Supply and Demand Zones in Forex: A Beginner’s Guide

Contents

One of the most basic concepts you might remember from your college economics class is the law of supply and demand. Did you know that you can put that principle to good use in your Forex trading by identifying areas of supply and demand on your chart? In this guide, you will learn the basics of how to trade using supply and demand zones.

What are supply and demand?

First of all, let’s start out by defining supply and demand.

- Supply is how much of an asset is available.

- Demand is how much traders want to buy an asset.

High demand creates a rise in price, assuming it outpaces supply. Lots of buyers are competing with each other to purchase the asset.

Conversely, if supply exceeds demand, it is the sellers who are competing for the buyers. So, the price of the asset falls.

Key point: Supply, demand, and price movements are all interrelated. High demand drives price up, while high supply drives price down.

What are supply and demand zones?

Supply and demand zones are areas you can identify on a price chart where high demand is creating support, or high supply is creating resistance.

Indeed, a lot of traders simply think of them as synonymous with support and resistance zones or pivot areas.

But it is possible to draw distinctions between these interrelated concepts.

What those distinctions are though depends on whom you ask — individual traders may define these concepts in slightly different ways.

- One common way of defining the difference between support/resistance vs. supply/demand zones is in terms of their origin. Some traders feel that one should only describe areas of imbalance generated by big institutions as “supply/demand” zones, whereas the reasons for the existence of “support/resistance” areas are non-specific.

- Traders may differ in their exact rules for drawing supply and demand zones. If those rules are more specific and narrow than those they use for identifying support and resistance zones, that could be another distinction between the two concepts.

- Some investors also feel that a narrower and more specific price range is necessary for defining supply and demand zones versus broader zones for support and resistance.

It is important to know that there is no “official” right answer here. So, once you understand the basic idea of supply and demand zones, it is up to you to decide exactly how you want to define it for your trading.

Key point: Supply and demand zones are very similar to support and resistance zones. The exact difference between the concepts depends on whom you ask. Different traders have different definitions.

What happens when an asset encounters a supply or demand zone?

When price reaches a supply or demand zone, you can expect similar behavior as you would in a support or resistance zone.

In some cases, price may not be able to break through the zone, resulting in a reversal. Sometimes, this reversal can be dramatic, resulting in a large move up or down.

In other situations, price may hover at the supply or demand zone, testing it, and then break through in a continuation of the existing trend.

Key point: Supply and demand zones can help you to spot reversals. Sometimes, however, price will break through supply and demand zones during a continuation.

How to identify supply and demand zones

Now you know what supply and demand zones are. But how can you spot them on your charts?

Because the definition of supply and demand zones is somewhat variable (as discussed above), methods for identifying and drawing these zones can vary as well.

Below is one basic method for how you can identify these zones.

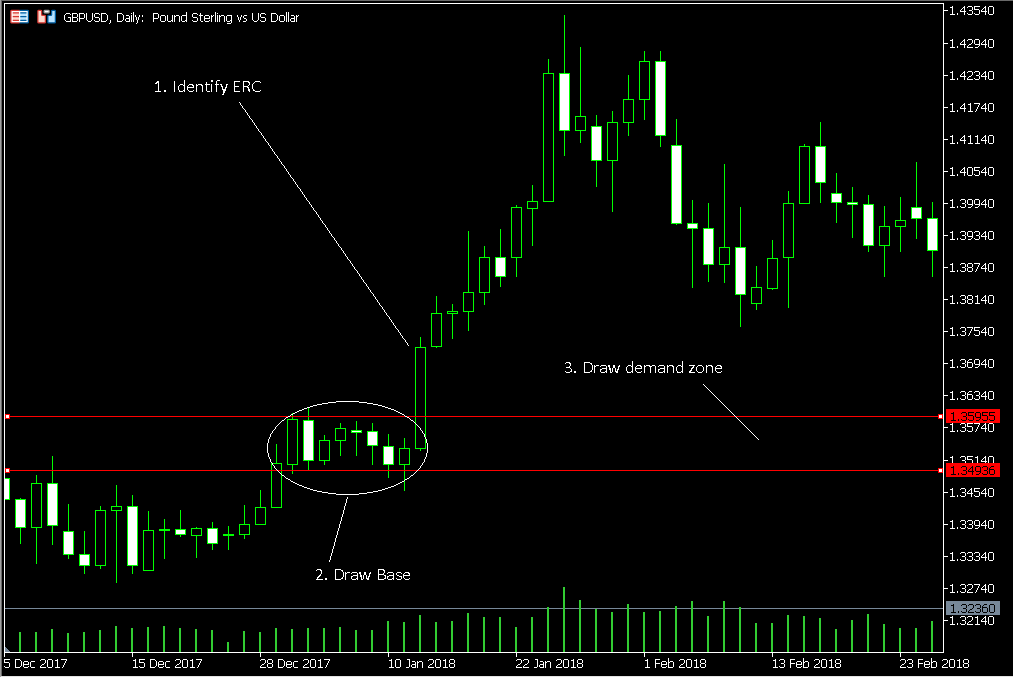

- Open your chart.

The best timeframes for supply and demand zones are longer ones. So, this is not the time to be looking at your 5-minute chart. Something like a daily chart would be better.

- Check the current price.

This step is pretty self-explanatory. Scroll all the way to the right on your chart, and check what the price is right now.

- Search for ERCs.

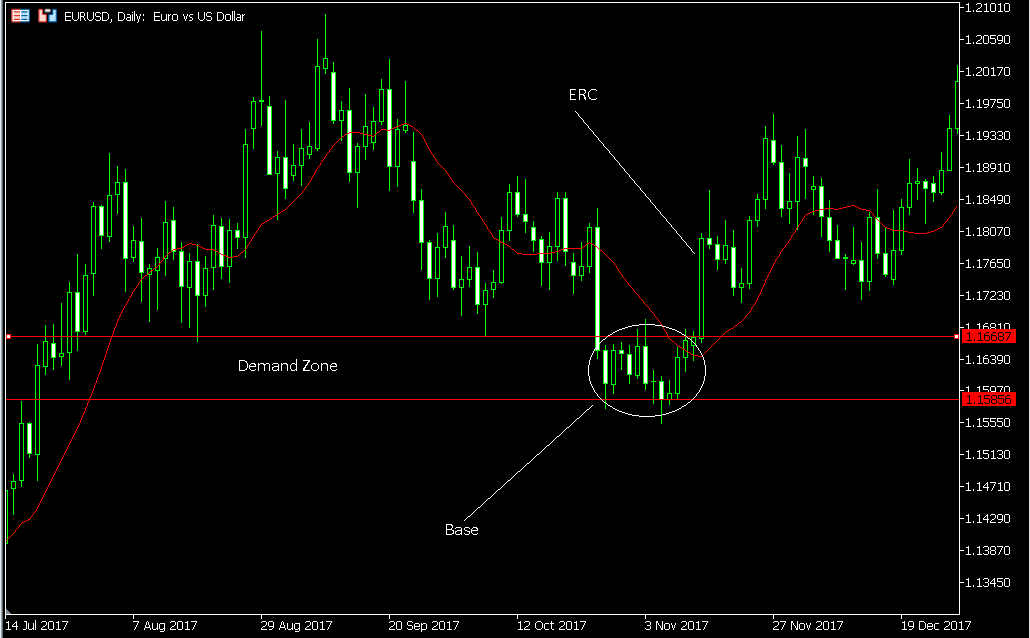

Once you are aware of the current price, you need to scroll back to the left and begin searching for what are known as “extended range candles,” or ERCs.

These are just super long bars or candles during which price traveled significantly and one direction or the other. They can be bullish or bearish. Note that their bodies should comprise most of their lengths, not their wicks.

Along with ERCs, something else you can be on the lookout for are gaps.

- Check to see what happened before the ERCs.

When you spot an ERC, you then need to look to the left of it to see what happened right before the big move up or down.

You will probably spot some consolidation which took place prior to the breakout. Normally, there will be fewer than 10 candles involved, though there can sometimes be more.

You can refer to that little consolidation phase as a “base.”

In some situations, a “base” may consist of just a solitary candle.

The “base” is where you can draw the supply or demand zone.

Key point: The basic steps above can be used to identify supply and demand zones on your charts. You will encounter variations based on the exact methods different traders prefer.

How to draw supply and demand zones

The exact ways that traders draw supply and demand zones differ. But generally speaking, you want to highlight the zone where you found your base, drawing two horizontal lines across your chart that sandwich the base.

Some traders may use the bodies of the candlesticks to define the top and bottom of each supply and demand zone, and ignore the wicks.

Others incorporate the wicks, and/or might base their decision on contextual factors each time.

Whatever approach you decide on, you should try to be consistent about it. You might even want to test out a few different strategies so you can establish what method works best for you.

Key point: Once you have discovered a supply or demand zone on your chart, you can draw horizontal lines that define it, providing you with a clear visual reference for the next time price moves into that zone. Once again, there are variations in how to draw the zones.

How to use supply and demand zones in your trading

So, let’s say you have drawn some supply and demand zones on your charts. How do you use them?

- Look for confluence.

One thing you might want to do is see if you can find some confluence by using other indicators or drawing tools.

For example, you can draw Fibonacci levels, and see if those line up with the zones you have identified.

If they do, that is a good sign that you may have identified them correctly. Moreover, if one of the lines is right inside a zone, that tells you where price may be most likely to pivot inside the zone. That extra precision may help you to plan your trades.

Another option is to plot a stochastic indicator on your chart. You could also use the relative strength index (RSI).

This indicator helps you figure out if the market is overbought or oversold.

If price is in a demand zone and your indicator tells you that the market is oversold, it makes sense to expect price to test the demand zone and rise.

Likewise, if price is in the supply zone and your indicator tells you that the market is overbought, it is logical that you can expect price to potentially test the supply zone and then drop.

- Get in on a price reversal.

Perhaps the biggest appeal of identifying a supply or demand zone is the opportunity to get in on a price reversal.

In fact, you may find yourself with the chance to get in on a new trend just as it is about to form.

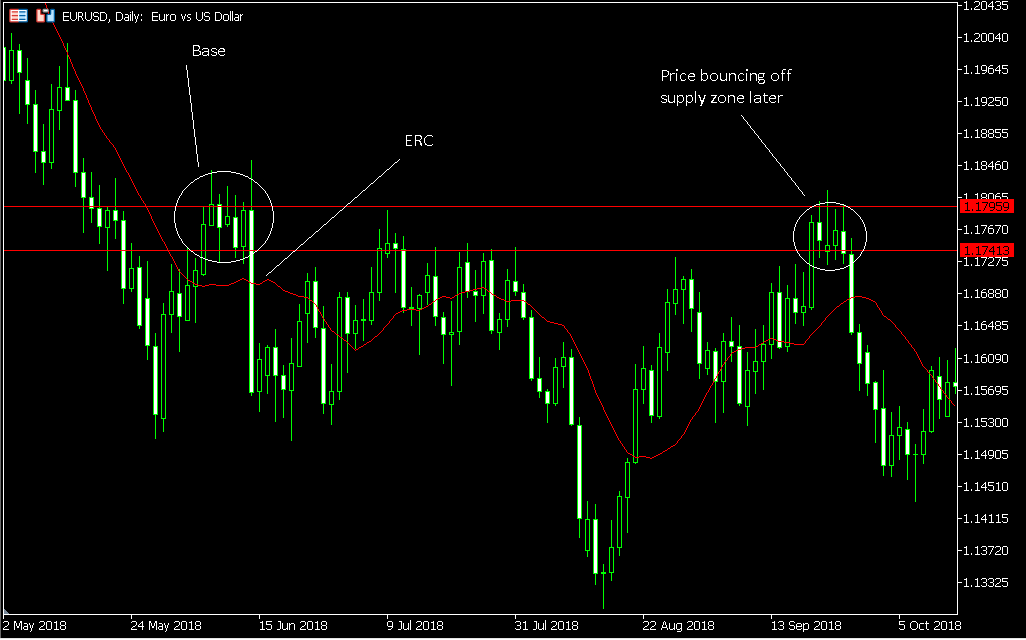

One thing to be aware of is that after price breaks through a supply or demand zone, there is a chance that it may retrace back to that zone before bouncing off of it again and continuing in its new direction.

Sometimes, you might think that the retracement means you actually were wrong — that price isn’t reversing, and merely is going to continue in its previous direction.

So, you get out of the trade — or your stop-loss is triggered — and then the retracement completes, and price goes on to do exactly what you thought it would do in the first place.

One possible trick to dealing with this issue is to wait for the retracement before you enter your trade.

Alternately, if you do not want to wait to get in, you could set your stop-loss a bit further back so a retracement is not as likely to trigger it.

- Place appropriate stop-losses.

As we already discussed, sometimes price reverses after moving into a supply or demand zone. But other times, it simply continues.

Let’s say that price is bouncing off a demand zone and rising, and you are in a long trade.

What you can do is set a stop — below the demand zone.

The thinking here is that if price has reversed and managed to test and penetrate the demand zone entirely, there is a good chance it will continue to fall against your position. After all, the demand zone was not able to entirely contain it.

- Establish context.

Another reason to plot supply and demand zones on your charts is to provide you with valuable context for your strategies, whether they use technical analysis or price action.

For instance, let’s say you use pinbars to spot potential reversals.

For a pinbar to make a good setup, it not only needs to be well-formed, but it has to be in a suitable location.

If you have a pinbar at a supply or demand zone, the zone gives you the context for the trade. It tells you that the pinbar is at one of those ideal locations.

You can also just think of this as confluence by another name — you have two things telling you to trade, the price formation itself, and the zone that it is in.

Key Point: There are a number of ways that supply and demand zones can be useful to you when you are trading Forex.

Conclusion

Supply and demand zones offer valuable context to Forex trades. Now you know what supply and demand zones are, how to identify them, and a few ways you can incorporate them into your Forex strategies.

Here are a few general tips for getting the most out of these zones:

- Go over old charts and focus on nothing but looking for and drawing supply and demand zones. Do it over and over and over again until it becomes easy.

- Backtest different variations on how you identify and plot supply and demand zones. See what works best in terms of measurable results.

- As always, demo test changes to your trading method before you go live with them, even if all you are doing is integrating supply and demand for confluence or context.

- Do not forget to think about what is going on in the present. Maybe price is in or near a supply or demand zone, but perhaps the market is currently choppy and full of whipsaws. It might not be the ideal time to open a trade.

Good luck putting supply and demand zones to use in your Forex trading. They can help you get in on reversals, set useful stops, and confirm what price patterns and indicators are telling you.

If you want to share your opinion, observations, conclusions, or simply to ask questions regarding the use of supply & demand zones in currency trading, feel free to join a discussion on our FX forum.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.