E-Book Review: Crowds, Crashes, and the Carry Trade by Valeri Sokolovski

Presented below is a review of a research paper called Crowds, Crashes, and the Carry Trade. It was published by Valeri Sokolovski, a finance scholar at HEC Montréal. It was presented by Mr. Sokolovski at the conference called Exchange Rate Models for a New Era: Major and Emerging Market Currencies organized by the City University of Hong Kong. The article is available for free download in our Forex

Crowdedness

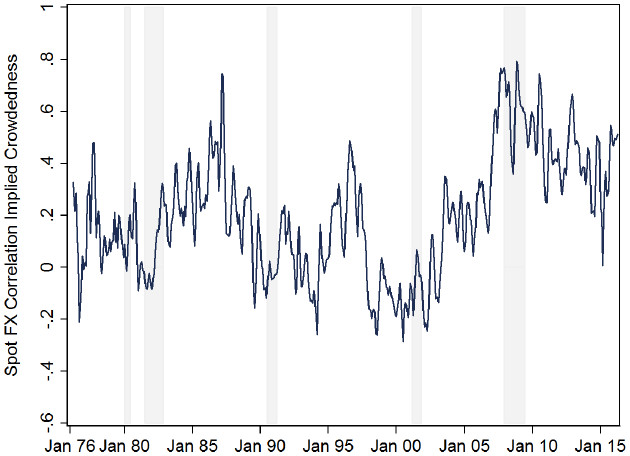

As the title of the work suggests, it is dedicated entirely to the carry trade and its relation to the carry trade crowdedness — a term that describers a measure of the total volume of carry trade positions held by investors globally. The author uses spot FX correlation implied crowdedness and its effect on the negative carry trade returns amplification as the main research subjects.

The idea behind this measure is simple — when there is a strong correlation between currencies that can be used as the carry trade funding sources but are otherwise unrelated, traders are either opening or closing carry trade positions. For example, simultaneous jumps in CHF and JPY exchange rates would imply a growth of carry trade positions, while their simultaneous fall would imply a decline in carry trade activity.

Additionally, Valeri uses

Main conclusions

The most important conclusions made by Valeri Sokolovsi in his article are the following:

- Spot Forex correlation implied method of measuring the crowdedness of carry trades is viable.

- The probability of a significant carry trade loss increases with the rising level of crowdedness.

- The majority of the biggest carry trade crashes occurs during the periods of elevated carry trade crowdedness.

- Previously established measures, such as Forex volatility, illiquidity, VIX, and funding illiquidity, play their negative role during the carry trade crashes, but their effect is greater during the periods of high carry trade crowdedness.

Why read it?

You definitely need to read this

If you have any questions, comments, or opinions regarding Crowds, Crashes, and the Carry Trade by Valeri Sokolovski, feel free to post them on our Forex forum.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.