Chaos and the financial crisis 2020. Everyone will be deceived! Part 2

INDICATOR No. 1. THE GROWTH OF THE WORLD ECONOMY Slowed Down to 90 Trillion.

Instead of 97 trillion, we got 90 trillion .... and this is a harbinger of chaos.

“The global economy is now experiencing a synchronous slowdown,” the IMF recently said. Next year, growth will be at its lowest level since the beginning of the decade. By the end of 2020, according to IMF economists, world trade will cease to grow, having lost almost 700 billion dollars, or 0.8% of world GDP.

Speaking in numbers, they EXPECTED the growth of world GDP in the amount of 97 trillion USD, and received only 90 trillion USD.

What matters here is not size, but growth and its speed. Our civilization has been developing very rapidly over the past 300 years due to such a strange thing as CREDIT. Well, this is when investors lend to the future growth of the economy by buying shares and bonds of the companies that make up the economy. This vile system (causes inflation) is better than what it was before the loan, because it allows you to believe in the future and grow.

However, inflation and periodic crises are a payment for this growth. Because at some point there are too many goods and services, they are not being bought. Demand falls and profitability falls. Investors who invested money in these sectors (through securities) lose their profitability and withdraw their money (sell securities). The economy is losing its blood ... And it is very bad.

Why do investors take their money?

They are scared, because if you drag out with the withdrawal of money, then you can generally lose most of them. Credit money (investment) for the economy is like steroids for an athlete. The athlete uses them to speed up his physical progress. But the longer he uses them, the more side effects increase: acne, liver problems, cholesterol, etc. At some point, you have to get down to restore health. There are only two options:

HEIGHT. You use stimulants (credit money).

LOSSES. Stimulants were taken from you due to withdrawal syndrome (this is a crisis)

Progress needs money for development. But over the past 10 years, he received enough of them to earn withdrawal symptoms. And now we see the beginning of this cancellation on the chart. The global economic growth rate has slowed to 10-year lows. We are in a crisis.

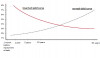

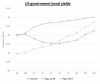

INDICATOR No. 2. US FRS ACCOUNT RATE REDUCES TO 1.75%

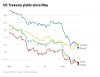

ACCOUNT RATE - this is the percentage at which the central bank (FRS for the USA) issues loans. The higher the rate, the more expensive the money in the state. The lower the rate, the cheaper the money in the state. Here is how it looks in dynamics now:

A crisis always correlates with a reduction in the discount rate, because when the economy begins to slow down, the government lowers the discount rate in order to stimulate the economy with cheap loans.

At the moment, the discount rate has been reduced several times. WAS = 2.25%. NOW = 1.75%

If you look at the chart, we will see that during a crisis, they always lower their rates. This indicator suggests that NOW the doctor understands that he is facing a dying patient and is frantically trying to save him with a blood transfusion.

INDICATOR No. 3. Percent Failure IPO USA Equals 80%

INDICATOR No. 3. Percent Failure IPO USA Equals 80%

An IPO is when a company collects money for its development by selling it to investors through stocks (a form of joint lending to complex projects). To do this, you need to go through certain procedures and publicly place your shares on any exchange. Google, Amazon, Apple, Gazprom, VTB ... all these companies went on IPO. Investors bought their shares in order to earn through the growth of the company. Well, the company itself received money for its development (so that this growth was). This is how lending to the future development of the economy of the state (through its companies) works.

When a company goes IPO, the initial price for its shares is set. You can buy them, but there is a significant risk, because you do not know what will be the demand for this stock after placing it on the exchange:

DEMAND IS GROWING = Stock price is rising = you have more money.

DEMAND DECLINES = Stock price drops below the initial = this is a failure (you lose money)

When the economy is healthy and growing, the percentage of failed IPOs ranges from 20-40%. When the economy is weak and overvalued, there can be up to 80% failed IPOs. Now this is exactly the situation (80% of failed ICOs) as it was during the “dotcom crisis” of the 2000s).

INDICATOR No. 4. WARREN BUFFETT WAS CASHED.

Warren Buffett is the most famous investor and philanthropist in the world.

Warren Buffett is the most famous investor and philanthropist in the world. Among other things, he is the third on the list of the richest people in the world. He makes money from managing foreign investments through his Berkshire Hathaway fund. Usually, the US market is growing at about 10% per year. For the past half a century, Warren Buffett has been giving his partners about 20% per year. Those. it is a practitioner who is well versed in markets and knows how to understand and overtake them.

He owns the famous phrase "You need to be careful when everything is euphoric, and be greedy only when everything is in fear." Which means that you don’t need to listen to the crowd, you need to listen to the mind (buy when everyone sells, sell when everyone buys).

FUND = 208 billion USD (total money)

Cache = 122 billion USD (60% of assets are now in cache)

This summer, Warren Buffett "went into the cache." He did it beforehand, before the panic started. He sold shares at good prices (when there is demand for them) and is waiting for a crisis to buy shares, when everyone will betray them in horror (at low prices).

He now holds more than half of his assets in a bank account in cache. This situation over the past 30 years (according to the Bloombering agency) has been only two times: 1) before the 2001 dot-com crisis. 2) before the crisis of 2008.