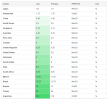

More than a dozen major central banks will disclose their most recent decisions and insight this week. Some of the biggest central banks will receive similar treatment in the markets. An explanation for this could be the belief that they will all cooperate to loosen policy simultaneously. On the other hand, it could be that the markets are not paying enough attention to the specific factors in each region that influence central bank decisions. The information we receive this week could offer insights into whether the markets should place greater emphasis on these regional differences.

The key question is whether the upcoming inflation readings will enable policymakers to change course quickly and counteract the consequences of their previous tightening measures. This strategic shift is aimed at preventing a severe economic downturn. As the central banks grapple with these crucial decisions, the unfolding events this week promise to provide a clearer understanding of the delicate balance between coordinated actions and nuanced regional considerations in the global financial markets.

The Federal Reserve Bank (Fed) is unlikely to meet market expectations on Wednesday. The FOMC is expected to hold the fed funds target rate unchanged at 5.5% on Wednesday. More of the attention is likely to be placed upon forward rate guidance offered by a freshened ‘dot plot’, plus updated macroeconomic projections and Chair Powell’s press conference.

In addition, the European Central Bank (ECB) will hold a meeting. Inflation forecasts could influence the timing of rate cuts and QT plans could be discussed (Thursday). The ECB (European Central Bank) is expected to leave its key interest rates unchanged on Thursday but update forecasts and initiate a discussion on the timing of the end of quantitative tightening (QT). The ECB has already stated that an inflation rate of 2% will not be achieved before 2025.

The Bank of England (BoE) is also expected to leave interest rates unchanged at 5.25% on Thursday. It will publish a statement and meeting minutes, but there will be no forecasts or press conferences. This limits the amount of information they can give. Some members of the committee may vote in favor of another rate hike, but they will be in the minority. The minutes may try to counter the expectation of a significant rate cut, which some people estimate will be around 75 basis points next year.

Anticipation surrounds the upcoming monetary policy decision by the People's Bank of China (PBoC), as market analysts expect the central bank to keep its benchmark 1-year medium-term lending rate steady at 2.5% during the scheduled announcement on Thursday evening. This projection highlights the PBoC's cautious approach to interest rate adjustments, signalling a commitment to stability in the face of prevailing economic conditions. The PBOC is expected to maintain the cut risk and may decide to use alternative policy tools.

Looking ahead to 2024, traders may argue that fundamentals are increasingly in their favor. Their conviction is based on the expectation that policymakers will soon adopt a more dovish stance. With inflation rates lower than a year ago and central bank rates significantly higher, the case for potential benchmark cuts for the coming year is becoming increasingly compelling.

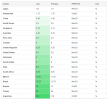

The key question is whether the upcoming inflation readings will enable policymakers to change course quickly and counteract the consequences of their previous tightening measures. This strategic shift is aimed at preventing a severe economic downturn. As the central banks grapple with these crucial decisions, the unfolding events this week promise to provide a clearer understanding of the delicate balance between coordinated actions and nuanced regional considerations in the global financial markets.

The Federal Reserve Bank (Fed) is unlikely to meet market expectations on Wednesday. The FOMC is expected to hold the fed funds target rate unchanged at 5.5% on Wednesday. More of the attention is likely to be placed upon forward rate guidance offered by a freshened ‘dot plot’, plus updated macroeconomic projections and Chair Powell’s press conference.

In addition, the European Central Bank (ECB) will hold a meeting. Inflation forecasts could influence the timing of rate cuts and QT plans could be discussed (Thursday). The ECB (European Central Bank) is expected to leave its key interest rates unchanged on Thursday but update forecasts and initiate a discussion on the timing of the end of quantitative tightening (QT). The ECB has already stated that an inflation rate of 2% will not be achieved before 2025.

The Bank of England (BoE) is also expected to leave interest rates unchanged at 5.25% on Thursday. It will publish a statement and meeting minutes, but there will be no forecasts or press conferences. This limits the amount of information they can give. Some members of the committee may vote in favor of another rate hike, but they will be in the minority. The minutes may try to counter the expectation of a significant rate cut, which some people estimate will be around 75 basis points next year.

Anticipation surrounds the upcoming monetary policy decision by the People's Bank of China (PBoC), as market analysts expect the central bank to keep its benchmark 1-year medium-term lending rate steady at 2.5% during the scheduled announcement on Thursday evening. This projection highlights the PBoC's cautious approach to interest rate adjustments, signalling a commitment to stability in the face of prevailing economic conditions. The PBOC is expected to maintain the cut risk and may decide to use alternative policy tools.

Looking ahead to 2024, traders may argue that fundamentals are increasingly in their favor. Their conviction is based on the expectation that policymakers will soon adopt a more dovish stance. With inflation rates lower than a year ago and central bank rates significantly higher, the case for potential benchmark cuts for the coming year is becoming increasingly compelling.