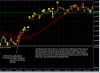

Indicators 5, 20 EMA Close

Envelopes 20 EMA Close .1% deviation

RSI Chart Bars Period 14 Overbough 55 Oversold 45

MA crossover alert 10, 20 EMA At open

Start trading at 3 am ast Europe open

This is a very simple method that is giving me very good results.

1. M0ney Managemet

Goal for the week 6% account increase 3% Risk in 100 pips

Example Balance $500*.03/100=.15 micro lot (IBFX accepts that)

Total pips to achieve goal 200 week = 40 per day

Risk Take profit 40 pips stop loss 20 pips. Using this method if you put 20 trades you only need to win 7 trades to be 20 pips in profit.

The concept is very simple what is important is having a specific goal for the week, do not over trade and again stick to your goal.

I simply waits for the cross over in the 15M chart and waits for the bar to close, the close RSi needs to be over 55 or under 45. Also I trade the retracement when the bar touches the 20 EMA Line or in the .10 % envelope area. I usually make the 40 pips goal for the day in the first hours of trading. I has learned that the important thing in forex is always make the same ammount of pips and week by week when your account grew larger the size of the lot is going to be greater also. You need to understad that probably making $30 in a week is not much, this is while you gain confidence. But if you have 5000 and make 6% that is $300. Its only a matter of time. Also be aware at what time the economics reports are out. IS good to time your trades. If you want to see an example charts or need some indicator just ask. lopezoscari@gmail.com

Envelopes 20 EMA Close .1% deviation

RSI Chart Bars Period 14 Overbough 55 Oversold 45

MA crossover alert 10, 20 EMA At open

Start trading at 3 am ast Europe open

This is a very simple method that is giving me very good results.

1. M0ney Managemet

Goal for the week 6% account increase 3% Risk in 100 pips

Example Balance $500*.03/100=.15 micro lot (IBFX accepts that)

Total pips to achieve goal 200 week = 40 per day

Risk Take profit 40 pips stop loss 20 pips. Using this method if you put 20 trades you only need to win 7 trades to be 20 pips in profit.

The concept is very simple what is important is having a specific goal for the week, do not over trade and again stick to your goal.

I simply waits for the cross over in the 15M chart and waits for the bar to close, the close RSi needs to be over 55 or under 45. Also I trade the retracement when the bar touches the 20 EMA Line or in the .10 % envelope area. I usually make the 40 pips goal for the day in the first hours of trading. I has learned that the important thing in forex is always make the same ammount of pips and week by week when your account grew larger the size of the lot is going to be greater also. You need to understad that probably making $30 in a week is not much, this is while you gain confidence. But if you have 5000 and make 6% that is $300. Its only a matter of time. Also be aware at what time the economics reports are out. IS good to time your trades. If you want to see an example charts or need some indicator just ask. lopezoscari@gmail.com