EUR/USD meets resistance on Wednesday

"The 240-minute EUR/USD chart is rallying from a head and shoulders bottom. If the bulls get a breakout, the targets are a measured move up and a 50% correction."

– Al Brooks, Brooks Price Action (based on investing.com)

Pair's Outlook

The common European currency has reached the resistance put up by the weekly R2 at 1.0729 against the US Dollar. On Wednesday morning the currency exchange rate was in a slight retreat, as a consolidation of positions was occurring after the almost 100 base point surge of Tuesday. There are two possible short term outcomes for the pair. It can soon resume the surge and set its eyes on the weekly R3, which is located at the 1.0780 level. On the other hand the pair might bounce off the weekly R2 and retreat back to the combined support of the 20-day SMA at 1.0690 and the monthly PP at 1.0686.

Traders' Sentiment

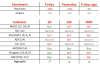

SWFX traders have shifted their positions, as 51% of open positions are short on Wednesday, compared to 51% long on Tuesday. Meanwhile, 53% of set up orders are to sell.

"The 240-minute EUR/USD chart is rallying from a head and shoulders bottom. If the bulls get a breakout, the targets are a measured move up and a 50% correction."

– Al Brooks, Brooks Price Action (based on investing.com)

Pair's Outlook

The common European currency has reached the resistance put up by the weekly R2 at 1.0729 against the US Dollar. On Wednesday morning the currency exchange rate was in a slight retreat, as a consolidation of positions was occurring after the almost 100 base point surge of Tuesday. There are two possible short term outcomes for the pair. It can soon resume the surge and set its eyes on the weekly R3, which is located at the 1.0780 level. On the other hand the pair might bounce off the weekly R2 and retreat back to the combined support of the 20-day SMA at 1.0690 and the monthly PP at 1.0686.

Traders' Sentiment

SWFX traders have shifted their positions, as 51% of open positions are short on Wednesday, compared to 51% long on Tuesday. Meanwhile, 53% of set up orders are to sell.