Week of 21st - 25th AUGUST 2023

23 August 2023

Wednesday

The Flash Manufacturing PMI and Flash Services PMI will be jointly announced by France, Germany, the UK, and the US on August 23rd.

- French Flash Manufacturing PMI

- French Flash Services PMI

- German Flash Manufacturing PMI

- German Flash Services PMI

- GBP Flash Manufacturing PMI

- GBP Flash Services PMI

- US Flash Manufacturing PMI

- US Flash Services PMI

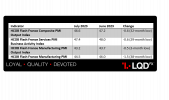

French Flash Manufacturing PMI & French Flash Services PMI

In June, the HCOB Flash France Composite PMI Output Index reached a 32-month low of 46.6 (compared to 47.2 in June), while the HCOB Flash France Services PMI Business Activity Index dropped to a 29-month low of 47.4 (compared to 48.0 in June). Simultaneously, the HCOB Flash France Manufacturing PMI Output Index had dipped to a 3-month low of 43.2 (compared to 43.7 in June), and the HCOB Flash France Manufacturing PMI had hit a 38-month low of 44.5 (compared to 46.0 in June). The French economy had initiated Q3 2023 with a sharp reduction in business activity, as highlighted by HCOB PMI® data from S&P Global. There was a contraction in the output for July, marking the second consecutive month of decline and indicating an ongoing economic downturn. Weak demand had prompted companies to rely on backlogs, causing a slowdown in employment growth. Inflationary pressures had eased, with differing trends observed across sectors. The Composite PMI Output Index had recorded its fourth consecutive month of decline, remaining below the growth threshold. Both manufacturing and services output had experienced declines, with contraction rates accelerating. Businesses had increasingly turned to backlogs as sales weakened, while inflation had cooled with varying trends across different sectors.

The next French Flash Manufacturing PMI & Flash Services PMI is set for August 23, 2023, at 08:15 AM GMT+1.

The forecast for French Flash Manufacturing PMI is reading an increase to 45.2 points.

The forecast for French Flash Services PMI is reading an increase to 47.5 points.

TL;DR

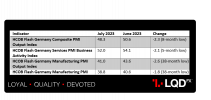

German Flash Manufacturing PMI & German Flash Services PMI

In July, the HCOB Flash Germany Composite PMI Output Index fell to 48.3 (compared to 50.6 in June), marking an 8-month low. Additionally, the HCOB Flash Germany Services PMI Business Activity Index decreased to 52.0 (compared to 54.1 in June), reaching a 5-month low. Simultaneously, the HCOB Flash Germany Manufacturing PMI Output Index reached its lowest point in 38 months at 41.0 (compared to 43.6 in June), while the HCOB Flash Germany Manufacturing PMI dropped to a 38-month low of 38.8 (compared to 40.6 in June). The German economy contracted in July as manufacturing output significantly declined and services activity growth slowed, according to the HCOB 'flash' PMI® survey conducted by S&P Global. Expectations regarding future activity turned negative for the first time this year, influencing job creation. Inflation rates for input costs and output charges slowed, largely driven by falling manufacturing costs and output prices, while the service sector experienced relatively high inflation. The HCOB Flash Germany Composite PMI Output Index moved into sub-50 contraction territory for the first time since January, reflecting declines in both the manufacturing and services sectors. Manufacturing production levels saw notable decreases, and services growth weakened due to reduced new work. Factors such as declining demand, high inflation, and rising interest rates contributed to the sharp drop in new work inflows, affecting both goods and services. Backlogs of work decreased significantly, impacting firms' expectations towards future activity, leading to a negative outlook. Employment growth slowed across the private sector, with a slowdown in service sector hiring and a marginal decline in manufacturing payroll numbers. Despite an overall easing of price pressures, divergent trends between sectors persisted, with sharp drops in manufacturing purchase prices and slight increases in service sector costs.

The upcoming German Flash Manufacturing PMI and Flash Services PMI are scheduled for August 23, 2023, at 08:30 AM GMT+1.

Forecast for German Flash Manufacturing PMI is reading a decrease to 38.6 points.

Forecast for German Flash Services PMI is reading a decrease to 51.6 points.

TL;DR

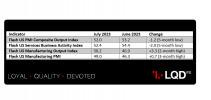

GBP Flash Manufacturing PMI & GBP Flash Services PMI

In July, the UK's private sector experienced its slowest growth in output over the past six months, with the Flash UK PMI data indicating declines in several indices. The Flash UK PMI Composite Output Index fell to 50.7 (from 52.8 in June), marking a six-month low. Similarly, the Flash UK Services PMI Business Activity Index dropped to 51.5 (from 53.7 in June), also hitting a six-month low. Additionally, the Flash UK Manufacturing Output Index reached 46.5 (compared to 48.1 in June), a seven-month low, while the Flash UK Manufacturing PMI dropped to a 38-month low of 45.0 (compared to 46.5 in June). The data revealed a significant slowdown in business activity growth across the UK private sector. This weaker expansion was attributed to stagnant new orders and reduced backlogs of work. Manufacturers reported improved supplier delivery times, which reduced cost pressures and led to decreased output charges. The prices charged inflation within the private sector was the slowest in almost two-and-a-half years. The seasonally adjusted S&P Global / CIPS Flash UK Composite Output Index dropped to 50.7 in July, the lowest reading since January, indicating a cautious outlook due to rising interest rates, inflation, and economic uncertainty. Service sector activity growth moderated for the third successive month, while manufacturing production fell for the fifth consecutive month. Private sector employment growth slowed, and efforts to catch up on outstanding business were aided by additional staff recruitment. Manufacturer-reported improvements in supplier lead times and a reduction in purchase prices contributed to easing cost pressures. Business activity expectations moderated, reflecting concerns about higher borrowing costs impacting customer demand. Overall, sentiment regarding growth prospects for the year ahead weakened, particularly in the service economy.

The UK Flash Manufacturing PMI and Flash Services PMI will be released on August 23, 2023, at 09:30 AM GMT+1.

Forecast for UK Flash Manufacturing PMI is reading a slight decrease to 45.2 points.

Forecast for UK Flash Services PMI is reading a decrease to 50.9 points.

TL;DR

US Flash Manufacturing PMI & US Flash Services PMI

In July, the expansion of the US economy exhibited a slowdown in momentum, particularly evident in the growth of the service sector. Key data highlights included the Flash US PMI Composite Output Index decreasing to 52.0 from June's 53.2, marking a 5-month low, and the Flash US Services Business Activity Index dropping to 52.4 from June's 54.4, also hitting a 5-month low. On a positive note, the Flash US Manufacturing Output Index improved, rising to 50.2 from June's 46.9, reaching a 2-month high, and the Flash US Manufacturing PMI increased to 49.0 from June's 46.3, a 3-month high. S&P Global's Flash US Manufacturing PMI rising to 49.0 in July (up from June's 46.3) indicated a slower deterioration in operating conditions over the last three months, attributed to relatively steady output levels and a reduced drop in new orders. Despite the decelerated contraction in new sales, manufacturers persisted in decreasing input purchases and both pre- and post-production inventories in July, with substantial reductions driven by efforts to curtail stock and cut costs amid muted domestic and international demand. The waning demand for inputs led to shorter supplier delivery times, reflecting solid vendor performance improvements that exceeded those observed in June.

On August 23, 2023, at 14:45 PM GMT+1, the US Flash Manufacturing PMI and Flash Services PMI are set to be unveiled.

Forecast for the US Flash Manufacturing PMI is reading an increase to 49.2 points.

Forecast for the US Flash Services PMI is reading a decrease to 52.1 points.

TL;DR

24 August 2023

Thursday

An important announcement is scheduled for August 24, 2023, concerning US unemployment claims.

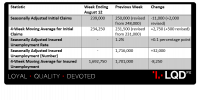

US Unemployment claims

For the week ending August 12, the advanced figure for seasonally adjusted initial claims was 239,000, marking a decrease of 11,000 from the revised level of the previous week. The previous week's level was revised up by 2,000, reaching 250,000 from 248,000. The 4-week moving average stood at 234,250, reflecting an increase of 2,750 from the revised average of the prior week. The previous week's average was adjusted upward by 500, reaching 231,500 from 231,000. The advanced seasonally adjusted insured unemployment rate had been 1.2% for the week ending August 5, indicating an increase of 0.1 percentage point from the unrevised rate of the previous week. The advance number for seasonally adjusted insured unemployment during the week concluding on August 5 had been 1,716,000, signifying a rise of 32,000 from the unrevised level of the previous week, which had been 1,684,000. The 4-week moving average had been 1,692,750, demonstrating a decrease of 8,250 from the unrevised average of the prior week, which had been 1,701,000.

The next jobless claims statement is scheduled for August 24, 2023, at 13:30 GMT+1.

Forecast for US Unemployment Claims indicates a rise, with an anticipated 242,000 individuals seeking unemployment benefits, reflecting a higher number than last month's applicants.

TL;DR

25 August 2023

Friday

A noteworthy announcement is planned for August 25, 2023, regarding the US Revised UoM Consumer Sentiment & German ifo Business Climate.

German ifo Business Climate

The ifo Business Climate is a monthly poll of German enterprises that evaluates their current situation and forecasts trends for the next six months. The survey focuses on a variety of topics, including production, orders, staffing, inventory, and price. Its findings add to an index that provides insight into the overall business climate. A higher index number indicates business optimism, whereas a lower value indicates business pessimism. In July, the ifo Business Climate Index fell to 87.3 points (seasonally adjusted), a decrease from 88.6 points in June. This marked the company's third consecutive decline. Notably, companies expressed notable dissatisfaction with their ongoing business situation, and expectations were diminished. The status of the German economy was experiencing a deterioration.

The next German ifo Business Climate is scheduled for August 25, 2023, at 9:00 a.m. GMT+1.

Forecast for German ifo Business Climate indicates a decrease to 86.9.

TL;DR

- German ifo Business Climate Index for July: 87.3 points.

- Down from 88.6 points in June.

- Third consecutive monthly decline.

- German Flash Services PMI

- Signals a weakening German economy.

Revised UoM Consumer Sentiment

The final July University of Michigan US consumer sentiment index was reported at 71.6, slightly below the expected 72.6, although still reflecting an improvement from the preliminary reading of 72.6 and a notable increase from the prior reading of 64.4. The current conditions component of the index stood at 76.6, which was lower than the preliminary figure of 77.5 but higher than the previous reading of 69.0. Meanwhile, the expectations component registered at 68.3, slightly below the preliminary 69.4 and above the prior 61.5. Inflation expectations for the coming year remained steady at 3.4%, mirroring the preliminary reading and reflecting a slight uptick from the 3.3% recorded earlier. Long-term inflation expectations for the 5-10 year horizon were reported at 3.0%, slightly below the preliminary 3.1% but consistent with the previous 3.0%. Notably, these metrics had a nuanced impact on market movements, holding significance beyond their immediate use for traders. The data highlighted a noteworthy divergence, with higher-income consumers exhibiting increased optimism while lower-income consumers, burdened by debt and rent payments, experienced a decline in sentiment. This pattern aligned with expectations in a rising rate environment, particularly in a country with a prevalent market for 30-year fixed mortgages.

The Revised University of Michigan Consumer Sentiment will be released on August 25, 2023, at 15:00 PM GMT+1.

Forecast for The Revised University of Michigan Consumer Sentiment is indicating a decrease in consumer confidence, coming at 71.2.

TL;DR

Disclaimer: The market news provided herein is for informational purposes only and should not be considered as trading advice.