals missing between brokers..... in other words oanda might have 262 signals and fxcm might have only 260..... that's to be expected as you have noted the differences between high and lows of brokers......

if we defined a signal as the qqe() crossing the 50.0 line, there will be a predictable number of signals missing between brokers..... in other words oanda might have 44 signals and fxcm might have 46..... that's to be expected because it is based on the closing price and they also differ between brokers......

none of that should be cause for alarm.....

the only thing that matters is your signal and your broker.....h

//------

View attachment 18100

It looks like you are either trolling or breaking the forum rule #0. In either case, you'll get yourself banned in no time if you go on like that.it should have the same market watch time for every mt4 and mt5, if showing different and you getting different highs/lows, then its manipulated

You are clearly misunderstanding this. The fact that the majority of Forex traders lose has nothing to do with differing price feeds across multiple brokers.now i can fully understand why alot of traders are losing funds and frustrated with forex, its because its not universally streamed under 1 blanket/umberella but from diff sources kinda like black market trading

so asking educational questions of exactly what i see in forex is going to get me banned, very well, there is something shady about forex then if that is your forward to getting normalityIt looks like you are either trolling or breaking the forum rule #0. In either case, you'll get yourself banned in no time if you go on like that.

You are clearly misunderstanding this. The fact that the majority of Forex traders lose has nothing to do with differing price feeds across multiple brokers.

its been sorted, it was the spring/summer time adjustment for the USA market close, all is back to normal, cheersI think it depends on your broker

Many retail traders don't realise that the Central Banks are active in the FX markets almost every day. They times they make a big purchase or sell are obvious of course, but the US Fed has a thing called 'Temporary Open Market Operations' ( TOMO) run out of the New York Fed which attempts to keep exchange rates and asset prices relatively stable. They operate in a known fixed time period and report (just afterwards) how much USD they injected or extracted from the market.Stocks are traded on centralized exchanges. Forex is traded over-the-counter, without a centralized exchange.

The discrepancies in price feeds are often minor and affect only scalp positions. If your take-profit is several hundred pips large, 1-2 pips don't matter much.

Similar threads

- Replies

- 3

- Views

- 870

- Replies

- 5

- Views

- 1K

- Replies

- 1

- Views

- 548

- Replies

- 8

- Views

- 3K

- Replies

- 29

- Views

- 8K