Forecasting Forex Trading

Contents

What is Forex forecast

Predicting current and future market trends using existing data and facts is called forecasting. In Forex (FX), which is the largest financial market in the world, with a daily volume of more than $7.5 trillion, forecasting is the main tool for traders to open and close positions in currency pairs.

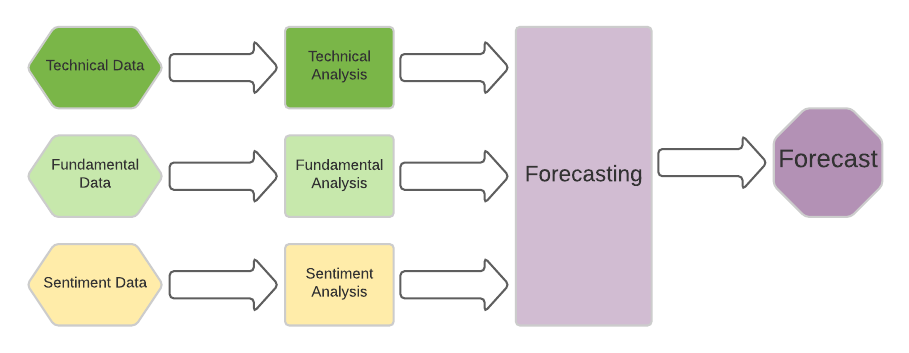

Analysts rely on technical indicators, fundamental statistics, and market sentiment to predict the direction of the global foreign exchange rates.

Let's review the process Forex forecasting in detail and see what makes a properly constructed market prediction and how it is different from a simple educated guess.

Technical analysis in Forex forecasting

Technical analysis uses charts and chart-derived calculations to detect important levels, current trend, its strength, potential points of reversal, and optimal targets for the next exchange rate movements.

Not all forecasters use technical analysis in their models when producing a Forex forecast. However, technical analysis provides some important benefits when employed in the forecasting process:

- Opportunity to use rigid rules based on mathematics.

- Possibility to use backtesting process to analyze specific technical indicators and factors when deciding whether to use the in forecasts.

- The data (chart history) is easily available and is 99.9% the same for everyone, resulting in an objective approach.

- Plethora of methods to work with the available data.

When you develop your own Forex forecast, it is up to you to decide, which chart data to use, which technical indicators and transformations to apply to this data, and what overall role the resulting technical prognosis play will play in your final forecast.

Fundamental analysis in Forex forecasting

Even though many Forex traders, especially newbies, tend to ignore fundamental analysis after they learn the basics of technical analysis, the former remains the primary method by which to evaluate the strengths and weaknesses of currencies.

Fundamental analysis studies macroeconomic and financial factors affecting a given currency and the country (or the monetary union in case of the euro) it belongs to.

Such analysis can be rather shallow, touching mostly on the most prominent factors, such as interest rates, current accounts, and projected GDP rates, or it can also be very deep, involving complex econometric models and incorporating such forward-looking indicators as PMI and breakeven inflation rates.

To get started with fundamental analysis, it is first best to learn how fundamental factors affect currency rates. During the actual forecasting process, fundamental analysts gather the specific economic indicators and data they are going to use and also conduct research regarding the past effect of those indicators on the foreign exchange market.

A common misconception about fundamental analysis is that it only concerns the long-term forecasts and is useless in short-term. As the further sections of this guide will show, it isn't so. Fundamental analysis can be used to trade (and profit from) mere seconds following some impactful economic announcement.

Sentiment analysis in Forex forecasting

Sentiment analysis involves looking at the actual positioning of various Forex market participants. Simply put, when you rely on sentiment analysis, you check who is selling and who is buying in the market, with the emphasis on who.

Indicators available to sentiment analysts are divided into two major categories:

Institutional — namely, the Commitments of Traders report (CoT), which shows how different sorts of institutional traders are positioned in the US futures and options market; volatility indices such as CBOE's VIX; and market inflow/outflow indicators provided by banks, exchanges, and central banks.

Retail — some retail Forex brokers provide information on how their traders are positioned on a given currency pair. This information is very basic of course — usually, it is just a percentage of long and short positions, long and short orders, and sometimes, concentration of those orders at specific exchange rate levels. Additionally, retail FX sentiment may be glimpsed from trade sharing websites such as Myfxbook and ForexFactory.

Interpretation of market sentiment information is done based on specific Forex forecasting methodology. In general, it is believed that large institutional speculators from the CoT report are more often correct in their anticipations compared to the positions of retail traders.

Long-term forecasting

Whatever priorities you assign to each of the three above-mentioned forecasting methods, you have to make sure that you are using the right indicators for the right time horizon. Using a combination of a yearly chart technical analysis, quarterly GDP data, and weekly CoT reports to produce an intraday Forex forecast makes little sense. It is very important to keep the timeframe in mind when working on your forecast.

For long-term forecasting, fundamental analysis offers plenty of macroeconomic indicators. In fact, most of them aren't available in a higher resolution than monthly.

The good thing is that technical analysis also doesn't lack in long-term tools. It is easy to access weekly, monthly, and even yearly charts — the charts, where each bar or candle represents a week, a month, or a year — and apply any technical indicator, calculation algorithm, or self-learning process to that data.

Sentiment analysis, although less flexible than the two other methods, can also be assessed on a rather long-term basis using weekly CoT data and, to lesser extent, retail sentiment information from brokers. Unfortunately, no broker provides any information regarding periodicity of their traders' positions.

A vast amount of reliable fundamental data (such as interest rates expectations) makes long-term Forex forecasting on average more accurate than short-term forecasting.

Short-term forecasting

Sadly, you would have to wait a rather long time to profit from a long-term forecast. That is why most Forex traders are attracted to short-term FX forecasting and cope with its lower average accuracy.

In short-term forecasting, models with higher attention to technical analysis tend to prevail — mostly, because both fundamental and sentiment analysis cannot provide enough reliable information at low enough resolution.

That is not to say that a trader should completely disregard those types of analysis when preparing a short-term Forex forecast. For example, news trading is based purely on fundamental analysis and is extremely short-term and fast.

One way, a wider range of fundamental indicators can be incorporated in short-term FX forecasting is as support signals. For example, you could rely on general strength or weakness of a given currency, indicated by its fundamental factors, to adjust your lower timeframe forecast or even to discard one if it contradicts those fundamental factors.

You can use sentiment analysis in a similar way. For example, if you prefer to trade against the prevailing retail sentiment, you can adjust your short-term forecast, based on other forms of analysis, to reflect that predisposition — if the majority of retail traders are selling, and your short-term forecast suggests an uptrend, then your forecast is reinforced by the sentiment; if your short-term forecast suggests a downtrend, then the sentiment weakens your original forecast.

Acting on Forex forecasts

There is little point in creating a Forex forecast (other than for fun) if you are not going to act on it somehow. The important part is to understand that any currency trading forecast is based on probabilities — there is no such thing as a sure-fire forecast in FX trading. Therefore, all actions should take into account the probabilities of your Forex forecasts.

When opening a trade based on your forecast, you must assume some chance of failure, taking relevant protective measures — in most cases, a simple stop-loss order.

It also makes sense to update your forecasts as new data arrives or gets revised. Such updates sometimes prompt changes to the trades you have open based on those forecasts. This makes sense not only for long-term forecasts but also for short-term ones — any change to the input data from the flowchart mentioned in the beginning of this guide triggers changes in the analysis, then in the forecast, and then the change flows to your actual market positions.

Now you understand what a forecast is in the context of foreign exchange trading and you should be prepared to develop your own Forex forecast system. If you have any questions or recommendations regarding preparing forecasts in Forex trading, you can discuss this topic on our forum.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.