Presidential Cycles in Forex

The influence of US presidential cycles on the stock market is known for years. There are articles published in

Classic cycle

The article asserts that it pays off to hold a long S&P500 position from October 1 of the second-year of the US president's term till December 31 of the fourth year. It is also profitable to short the market from January 1 of the first year through September 30 of the second year (remaining term). Such a strategy, tested between the years 1950 and 2012, yields significantly more profit than the traditional

An article published by Fidelity in January 2020 suggests that stock market performance is normally above average during the two final years of a presidential term and weaker than average during the first two years of a term. But there are exceptions to the rule.

Naturally, it seems an interesting concept to test in relation to the currency market. Our first step was to create an MT5 script that would buy a currency pair according to the favorable conditions and sell it during unfavorable conditions. As it is not obvious, which part of the presidential term is favorable for a given currency pair, a reverse option is available in the script. Without a reverse, it will long from October 1, second year, through December 31, fourth year. With a reverse, it will long from January 1, first year, through September 30, second year.

Unfortunately, the Forex test results did not show as much promise as those attained in equities. The test assumes a position of 1 standard lot. At first, it was used to go long from October 1 of the second year of the presidential term through December 31 of the fourth year. EUR/USD chart data start on January 4, 1971 in our MetaTrader 5 (before 1999, the rates are based for Deutsche mark vs. US dollar); the data is even worse for other currency pairs except USD/JPY. The result was the profit of $17,192, which is significantly lower than $67,590 that would have been attained if a plain

USD/JPY (another pair with history available from 1971) yielded similar results. Buying from October 1 of the second year through December 31 of the fourth year resulted in a loss of $107,559. Buying from January 1 of the first year through September 30 of the second year results in a loss of $87,725. The loss can be easily turned to profit by substituting long orders with short ones, but the resulting profit in both cases would be dwarfed by the classic

Results achieved in other currency pairs (GBP/USD, USD/CAD) are similar, but the historical data starts from the year 1993 there, so there was little sense in testing such a

The obvious conclusion is that US presidential cycles do not work in Forex the same way they do in stocks. The growth cycle works for equities because of the way US presidents apply economic policy during the course of their term. Currencies behave differently, but probably there is some other way presidential cycles could be applied to them?

Democrat/Republican cycle

From some limited tests, it occurs that the currency pairs' performance depends on the president's political party. The US dollar demonstrates a tendency towards weakening during the rule of a Republican president, and it leans towards bullishness during the rule of Democratic presidents.

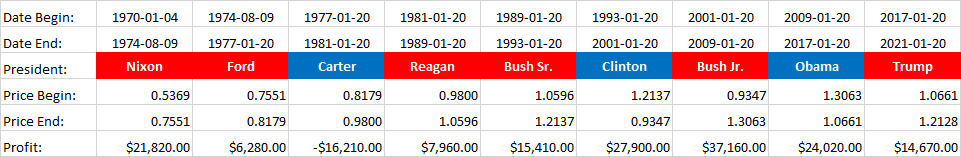

Another small test was conducted using another script that records gains (and losses) for holding a long position for Democrats and Republicans separately. Reversing the trade direction for Democratic presidents results in a nice steady profitability with only few exceptions:

During the terms of all the Democratic presidents, with the exception of Carter, EUR/USD was falling, consistent with a stronger US dollar. The currency pair was rising during the terms of all Republican presidents.

Nevertheless, the combined profit of going long on EUR/USD during Republicans and shorting the pair during Democrats yields $139,010 profit (position size of 1 standard lot) vs. $67,590 profit of the

The test on USD/JPY showed that the currency pair declines during the terms of Republicans and Democrats alike. It means that the correlation found in EUR/USD is not consistent across other currency pairs and should be used very cautiously. Moreover, the nine presidents we analyze during the period is really not enough in terms of data points. It would be premature to come to any definite conclusion of profitability. It isn't recommended betting your real money on the presidential cycle strategy, but it is still an interesting idea for further research.

If you have some comments about this small research or if you want to share your own ideas about trading Forex using US presidential cycles, please speak your mind on our forum.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.