Scalping system “10 points”

Recommended timeframes M1

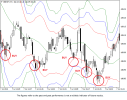

This trading strategy is used on the chart with the period M1. We add MACD Oscillator with the settings (13, 26 and 9) and Stochastic Oscillator the settings (5, 3 and 3), which will be used as indicators. The best time periods for trading with the use of this strategy is European and American sessions. It is preferable to choose currency pairs with the medium or high volatility (currency pair of the Major group are quite suitable).

After adjusting the chart and adding required indicators, follow the instructions below to open trading positions:

The following conditions can be used as a signal for opening long positions:

- the lines of MACD histogram are in the positive zone above the zero level;

- after the decline below the level 20, Stochastic Oscillator (the line %К or %D) has risen above this level.

Stop loss is set at the distance of one point below the nearest local low.

Take profit is set at the level of 10 points from the opening price.

Fig. 1

Fig. 1

A candlestick, which is marked on the chart with the period M1 meets the requirements for opening long positions (Fig1).

The following conditions can be used as a signal for opening short positions:

- the lines of MACD histogram are in the negative zone below the zero level;

- after the rise above the level 80 in the overbought zone, Stochastic Oscillator (the line %К or %D) fell below this level.

Stop loss is set at the distance of one point above the nearest local high.

Take profit is set at the level of 10 points from the opening price.

Fig. 2

Fig. 2

A candlestick, which is marked on the chart with the period M1 meets the requirements for opening short positions (Fig2).